I would love some help with this analytical measure!!

(Below is any information you should need)

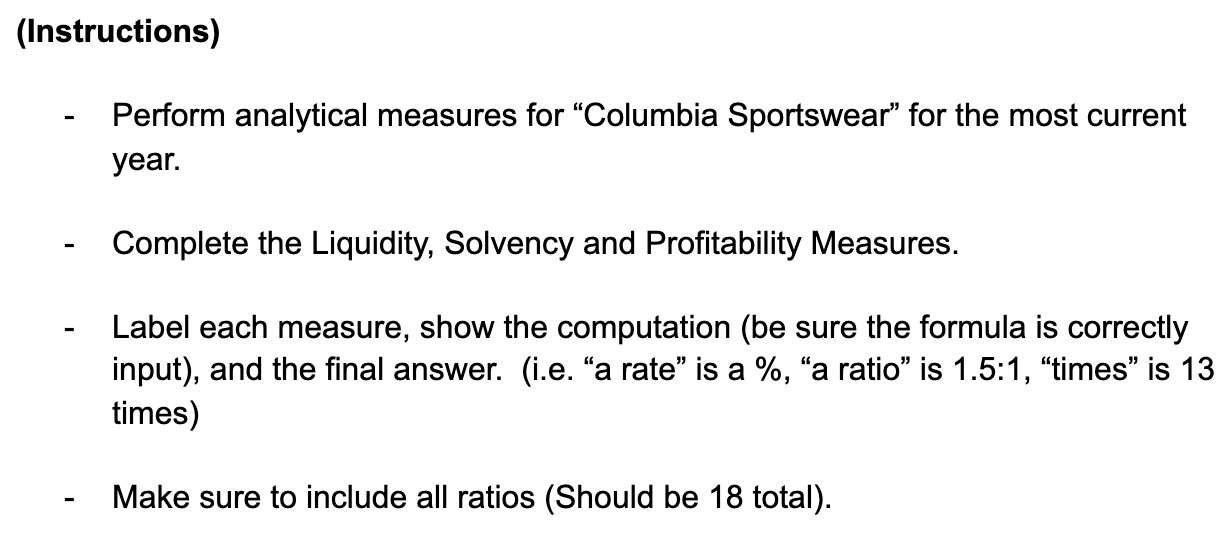

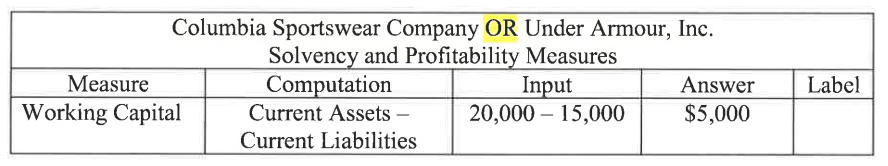

