Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will need the journal entries. At the b ' ' ' eglnnrng of 2024, Taylor Corporation had the following stockholders' equity balances in its

I will need the journal entries.

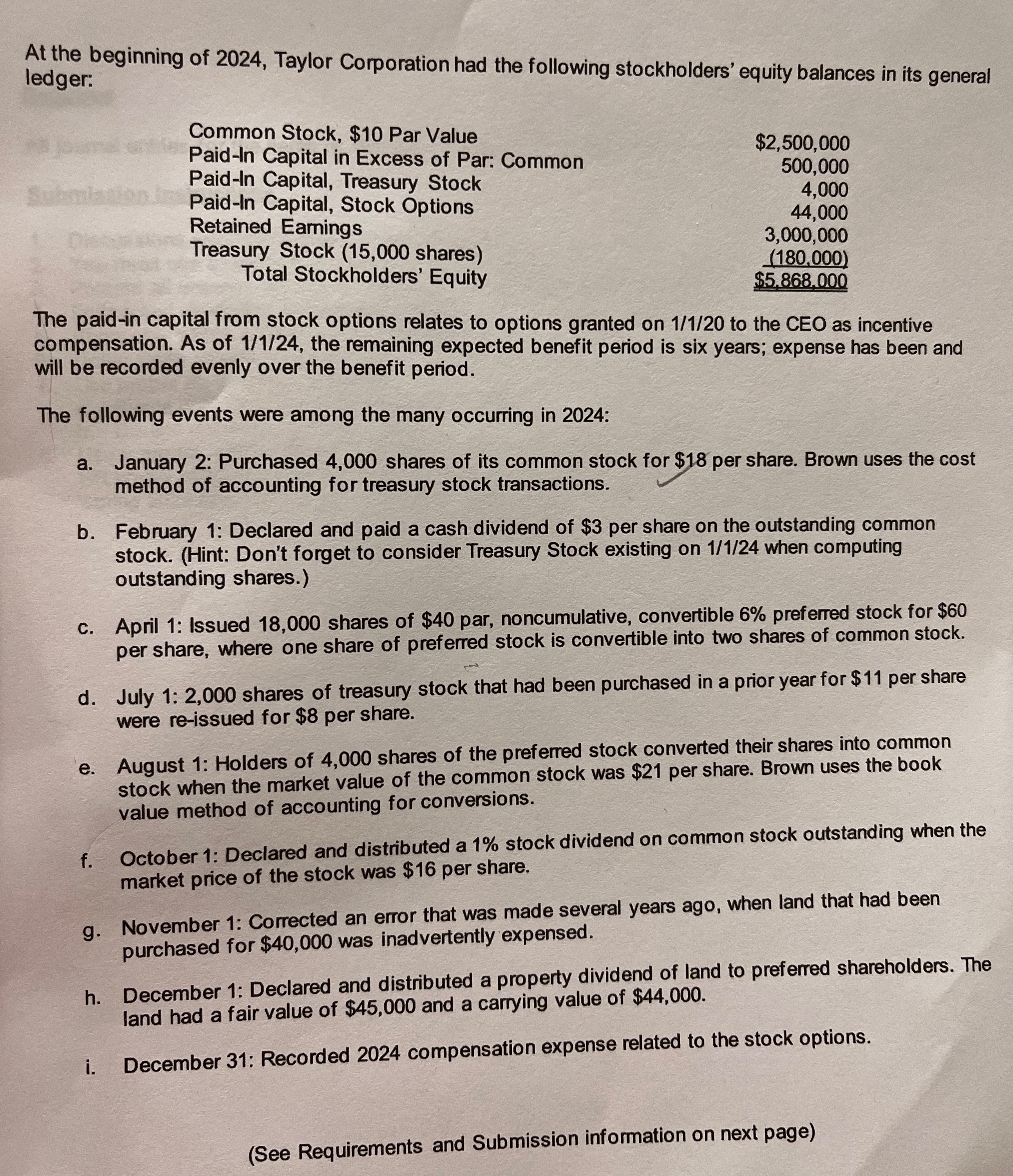

At the b ' ' ' eglnnrng of 2024, Taylor Corporation had the following stockholders' equity balances in its general ledger. Common Stock, $10 Par Value PaidIn Capital in Excess of Par: Common \"33,000 Paid-In Capital, Treasury Stock 4'000 Paid-ln Capital, Stock Options 44%00 Retained Earnings 3 006033 Treasury Stock (15,000 shares) Jim Total Stockholders' Equity M The paid-in capital from stock options relates to options granted on 1/1/20 to the CEO as incentive compensation. As of 1I1/24, the remaining expected benefit en'od is six ears will be recorded evenly over the benefit period. p y ' expense has been and The following events were among the many occurring in 2024: a. January 2: Purchased 4,000 shares of its common stock for $ 'per share. Brown uses the cost method of accounting for treasury stock transactions. b. Febmary 1: Declared and paid a cash dividend of $3 per share on the outstanding common stock. (Hint: Don't forget to consider Treasury Stock existing on 1I1/24 when computing outstanding shares.) G. April 1: issued 18,000 shares of $40 par, noncumulative, convertible 6% preferred stock for $60 per share, where one share of preferred stock is convertible into two shares of common stock. d. July 1: 2,000 shares of treasury stock that had been purchased in a prior year for $11 per share were reissued for $8 per share. ed th ' t 1: Holders of 4,000 shares of the prefean stock convert :ttcgclkswhen the market value of the common stock was $21 per share. Brown uses the book value method of accounting for conversrons. f October 1' Declared and distributed a 1% stock dividend on common stock outstanding when the market price of the stock was $16 per share. 1' Corrected an error that was made several years ago. when land that had been for $40,000 was inadvertentlyexpensed. 'stributed a property dividend of land to preferred shareholders. The nying value of $44,000. 9. November purchased Recorded 2024 compensation expense related to the stock options. i. December 31: (See Requirements and Submission information on next page)

