I will make sure to thumbs up for all the help! thank you so much in advange!

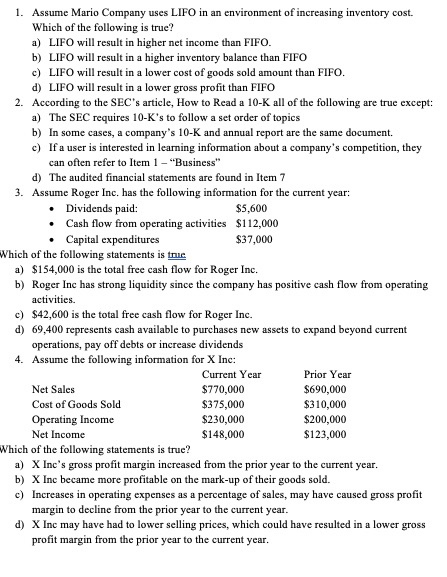

1. Assume Mario Company uses LIFO in an environment of increasing inventory cost. Which of the following is true? a) LIFO will result in higher net income than FIFO. b) LIFO will result in a higher inventory balance than FIFO c) LIFO will result in a lower cost of goods sold amount than FIFO. d) LIFO will result in a lower gross profit than FIFO 2. According to the SEC's article, How to Read a 10-K all of the following are true except: a) The SEC requires 10-K's to follow a set order of topics b) In some cases, a company's 10-K and annual report are the same document. c) If a user is interested in learning information about a company's competition, they can often refer to Item 1 - "Business" d) The audited financial statements are found in Item 7 3. Assume Roger Inc. has the following information for the current year: Dividends paid $5,600 Cash flow from operating activities $112,000 Capital expenditures $37,000 Which of the following statements is true a) $154,000 is the total free cash flow for Roger Inc. b) Roger Inc has strong liquidity since the company has positive cash flow from operating activities. c) $42,600 is the total free cash flow for Roger Inc. d) 69,400 represents cash available to purchases new assets to expand beyond current operations, pay off debts or increase dividends 4. Assume the following information for X Inc: Current Year Prior Year Net Sales $770,000 $690,000 Cost of Goods Sold $375,000 $310,000 Operating Income $230,000 $200,000 Net Income $148,000 $123,000 Which of the following statements is true? a) X Inc's gross profit margin increased from the prior year to the current year. b) X Inc became more profitable on the mark-up of their goods sold. c) Increases in operating expenses as a percentage of sales, may have caused gross profit margin to decline from the prior year to the current year. d) X Inc may have had to lower selling prices, which could have resulted in a lower gross profit margin from the prior year to the current year