Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to ask 2c and 2d. Problem 2 (Short answer please!). Consider the following capital allocation problem. The riskfree asset has a return

I would like to ask 2c and 2d.

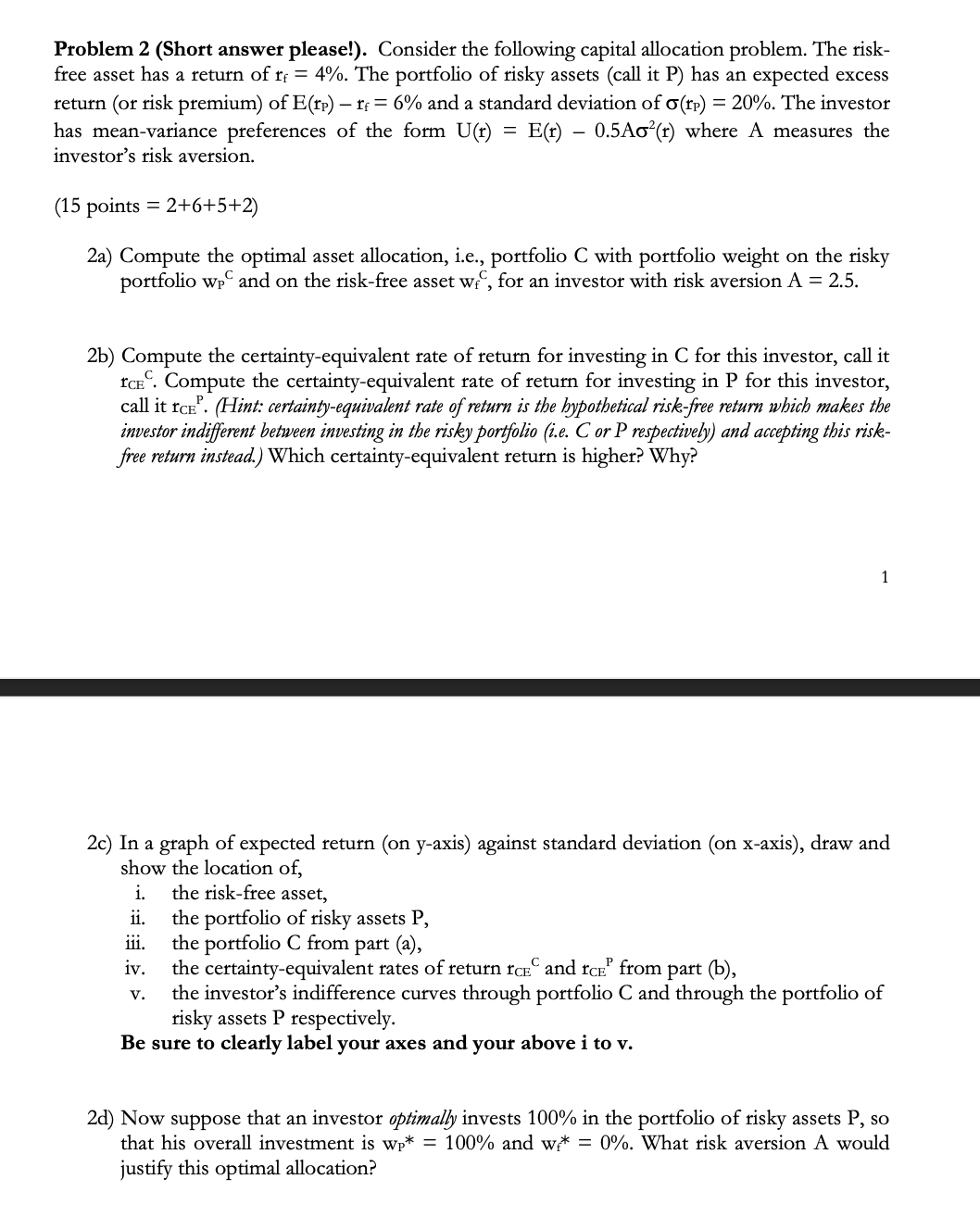

Problem 2 (Short answer please!). Consider the following capital allocation problem. The riskfree asset has a return of rf=4%. The portfolio of risky assets (call it P ) has an expected excess return (or risk premium) of E(rP)rf=6% and a standard deviation of (rP)=20%. The investor has mean-variance preferences of the form U(r)=E(r)0.5A2(r) where A measures the investor's risk aversion. (15 points =2+6+5+2) 2a) Compute the optimal asset allocation, i.e., portfolio C with portfolio weight on the risky portfolio wPC and on the risk-free asset wfC, for an investor with risk aversion A=2.5. 2b) Compute the certainty-equivalent rate of return for investing in C for this investor, call it rCEC. Compute the certainty-equivalent rate of return for investing in P for this investor, call it rCEP. (Hint: certainty-equivalent rate of return is the bypothetical risk-free return which makes the investor indifferent between investing in the risky porffolio (i.e. C or P respectively) and accepting this riskfree return instead.) Which certainty-equivalent return is higher? Why? 1 2c) In a graph of expected return (on y-axis) against standard deviation (on x-axis), draw and show the location of, i. the risk-free asset, ii. the portfolio of risky assets P, iii. the portfolio C from part (a), iv. the certainty-equivalent rates of return rCEC and rCEp from part (b), v. the investor's indifference curves through portfolio C and through the portfolio of risky assets P respectively. Be sure to clearly label your axes and your above i to v. 2d) Now suppose that an investor optimally invests 100% in the portfolio of risky assets P, so that his overall investment is wp=100% and wf=0%. What risk aversion A would justify this optimal allocationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started