I would like some help solving this problem with steps please, thank you.

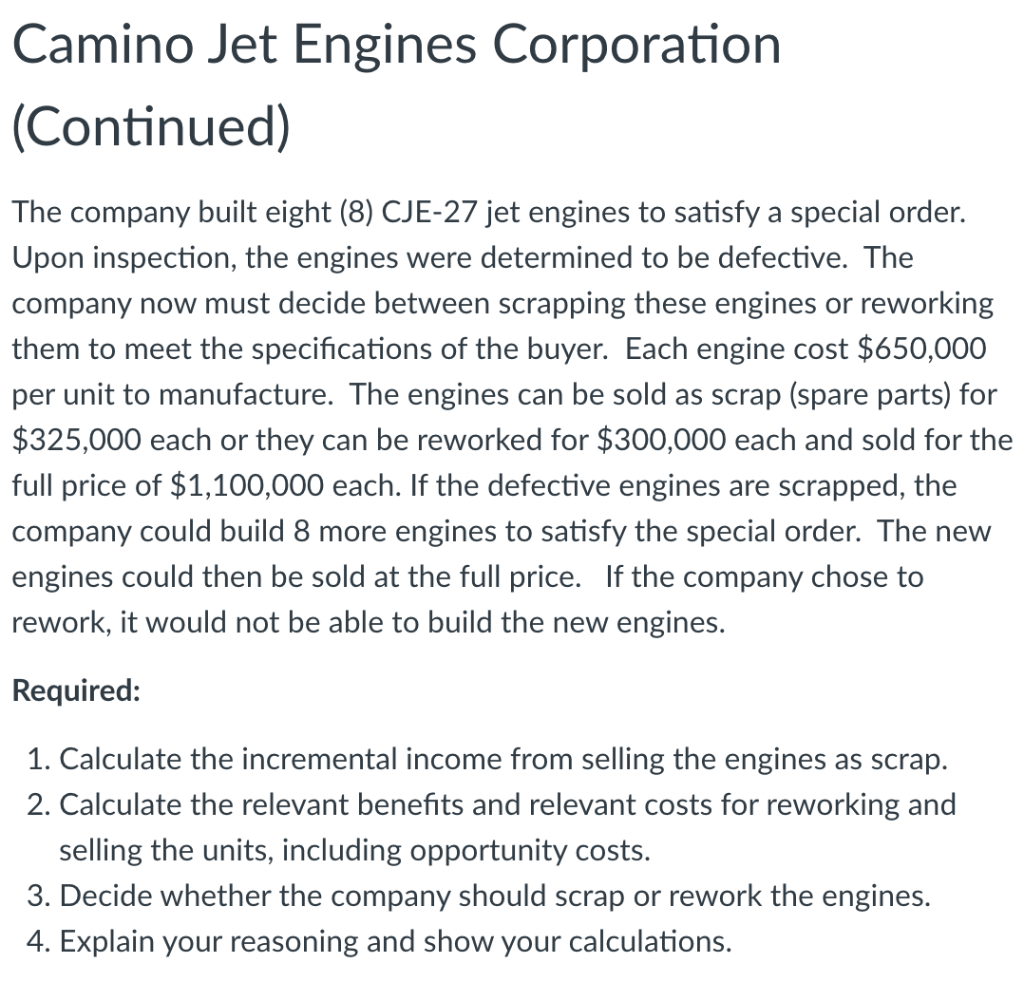

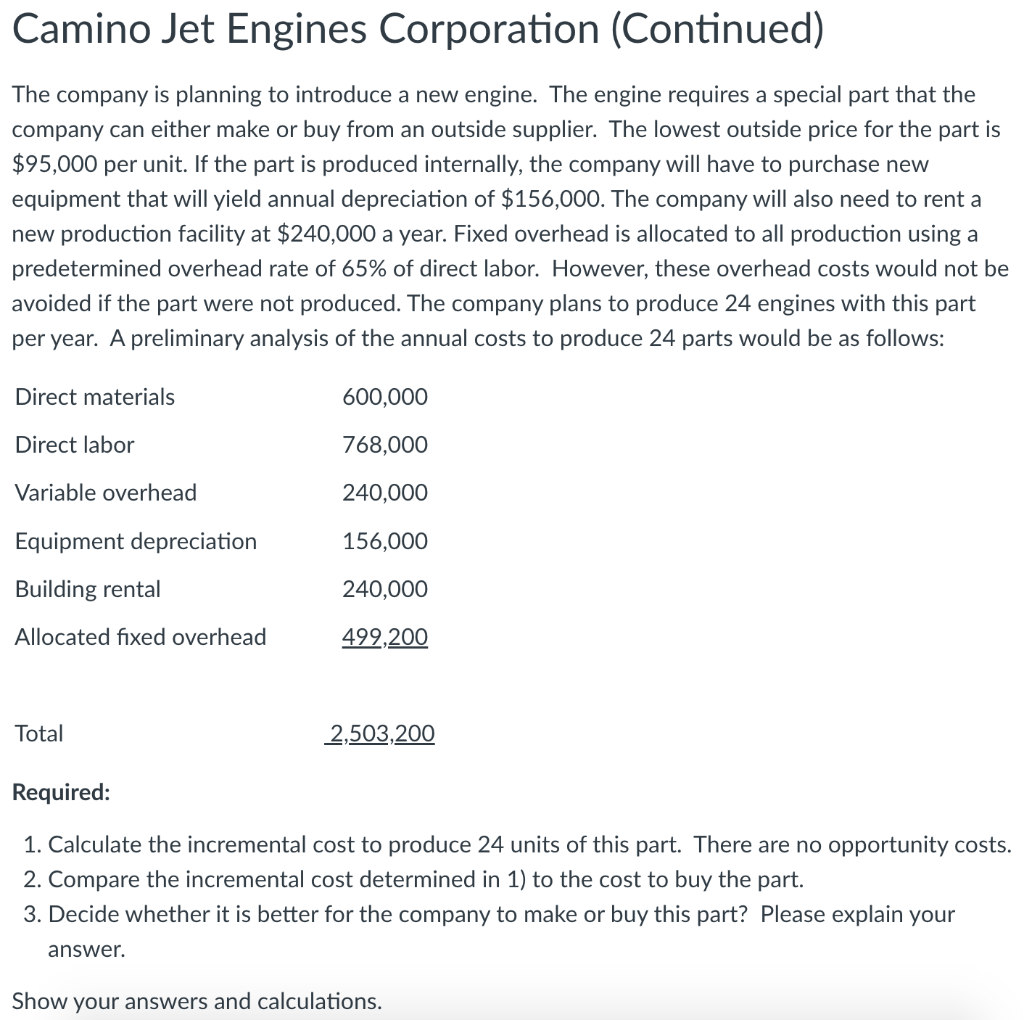

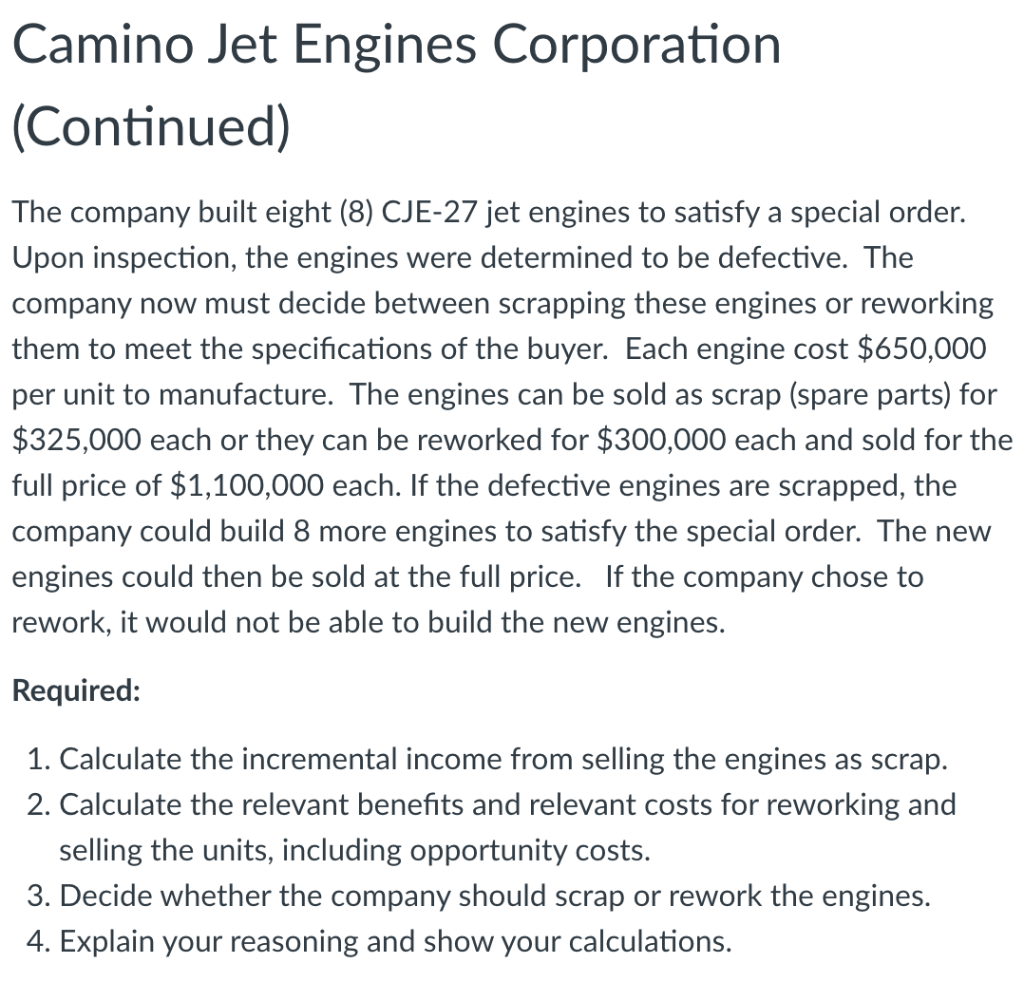

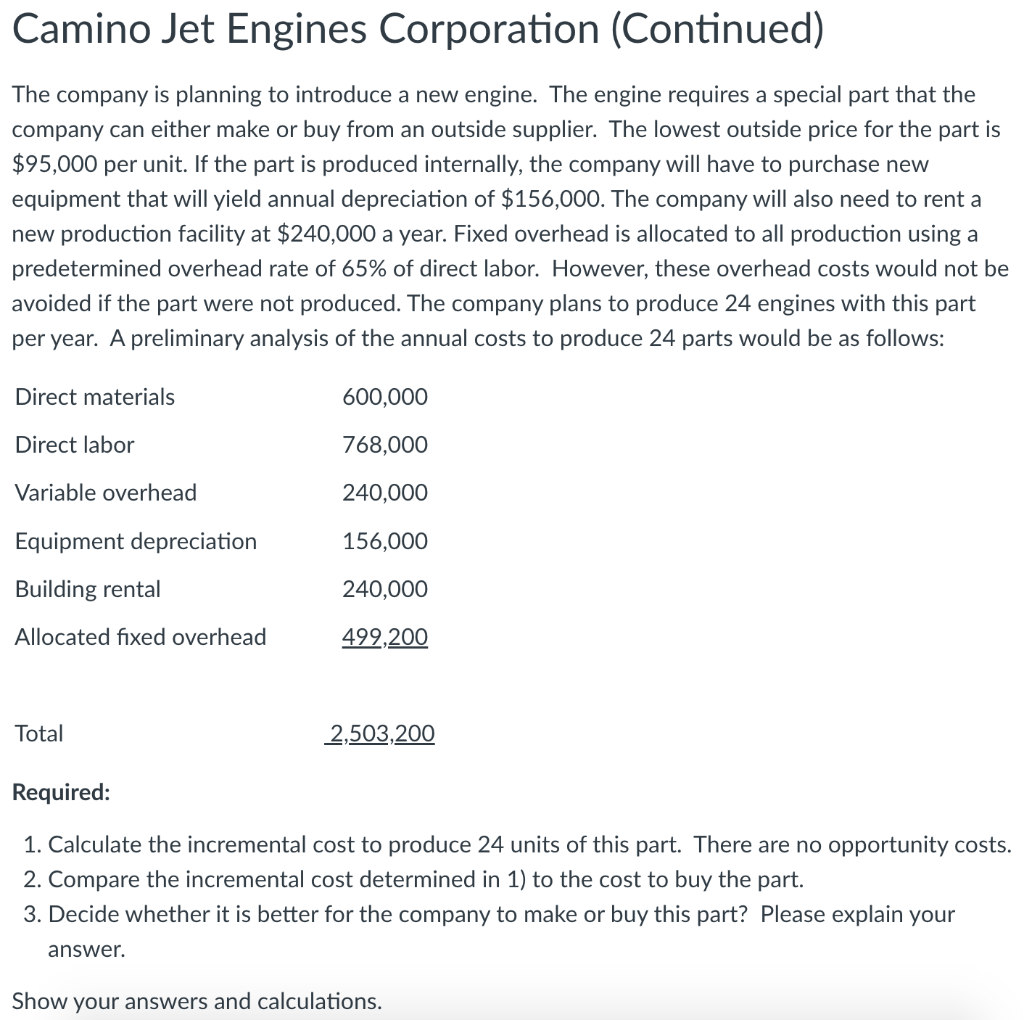

Camino Jet Engines Corporation (Continued) The company built eight (8) CJE-27 jet engines to satisfy a special order. Upon inspection, the engines were determined to be defective. The company now must decide between scrapping these engines or reworking them to meet the specifications of the buyer. Each engine cost $650,000 per unit to manufacture. The engines can be sold as scrap (spare parts) for $325,000 