Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will upvote u A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the

I will upvote u

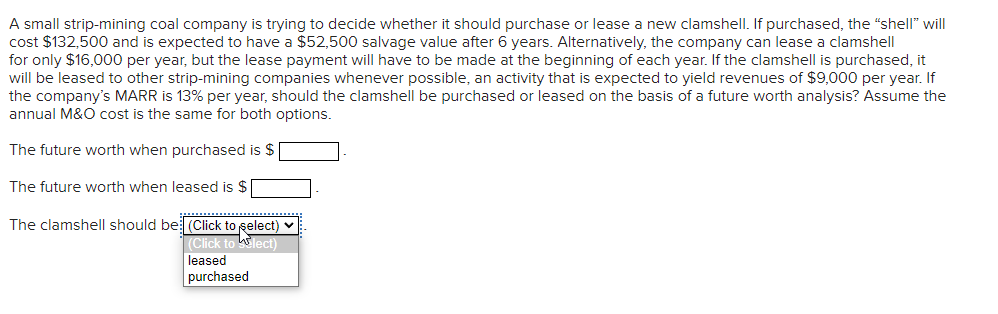

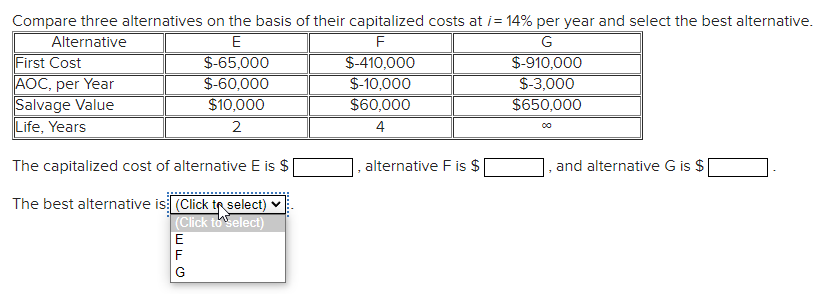

A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the "shell" will cost $132,500 and is expected to have a $52,500 salvage value after 6 years. Alternatively, the company can lease a clamshell for only $16,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenues of $9,000 per year. If the company's MARR is 13% per year, should the clamshell be purchased or leased on the basis of a future worth analysis? Assume the annual M&O cost is the same for both options. The future worth when purchased is $ The future worth when leased is $ The clamshell should be (Click to select) (Click to Wlect) leased purchased Compare three alternatives on the basis of their capitalized costs at i = 14% per year and select the best alternative. Alternative F G First Cost $-65,000 $-410,000 $-910,000 AOC, per Year $-60,000 $-10,000 $-3,000 Salvage Value $10,000 $60,000 $650,000 Life, Years 2 4 The capitalized cost of alternative E is $ alternative F is $ and alternative G is $ The best alternative is Click tr select) (Click to select) E F GStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started