Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to know the answer by step by step. and detail explanation QUESTION 2 (25 marks) (A) Describe the Five option Greeks. (10

I would like to know the answer by step by step. and detail explanation

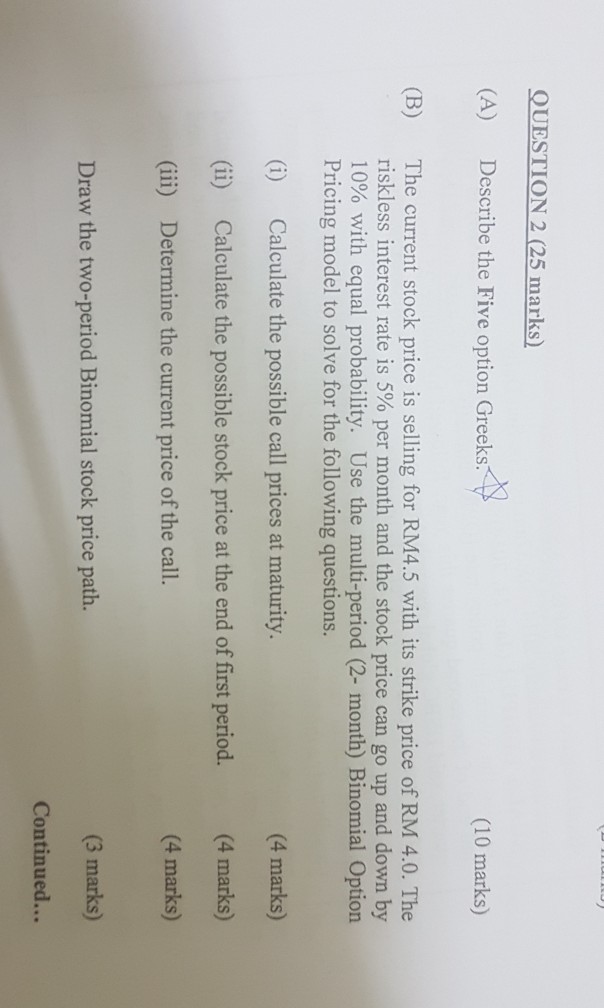

QUESTION 2 (25 marks) (A) Describe the Five option Greeks. (10 marks) The current stock price is selling for RM4.5 with its strike price of RM 4.0. The riskless interest rate is 5% per month and the stock price can go up and down by 10% with equal probability. Use the multi-period (2-month) Binomial Option Pricing model to solve for the following questions. (B) (i) Calculate the possible call prices at maturity. (ii) Calculate the possible stock price at the end of first period. (ii) Determine the current price of the call. Draw the two-period Binomial stock price path. (4 marks) (4 marks) (4 marks) (3 marks) ContinuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started