Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would just like information regarding the last three bulletpoints. LYNX CLOTHING COMPANY Background Info: One of the members of your firm is an active

I would just like information regarding the last three bulletpoints.

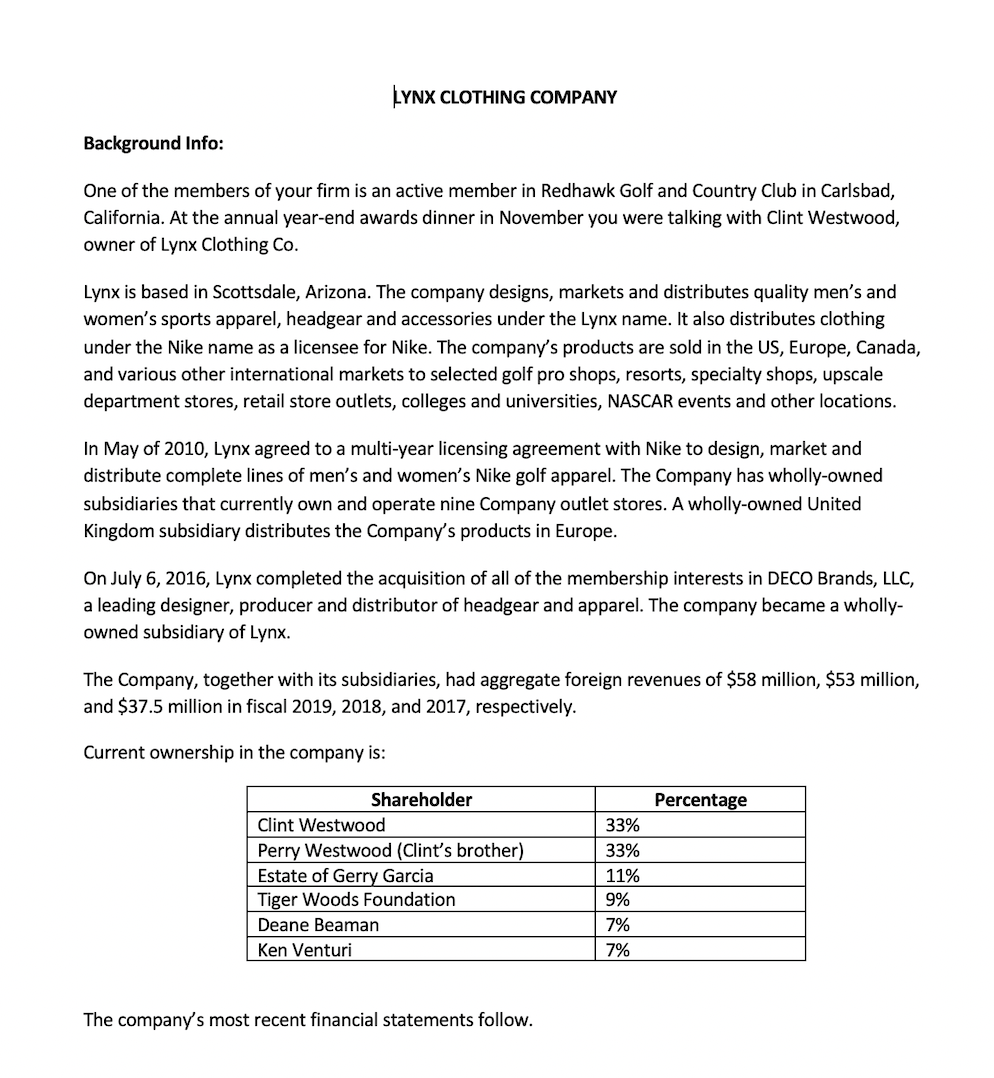

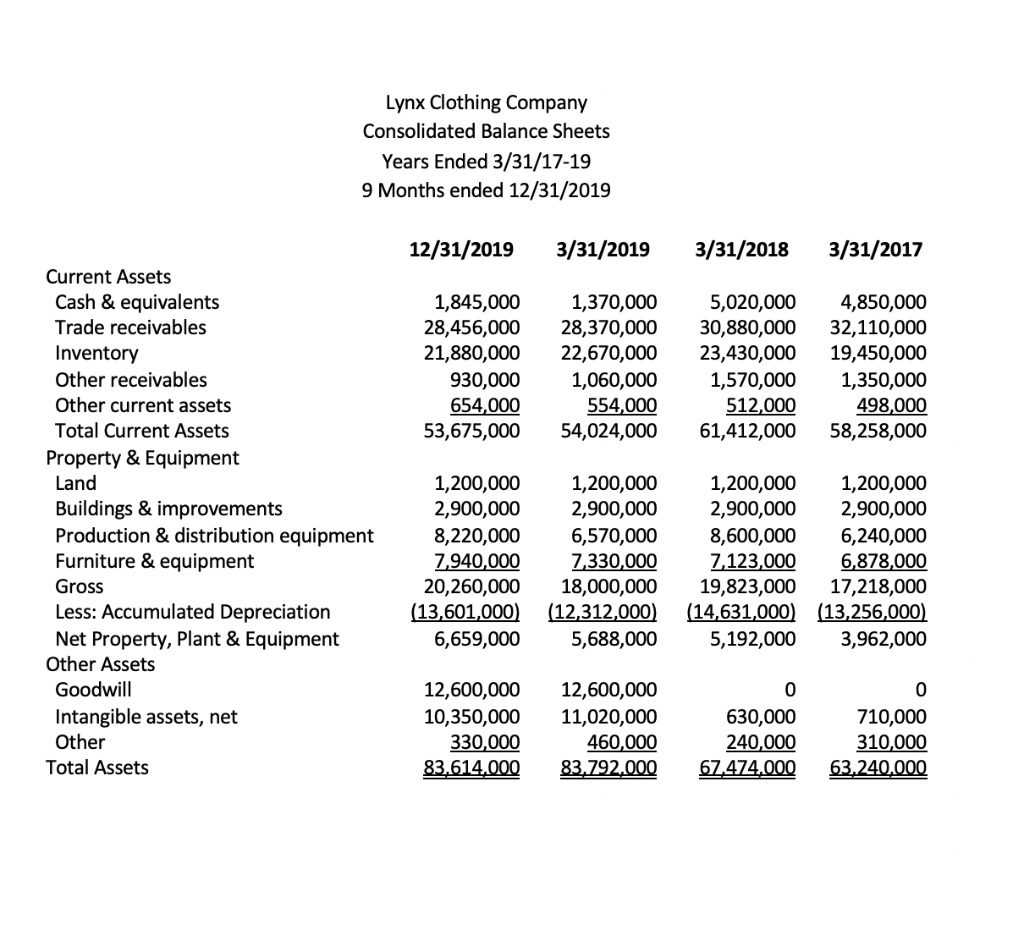

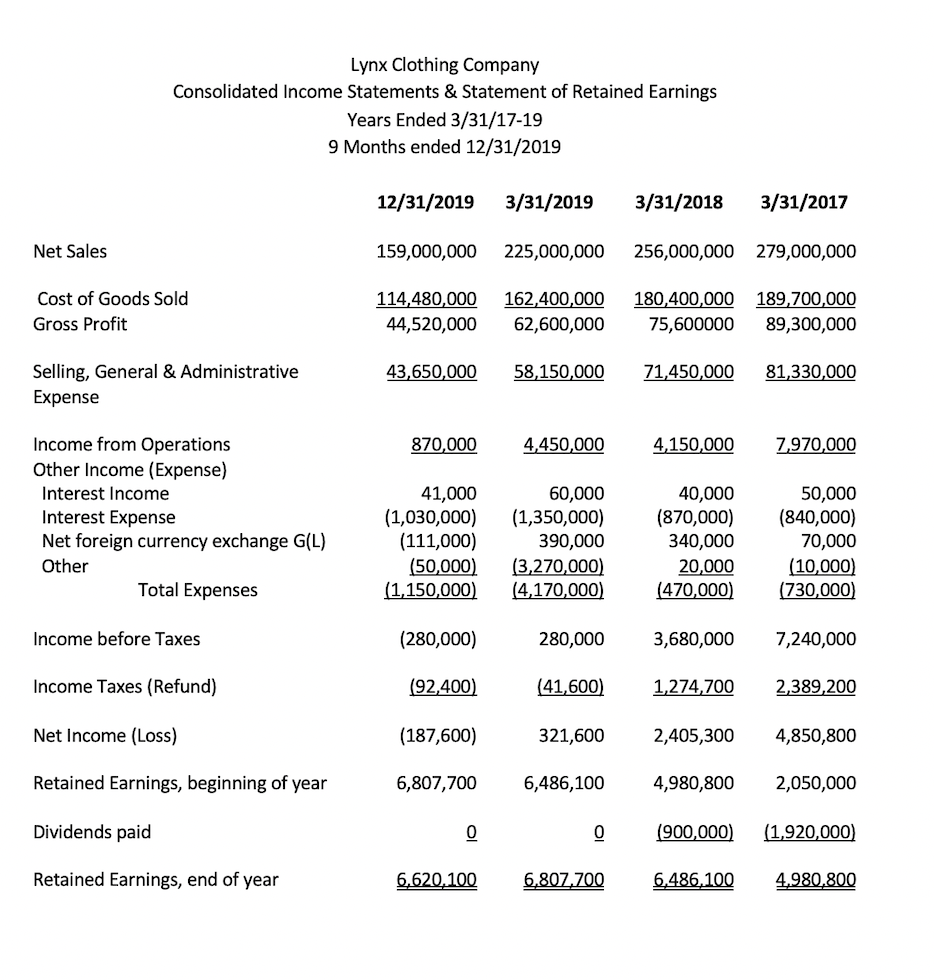

LYNX CLOTHING COMPANY Background Info: One of the members of your firm is an active member in Redhawk Golf and Country Club in Carlsbad, California. At the annual year-end awards dinner in November you were talking with Clint Westwood, owner of Lynx Clothing Co. Lynx is based in Scottsdale, Arizona. The company designs, markets and distributes quality men's and women's sports apparel, headgear and accessories under the Lynx name. It also distributes clothing under the Nike name as a licensee for Nike. The company's products are sold in the US, Europe, Canada, and various other international markets to selected golf pro shops, resorts, specialty shops, upscale department stores, retail store outlets, colleges and universities, NASCAR events and other locations. In May of 2010, Lynx agreed to a multi-year licensing agreement with Nike to design, market and distribute complete lines of men's and women's Nike golf apparel. The Company has wholly-owned subsidiaries that currently own and operate nine Company outlet stores. A wholly-owned United Kingdom subsidiary distributes the Company's products in Europe. On July 6, 2016, Lynx completed the acquisition of all of the membership interests in DECO Brands, LLC, a leading designer, producer and distributor of headgear and apparel. The company became a wholly- owned subsidiary of Lynx. The Company, together with its subsidiaries, had aggregate foreign revenues of $58 million, $53 million, and $37.5 million in fiscal 2019, 2018, and 2017, respectively. Current ownership in the company is: Percentage Shareholder Clint Westwood Perry Westwood (Clint's brother) Estate of Gerry Garcia Tiger Woods Foundation Deane Beaman Ken Venturi 33% 33% 11% 9% 7% 7% The company's most recent financial statements follow. Lynx Clothing Company Consolidated Balance Sheets Years Ended 3/31/17-19 9 Months ended 12/31/2019 12/31/2019 3/31/2019 3/31/2018 3/31/2017 1,845,000 28,456,000 21,880,000 930,000 654,000 53,675,000 1,370,000 28,370,000 22,670,000 1,060,000 554,000 54,024,000 5,020,000 30,880,000 23,430,000 1,570,000 512,000 61,412,000 4,850,000 32,110,000 19,450,000 1,350,000 498,000 58,258,000 Current Assets Cash & equivalents Trade receivables Inventory Other receivables Other current assets Total Current Assets Property & Equipment Land Buildings & improvements Production & distribution equipment Furniture & equipment Gross