Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i will thumbs up if right 3. How much car can I afford? How much car can 1 afford? Before buying a cat, it is

i will thumbs up if right

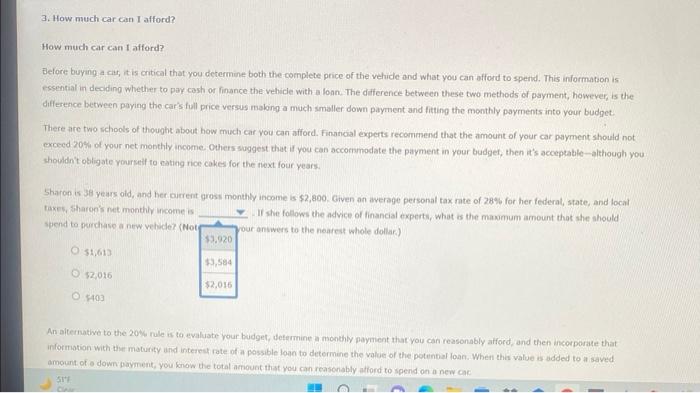

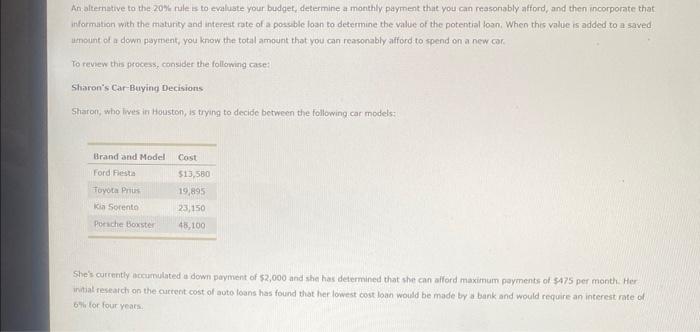

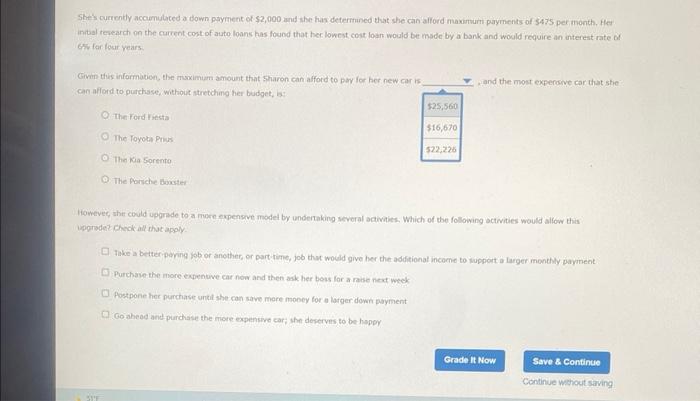

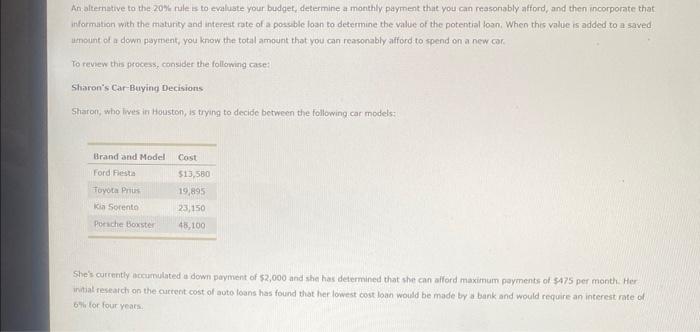

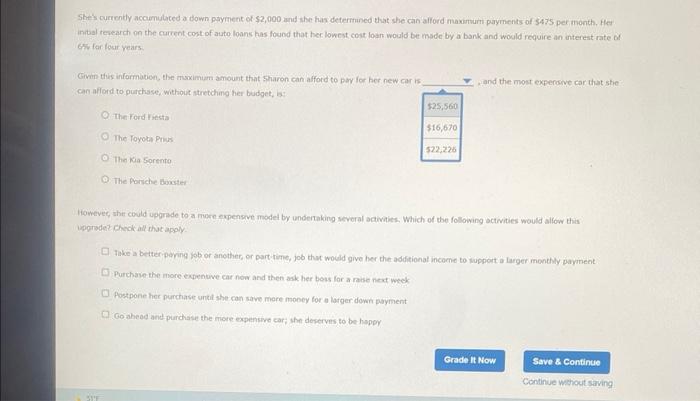

3. How much car can I afford? How much car can 1 afford? Before buying a cat, it is critical that you determine both the complete price of the vehide and what you can afford to spend. This information is essential in deoding whether to pay cosh or finance the vehicie with a fonn. The difference between these two methods of payment, however, is the difference between paying the car's full price versus mabing a much smaller down payment and fitting the monthly payments into your budget. There are two schools of thought about how much car you can afford. Finatical experts recommend that the amount of your car payment should not exceed 20% of your net monthly income. Others suggest that if you can accormmodate the payment in your budget, then it's acceptable-although you shouldn't obling ate yourselt to eating rice cakes for the next four years: Sharon is 38 yeurs oid, and her airrent gross monthly income is $2,800. Civen an average personal tax rate of 28% for her federal, state, and local taxes, tharon's net monthiy uncome is _. If she follows the advice of linancial experts, what is the maxmum amount that she ahould stend to perichase a new vehiclez (Noi - our anwers to the nearest whole dollar.) 51,613 $2,016 $403 An alternative to the 20% nule is th evaluate your budget, determine a monthly payment that you can reasonably afford, and then incorporate that informotion with the maturity und intereck rate of a possible loan to determine the value of the potential loan. When this value as added to a saved amount of a down payment, you know the total amiount that you can reasonably attiond to spend on a new cac: An-alternative to the 209 , rule is to evaluste your budget, determine a monthly payment that you can reasonably afford, and then incorporate that informatian with the maturity and intereat rate of a possible loan to determine the value of the potential loan, When this value is added to a saved umotint of a down payment, you know the total amount that you can reasonably aifford-to spend on a new car: To review this process, consider the following case: Sharon's Car-Buying Decisions Shat on, who lives in Houston, is trying to decide between the following car models: She's currently inchumulated a down payment of 52,000 and she has determined that she can alford maximum payments of $475 per month. Her initial reseatch on the curtent cost of auto loans has found that her lowest cost loan would be made by a bank and would require an interest rate of b\% for four yeacs. Shets currently accumulteed a down payment of $2,000 and she has detertined that she can alford maximuri payments of $475 per month. Hee initial terearch on the cureent cost of auto loans thas found that her lowest cost loan would be made by a bank and would require an interest rate of G.w for four years. Givin thes informbtion, the msximum amount that sharon can afford to per for her new car is wand the most expenarve car that stie can afford to purchsse, withoit ntretching her budget, is: The ford Isesta The Toyota Puss The Kia Sorento The poriche bowater Hiowevec, ahe could upgrade to a mere eqpensive model by underaking several activaties, Which of the following octivities would alliow this wogrodez check all that apoly. Take a betteriparing sob or anether, or part time, job thut would give her the additionat income to icupport a larger monthly payment Purchave the more expentuve car now and then ask her bess for a rase necd weck Aostpone her purchase untit she con save more money for a larger down payment Go aheod and purchase the miore expensive car; she deservis to be hopoy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started