I would like to clarify my answers and some questions I don't know. Thank you in advance.

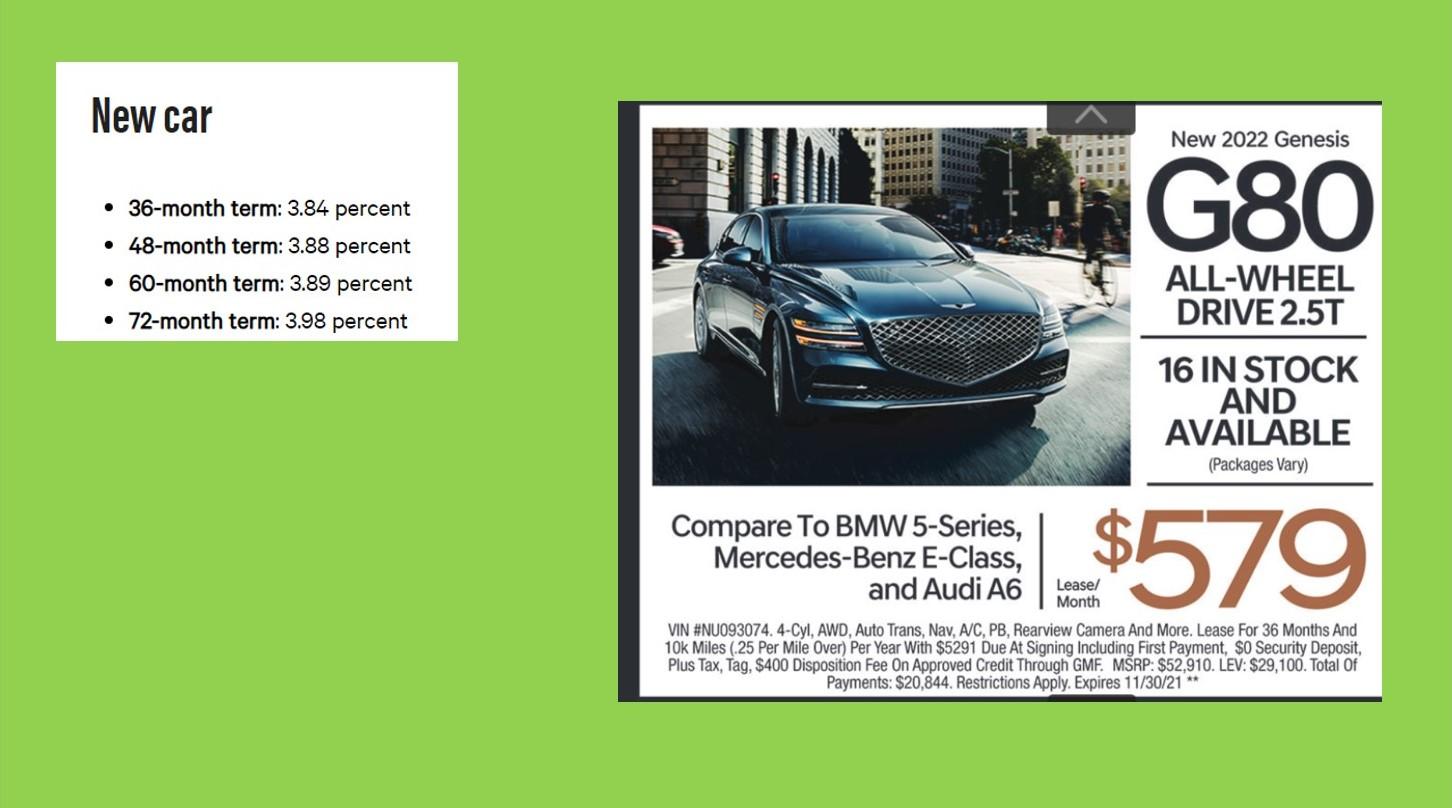

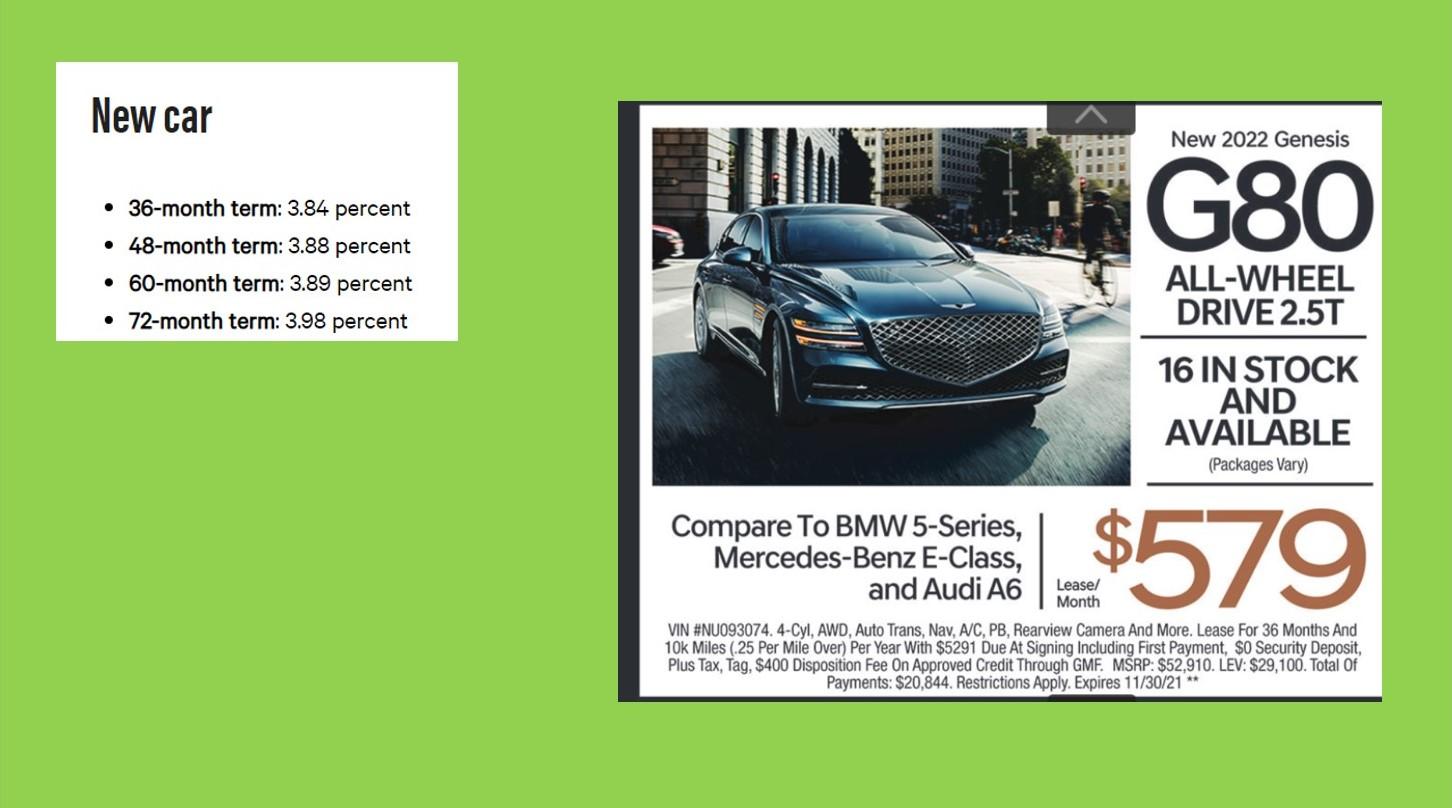

Name: Khanh Tran November 21, 2021 3. What did you learn from the Cars week that you can apply either now or in your future when thinking of transportation requirements? (1 point) To make better decision on buying or taking a lease of the car. I will choose the cheaper option FIN150 - buy or lease or purchase a car Total of this 10% of your grade, points broken out as follows: Use a website such as http://www.cars.com/go/advice/financing/calc/loanLeaseCalc.jsp to calculate the payments. Or you can use your amortization calculator or another option. REVIEW THE POWERPOINT FOR DETAILS on this offer!!! 1. Look you have the opportunity to buy a new 2022 Genesis G80! Do the following calculations use the powerpoint attached to see more clearly - 7 points) a. For the PURCHASE (cash) option what is your total all in cost for this car? (ves, it is obvious but don't go taking those discounts! $20,844 1) For the FINANCE option assume you will finance this car for the same length as the lease to compare payments here: 36 months. Use the powerpoint current interest rates to answer. What is the monthly payment assuming you are able to negotiate the MSRP to 92% of its list price. ADD to the price of the car 6% sales tax!!! Payment: $1,520/month 2) How much is the cost for this car - add in the interest you paid as well from the payments above (so answer #1 times 36 months) $1,520*36 = $54.720 6. For the LEASE option (left column): 1) How much is the lease cost to you if you only put 10,000 miles on the car each year for the 36 months? $0.25 * 10,000 * 3 * 12 = $90,000 2) How much would the total cost be if you drove 12.500 miles a year each year instead and the cost overage per mile was 25cents? $0.25 * 12.500 * 3 * 12 = $112,500 3) What is the residual value of this car after the car is returned? 