Less: Accumulated Depreciation Net Property, Plant & Equipment Other Assets Goodwill Intangible assets, net Other Total Assets 1,200,000 2,900,000 8,220,000 7,940,000 20,260,000 (13,601,000) 6,659,000 1,200,000 2,900,000 6,570,000 7,330,000 18,000,000 (12,312,000) 5,688,000 1,200,000 1,200,000 2,900,000 2,900,000 8,600,000 6,240,000 7,123,000 6,878,000 19,823,000 17,218,000 (14,631,000) (13,256,000) 5,192,000 3,962,000 12,600,000 10,350,000 330,000 83.614.000 12,600,000 11,020,000 460,000 83.792.000 0 630,000 240,000 67.474.000 0 710,000 310,000 63,240,000 Lynx Clothing Company Consolidated Balance Sheets Years Ended 3/31/17-19 9 Months ended 12/31/2019 12/31/2019 3/31/2019 3/31/2018 3/31/2017 1,355,000 3,100,000 41,785,900 0 454,000 46,694,900 1,235,000 2,600,000 41,264,000 24,300 776,000 45,899,300 297,000 2,270,000 43,396,900 312,000 562,000 46,837,900 547,000 3,450,000 39,792,200 630,000 432,000 44,851,200 Current Liabilities Current portion of long-term debt Line of credit payable Accounts payable Income taxes payable Accrued expenses Total Current Liabilities Long-Term Liabilities Long-term debt, non-current Deferred income taxes Other Total Long-Term Liabilities Total Liabilities Stockholders' Equity Common Stock (.001 par value) Paid in Capital Retained Earnings Accumulated Other Comprehensive Income Total Stockholders' Equity 18,775,000 675,000 280,000 19,730,000 19,190,000 865,000 360,000 20,415,000 2,630,000 820,000 440,000 3,890,000 2,770,000 288,000 210,000 3,268,000 66,424,900 66,314,300 50,727,900 48,119,200 20,000 10,000,000 6,620,100 549,000 20,000 10,000,000 6,807,700 650,000 20,000 10,000,000 6,486,100 (120,000) 20,000 10,000,000 4,980,800 120,000 17,189,100 83,614,000 17,477,700 83.792.000 16,746,100 67.474,000 15,120,800 63,240,000 Total Liabilities & Stockholders' Equity Lynx Clothing Company Consolidated Income Statements & Statement of Retained Earnings Years Ended 3/31/17-19 9 Months ended 12/31/2019 12/31/2019 3/31/2019 3/31/2018 3/31/2017 Net Sales 159,000,000 225,000,000 256,000,000 279,000,000 Cost of Goods Sold Gross Profit 114,480,000 44,520,000 162,400,000 62,600,000 180,400,000 189,700,000 75,600000 89,300,000 43,650,000 58,150,000 71,450,000 81,330,000 Selling, General & Administrative Expense 870,000 4,450,000 4,150,000 7.970,000 Income from Operations Other Income (Expense) Interest Income Interest Expense Net foreign currency exchange G(L) Other Total Expenses 41,000 (1,030,000) (111,000) (50,000) (1,150,000) 60,000 (1,350,000) 390,000 (3,270,000) (4,170,000) 40,000 (870,000) 340,000 20,000 (470,000) 50,000 (840,000) 70,000 (10,000) (730,000) Income before Taxes (280,000) 280,000 3,680,000 7,240,000 Income Taxes (Refund) (92,400) (41,600) 1,274,700 2,389,200 Net Income (Loss) (187,600) 321,600 2,405,300 