Answered step by step

Verified Expert Solution

Question

1 Approved Answer

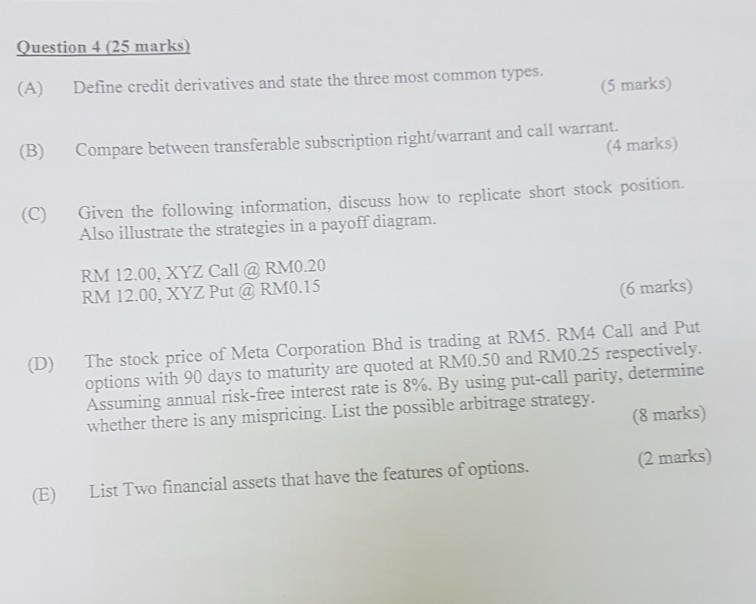

I would like to know the answer by step by step. and detail explanation Question 4 (25 marks (A) Define credit derivatives and state the

I would like to know the answer by step by step. and detail explanation

Question 4 (25 marks (A) Define credit derivatives and state the three most common types. (B) Compare between transferable subscription right/warrant and call warrant. (5 marks) (4 marks) Also illustrate the strategies in a payoff diagram. RM 12.00, XYZ Call@ RM0.20 RM 12.00, XYZ Put @ RM0.15 (6 marks) (D) The stock price of Meta Corporation Bhd is trading at RM5. RM4 Call and Put options with 90 days to maturity are quoted at RM0.50 and RM0.25 respectively Assuming annual risk-free interest rate is 8%. By using put-call parity, determine (8 marks) (2 marks) B) List Two financial assets that have the features of optionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started