Answered step by step

Verified Expert Solution

Question

1 Approved Answer

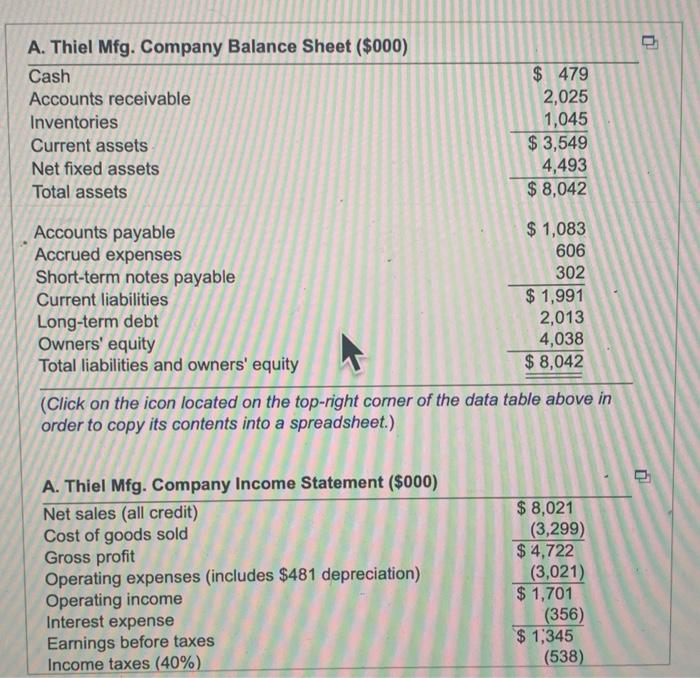

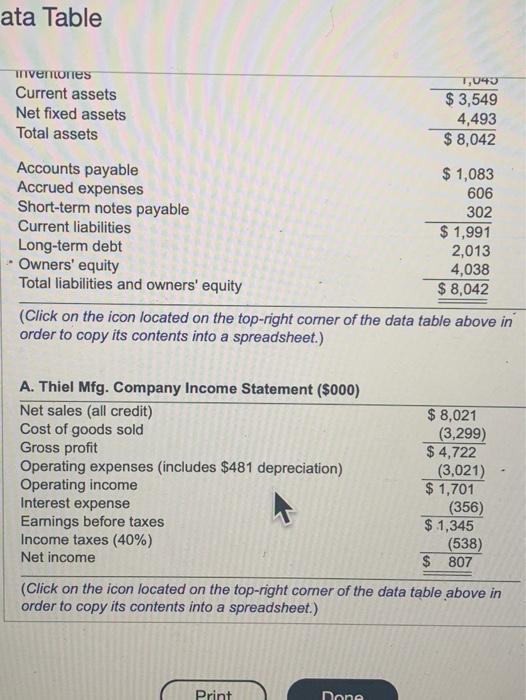

i would like the answers for a-j. (Ratio analysis) The balance sheet and income statement for the A. Thiel Mig. Company are given in the

i would like the answers for a-j.