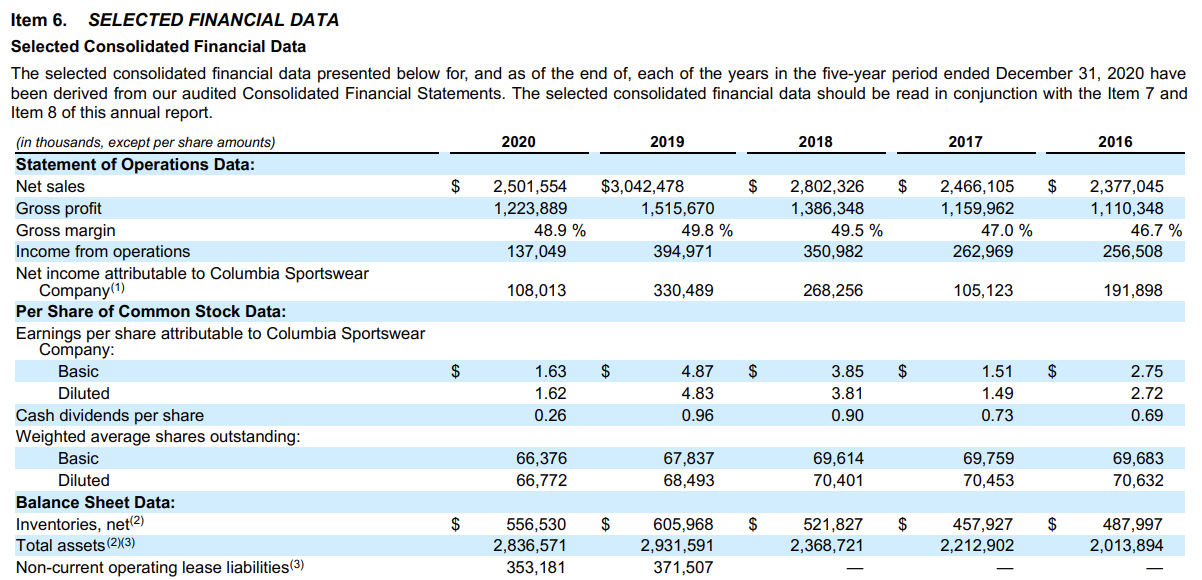

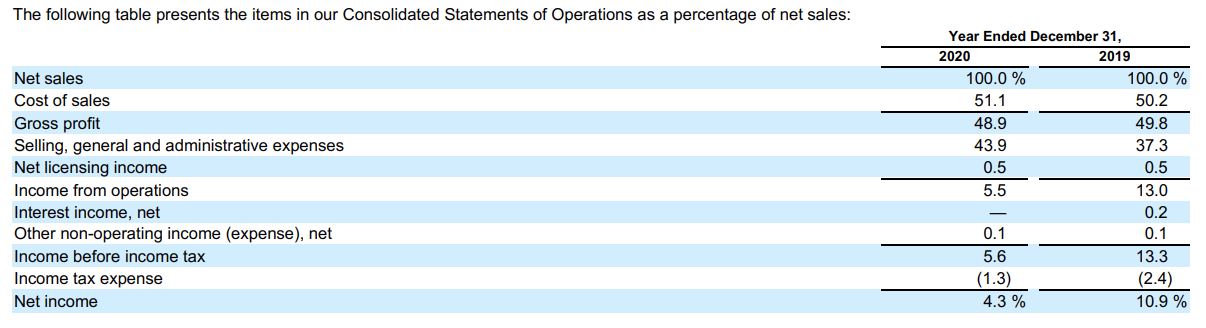

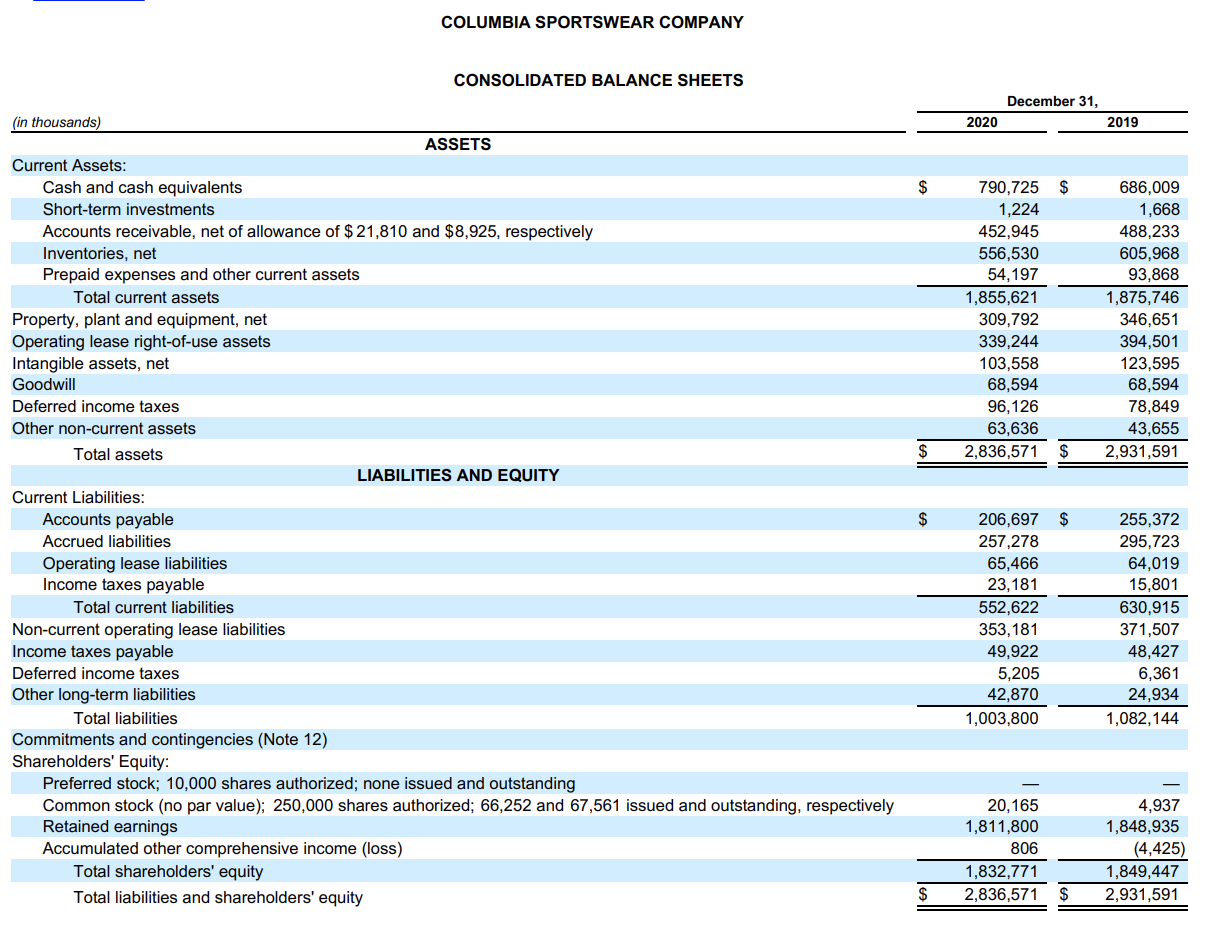

