Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would be very happy if you do the operations on the paper in detail and if you explain the reasons (6 years) Question 5.

I would be very happy if you do the operations on the paper in detail and if you explain the reasons (6 years)

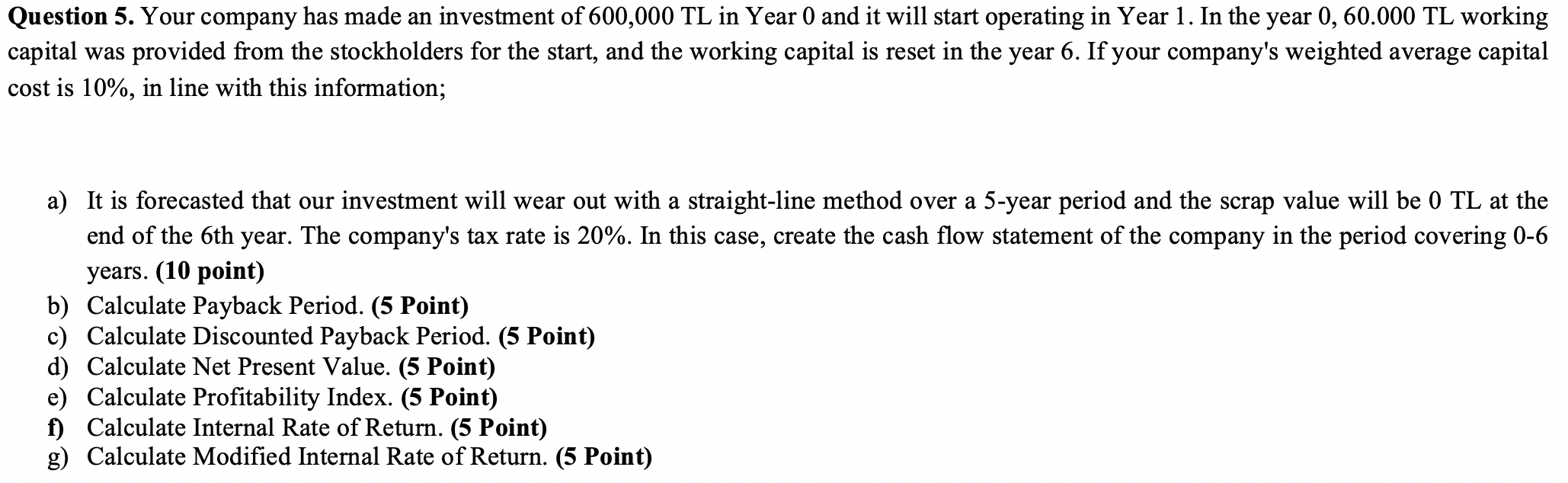

Question 5. Your company has made an investment of 600,000 TL in Year 0 and it will start operating in Year 1. In the year 0,60.000 TL working capital was provided from the stockholders for the start, and the working capital is reset in the year 6. If your company's weighted average capital cost is 10%, in line with this information; a) It is forecasted that our investment will wear out with a straight-line method over a 5-year period and the scrap value will be 0 TL at the end of the 6th year. The company's tax rate is 20%. In this case, create the cash flow statement of the company in the period covering 0-6 years. (10 point) b) Calculate Payback Period. (5 Point) c) Calculate Discounted Payback Period. (5 Point) d) Calculate Net Present Value. (5 Point) e) Calculate Profitability Index. (5 Point) f) Calculate Internal Rate of Return. (5 Point) g) Calculate Modified Internal Rate of Return. (5 Point) Question 5. Your company has made an investment of 600,000 TL in Year 0 and it will start operating in Year 1. In the year 0,60.000 TL working capital was provided from the stockholders for the start, and the working capital is reset in the year 6. If your company's weighted average capital cost is 10%, in line with this information; a) It is forecasted that our investment will wear out with a straight-line method over a 5-year period and the scrap value will be 0 TL at the end of the 6th year. The company's tax rate is 20%. In this case, create the cash flow statement of the company in the period covering 0-6 years. (10 point) b) Calculate Payback Period. (5 Point) c) Calculate Discounted Payback Period. (5 Point) d) Calculate Net Present Value. (5 Point) e) Calculate Profitability Index. (5 Point) f) Calculate Internal Rate of Return. (5 Point) g) Calculate Modified Internal Rate of Return. (5 Point)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started