4,850,800 Retained Earnings, beginning of year 6,807,700 6,486,100 4,980,800 2,050,000 Dividends paid 0 0 (900,000) (1,920,000) Retained Earnings, end of year 6.620,100 6.807,700 6,486,100 4,980,800 The business was started in 1990 by Clint and Perry Westwood with some seed money from Ken Venturi. The business has shown steady growth over the last 15 years and had sales of $225 million in the fiscal year ended March 31, 2019. Westwood is unhappy with his current auditors and is contemplating a change. Clint Westwood is concerned because their licensing agreement with Nike ran out December 31, 2018, and though Nike continues to use Lynx they have not been able to renegotiate a new agreement. Lynx is also facing extreme challenges from cheaper foreign markets, especially Singapore and Korea. They are spending additional monies on marketing, but things are uncertain. In fiscal 2016, the Company lost a protracted litigation matter with two former owners when the California District Court awarded the former owners a $15 million settlement, of which the Company has paid approximately $3.5 after insurance payments. The Company is also embroiled in a trademark infringement issue with another clothing manufacturer who has alleged that Lynx has illegally copied their logo. As the evening progresses (and Clint has had a few drinks), Clint starts to openly complain about his brother, who seemed to be spending more time in Las Vegas than Scottsdale, Arizona. He says, I don't know what my brother does around the place. I could easily replace him for half the money he draws." Mr. Westwood and the head of the audit committee would like to meet with your firm soon to discuss your possible retention as auditors. Mr. Westwood has given you the financial statements for the last three fiscal years as well as interim statements for the nine months ended December 31, 2019. In preparation for the meeting with the Company representatives, you should address the following issues. . Investigate the clothing manufacturing industry (also retail clothing sales industry) and prepare a financial analysis on Lynx Clothing Company and the industry. If FAMILIAR, USE BLOOMBERG SUPPLYCHAIN ANALYSIS! Identify the key audit risk areas based on your financial analysis and other information provided in the case. Why are they at risk? What specific audit procedures would you recommend to address those audit risk areas? What other information do you need from management at this meeting in addition to the information already provided and why do you need it? There is no statement of cash flows included is this a problem? Are there any business risks which you can identify? What additional steps or inquiries should you make before accepting this engagement? Would you accept this