Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to see if anyone could help me with my project please, im working on Duke Energy and Verizon companies usine various public

I would like to see if anyone could help me with my project please, im working on Duke Energy and Verizon

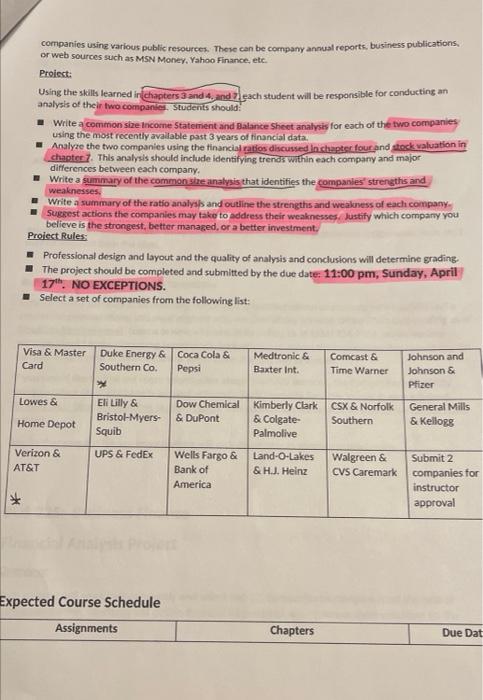

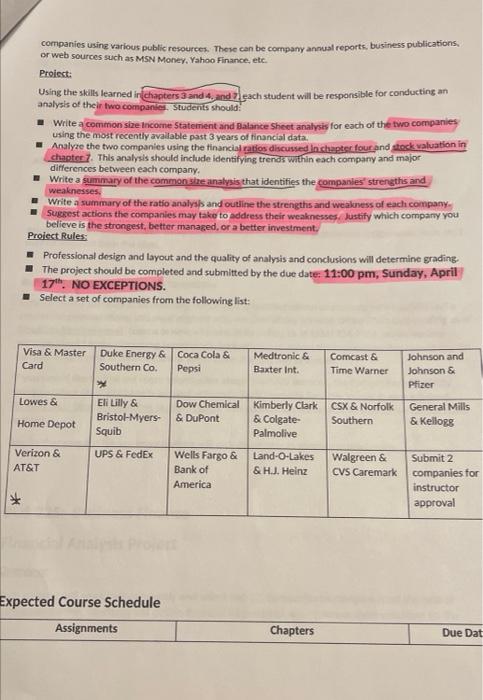

companies usine various public resources. These can be company annual reports, business publications, or web sources such as MSN Money, Yahoo Finance, etc. Proiesti Using the skills learned ir chapters 3 and 4, and peach student will be responsible for conducting an analysis of their two companies. Students should Write a common size Income Statement and Balance Sheet analysis for each of the two companies using the most recently available past 3 years of financial data. - Analyze the two companies using the financial ratios discussed in chapter fout and stock valuation in chapter. This analysis should include identifying trends within each company and major differences between each company. - Write a summary of the common size analysis that identifies the companies' strengths and weaknesses. Write a summary of the ratio analysis and outline the strengths and weakness of each company Suerest actions the companies may take to address their weaknesses. Justify which company you believe is the strongest, better managed, or a better investment Project Rules: Professional design and layout and the quality of analysis and conclusions will determine grading The project should be completed and submitted by the due date: 11:00 pm, Sunday, April 17h. NO EXCEPTIONS. Select a set of companies from the following list: Visa & Master Card Duke Energy & Coca Cola & Southern Co. Pepsi Medtronic & Baxter Int. Comcast & Time Warner Johnson and Johnson & Pfizer Lowes & Eli Lilly & Bristol-Myers- Squib Dow Chemical & DuPont Kimberly Clark CSX & Norfolk & Colgate- Southern Palmolive General Mills & Kellogg Home Depot Verizon & AT&T UPS & FedEx Wells Fargo & Bank of America Land-O-Lakes & HJ. Heinz Walgreen & CVs Caremark Submit 2 companies for instructor approval Expected Course Schedule Assignments Chapters Due Dat companies usine various public resources. These can be company annual reports, business publications, or web sources such as MSN Money, Yahoo Finance, etc. Proiesti Using the skills learned ir chapters 3 and 4, and peach student will be responsible for conducting an analysis of their two companies. Students should Write a common size Income Statement and Balance Sheet analysis for each of the two companies using the most recently available past 3 years of financial data. - Analyze the two companies using the financial ratios discussed in chapter fout and stock valuation in chapter. This analysis should include identifying trends within each company and major differences between each company. - Write a summary of the common size analysis that identifies the companies' strengths and weaknesses. Write a summary of the ratio analysis and outline the strengths and weakness of each company Suerest actions the companies may take to address their weaknesses. Justify which company you believe is the strongest, better managed, or a better investment Project Rules: Professional design and layout and the quality of analysis and conclusions will determine grading The project should be completed and submitted by the due date: 11:00 pm, Sunday, April 17h. NO EXCEPTIONS. Select a set of companies from the following list: Visa & Master Card Duke Energy & Coca Cola & Southern Co. Pepsi Medtronic & Baxter Int. Comcast & Time Warner Johnson and Johnson & Pfizer Lowes & Eli Lilly & Bristol-Myers- Squib Dow Chemical & DuPont Kimberly Clark CSX & Norfolk & Colgate- Southern Palmolive General Mills & Kellogg Home Depot Verizon & AT&T UPS & FedEx Wells Fargo & Bank of America Land-O-Lakes & HJ. Heinz Walgreen & CVs Caremark Submit 2 companies for instructor approval Expected Course Schedule Assignments Chapters Due Dat

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started