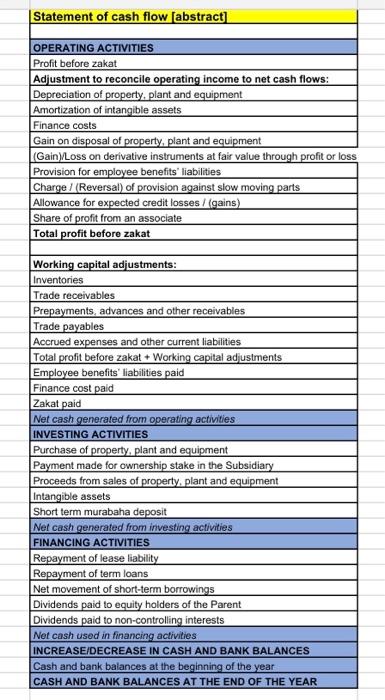

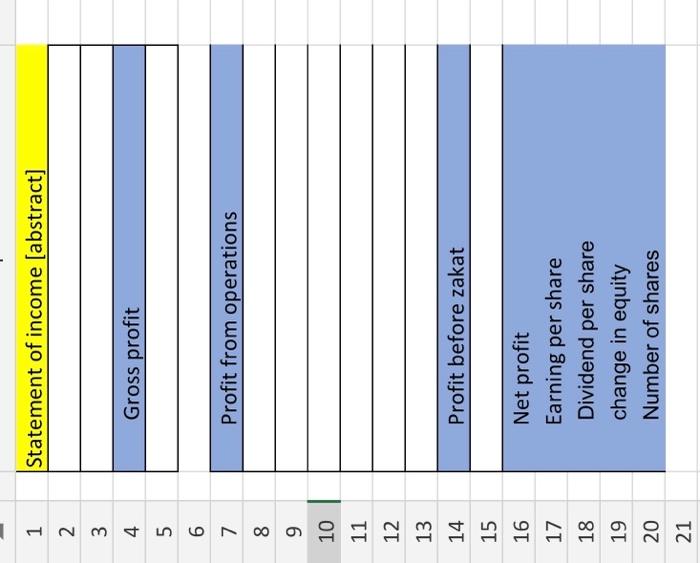

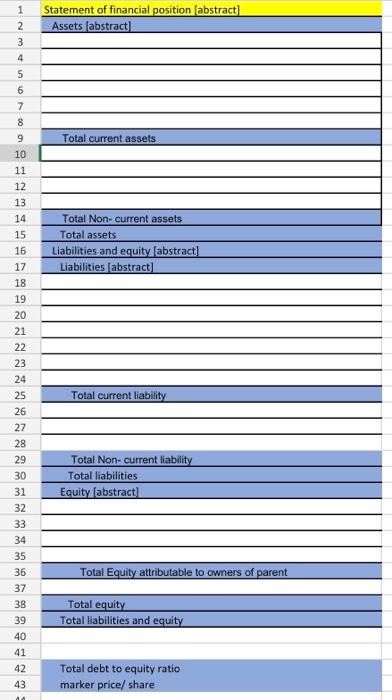

I will provide you data of cash flow, and I need to Rearranging the data of cash flow into two Financial Statements ( Balance Sheet, Income Statement)

\begin{tabular}{|l|} \hline Statement of cash flow [abstract] \\ \hline \\ \hline OPERATING ACTIVITIES \\ \hline Profit before zakat \\ \hline Adjustment to reconcile operating income to net cash flows: \\ \hline Depreciation of property, plant and equipment \\ \hline Amortization of intangible assets \\ \hline Finance costs \\ \hline Gain on disposal of property, plant and equipment \\ \hline (Gain)/Loss on derivative instruments at fair value through profit or loss \\ \hline Provision for employee benefits' liabilities \\ \hline Charge / (Reversal) of provision against slow moving parts \\ \hline Allowance for expected credit losses / (gains) \\ \hline Share of profit from an associate \\ \hline Total profit before zakat \\ \hline \\ \hline Working capital adjustments: \\ \hline Inventories \\ \hline Trade receivables \\ \hline Prepayments, advances and other receivables \\ \hline Trade payables \\ \hline Accrued expenses and other current liabilities \\ \hline Total profit before zakat + Working capital adjustments \\ \hline Employee benefits' liabilities paid \\ \hline Finance cost paid \\ \hline Zakat paid \\ \hline Net cash generated from operating activities \\ \hline INVESTING ACTIVITIES \\ \hline Purchase of property, plant and equipment \\ \hline Payment made for ownership stake in the Subsidiary \\ \hline Proceeds from sales of property, plant and equipment \\ \hline Intangible assets \\ \hline Short term murabaha deposit \\ \hline Net cash generated from investing activities \\ \hline FINANCING ACTIVITIES \\ \hline Repayment of lease liability \\ \hline Repayment of term loans \\ \hline Net movement of short-term borrowings \\ \hline Dividends paid to equity holders of the Parent \\ \hline Dividends paid to non-controlling interests \\ \hline Net cash used in financing activities \\ \hline INCREASEIDECREASE IN CASH AND BANK BALANCES \\ \hline Cash and bank balances at the beginning of the year \\ \hline CASH AND BANK BALANCES AT THE END OF THE YEAR \\ \hline \end{tabular} \begin{tabular}{c|l|} \hline 1 & Statement of income [abstract] \\ \hline 2 & \\ \hline 3 & \\ \hline 4 & Gross profit \\ \hline 5 & \\ \hline 6 & \\ \hline 7 & \\ \hline 8 & Profit from operations \\ \hline 9 & \\ \hline 10 & \\ \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & Profit before zakat \\ \hline 16 & \\ \hline 17 & Net profit \\ \hline 18 & Earning per share \\ \hline 19 & Dividend per share \\ \hline 20 & Change in equity \\ \hline 21 & Number of shares \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 1 & Statement of financial position [abstract] \\ \hline 2 & Assets [abstract] \\ \hline 3 & \\ \hline 4 & \\ \hline 5 & \\ \hline 6 & \\ \hline 7 & \\ \hline 8 & \\ \hline 9 & Total current assets \\ \hline 10 & \\ \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline 14 & Total Non-current assets \\ \hline 15 & Total assets \\ \hline 16 & Liabilities and equity [abstract] \\ \hline 17 & Liabilities [abstract] \\ \hline 18 & \\ \hline 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline 24 & \\ \hline 25 & Total current liability \\ \hline 26 & \\ \hline 27 & \\ \hline 28 & \\ \hline 29 & Total Non-current liability \\ \hline 30 & Total liabilities \\ \hline 31 & Equity [abstract] \\ \hline 32 & \\ \hline 33 & \\ \hline 34 & \\ \hline 35 & \\ \hline 36 & Total Equity attributable to owners of parent \\ \hline 37 & \\ \hline 38 & Total equity \\ \hline 39 & Total liabilities and equity \\ \hline 40 & \\ \hline 41 & \\ \hline 42 & Total debt to equity ratio \\ \hline 43 & marker price/ share \\ \hline \end{tabular}