each or they can be reworked for $300,000 each and sold for the full price of $1,100,000 each. If the defective engines are scrapped, the company could build 8 more engines to satisfy the special order. The new engines could then be sold at the full price. If the company chose to rework, it would not be able to build the new engines. Required: 1. Calculate the incremental income from selling the engines as scrap. 2. Calculate the relevant benefits and relevant costs for reworking and selling the units, including opportunity costs. 3. Decide whether the company should scrap or rework the engines. 4. Explain your reasoning and show your calculations. Camino Jet Engines Corporation (Continued) The company is planning to introduce a new engine. The engine requires a special part that the company can either make or buy from an outside supplier. The lowest outside price for the part is $95,000 per unit. If the part is produced internally, the company will have to purchase new equipment that will yield annual depreciation of $156,000. The company will also need to rent a new production facility at $240,000 a year. Fixed overhead is allocated to all production using a predetermined overhead rate of 65% of direct labor. However, these overhead costs would not be avoided if the part were not produced. The company plans to produce 24 engines with this part per year. A preliminary analysis of the annual costs to produce 24 parts would be as follows: Direct materials 600,000 Direct labor 768,000 Variable overhead 240,000 Equipment depreciation 156,000 Building rental 240,000 Allocated fixed overhead 499,200 Total 2,503,200 Required: 1. Calculate the incremental cost to produce 24 units of this part. There are no opportunity costs. 2. Compare the incremental cost determined in 1) to the cost to buy the part. 3. Decide whether it is better for the company to make or buy this part? Please explain your answer. Show your answers and calculations