4) What is the interest rate then on this? 2. What would you do if you had to decide on the PURCHASE, FINANCE or LEASE? Which is least expensive, most expensive, and why? (2 points) New car New 2022 Genesis G80 36-month term: 3.84 percent 48-month term: 3.88 percent 60-month term: 3.89 percent 72-month term: 3.98 percent ALL-WHEEL DRIVE 2.5T 16 IN STOCK AND AVAILABLE (Packages Vary) Compare To BMW 5-Series, Mercedes-Benz E-Class, and Audi A6 Lease/ VIN #NU093074.4-Cyl, AWD, Auto Trans, Nav, A/C, PB, Rearview Camera And More. Lease For 36 Months And 10k Miles (.25 Per Mile Over) Per Year With $5291 Due At Signing Including First Payment. $0 Security Deposit, Plus Tax, Tag, $400 Disposition Fee On Approved Credit Through GMF. MSRP: $52,910. LEV: $29,100. Total of Payments: $20,844. Restrictions Apply. Expires 11/30/21 ** | $579 Name: Khanh Tran November 21, 2021 3. What did you learn from the Cars week that you can apply either now or in your future when thinking of transportation requirements? (1 point) To make better decision on buying or taking a lease of the car. I will choose the cheaper option FIN150 - buy or lease or purchase a car Total of this 10% of your grade, points broken out as follows: Use a website such as http://www.cars.com/go/advice/financing/calc/loanLeaseCalc.jsp to calculate the payments. Or you can use your amortization calculator or another option. REVIEW THE POWERPOINT FOR DETAILS on this offer!!! 