i would like to know if i have done this right. can you please check canoe rental revenue, this is an example. also check these plz rent, wages utilities, telephone, supplies, depreciation building & canoes, interest and dividends.

clos(1)15,150 l 15,150 adj bal

l 0. bal

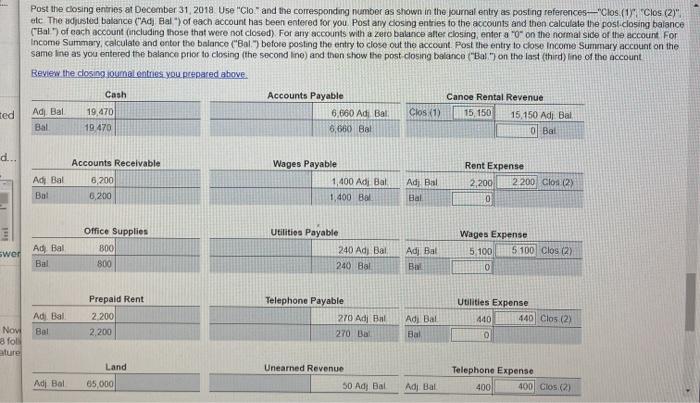

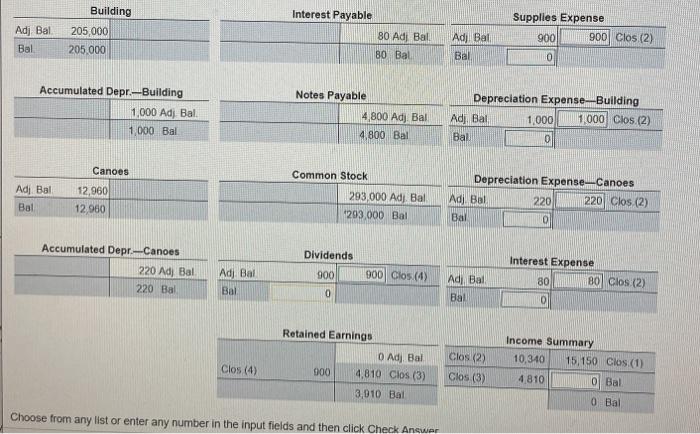

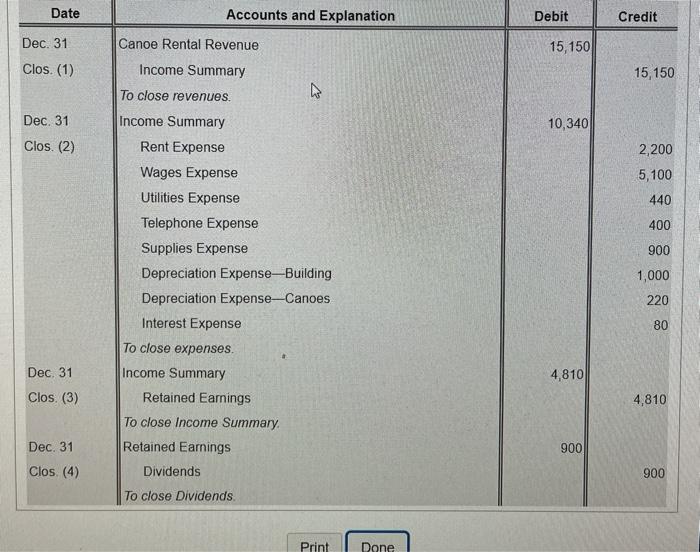

Post the closing entries at December 31, 2018 Use "Clo" and the corresponding number as shown in the journal entry as posting references "Clos (1 Clos (2)" etc The adjusted balance ("Adi Bal) of each account has been entered for you. Post any closing entries to the accounts and then calculate the post.closing balance ("Bal") of each account (including those that were not closed) For any accounts with a zero balance alter closing, enter a "0" on the normal side of the account For Income Summary, calculate and enter the balance ("Bal") before posting the entry to close out the account. Post the entry to close Income Summary account on the same line as you entered the balance prior to closing the second lino) and then show the post closing balanco ("Bal") on the last third) line of the account Review the closing oumal entries you prepared above Cash Accounts Payable Canoe Rental Revenue Ad. Bal 19.470 6,660 Adi Bal Clos (1) 15 150 15.150 Ad Bal Bal 19.470 6,650 Bal o Bal ted d... Ady Bal Bal Accounts Receivable 6,200 6,200 Wages Payable 1,400 Adj Bal 1,400 Bal Adj Bal Bal Rent Expense 2,200 2 200 Clos (2) 0 ul Office Supplies 800 800 Ad Bal Bal swer Utilities Payable 240 Adi Bal 240 Bal Adi Bal Bal Wages Expense 5 100 5 100 Clos (2) 0 Prepaid Rent 2.200 2,200 Adi Bal Bol Telephone Payable 270 Ad Bal 270 Bar Utilities Expense 440 440 Clos (2) Adj Bal Bal 0 Novi 8 foll ature Unearned Revenue Land 65,000 Telephone Expense 400 400 Clos (2) Adi Bal 50 Ad Bal Adi Bal Interest Payable Adj Bal Building 205,000 205.000 Supplies Expense 900 900 Clos (2) 80 Ad Ball Bal Adj Bal Bal. 80 Bal 0 Accumulated Depr.-Building 1,000 Adj Bal 1 000 Bal Notes Payable 4,800 Adj. Bal 4.800 Bal Depreciation Expense Building Ad Bal 1,000 1,000 Clos.(2) Bal 0 Canoes Common Stock Adi Bal Bal 12,960 12960 293,000 Adj. Bal 1293,000 Bal Depreciation Expense_Canoes Ad) Bal 220 220 Clos (2) Bai 0 Accumulated Depr.-Canoes 220 Adj Bal 220 Bal Dividends 900 900 Clos (4) Adj Bal Bal , Interest Expense 80 80 Clos (2) 0 Adi Bal Bal 0 Clos (4) Retained Earnings 0 Adj. Bal 900 4,810 Clos (3) 3,010 Bal Clos (2) Clos (3) Income Summary 10,340 15,150 Clos (1) 4810 O Bal 0 Bal Choose from any list or enter any number in the input fields and then click Check Answer Date Accounts and Explanation Debit Credit Dec. 31 Canoe Rental Revenue 15,150 Clos. (1) Income Summary 15,150 To close revenues. N. Dec. 31 10,340 Clos. (2) 2,200 5,100 440 400 900 1,000 220 Income Summary Rent Expense Wages Expense Utilities Expense Telephone Expense Supplies Expense Depreciation Expense-Building Depreciation Expense-Canoes Interest Expense To close expenses. Income Summary Retained Earnings To close Income Summary Retained Earnings Dividends To close Dividends 80 Dec. 31 4,810 Clos (3) 4,810 Dec. 31 900 Clos (4) 900 Print Done