Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to have answer to this question. thanks Mark for follow up Question 30 of 30. All of the following taxpayers received a

I would like to have answer to this question. thanks

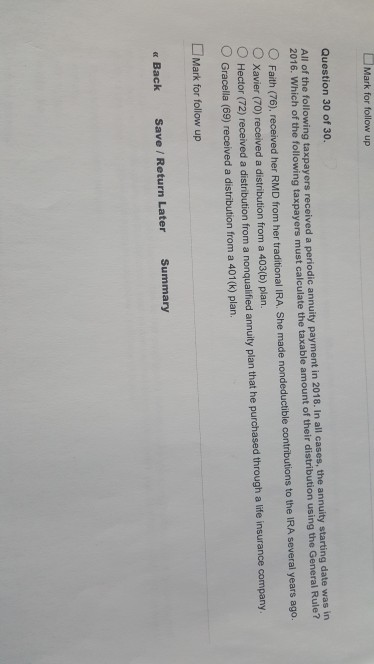

Mark for follow up Question 30 of 30. All of the following taxpayers received a periodic annuity payment in 2018. In all cases, the annuity starting date was in 2016. Which of the following taxpayers must calculate the taxable amount of their distribution using the General Ruler Faith (76), received her RMD from her traditional IRA. She made nondeductible contributions to the IRA several years ago. O Xavier (70) received a distribution from a 403(b) plan. Hector (72) received a distribution from a nonqualified annuity plan that he purchased through a life insurance company O Gracella (69) received a distribution from a 401(k) plan. Mark for follow up Back Save / Return Later Summary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started