Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i will vote thumbs up if right! Thank you! (answer the next 4 questions) EBV made a $6M Series A investment in Newco. EBV's investment

i will vote thumbs up if right! Thank you!

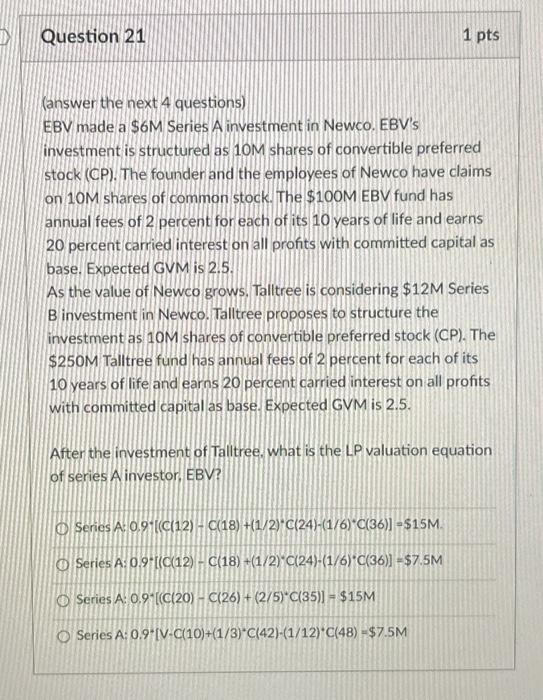

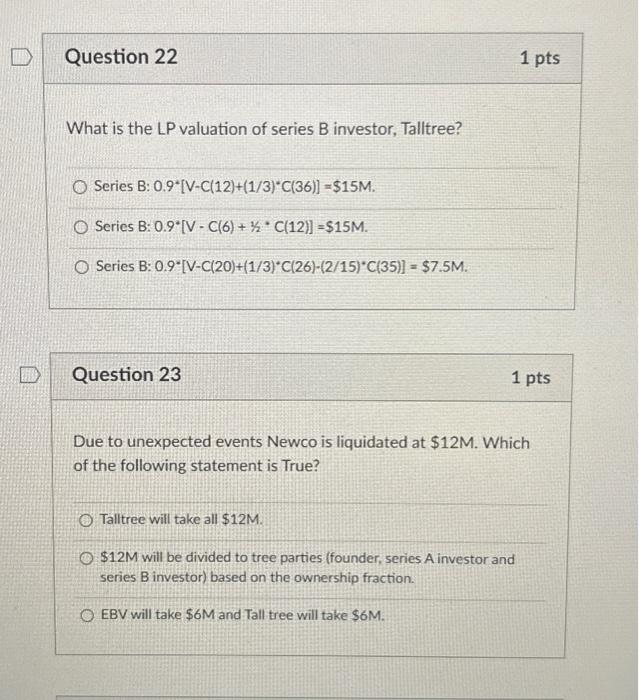

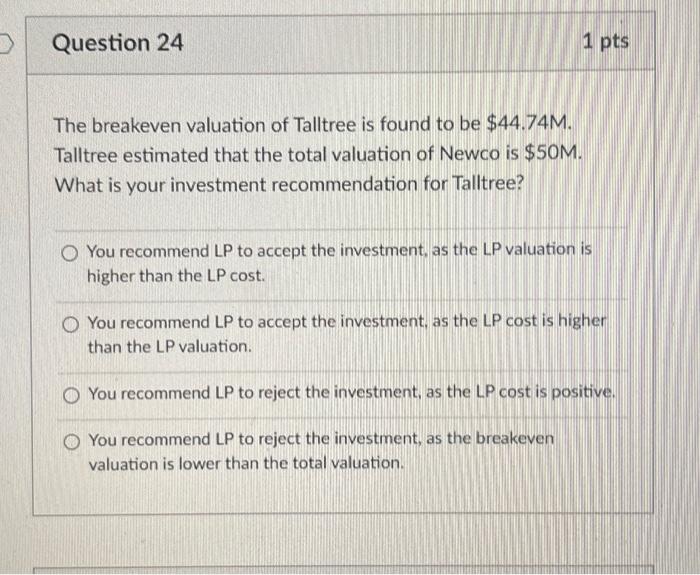

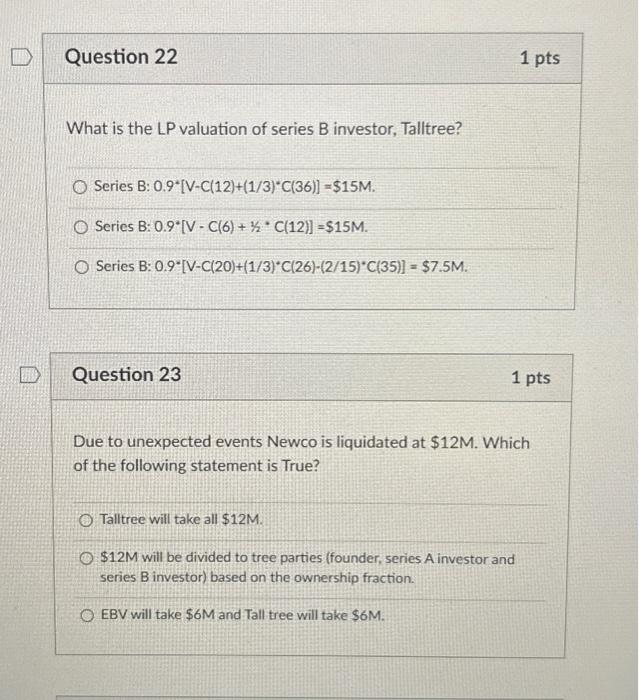

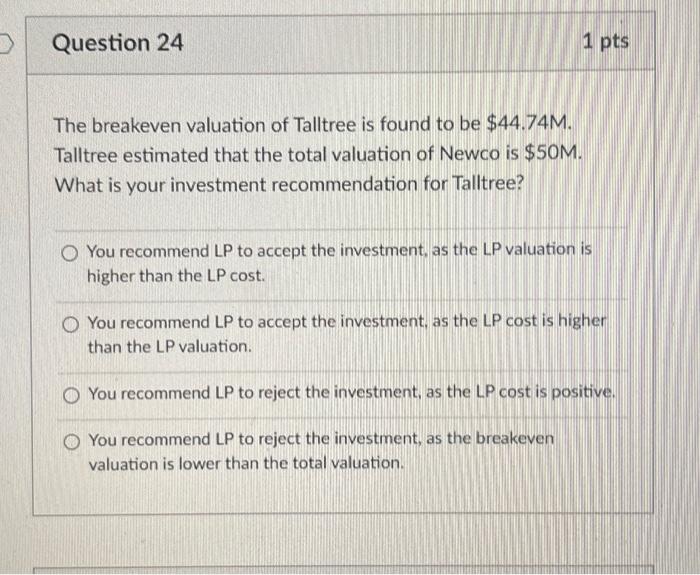

(answer the next 4 questions) EBV made a $6M Series A investment in Newco. EBV's investment is structured as 10M shares of convertible preferred stock (CP). The founder and the employees of Newco have claims on 10M shares of common stock. The \$100M EBV fund has annual fees of 2 percent for each of its 10 years of life and earns 20 percent carried interest on all profits with committed capital as base. Expected GVM is 2.5 . As the value of Newco grows. Talltree is considering $12M Series B investment in Newco. Talltree proposes to structure the investment as 10M shares of convertible preferred stock (CP). The $250M Talitree fund has annual fees of 2 percent for each of its 10 years of life and earns 20 percent carried interest on all profits with committed capital as base. Expected GVM is 2.5 . After the investment of Talltree. what is the LP valuation equation