Answered step by step

Verified Expert Solution

Question

1 Approved Answer

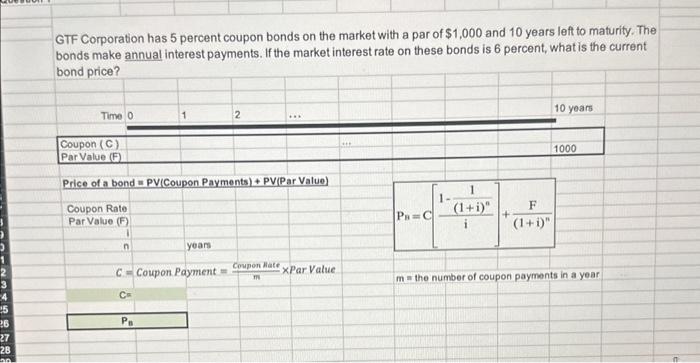

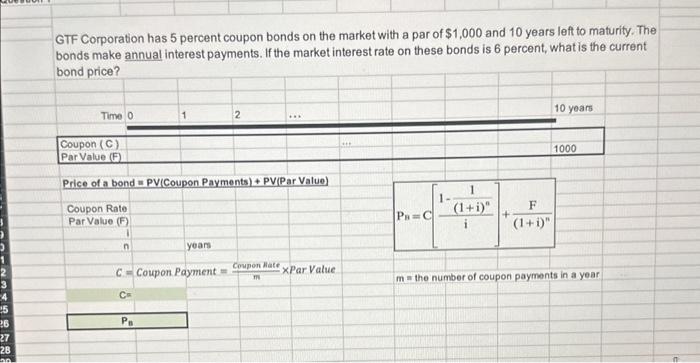

i will thumbs up! GTF Corporation has 5 percent coupon bonds on the market with a par of $1,000 and 10 years left to maturity.

i will thumbs up!

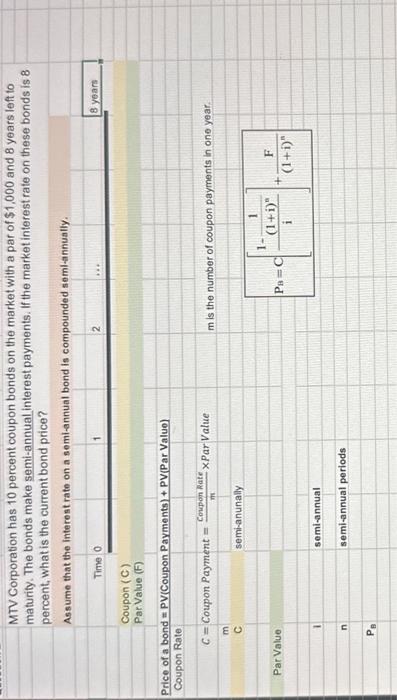

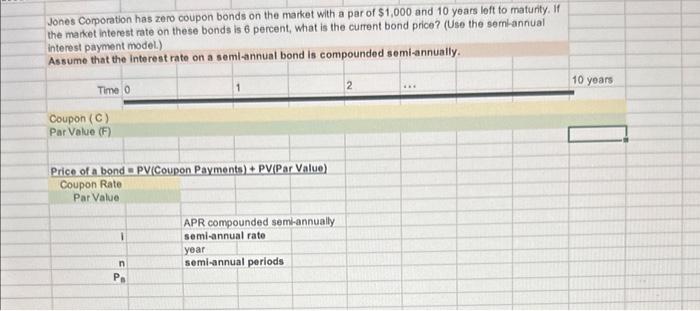

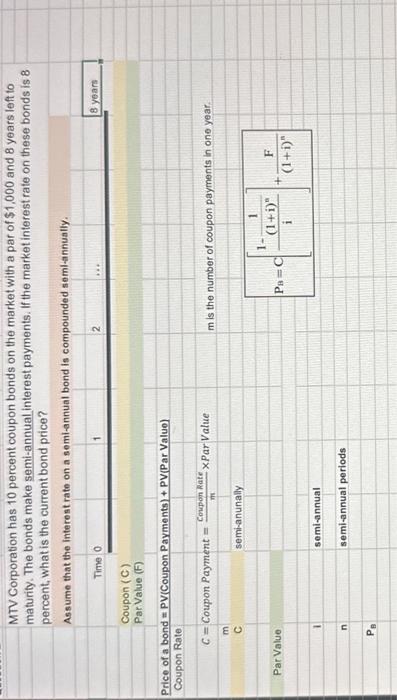

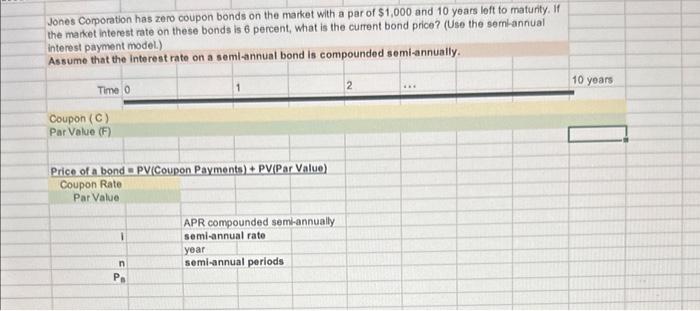

GTF Corporation has 5 percent coupon bonds on the market with a par of $1,000 and 10 years left to maturity. The bonds make annual interest payments. If the market interest rate on these bonds is 6 percent, what is the current hand arina? Priceofabond=PV(CouponPayments)+PV(ParValue)CouponRatoParValue(F)IyeamPB=C[i1(1+i)n1]+(1+i)nFc=CouponPayment=mCouponnateParValuem=thenumberofcouponpaymentsinayear MTV Corporation has 10 percent coupon bonds on the market with a par of $1,000 and 8 years left to maturity. The bonds make semi-annual interest payments. If the market interest rate on these bonds is 8 percent, what is the current bond price? Assume that the interest rate on a semi-annual bond is compounded seml-annually. Price of a bond = PV(Coupon Payments )+PV(Par Value) Coupon Rate Jones Comoration has zero coupon bonds on the market with a par of $1,000 and 10 years loft to maturity. If the makket interest rate on these bonds is 6 percent, What is the current bond price? (Use the semi-annual interest payment model.) Assume that the interest rate on a semi-annual bond is compounded semi-annually. Coupon (C) Par Value (F) Price of a bond = PV (Coupon Payments )+PV( Par Value) Coupon Rate Par Value APR compounded sem-annually \begin{tabular}{|l|l} \hline 1 & semiannual rate \\ \hlinen & year \\ \hlinePB & semi-annual periods \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started