engagement? Your paper should be in the form of a memo to the Audit Client Committee, either recommending you accept the client or not, and give reasons from the questions above . LYNX CLOTHING COMPANY Background Info: One of the members of your firm is an active member in Redhawk Golf and Country Club in Carlsbad, California. At the annual year-end awards dinner in November you were talking with Clint Westwood, owner of Lynx Clothing Co. Lynx is based in Scottsdale, Arizona. The company designs, markets and distributes quality men's and women's sports apparel, headgear and accessories under the Lynx name. It also distributes clothing under the Nike name as a licensee for Nike. The company's products are sold in the US, Europe, Canada, and various other international markets to selected golf pro shops, resorts, specialty shops, upscale department stores, retail store outlets, colleges and universities, NASCAR events and other locations. In May of 2010, Lynx agreed to a multi-year licensing agreement with Nike to design, market and distribute complete lines of men's and women's Nike golf apparel. The Company has wholly-owned subsidiaries that currently own and operate nine Company outlet stores. A wholly-owned United Kingdom subsidiary distributes the Company's products in Europe. On July 6, 2016, Lynx completed the acquisition of all of the membership interests in DECO Brands, LLC, a leading designer, producer and distributor of headgear and apparel. The company became a wholly- owned subsidiary of Lynx. The Company, together with its subsidiaries, had aggregate foreign revenues of $58 million, $53 million, and $37.5 million in fiscal 2019, 2018, and 2017, respectively. Current ownership in the company is: Percentage Shareholder Clint Westwood Perry Westwood (Clint's brother) Estate of Gerry Garcia Tiger Woods Foundation Deane Beaman Ken Venturi 33% 33% 11% 9% 7% 7% The company's most recent financial statements follow. Lynx Clothing Company Consolidated Balance Sheets Years Ended 3/31/17-19 9 Months ended 12/31/2019 12/31/2019 3/31/2019 3/31/2018 3/31/2017 1,845,000 28,456,000 21,880,000 930,000 654,000 53,675,000 1,370,000 28,370,000 22,670,000 1,060,000 554,000 54,024,000 5,020,000 30,880,000 23,430,000 1,570,000 512,000 61,412,000 4,850,000 32,110,000 19,450,000 1,350,000 498,000 58,258,000 Current Assets Cash & equivalents Trade receivables Inventory Other receivables Other current assets Total Current Assets Property & Equipment Land Buildings & improvements Production & distribution equipment Furniture & equipment Gross Less: Accumulated Depreciation Net Property, Plant & Equipment Other Assets Goodwill Intangible assets, net Other Total Assets 1,200,000 2,900,000 8,220,000 7,940,000 20,260,000 (13,601,000) 6,659,000 1,200,000 2,900,000 