i will like pls help

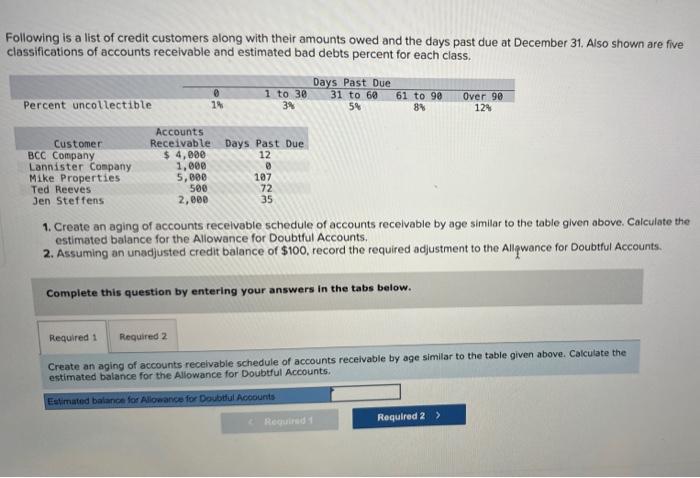

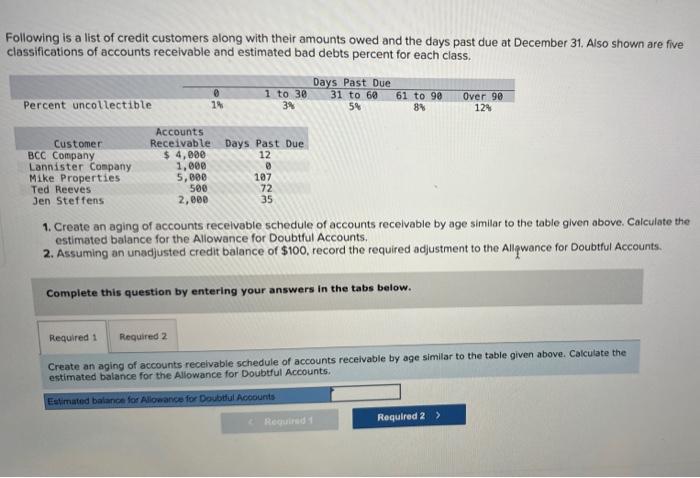

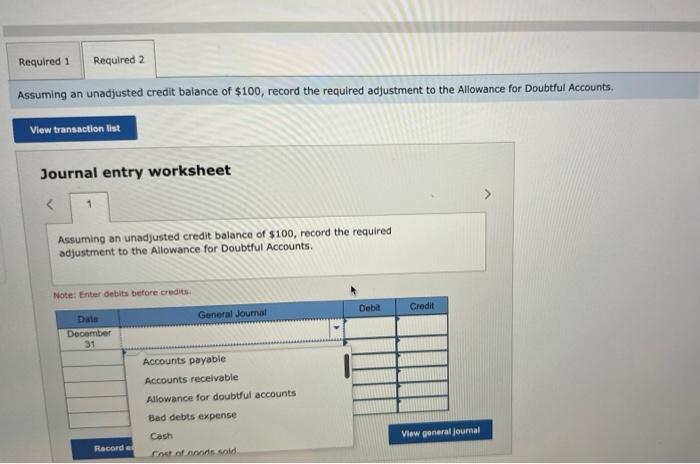

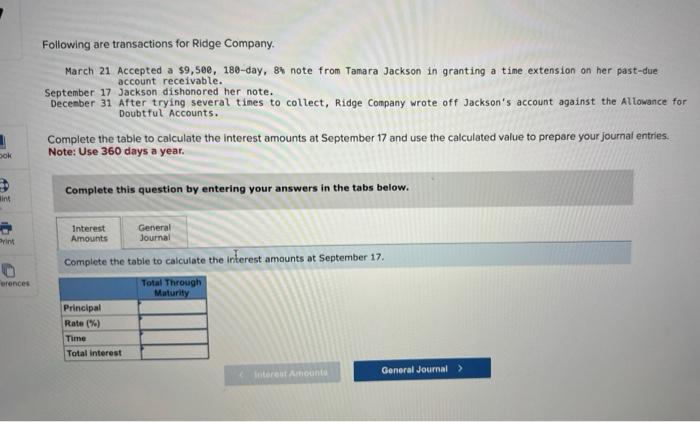

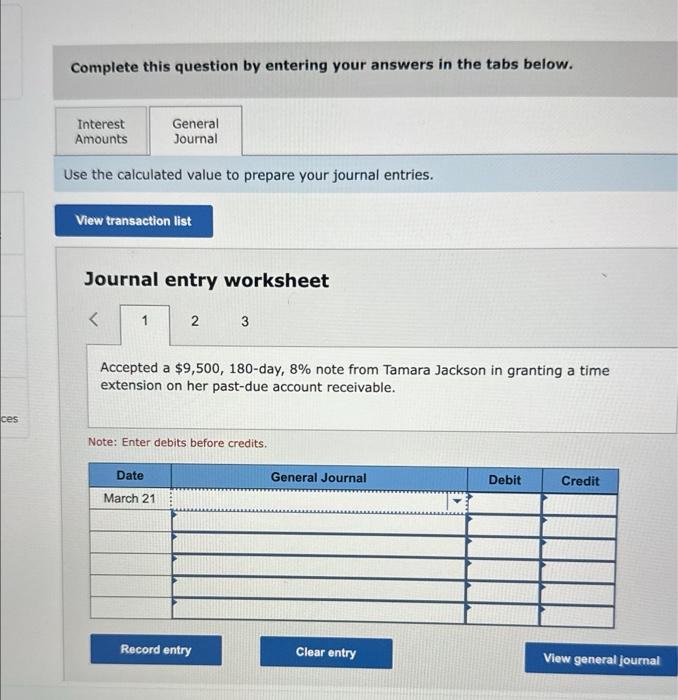

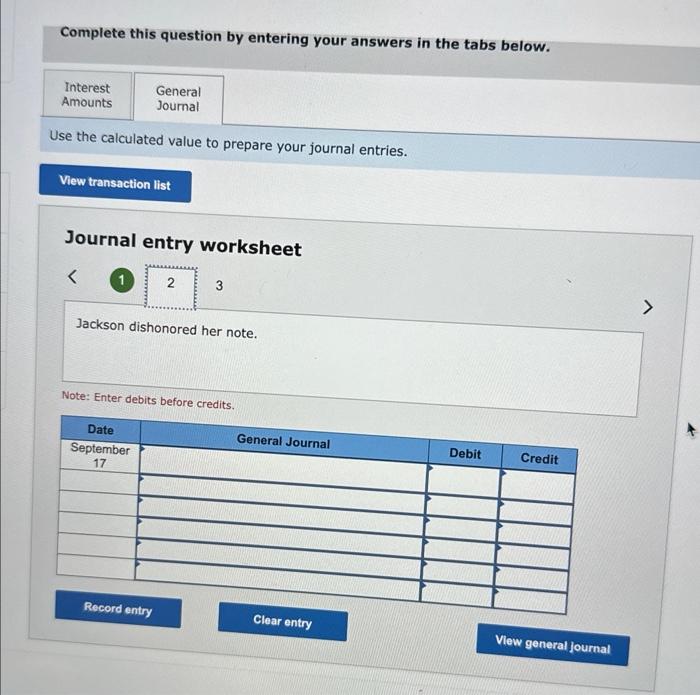

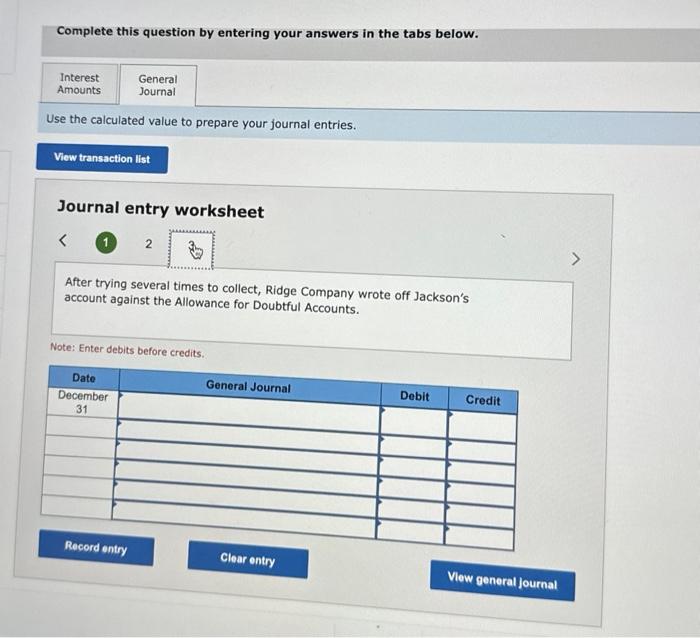

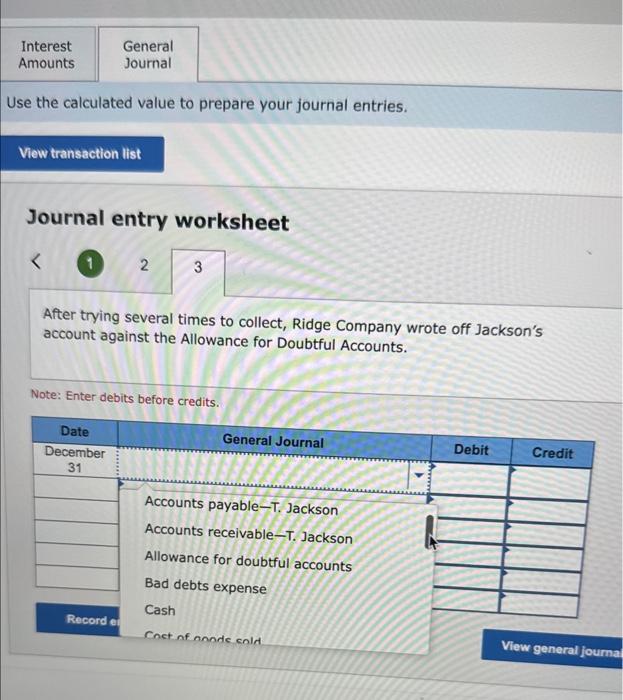

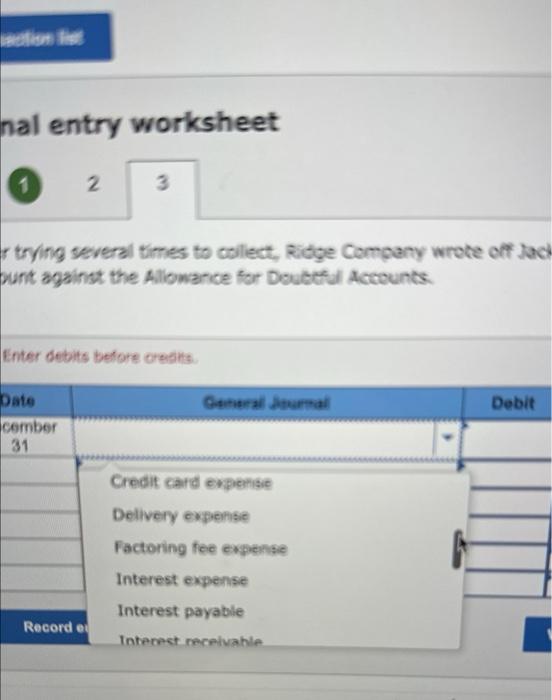

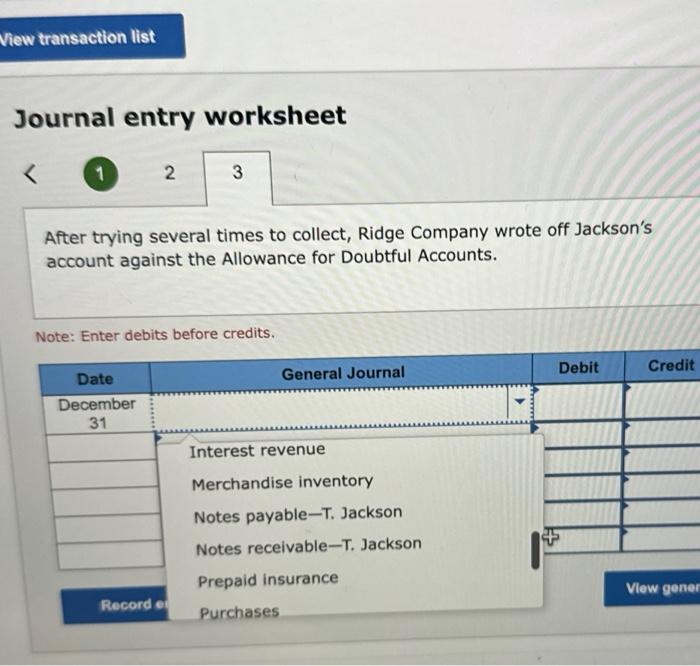

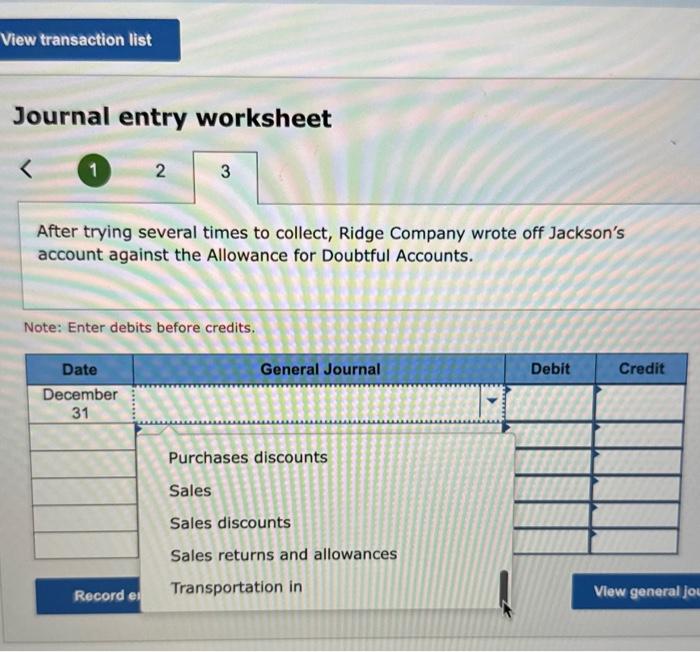

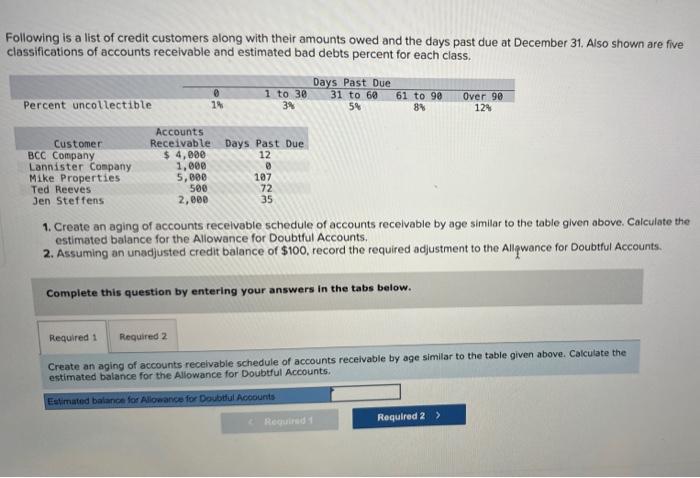

Following is a list of credit customers along with their amounts owed and the days past due at December 31. Also shown are five classifications of accounts receivable and estimated bad debts percent for each class. 1. Create an aging of accounts recelvable schedule of accounts recelvable by age similar to the table given above. Calculate the estimated balance for the Allowance for Doubtful Accounts. 