I would like to confirm the accuracy of the below answers as I think I might be off a little. Thanks

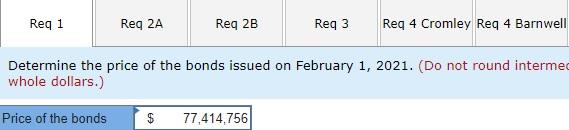

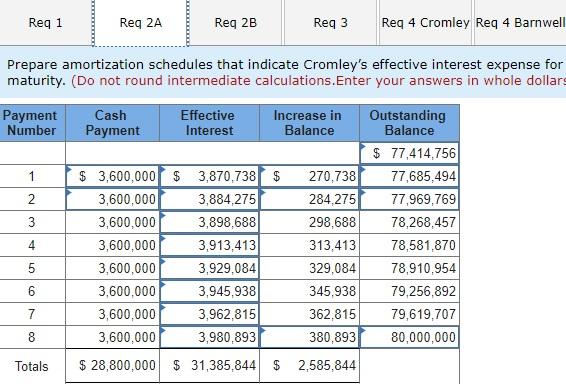

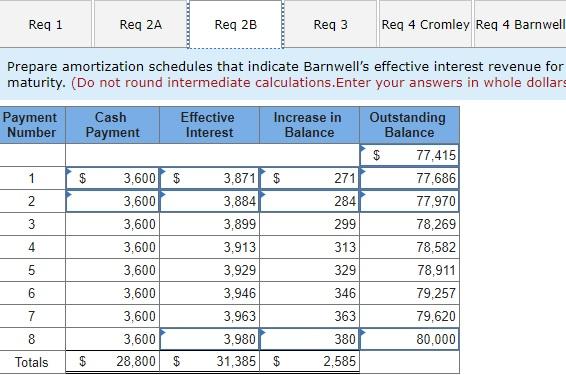

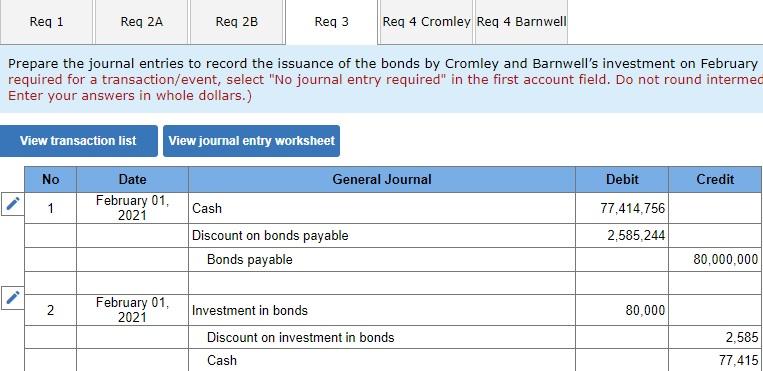

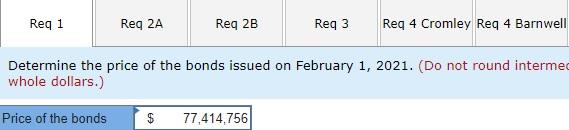

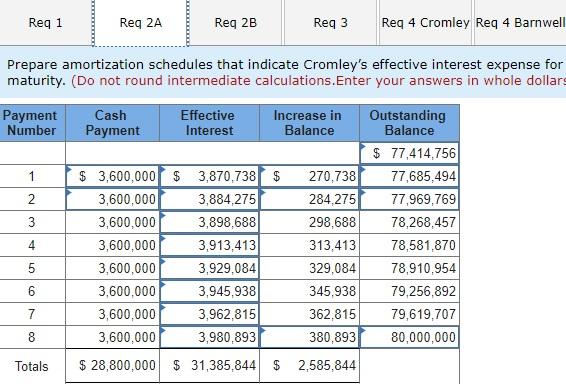

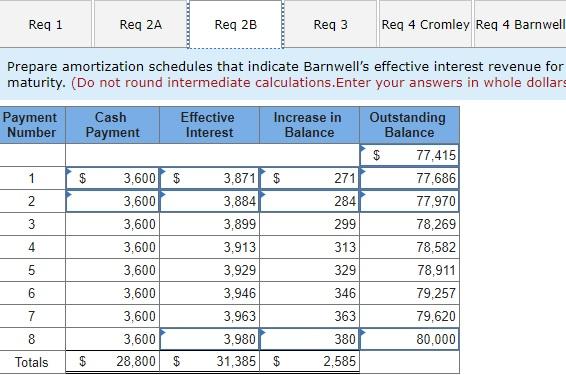

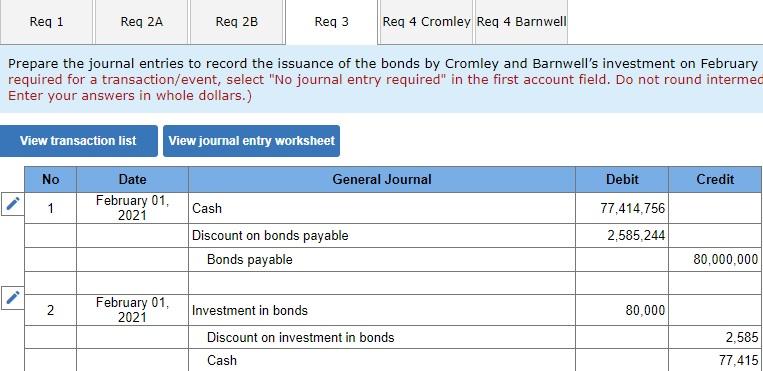

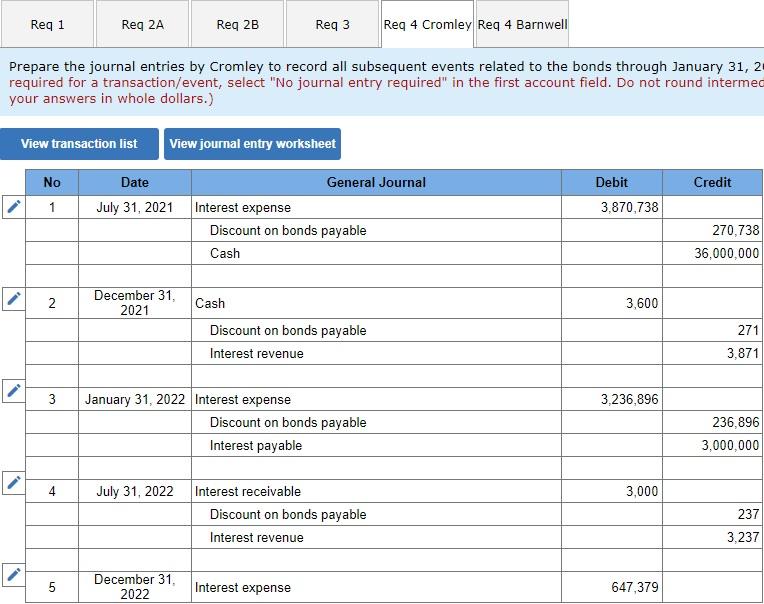

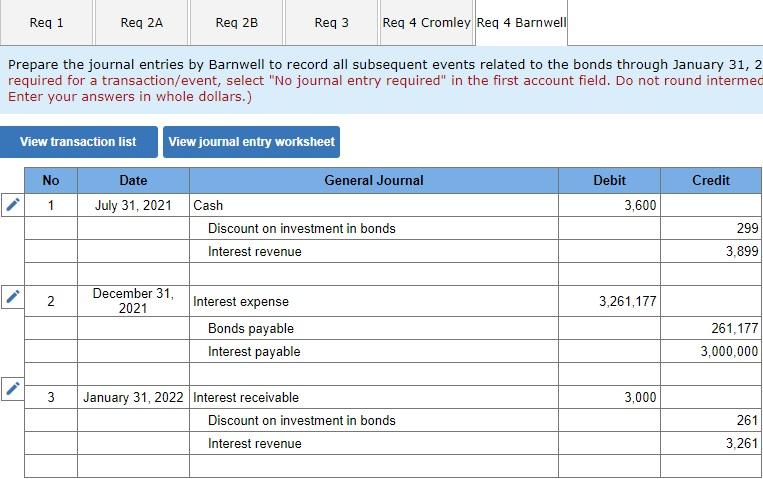

On February 1, 2021, Cromley Motor Products issued 9% bonds, dated February 1, with a face amount of $80 million. The bonds mature on January 31, 2025 (4 years). The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31. Barnwell Industries acquired $80,000 of the bonds as a long-term investment. The fiscal years of both firms end December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds issued on February 1, 2021. 2-a. Prepare amortization schedules that indicate Cromleys effective interest expense for each interest period during the term to maturity. 2-b. Prepare amortization schedules that indicate Barnwells effective interest revenue for each interest period during the term to maturity. 3. Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwells investment on February 1, 2021. 4. Prepare the journal entries by both firms to record all subsequent events related to the bonds through January 31, 2023.