6,570,000 7,330,000 18,000,000 (12,312,000) 5,688,000 1,200,000 1,200,000 2,900,000 2,900,000 8,600,000 6,240,000 7,123,000 6,878,000 19,823,000 17,218,000 (14,631,000) (13,256,000) 5,192,000 3,962,000 12,600,000 10,350,000 330,000 83.614.000 12,600,000 11,020,000 460,000 83.792.000 0 630,000 240,000 67.474.000 0 710,000 310,000 63,240,000 Lynx Clothing Company Consolidated Balance Sheets Years Ended 3/31/17-19 9 Months ended 12/31/2019 12/31/2019 3/31/2019 3/31/2018 3/31/2017 1,355,000 3,100,000 41,785,900 0 454,000 46,694,900 1,235,000 2,600,000 41,264,000 24,300 776,000 45,899,300 297,000 2,270,000 43,396,900 312,000 562,000 46,837,900 547,000 3,450,000 39,792,200 630,000 432,000 44,851,200 Current Liabilities Current portion of long-term debt Line of credit payable Accounts payable Income taxes payable Accrued expenses Total Current Liabilities Long-Term Liabilities Long-term debt, non-current Deferred income taxes Other Total Long-Term Liabilities Total Liabilities Stockholders' Equity Common Stock (.001 par value) Paid in Capital Retained Earnings Accumulated Other Comprehensive Income Total Stockholders' Equity 18,775,000 675,000 280,000 19,730,000 19,190,000 865,000 360,000 20,415,000 2,630,000 820,000 440,000 3,890,000 2,770,000 288,000 210,000 3,268,000 66,424,900 66,314,300 50,727,900 48,119,200 20,000 10,000,000 6,620,100 549,000 20,000 10,000,000 6,807,700 650,000 20,000 10,000,000 6,486,100 (120,000) 20,000 10,000,000 4,980,800 120,000 17,189,100 83,614,000 17,477,700 83.792.000 16,746,100 67.474,000 15,120,800 63,240,000 Total Liabilities & Stockholders' Equity Lynx Clothing Company Consolidated Income Statements & Statement of Retained Earnings Years Ended 3/31/17-19 9 Months ended 12/31/2019 12/31/2019 3/31/2019 3/31/2018 3/31/2017 Net Sales 159,000,000 225,000,000 256,000,000 279,000,000 Cost of Goods Sold Gross Profit 114,480,000 44,520,000 162,400,000 62,600,000 180,400,000 189,700,000 75,600000 89,300,000 43,650,000 58,150,000 71,450,000 81,330,000 Selling, General & Administrative Expense 870,000 4,450,000 4,150,000 7.970,000 Income from Operations Other Income (Expense) Interest Income Interest Expense Net foreign currency exchange G(L) Other Total Expenses 41,000 (1,030,000) (111,000) (50,000) (1,150,000) 60,000 (1,350,000) 390,000 (3,270,000) (4,170,000) 40,000 (870,000) 340,000 20,000 (470,000) 50,000 (840,000) 70,000 (10,000) (730,000) Income before Taxes (280,000) 280,000 3,680,000 7,240,000 Income Taxes (Refund) (92,400) (41,600) 1,274,700 2,389,200 Net Income (Loss) (187,600) 321,600 2,405,300 4,850,800 Retained Earnings, beginning of year 6,807,700 6,486,100 4,980,800 2,050,000 Dividends paid 0 0 (900,000) (1,920,000) Retained Earnings, end of year 6.620,100 6.807,700 6,486,100 4,980,800 The business was started in 