I would like to have the solution for Problem 7-5B accounting

I would like to have the solution for Problem 7-5B accounting

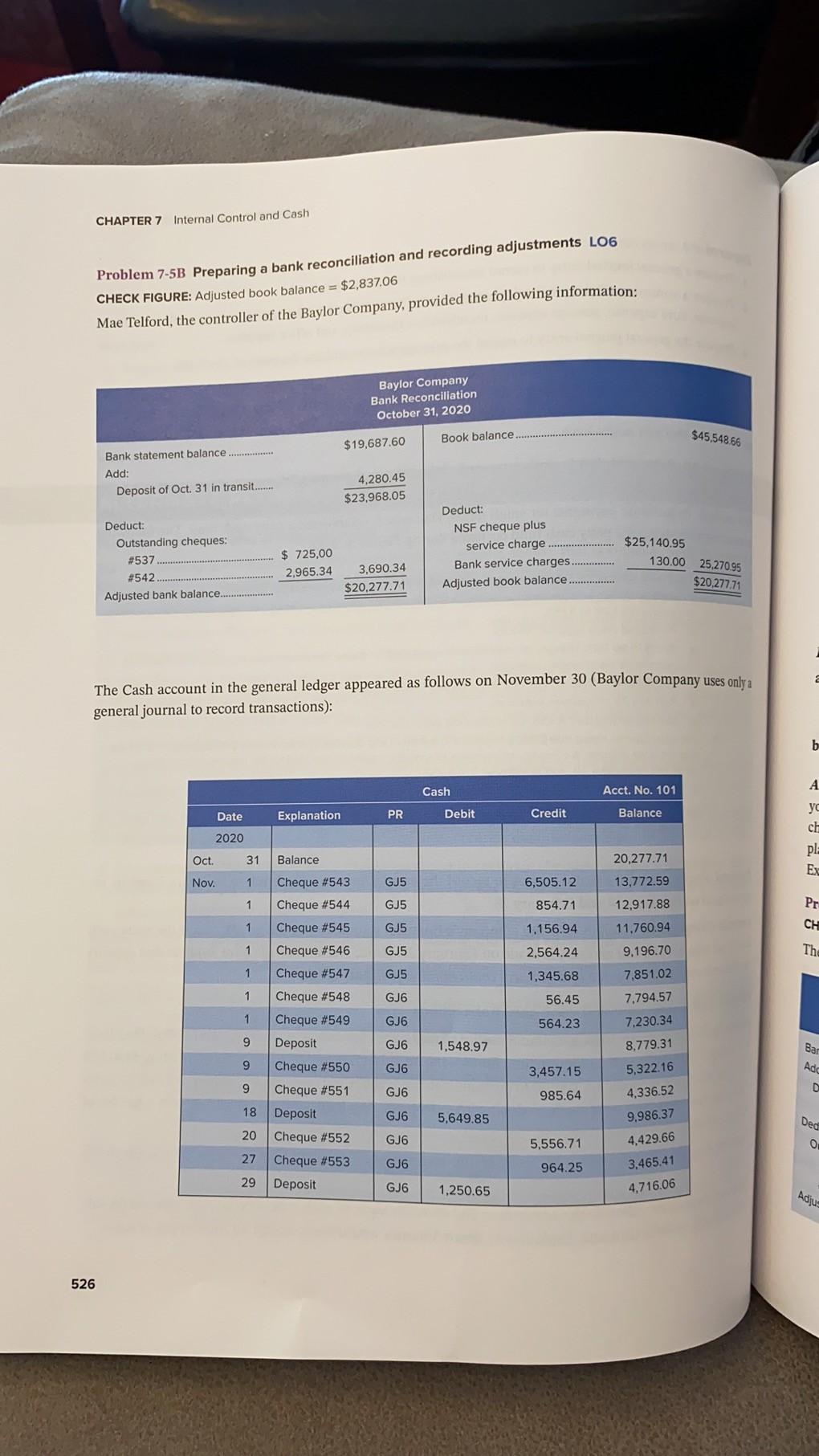

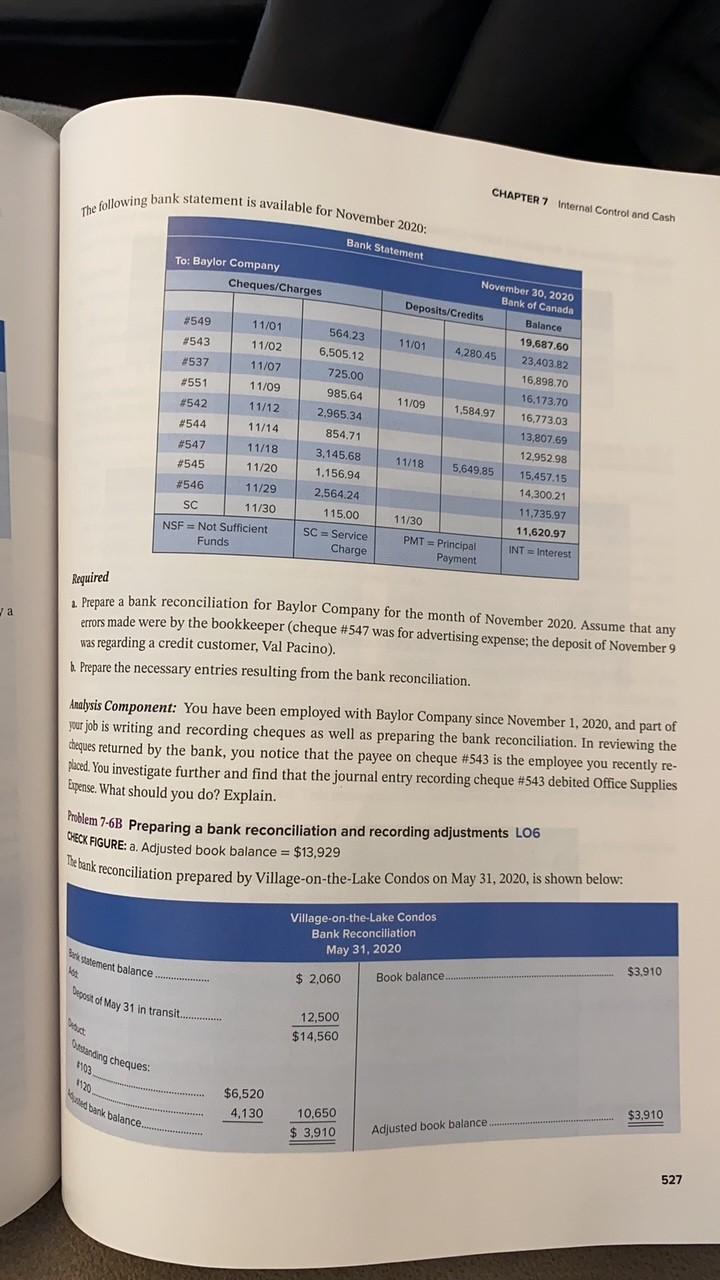

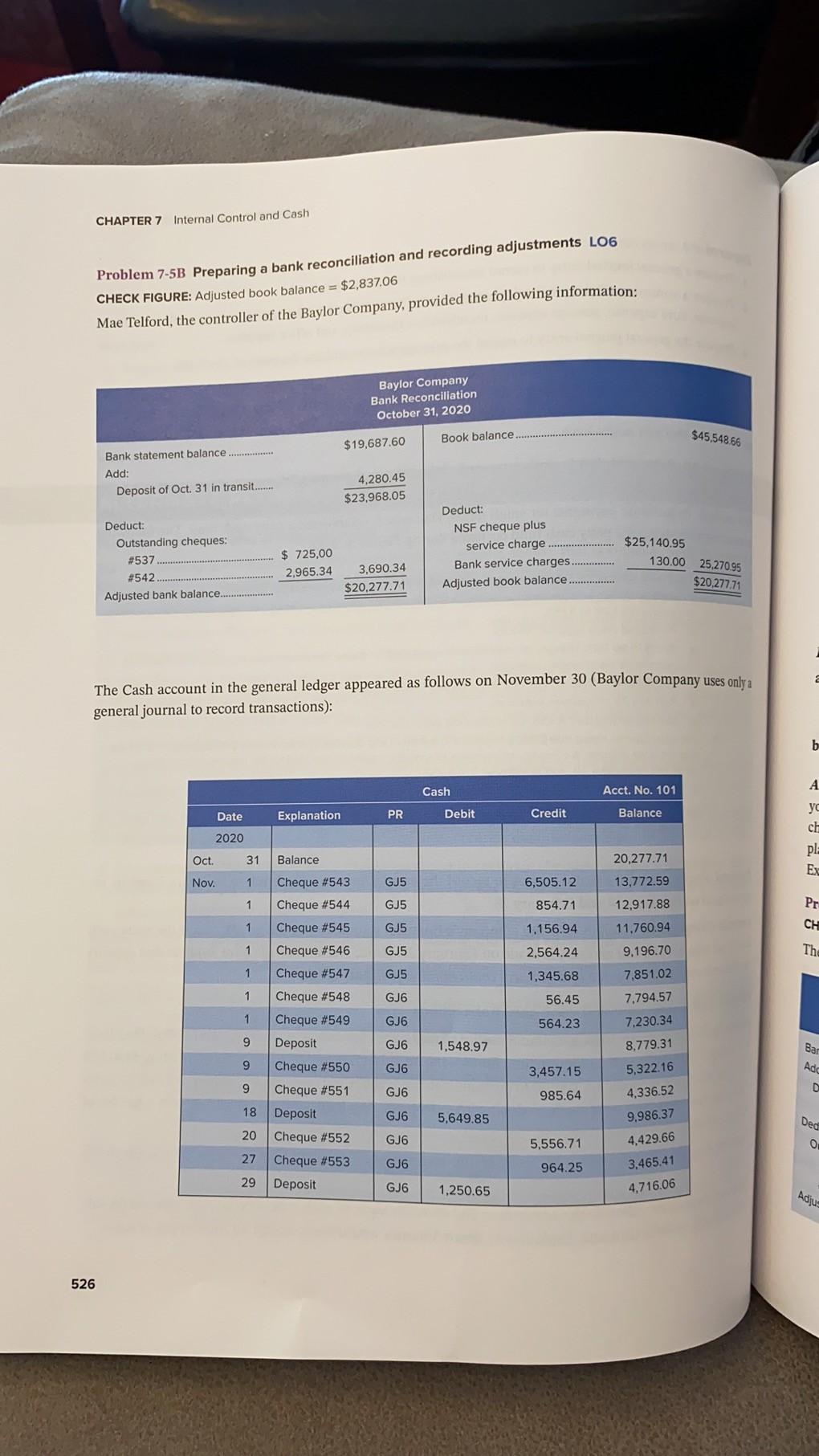

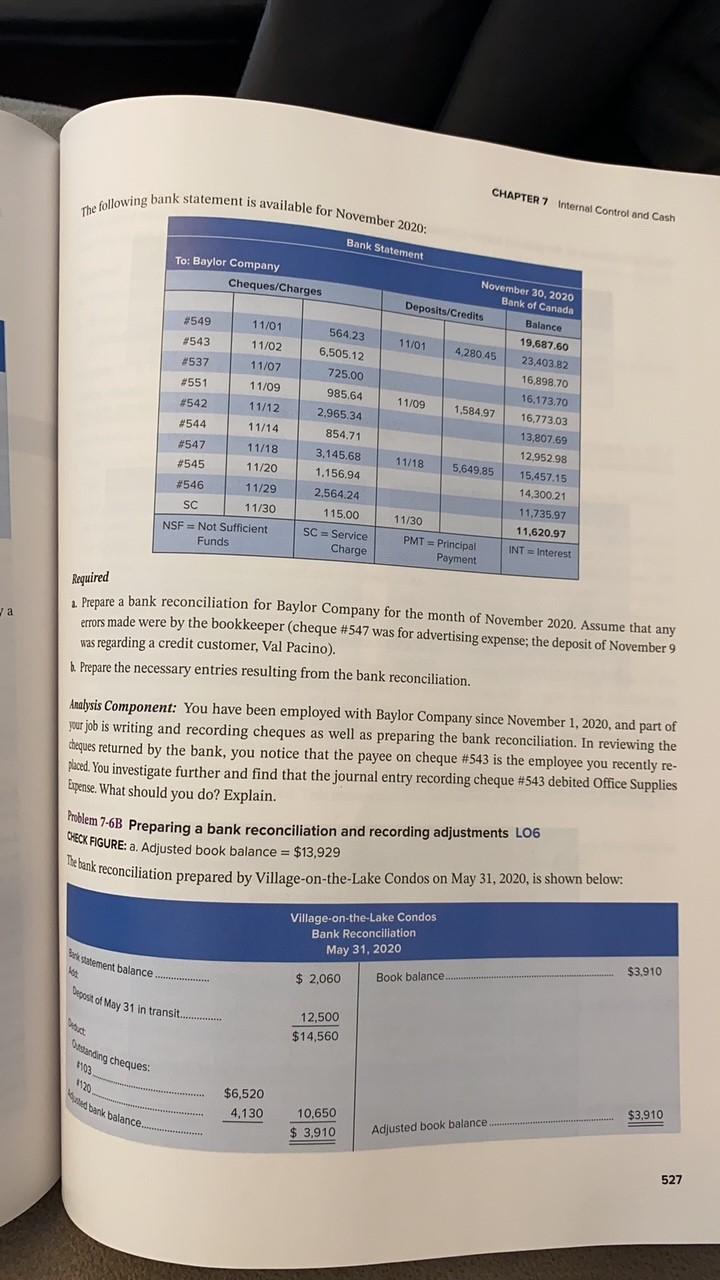

CHAPTER 7 Internal Control and Cash Problem 7-5B Preparing a bank reconciliation and recording adjustments L06 CHECK FIGURE: Adjusted book balance = $2,837.06 Mae Telford, the controller of the Baylor Company, provided the following information: Baylor Company Bank Reconciliation October 31, 2020 Book balance $45.548 66 $19,687.60 Bank statement balance................. Add: Deposit of Oct. 31 in transit....... 4,280.45 $23,968.05 Deduct: Outstanding cheques: #537 #542 Adjusted bank balance. $ 725,00 2,965.34 Deduct: NSF cheque plus service charge Bank service charges............. Adjusted book balance $25,140.95 130.00 25.270.95 3,690.34 $20.277.71 $20.277.71 The Cash account in the general ledger appeared as follows on November 30 (Baylor Company uses only a general journal to record transactions): b Cash Acct. No. 101 Date Explanation PR Debit Credit Balance CH 2020 Oct. 31 Balance 20,277.71 pl Nov. 1 GJ5 6,505.12 13,772.59 Cheque #543 Cheque #544 1 GJ5 854.71 12,917.88 Pr 1 GJ5 1.156.94 11.760.94 CH 1 GJ5 2,564.24 The Cheque #545 Cheque #546 Cheque #547 Cheque #548 Cheque #549 9,196.70 7,851.02 1 GJ5 1,345.68 1 GJ6 56.45 7.794.57 1 564.23 GJ6 GJ6 9 1,548.97 Deposit Cheque #550 7.230.34 8.779.31 5,322.16 Bar Add 9 GJ6 3,457.15 9 GJ6 985.64 4,336.52 18 GJ6 5,649.85 9.986.37 Ded 20 Cheque #551 Deposit Cheque #552 Cheque #553 Deposit GJ6 5,556.71 4,429.66 O 27 GJ6 964.25 3,465.41 29 GJ6 1.250.65 4,716.06 Adjus 526 CHAPTER 7 Internal Control and Cash The following bank statement is available for November 2020: Bank Statement To: Baylor Company Cheques/Charges 