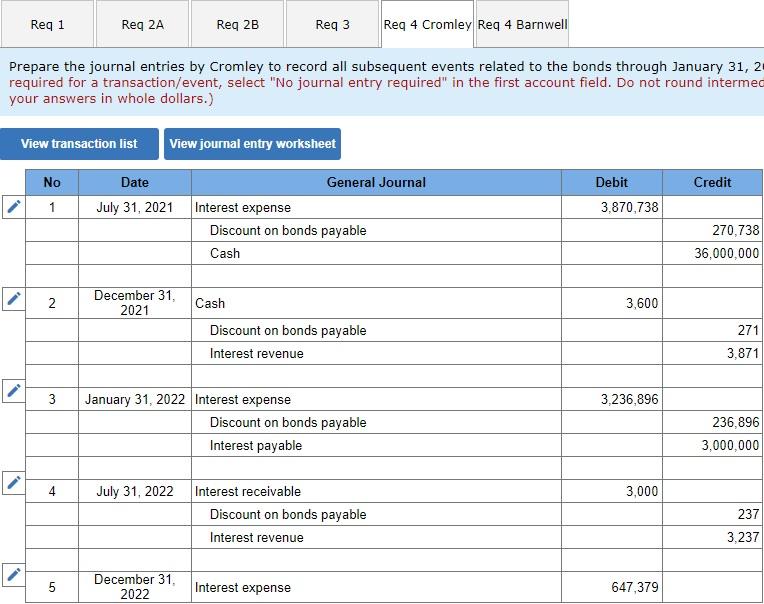

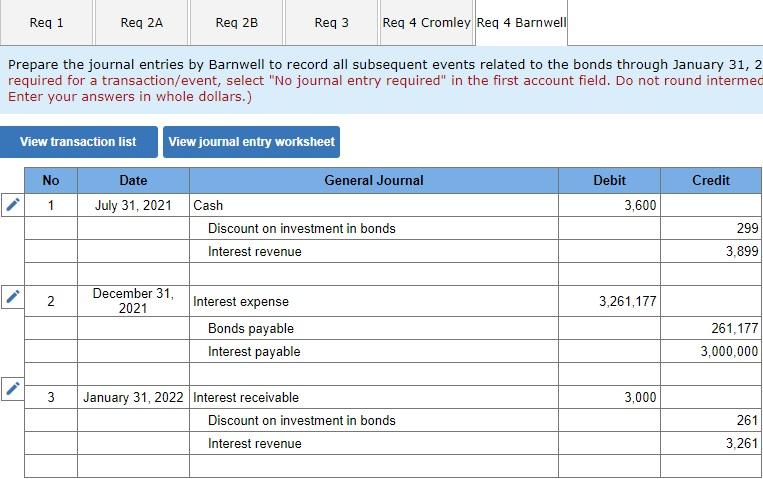

Reg 1 Reg 2A Req 2B Reg 3 Req 4 Cromley Req 4 Barnwell Determine the price of the bonds issued on February 1, 2021. (Do not round interme whole dollars.) Price of the bonds $ 77,414,756 Req 1 Reg 2A Reg 2B Req3 Req 4 Cromley Req 4 Barnwell Prepare amortization schedules that indicate Cromley's effective interest expense for maturity. (Do not round intermediate calculations.Enter your answers in whole dollars Payment Number Cash Payment Effective Interest Increase in Balance 1 N 3 $ 3,600,000 $ 3,870,738 $ 3,600,000 3,884,275 3,600,000 3,898,688 3,600,000 3,913,413 3,600,000 3,929,084 3,600,000 3,945,938 3,600,000 3,962,815 3,600.000 3,980,893 4 Outstanding Balance $ 77,414,756 77,685,494 77,969,769 78,268,457 78,581,870 78,910,954 79,256,892 79,619,707 80,000,000 270,738 284,275 298,688 313,413 329,084 345,938 362.815 380,893 5 5 6 7 8 Totals $ 28,800,000 $ 31,385,844 $ 2,585,844 Req 1 Reg 2A Req 2B Reg 3 Req 4 Cromley Req 4 Barnwell Prepare amortization schedules that indicate Barnwell's effective interest revenue for maturity. (Do not round intermediate calculations.Enter your answers in whole dollars Payment Number Cash Payment Effective Interest Increase in Balance 1 $ 2 3 4 3,600 $ 3,600 3,600 3,600 3,600 3,600 3,600 3,600 28,800 $ Outstanding Balance $ 77.415 77,686 77,970 78,269 78,582 78,911 79,257 79,620 80,000 3,871 $ 3,884 3,899 3,913 3,929 3,946 3,963 3,980 31,385 $ 271 284 299 313 329 346 363 5 6 7 8 380 2,585 Totals $ Req 1 Reg 2A Req 2B Reg 3 Req 4 Cromley Req 4 Barnwell Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwell's investment on February required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermed Enter your answers in whole dollars.) View transaction list View journal entry worksheet No General Journal Debit Credit Date February 01, 2021 1 Cash 77,414.756 2,585,244 Discount on bonds payable Bonds payable 80,000,000 2 February 01, 2021 80,000 Investment in bonds Discount on investment in bonds Cash 2,585 77,415 Reg 1 Reg 2A Reg 2B Reg 3 Req 4 Cromley Req 4 Barnwell Prepare the journal entries by Cromley to record all subsequent events related to the bonds through January 31, 2 required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermed your answers in whole dollars.) View transaction list View journal entry worksheet Debit Credit No 1 3,870,738 Date General Journal July 31, 2021 Interest expense Discount on bonds payable Cash 270,738 36,000,000 N December 31, 2021 3,600 Cash Discount on bonds payable Interest revenue 271 3.871 3 3,236,896 January 31, 2022 Interest expense Discount on bonds payable Interest payable 236,896 3,000,000 4 July 31, 2022 3,000 Interest receivable Discount on bonds payable Interest revenue 237 3,237 6 5 December 31 2022 Interest expense 647,379 Req 1 Reg 2A Reg 2B Req3 Reg 4 Cromley Req 4 Barnwell Prepare the journal entries by Barnwell to record all subsequent events related to the bonds through January 31, 2 required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermed Enter your answers in whole dollars.) View transaction list View journal entry worksheet Credit No 1 Date July 31, 2021 Debit 3,600 General Journal Cash Discount on investment in bonds Interest revenue 299 3,899 2 December 31, 2021 3,261,177 Interest expense Bonds payable Interest payable 261,177 3,000,000 3 3,000 January 31, 2022 Interest receivable Discount on investment in bonds Interest revenue 261 3,261