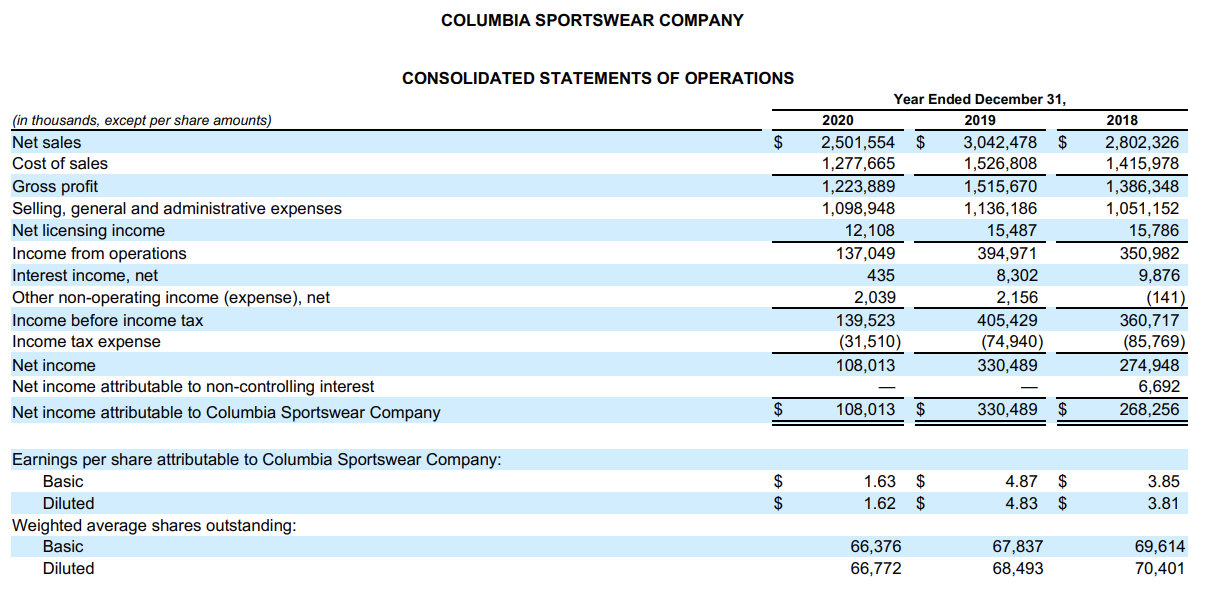

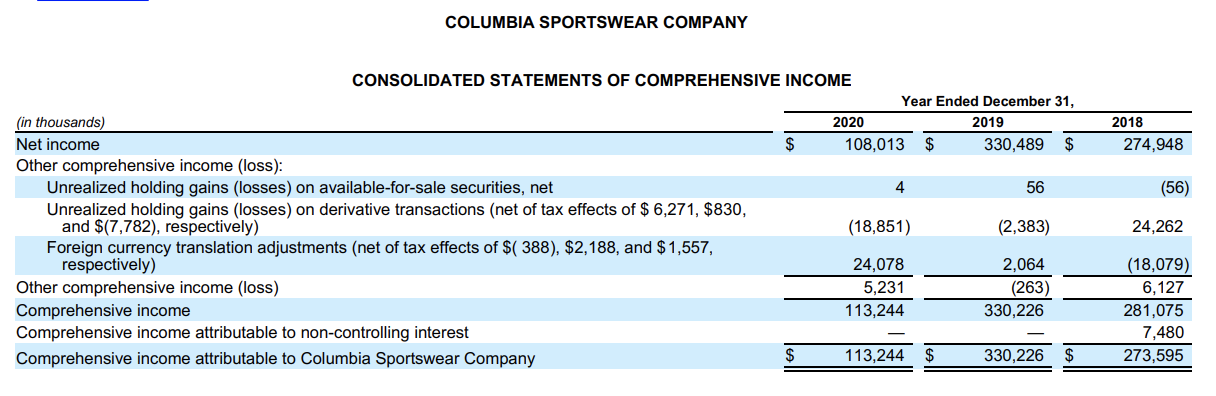

