Answered step by step

Verified Expert Solution

Question

1 Approved Answer

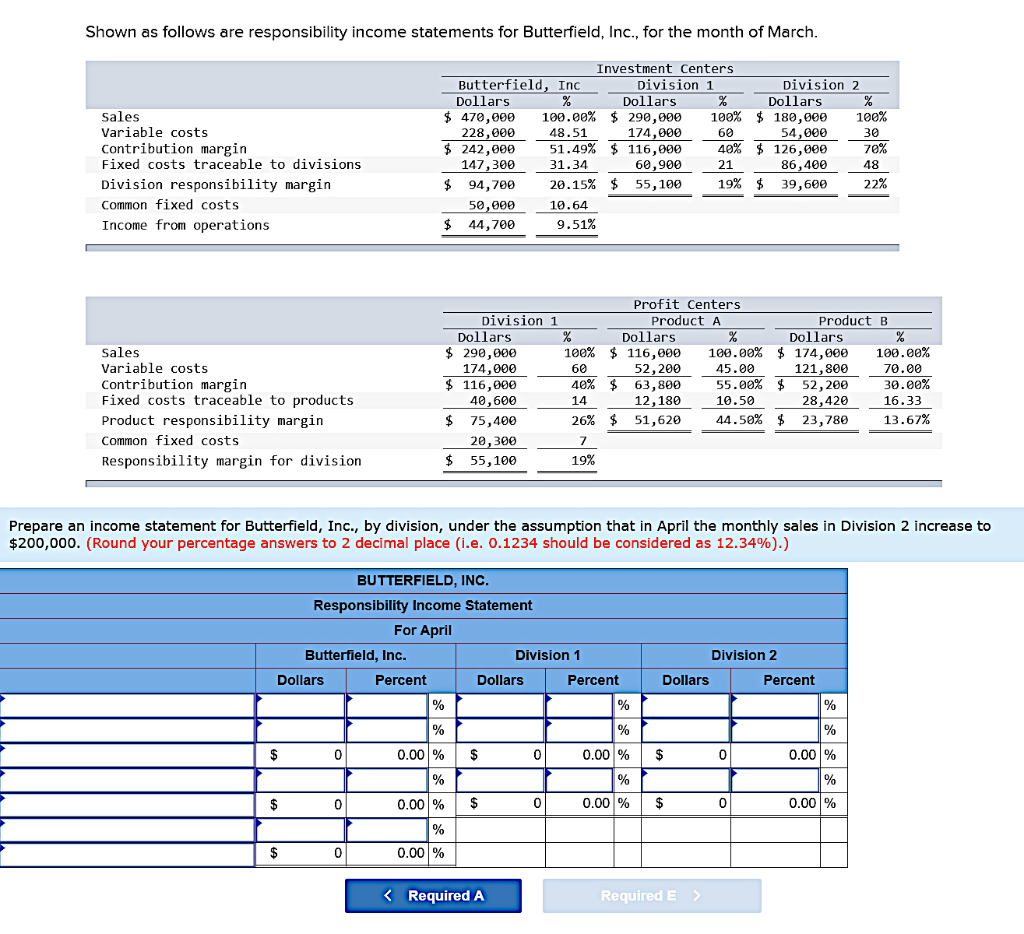

I will rate the correct answer, thank you in advance! Shown as follows are responsibility income statements for Butterfield, Inc., for the month of March

I will rate the correct answer, thank you in advance!

Shown as follows are responsibility income statements for Butterfield, Inc., for the month of March Investment Centers Butterfield, Inc Dollars Division 2 Dollars Division 1 Dollars 174,000 60,900 $.470,000 100.00%% 298,000 100%180,000 100% Sales Variable costs Contribution margin Fixed costs traceable to divisions Division responsibility margin Common fixed costs Income from operations 228,00048.51 54,000 $242,000 51.49% $ 116,000 40%$. 126,000 86,400 94,7ee 20.15% $ 55,100 19%, 39,680 60 30 147,300 31.34 21 48 2 2% 10.64 $44,700 9.51% Profit Centers Division 1 Product A Product B Dollars $ 29e,00e 174,000 $ 116,000 40,600 $ 75,400 20,300 $ 55,100 Dollars Dollars 100% $116,000 100.00%% 174,000 100.00% Sales Variable costs Contribution margin Fixed costs traceable to products Product responsibility margin Common fixed costs Responsibility margin for division 52,200 121,80070.e 60 40%$ 63,800 55.00% $52,200 30.00% 14 26% $51,620 44.50% $ 23,780 13.67% 45.00 12,18016.58 28,420 16.33 19% Prepare an income statement for Butterfield, Inc., by division, under the assumption that in April the monthly sales in Division 2 increase to $200,000. (Round your percentage answers to 2 decimal place (i.e. 0.1234 should be considered as 12.34% BUTTERFIELD, INC Responsibility Income Statement For April Butterfield, Inc. Division 1 Division 2 Dollars Percent Dollars Percent Dollars Percent 0.0019 $ 0.00 % 0.001 % 0.00 | % | $ 0 0.00% | $ 0.00 % 0.00 % Required A RequiredEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started