Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to know the answer by step by step. and detail explanation Question 1 (25 marks) (A) State your strategy and also the

I would like to know the answer by step by step. and detail explanation

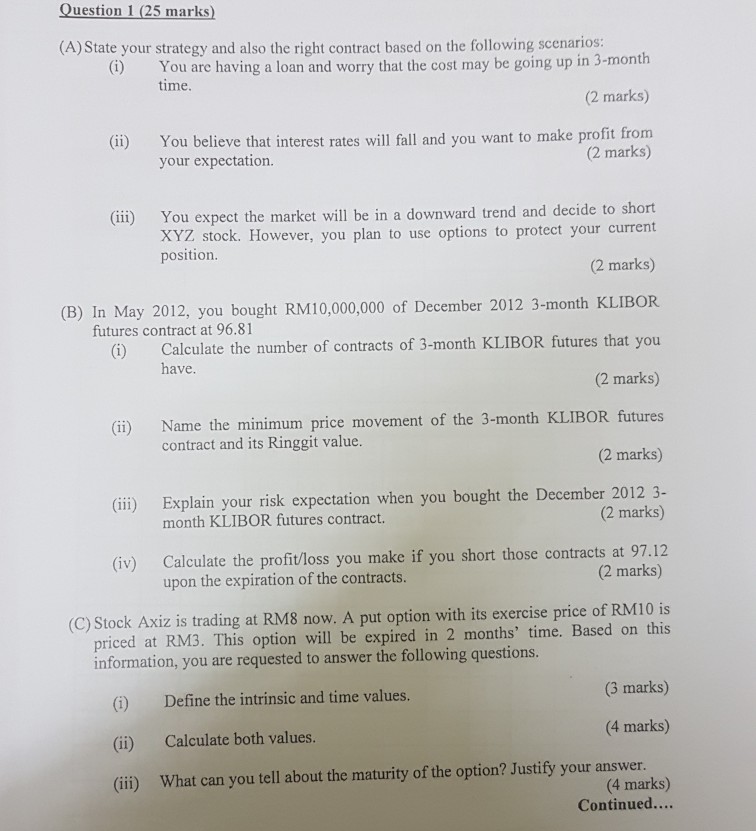

Question 1 (25 marks) (A) State your strategy and also the right contract based on the following scenarios: ()You arc having a loan and worry that the cost may be going up in 3-month (2 marks) time You believe that interest rates will fall and you want to make profit from (2 marks) (ii) your expectation. You expect the market will be in a downward trend and decide to short stock. However, you plan to use options to protect your current (2 marks) XYZ position (B) In May 2012, you bought RM10,000,000 of December 2012 3-month KLIBOR futures contract at 96.81 Calculate the number of contracts of 3-month KLIBOR futures that you (2 marks) (i) have Name the minimum price movement of the 3-month KLIBOR futures (2 marks) (ii) contract and its Ringgit value. Explain your risk expectation when you bought the December 2012 3- (2 marks) month KLIBOR futures contract. (iv) Calculate the profit/loss you make if you short those contracts at 97.12 (2 marks) upon the expiration of the contracts. (C) Stock Axiz is trading at RM8 now. A put option with its exercise price of RM10 is priced at RM3. This option will be expired in 2 months' time. Based on this (3 marks) (4 marks) (4 marks) information, you are requested to answer the following questions (i) Define the intrinsic and time values. (ii) Calculate both values. (ii) What can you tell about the maturity of the option? Justify your answer. ContinuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started