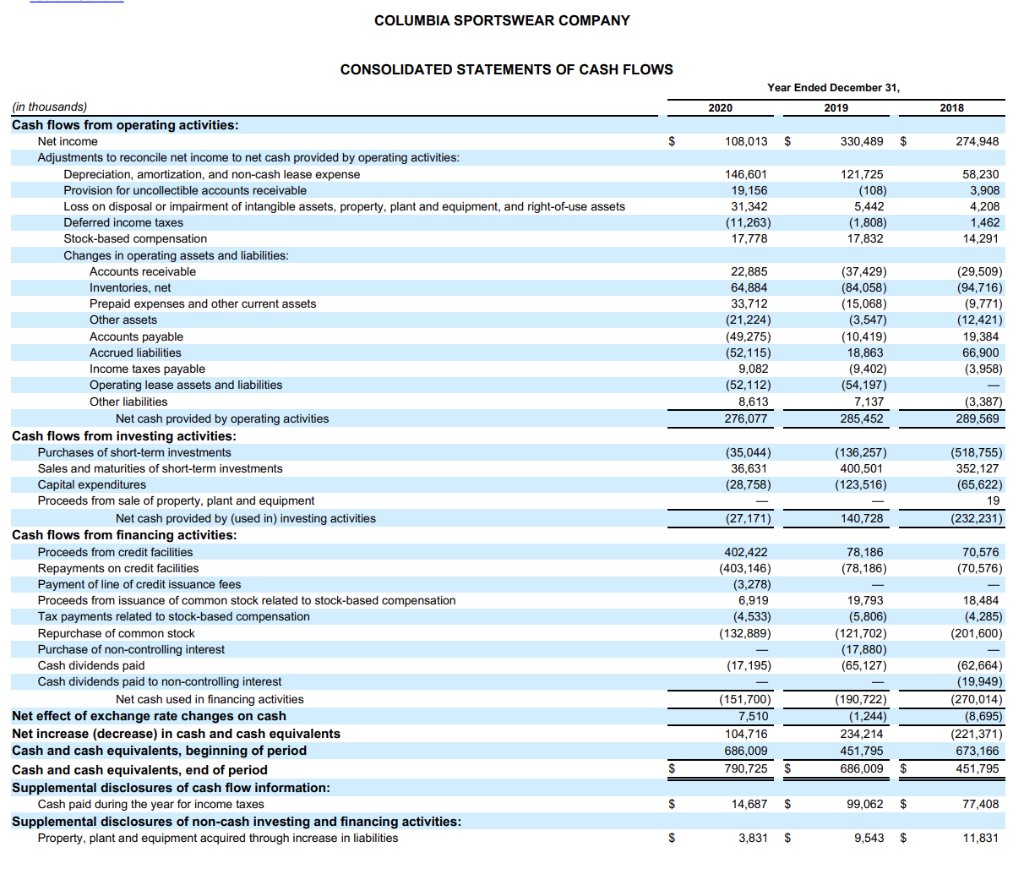

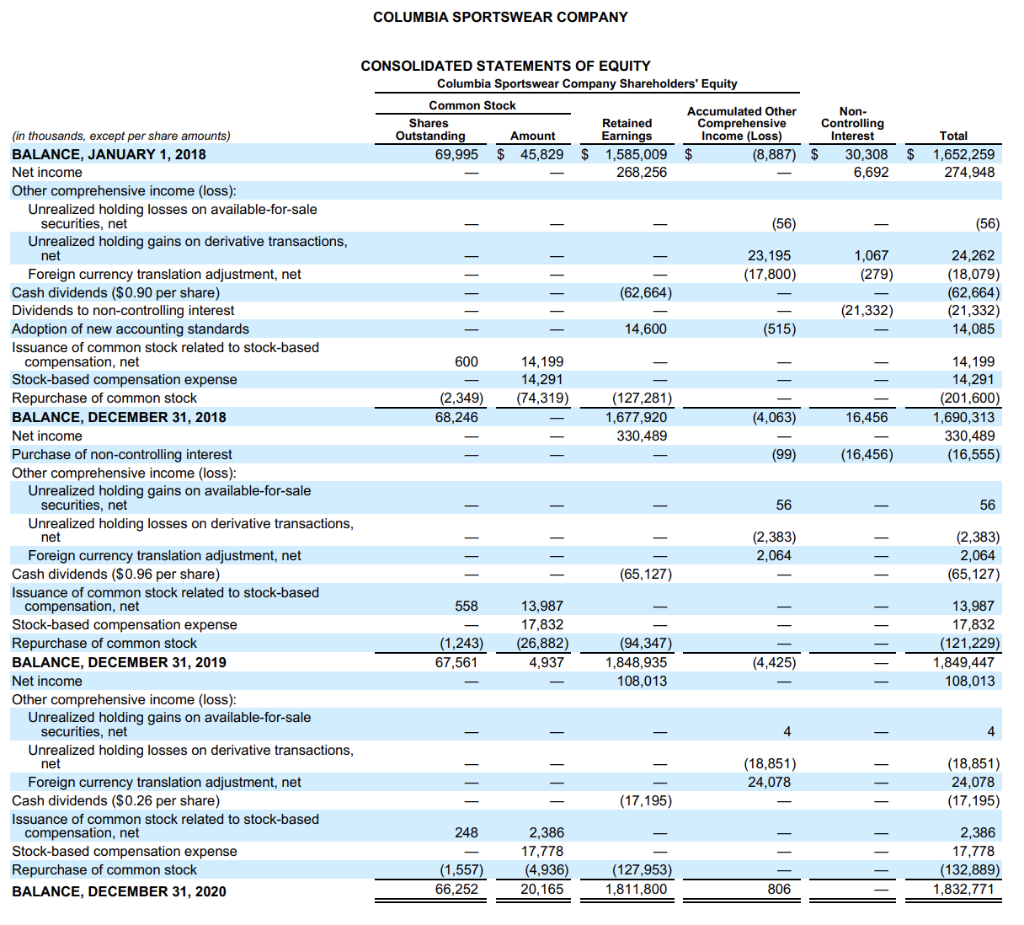

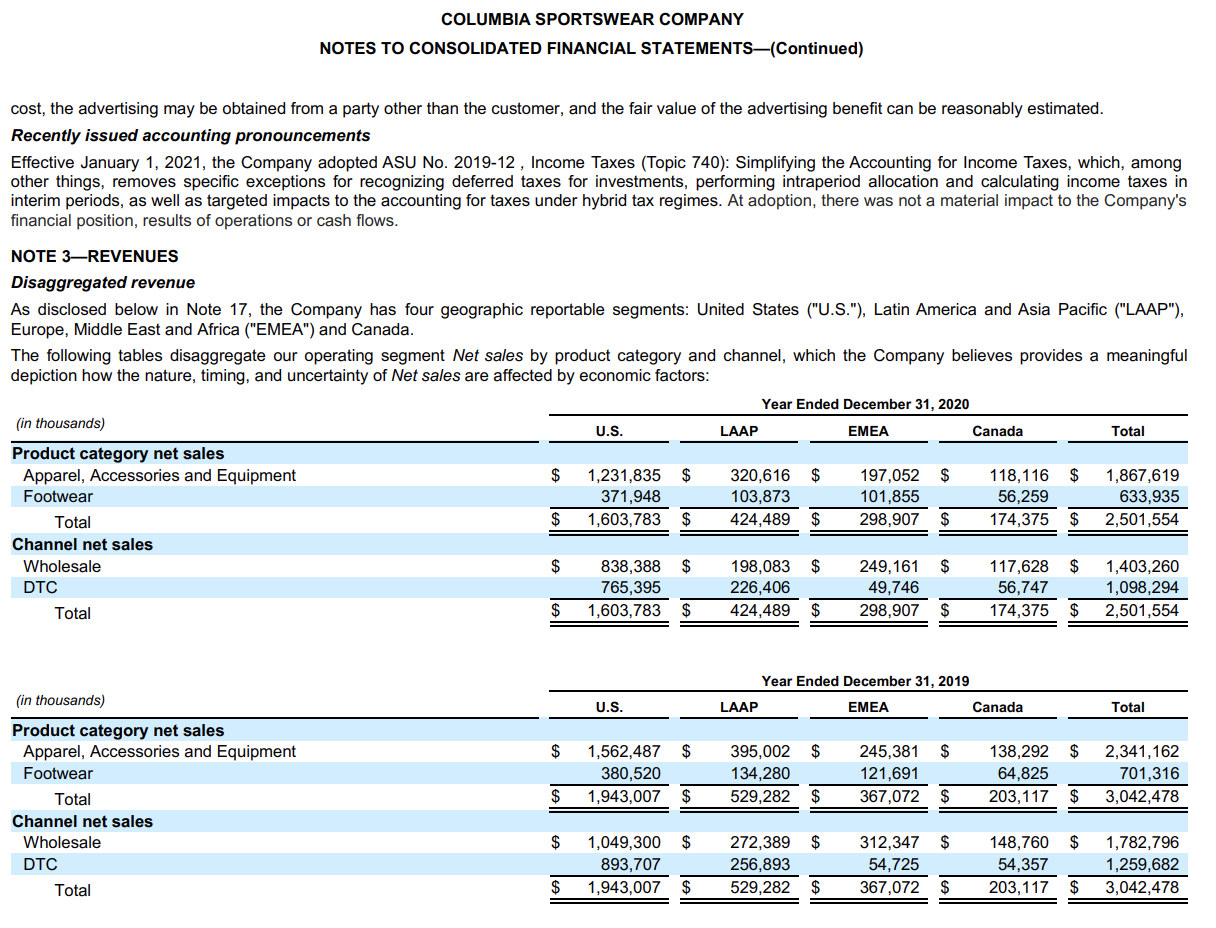