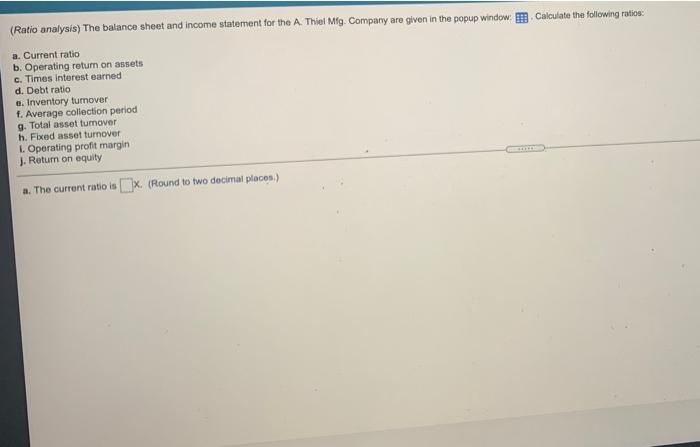

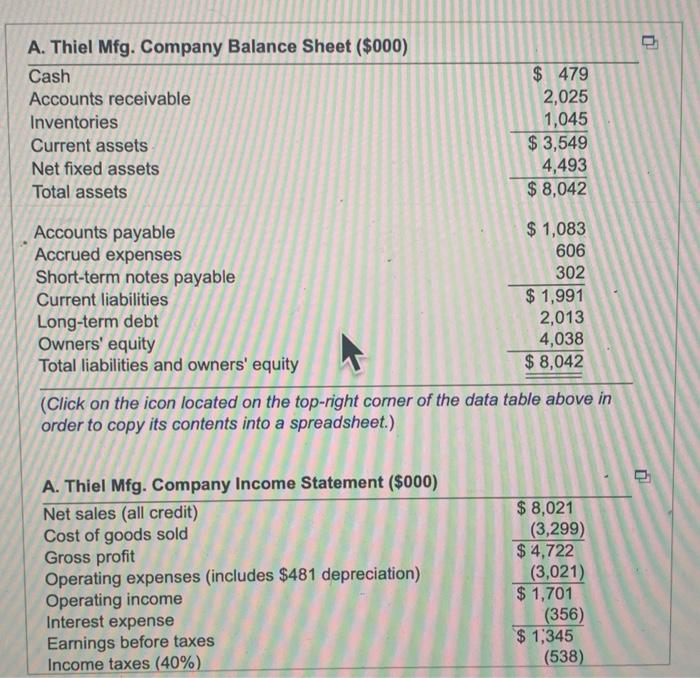

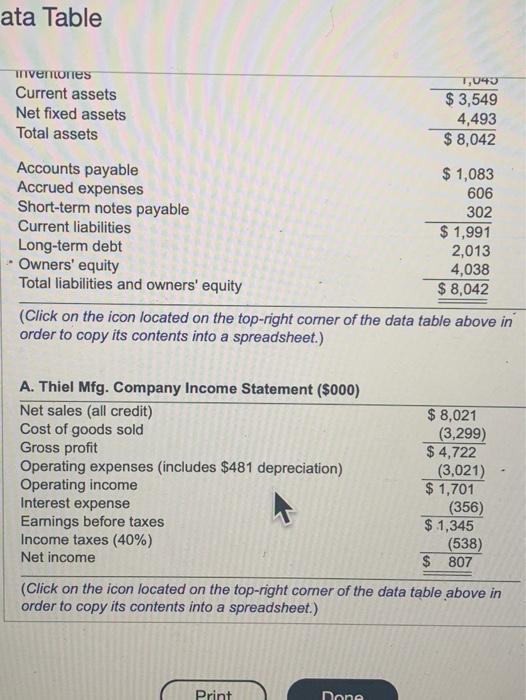

(Ratio analysis) The balance sheet and income statement for the A. Thiel Mig. Company are given in the popup window. Calculate the following ratios: a. Current ratio b. Operating return on assets c. Times interest earned d. Debt ratio e. Inventory turnover f. Average collection period g. Total asset tumover h. Fixed asset turnover L Operating profit margin J. Return on equity a. The current ratio is x. (Round to two decimal places) A. Thiel Mfg. Company Balance Sheet ($000) Cash Accounts receivable Inventories Current assets Net fixed assets Total assets $ 479 2,025 1,045 $ 3,549 4,493 $ 8,042 Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term debt Owners' equity Total liabilities and owners' equity $ 1,083 606 302 $ 1,991 2,013 4,038 $ 8,042 (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) A. Thiel Mfg. Company Income Statement ($000) Net sales (all credit) Cost of goods sold Gross profit Operating expenses (includes $481 depreciation) Operating income Interest expense Earnings before taxes Income taxes (40%) $ 8,021 (3,299) $ 4,722 (3,021) $ 1,701 (356) $ 1,345 (538) ata Table Thvernorres Current assets Net fixed assets Total assets 7,043 $ 3,549 4,493 $ 8,042 Accounts payable $ 1,083 Accrued expenses 606 Short-term notes payable 302 Current liabilities $ 1,991 Long-term debt 2,013 Owners' equity 4,038 Total liabilities and owners' equity $ 8,042 (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) A. Thiel Mfg. Company Income Statement ($000) Net sales (all credit) Cost of goods sold Gross profit Operating expenses (includes $481 depreciation) Operating income Interest expense Eamings before taxes Income taxes (40%) Net income $ 8,021 (3,299) $ 4,722 (3,021) $ 1,701 (356) $ 1,345 (538) $ 807 (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started