1. Look you have the opportunity to buy a new 2022 Genesis G80! Do the following calculations use the powerpoint attached to see more clearly - 7 points) a. For the PURCHASE (cash) option what is your total all in cost for this car? (ves, it is obvious but don't go taking those discounts! $20,844 1) For the FINANCE option assume you will finance this car for the same length as the lease to compare payments here: 36 months. Use the powerpoint current interest rates to answer. What is the monthly payment assuming you are able to negotiate the MSRP to 92% of its list price. ADD to the price of the car 6% sales tax!!! Payment: $1,520/month 2) How much is the cost for this car - add in the interest you paid as well from the payments above (so answer #1 times 36 months) $1,520*36 = $54.720 6. For the LEASE option (left column): 1) How much is the lease cost to you if you only put 10,000 miles on the car each year for the 36 months? $0.25 * 10,000 * 3 * 12 = $90,000 2) How much would the total cost be if you drove 12.500 miles a year each year instead and the cost overage per mile was 25cents? $0.25 * 12.500 * 3 * 12 = $112,500 3) What is the residual value of this car after the car is returned? 4) What is the interest rate then on this? 2. What would you do if you had to decide on the PURCHASE, FINANCE or LEASE? Which is least expensive, most expensive, and why? (2 points) New car New 2022 Genesis G80 36-month term: 3.84 percent 48-month term: 3.88 percent 60-month term: 3.89 percent 72-month term: 3.98 percent ALL-WHEEL DRIVE 2.5T 16 IN STOCK AND AVAILABLE (Packages Vary) Compare To BMW 5-Series, Mercedes-Benz E-Class, and Audi A6 Lease/ VIN #NU093074.4-Cyl, AWD, Auto Trans, Nav, A/C, PB, Rearview Camera And More. Lease For 36 Months And 10k Miles (.25 Per Mile Over) Per Year With $5291 Due At Signing Including First Payment. $0 Security Deposit, Plus Tax, Tag, $400 Disposition Fee On Approved Credit Through GMF. MSRP: $52,910. LEV: $29,100. Total of Payments: $20,844. Restrictions Apply. Expires 11/30/21 ** | $579