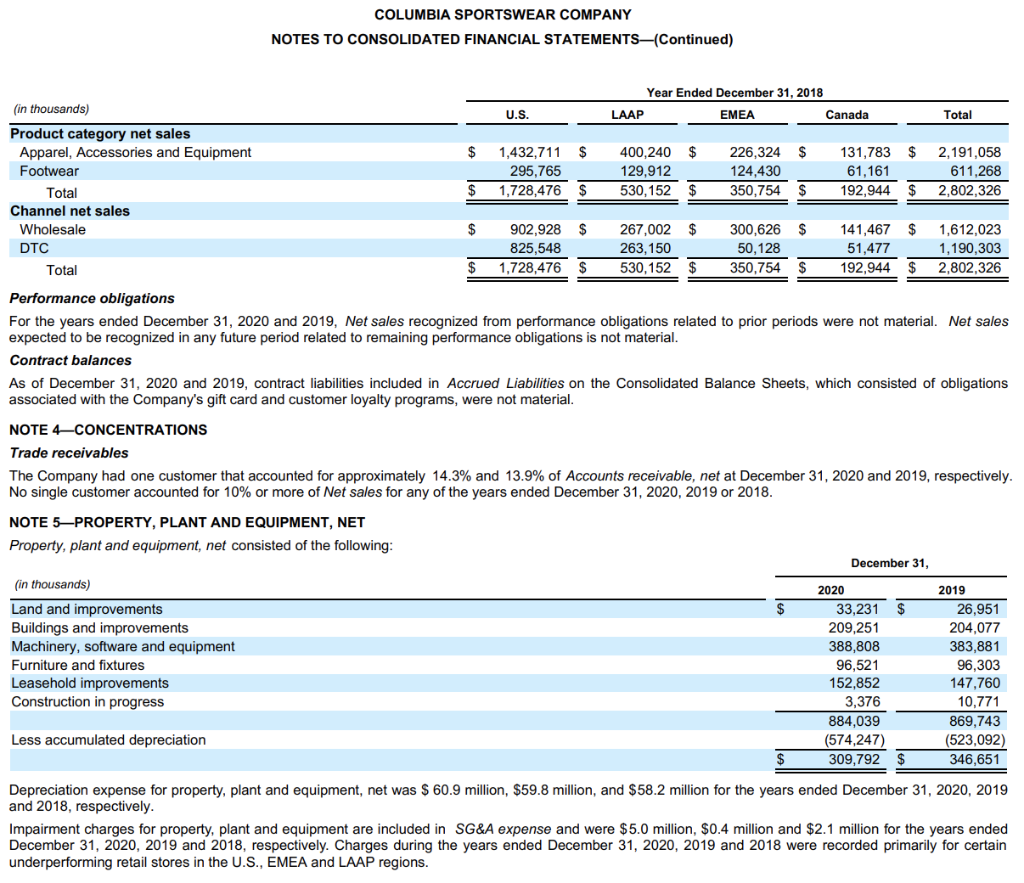

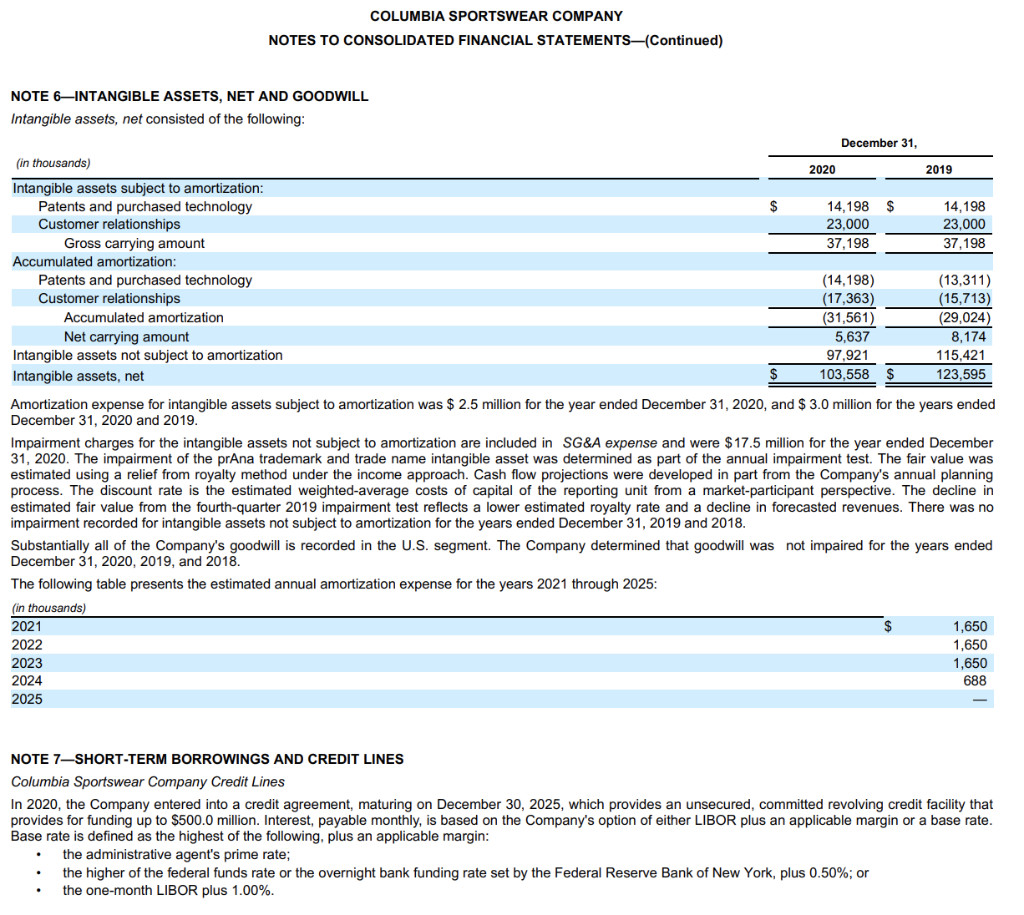