of series A investor. EBV? series A:0.9[(C(12)C(18)+(1/2)C(24)(1/6)C(36)]=$15M Series A:0.9 [(C(12)-C(18)+(1/2)*C(24)-(1/6)*C(36)]=\$7.5M Series A:0.9[(C(20)C(26)+(2/5)C(35)]=$15M Series A:0.9(VC(10)+(1/3)C(42)(1/12)C(48)=$7.5M What is the LP valuation of series B investor, Talltree? Series B:0.9[VC(12)+(1/3)C(36)]=$15M. Series B:0.9[VC(6)+1/2C(12)]=$15M. Series B:0.9[VC(20)+(1/3)C(26)(2/15)C(35)]=$7.5M. Question 23 1 pts Due to unexpected events Newco is liquidated at $12M. Which of the following statement is True? Talltree will take all $12M. $12M will be divided to tree parties (founder, series A investor and series B investor) based on the ownership fraction. EBV will take $6M and Tall tree will take $6M. The breakeven valuation of Talltree is found to be $44.74M. Talltree estimated that the total valuation of Newco is $50M. What is your investment recommendation for Talltree? You recommend LP to accept the investment, as the LP valuation is higher than the LP cost. You recommend LP to accept the investment, as the LP cost is higher than the LP valuation. You recommend LP to reject the investment, as the LP cost is positive. You recommend LP to reject the investment, as the breakeven valuation is lower than the total valuation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started