1990 by Clint and Perry Westwood with some seed money from Ken Venturi. The business has shown steady growth over the last 15 years and had sales of $225 million in the fiscal year ended March 31, 2019. Westwood is unhappy with his current auditors and is contemplating a change. Clint Westwood is concerned because their licensing agreement with Nike ran out December 31, 2018, and though Nike continues to use Lynx they have not been able to renegotiate a new agreement. Lynx is also facing extreme challenges from cheaper foreign markets, especially Singapore and Korea. They are spending additional monies on marketing, but things are uncertain. In fiscal 2016, the Company lost a protracted litigation matter with two former owners when the California District Court awarded the former owners a $15 million settlement, of which the Company has paid approximately $3.5 after insurance payments. The Company is also embroiled in a trademark infringement issue with another clothing manufacturer who has alleged that Lynx has illegally copied their logo. As the evening progresses (and Clint has had a few drinks), Clint starts to openly complain about his brother, who seemed to be spending more time in Las Vegas than Scottsdale, Arizona. He says, I don't know what my brother does around the place. I could easily replace him for half the money he draws." Mr. Westwood and the head of the audit committee would like to meet with your firm soon to discuss your possible retention as auditors. Mr. Westwood has given you the financial statements for the last three fiscal years as well as interim statements for the nine months ended December 31, 2019. In preparation for the meeting with the Company representatives, you should address the following issues. . Investigate the clothing manufacturing industry (also retail clothing sales industry) and prepare a financial analysis on Lynx Clothing Company and the industry. If FAMILIAR, USE BLOOMBERG SUPPLYCHAIN ANALYSIS! Identify the key audit risk areas based on your financial analysis and other information provided in the case. Why are they at risk? What specific audit procedures would you recommend to address those audit risk areas? What other information do you need from management at this meeting in addition to the information already provided and why do you need it? There is no statement of cash flows included is this a problem? Are there any business risks which you can identify? What additional steps or inquiries should you make before accepting this engagement? Would you accept this engagement? Your paper should be in the form of a memo to the Audit Client Committee, either recommending you accept the client or not, and give reasons from the questions aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started