2. Assuming an unadjusted credit balance of $100, record the required adjustment to the Alligwance for Doubtful Accounts. Complete this question by entering your answers in the tabs below. Create an aging of accounts recelvable schedule of accounts receivable by age similar to the table given above. Calculate the estimated balance for the Allowance for Doubtful Accounts. ssuming an unadjusted credit balance of $100, record the required adjustment to the Allowance for Doubtful Accounts. Journal entry worksheet Assuming an unadjusted credit balance of $100, record the required adjustment to the Allowance for Doubtful Accounts. Following are transactions for Ridge Company. March 21 Accepted a $9,500, 180-day, 84 note from Tamara Jackson in granting a time extension on her past-due account receivable. September 17 Jackson dishonored her note. December 31 After trying several times to collect, Ridge Company wrote off Jackson's account against the Allowance for Doubtful Accounts. Complete the table to calculate the interest amounts at September 17 and use the calculated value to prepare your journal entries. Note: Use 360 days a year. Complete this question by entering your answers in the tabs below. Complete the tabie to calculate the interest amounts at September 17. Complete this question by entering your answers in the tabs below. Use the calculated value to prepare your journal entries. Journal entry worksheet Accepted a $9,500,180-day, 8% note from Tamara Jackson in granting a time extension on her past-due account receivable. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Use the calculated value to prepare your journal entries. Journal entry worksheet Jackson dishonored her note. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Use the calculated value to prepare your journal entries. Journal entry worksheet After trying several times to collect, Ridge Company wrote off Jackson's account against the Allowance for Doubtful Accounts. Note: Enter debits before credits. Use the calculated value to prepare your journal entries. Journal entry worksheet After trying several times to collect, Ridge Company wrote off Jackson's account against the Allowance for Doubtful Accounts. Note: Enter debits before credits. nal entry worksheet (1) 2 r trying several times to collect, Ridge Company wrote off Jac punt against the Allowance for Doubtful Accounts. Enter debits before orebts. Journal entry worksheet After trying several times to collect, Ridge Company wrote off Jackson's account against the Allowance for Doubtful Accounts. Note: Enter debits before credits. Journal entry worksheet 2 After trying several times to collect, Ridge Company wrote off Jackson's account against the Allowance for Doubtful Accounts. Note: Enter debits before credits