Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would appreciate it if you could tell me the answer as soon as possible. No explanation or commentary is required on the above accounting

I would appreciate it if you could tell me the answer as soon as possible. No explanation or commentary is required on the above accounting question.

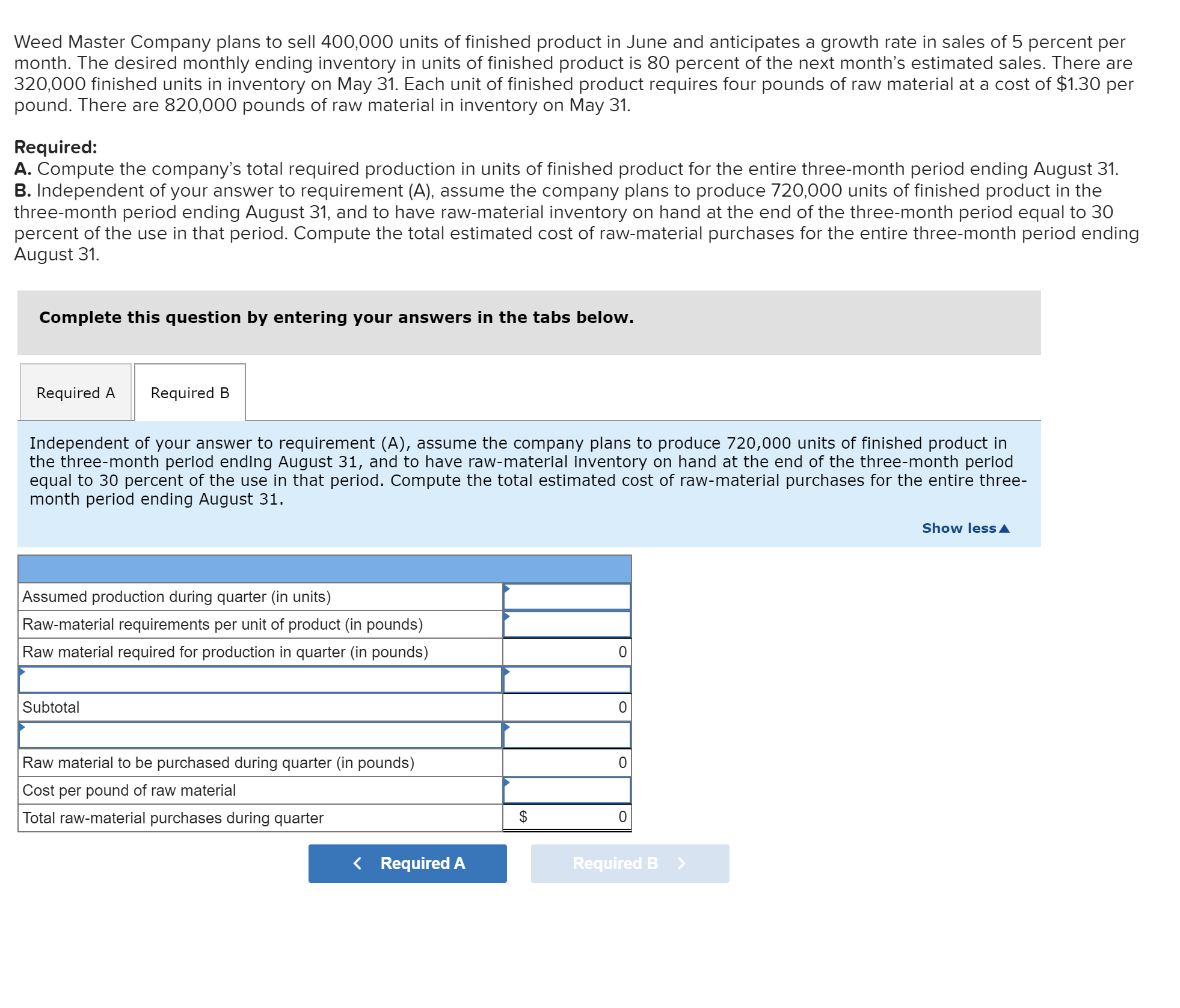

Weed Master Company plans to sell 400,000 units of finished product in June and anticipates a growth rate in sales of 5 percent per month. The desired monthly ending inventory in units of finished product is 80 percent of the next month's estimated sales. There ar 320,000 finished units in inventory on May 31. Each unit of finished product requires four pounds of raw material at a cost of $1.30 pe pound. There are 820,000 pounds of raw material in inventory on May 31. Required: A. Compute the company's total required production in units of finished product for the entire three-month period ending August 31. B. Independent of your answer to requirement (A), assume the company plans to produce 720,000 units of finished product in the three-month period ending August 31, and to have raw-material inventory on hand at the end of the three-month period equal to 30 percent of the use in that period. Compute the total estimated cost of raw-material purchases for the entire three-month period endir August 31. Complete this question by entering your answers in the tabs below. Independent of your answer to requirement (A), assume the company plans to produce 720,000 units of finished product in the three-month period ending August 31, and to have raw-material inventory on hand at the end of the three-month period equal to 30 percent of the use in that period. Compute the total estimated cost of raw-material purchases for the entire threemonth period ending August 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started