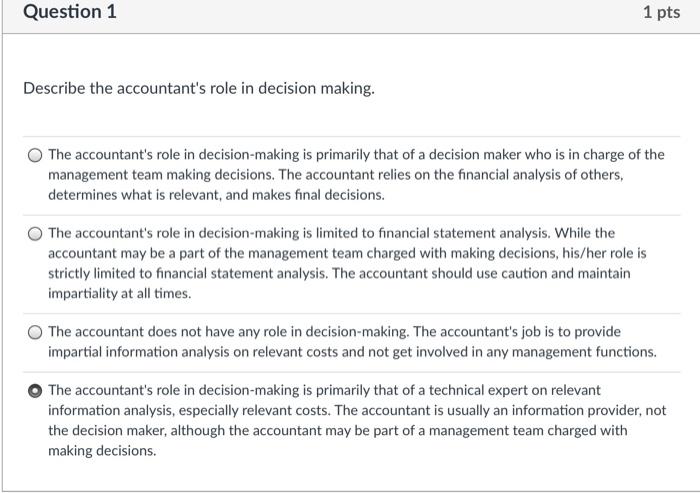

i would like to know whether my answer is correct or not, if not i will appeiciate if you can tell me ur answer!

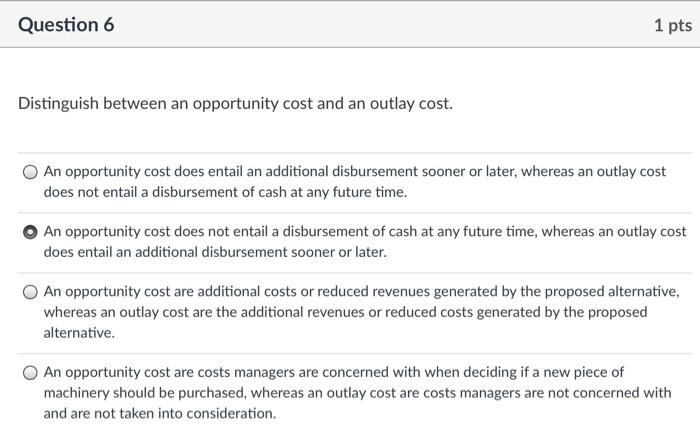

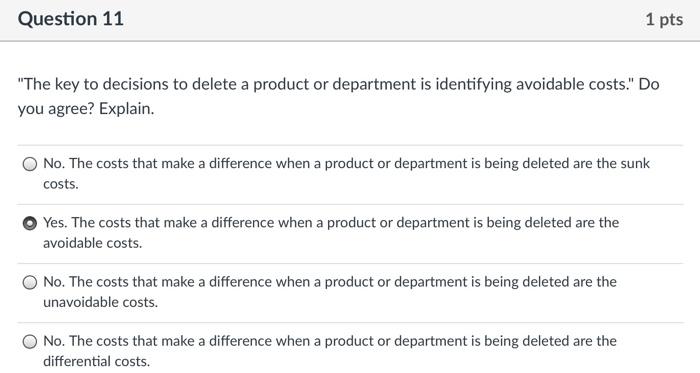

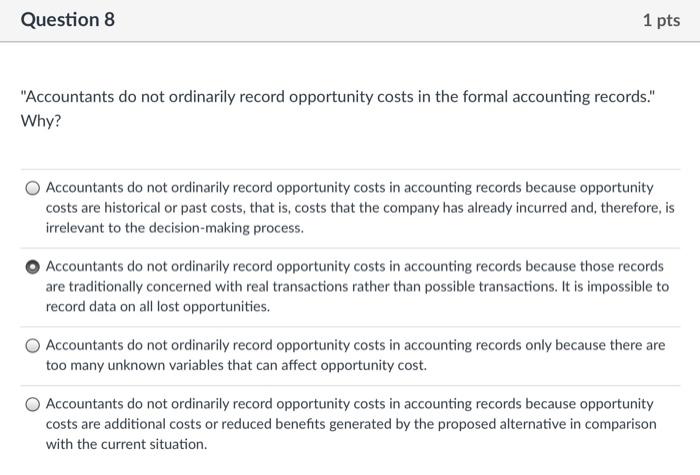

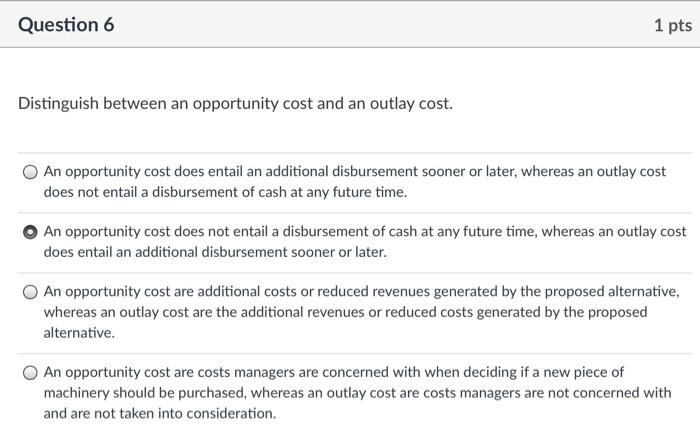

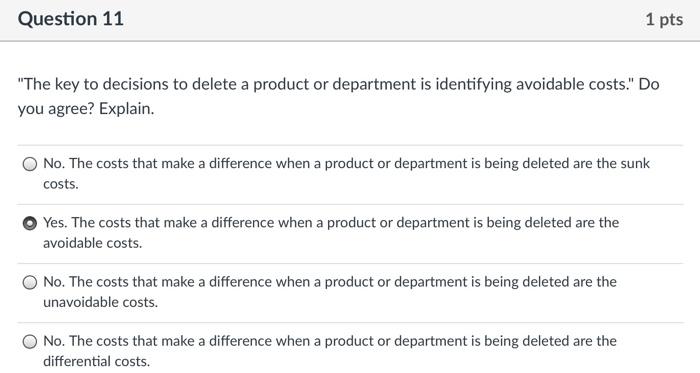

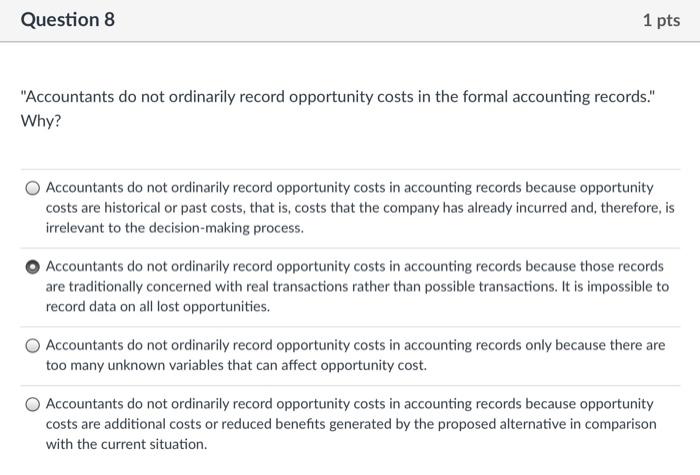

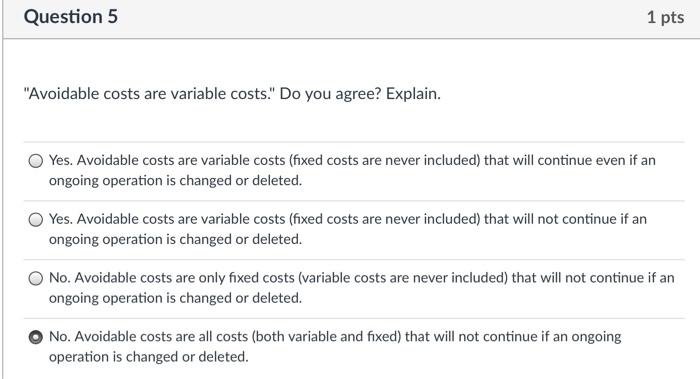

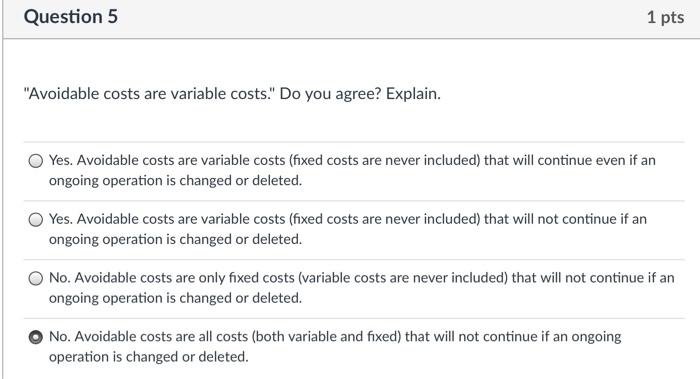

Question 6 1 pts Distinguish between an opportunity cost and an outlay cost. An opportunity cost does entail an additional disbursement sooner or later, whereas an outlay cost does not entail a disbursement of cash at any future time. An opportunity cost does not entail a disbursement of cash at any future time, whereas an outlay cost does entail an additional disbursement sooner or later. An opportunity cost are additional costs or reduced revenues generated by the proposed alternative, whereas an outlay cost are the additional revenues or reduced costs generated by the proposed alternative An opportunity cost are costs managers are concerned with when deciding if a new piece of machinery should be purchased, whereas an outlay cost are costs managers are not concerned with and are not taken into consideration. Question 8 1 pts "Accountants do not ordinarily record opportunity costs in the formal accounting records." Why? Accountants do not ordinarily record opportunity costs in accounting records because opportunity costs are historical or past costs, that is, costs that the company has already incurred and, therefore, is irrelevant to the decision-making process. Accountants do not ordinarily record opportunity costs in accounting records because those records are traditionally concerned with real transactions rather than possible transactions. It is impossible to record data on all lost opportunities. Accountants do not ordinarily record opportunity costs in accounting records only because there are too many unknown variables that can affect opportunity cost. Accountants do not ordinarily record opportunity costs in accounting records because opportunity costs are additional costs or reduced benefits generated by the proposed alternative in comparison with the current situation. Question 5 1 pts "Avoidable costs are variable costs." Do you agree? Explain. Yes. Avoidable costs are variable costs (fixed costs are never included) that will continue even if an ongoing operation is changed or deleted. Yes. Avoidable costs are variable costs (fixed costs are never included) that will not continue if an ongoing operation is changed or deleted. No. Avoidable costs are only fixed costs (variable costs are never included) that will not continue if an ongoing operation is changed or deleted. No. Avoidable costs are all costs (both variable and fixed) that will not continue if an ongoing operation is changed or deleted