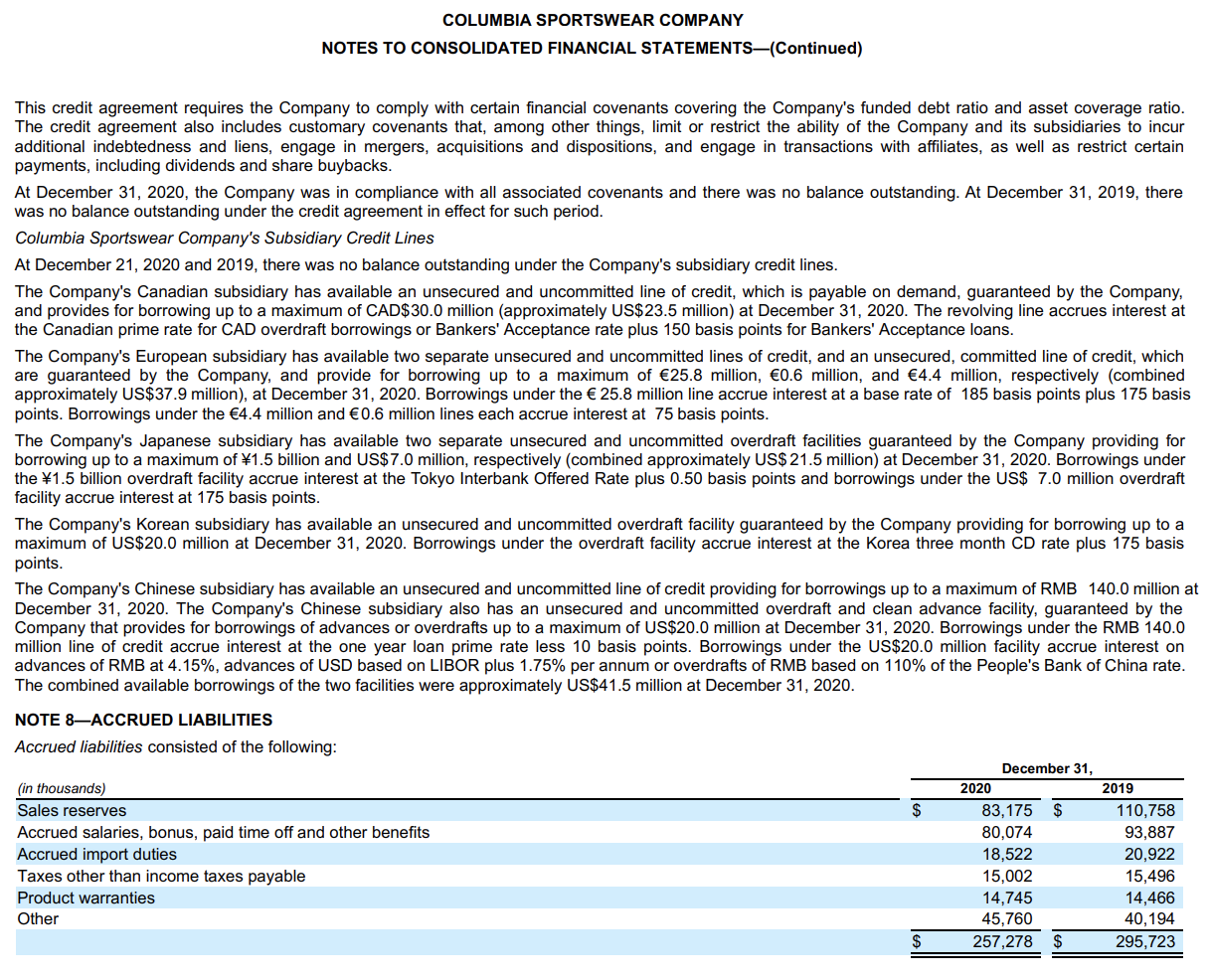

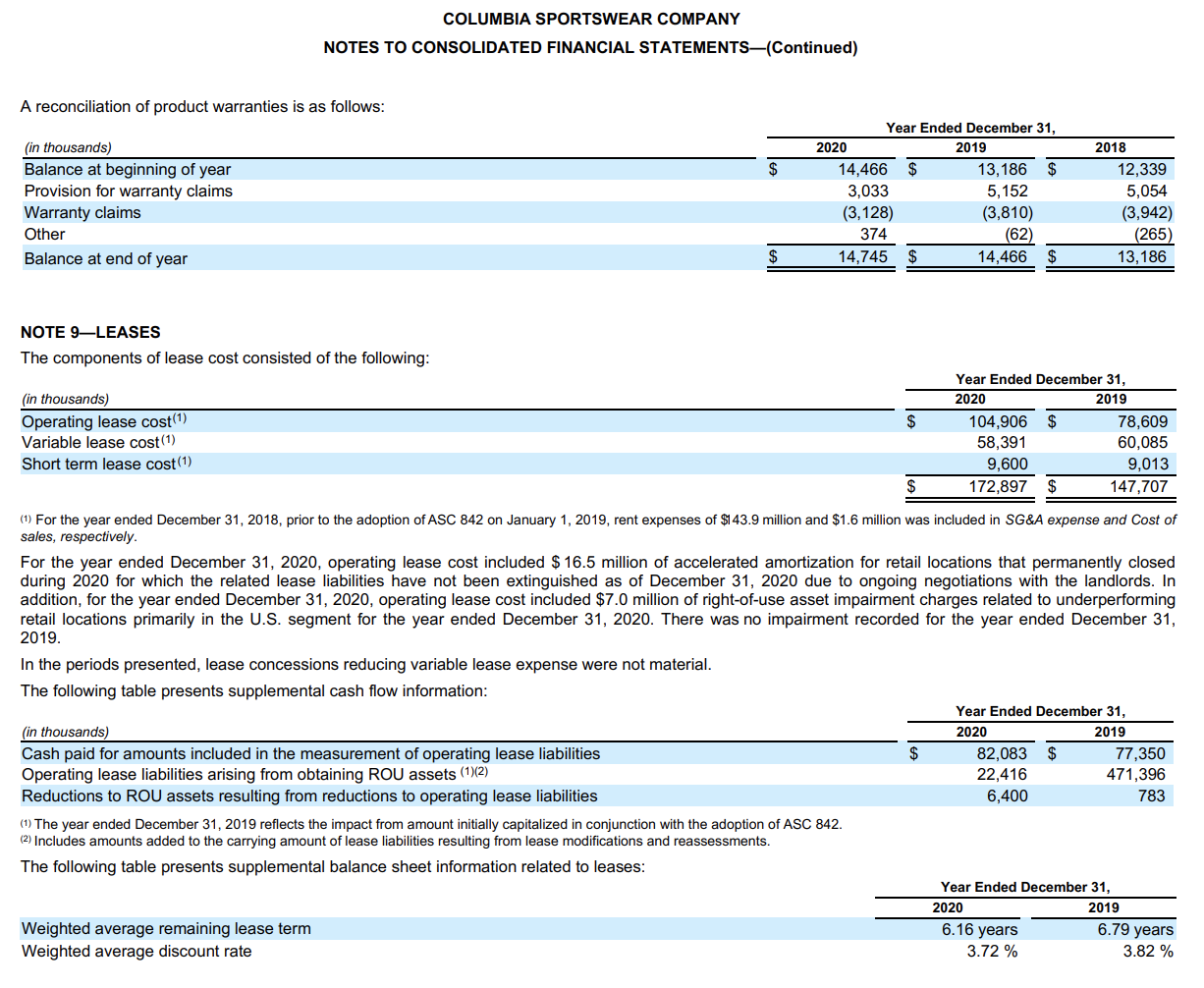

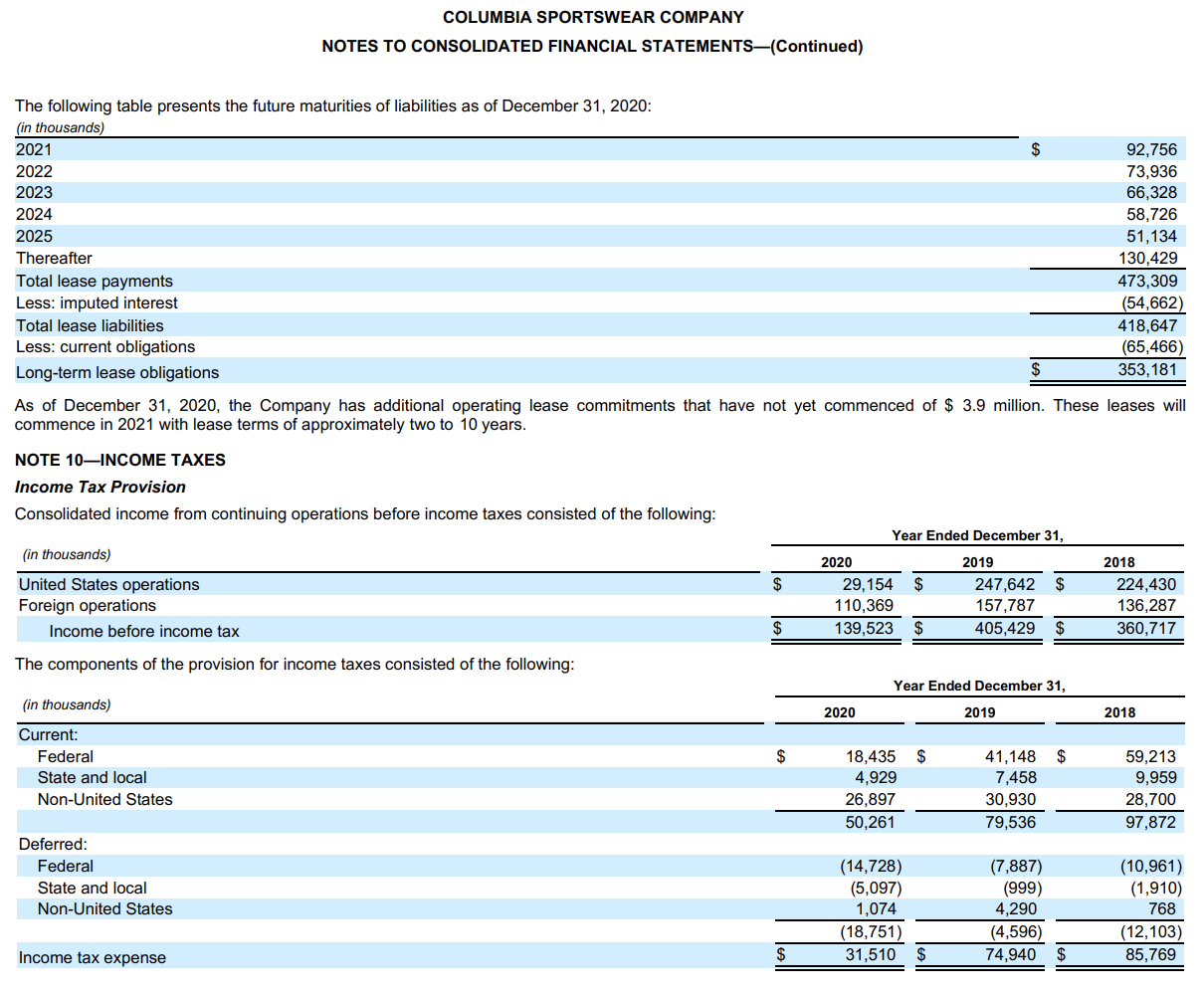