At the b ' ' ' eglnnrng of 2024, Taylor Corporation had the following stockholders' equity balances in its general ledger. Common Stock, $10 Par Value PaidIn Capital in Excess of Par: Common \"33,000 Paid-In Capital, Treasury Stock 4'000 Paid-ln Capital, Stock Options 44%00 Retained Earnings 3 006033 Treasury Stock (15,000 shares) Jim Total Stockholders' Equity M The paid-in capital from stock options relates to options granted on 1/1/20 to the CEO as incentive compensation. As of 1I1/24, the remaining expected benefit en'od is six ears will be recorded evenly over the benefit period. p y ' expense has been and The following events were among the many occurring in 2024: a. January 2: Purchased 4,000 shares of its common stock for $ 'per share. Brown uses the cost method of accounting for treasury stock transactions. b. Febmary 1: Declared and paid a cash dividend of $3 per share on the outstanding common stock. (Hint: Don't forget to consider Treasury Stock existing on 1I1/24 when computing outstanding shares.) G. April 1: issued 18,000 shares of $40 par, noncumulative, convertible 6% preferred stock for $60 per share, where one share of preferred stock is convertible into two shares of common stock. d. July 1: 2,000 shares of treasury stock that had been purchased in a prior year for $11 per share were reissued for $8 per share. ed th ' t 1: Holders of 4,000 shares of the prefean stock convert :ttcgclkswhen the market value of the common stock was $21 per share. Brown uses the book value method of accounting for conversrons. f October 1' Declared and distributed a 1% stock dividend on common stock outstanding when the market price of the stock was $16 per share. 1' Corrected an error that was made several years ago. when land that had been for $40,000 was inadvertentlyexpensed. 'stributed a property dividend of land to preferred shareholders. The nying value of $44,000. 9. November purchased Recorded 2024 compensation expense related to the stock options. i. December 31: (See Requirements and Submission information on next page) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started