11/02 #549 11/01 #543 #537 11/07 #551 11/09 #542 11/12 #544 11/14 #547 #545 11/20 #546 11/29 SC 11/30 NSF = Not Sufficient Funds 564.23 6,505.12 725.00 985.64 2.965.34 854.71 3,145.68 1.156.94 2,564.24 115.00 SC = Service Charge November 30, 2020 Bank of Canada Deposits/Credits Balance 19,687.60 11/01 4280.45 23.403.82 16,898.70 16.173.70 11/09 1,584,97 16,773.03 13,807,69 12,952.98 11/18 5,649.85 15,457.15 14.300.21 11.735.97 11/30 11.620.97 PMT = Principal INT = Interest Payment 11/18 Required Ja 1. Prepare a bank reconciliation for Baylor Company for the month of November 2020. Assume that any errors made were by the bookkeeper (cheque #547 was for advertising expense; the deposit of November 9 was regarding a credit customer, Val Pacino). b. Prepare the necessary entries resulting from the bank reconciliation. Analysis Component: You have been employed with Baylor Company since November 1, 2020, and part of your job is writing and recording cheques as well as preparing the bank reconciliation. In reviewing the cheques returned by the bank, you notice that the payee on cheque #543 is the employee you recently re- placed. You investigate further and find that the journal entry recording cheque #543 debited Office Supplies Expense. What should you do? Explain. Problem 7-6B Preparing a bank reconciliation and recording adjustments L06 CHECK FIGURE: a. Adjusted book balance = $13,929 Sebank reconciliation prepared by Village-on-the-Lake Condos on May 31, 2020, is shown below: Village-on-the-Lake Condos Bank Reconciliation May 31, 2020 Bek Statement balance $3.910 $ 2,060 Book balance of May 31 in transit.......... 12,500 $14,560 Constanding cheques 112 Stark balance $6,520 4,130 $3,910 10,650 $ 3,910 Adjusted book balance 527

I would like to have the solution for Problem 7-5B accounting

I would like to have the solution for Problem 7-5B accounting