Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to know the answer by step by step. and detail explanation Answer all questions in the answer booklet provided. (A)Now is March

I would like to know the answer by step by step. and detail explanation

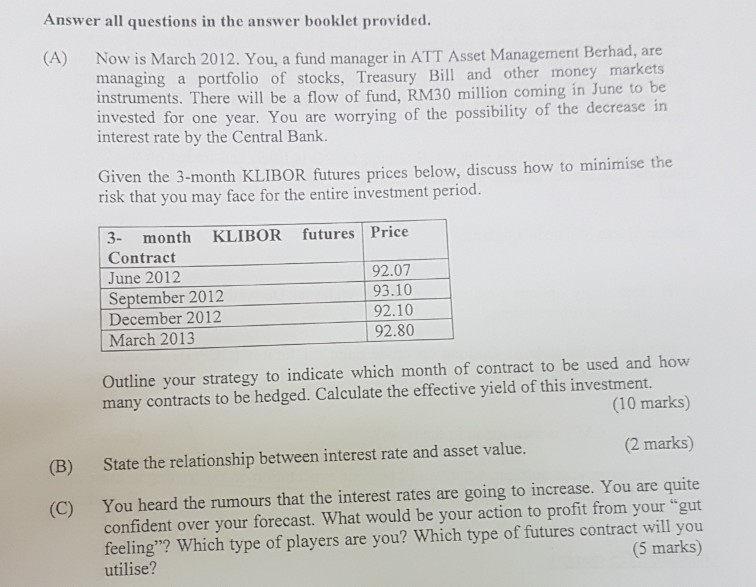

Answer all questions in the answer booklet provided. (A)Now is March 2012. You, a fund manager in ATT Asset Management Berhad, are ury Bill and other money markets managing a portfolio of stocks, Treas instruments. There will be a flow of fund, RM30 million coming in June t for one year. You are worrying of the possibility of the decrease in interest rate by the Central Bank. Given the 3-month KLIBOR futures prices below, discuss how to minimise the risk that you may face for the entire investment period. 3 month KLIBOR futures Price Contract June 2012 September 2012 92.07 93.10 92.10 92.80 December 2012 March 2013 Outline your strategy to indicate which month of contract to be used and how many contracts to be hedged. Calculate the effective yield of this investment. (10 marks) (B) State the relationship between interest rate and asset value. (2 marks) You heard the rumours that the interest rates are going to increase. You are quite confident over your forecast. What would be your action to profit from your "gut feeling"? Which type of players are you? Which type of futures contract will you utilise? (C) (5 marks) Answer all questions in the answer booklet provided. (A)Now is March 2012. You, a fund manager in ATT Asset Management Berhad, are ury Bill and other money markets managing a portfolio of stocks, Treas instruments. There will be a flow of fund, RM30 million coming in June t for one year. You are worrying of the possibility of the decrease in interest rate by the Central Bank. Given the 3-month KLIBOR futures prices below, discuss how to minimise the risk that you may face for the entire investment period. 3 month KLIBOR futures Price Contract June 2012 September 2012 92.07 93.10 92.10 92.80 December 2012 March 2013 Outline your strategy to indicate which month of contract to be used and how many contracts to be hedged. Calculate the effective yield of this investment. (10 marks) (B) State the relationship between interest rate and asset value. (2 marks) You heard the rumours that the interest rates are going to increase. You are quite confident over your forecast. What would be your action to profit from your "gut feeling"? Which type of players are you? Which type of futures contract will you utilise? (C)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started