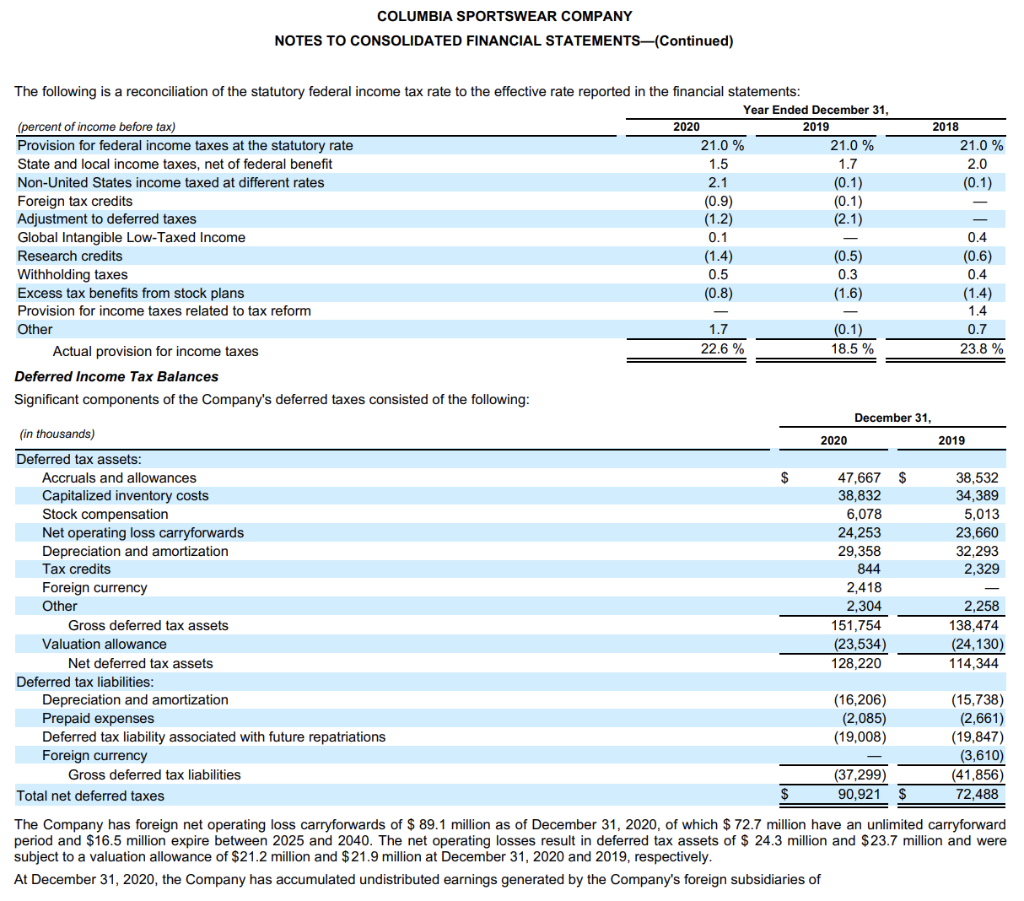

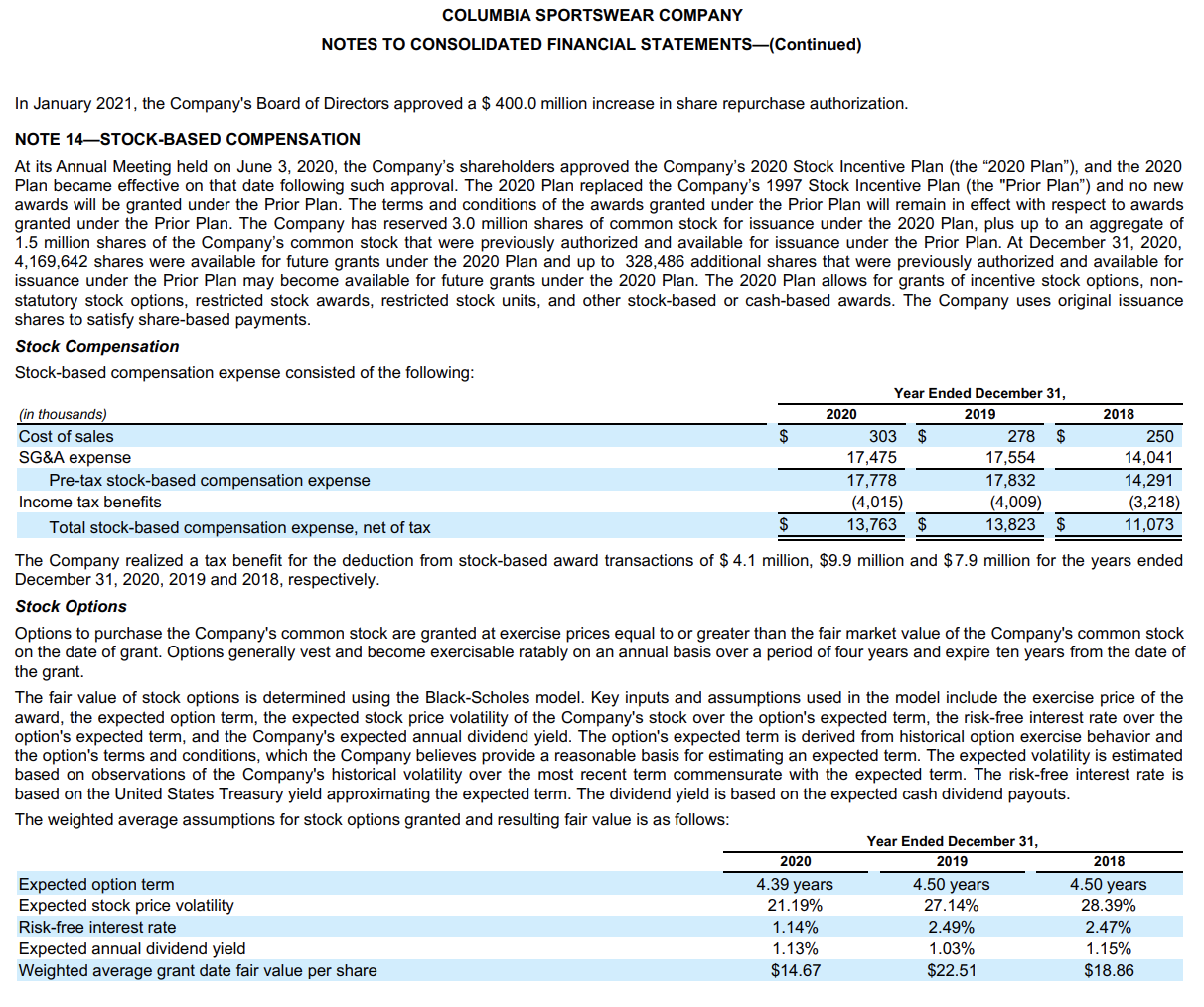

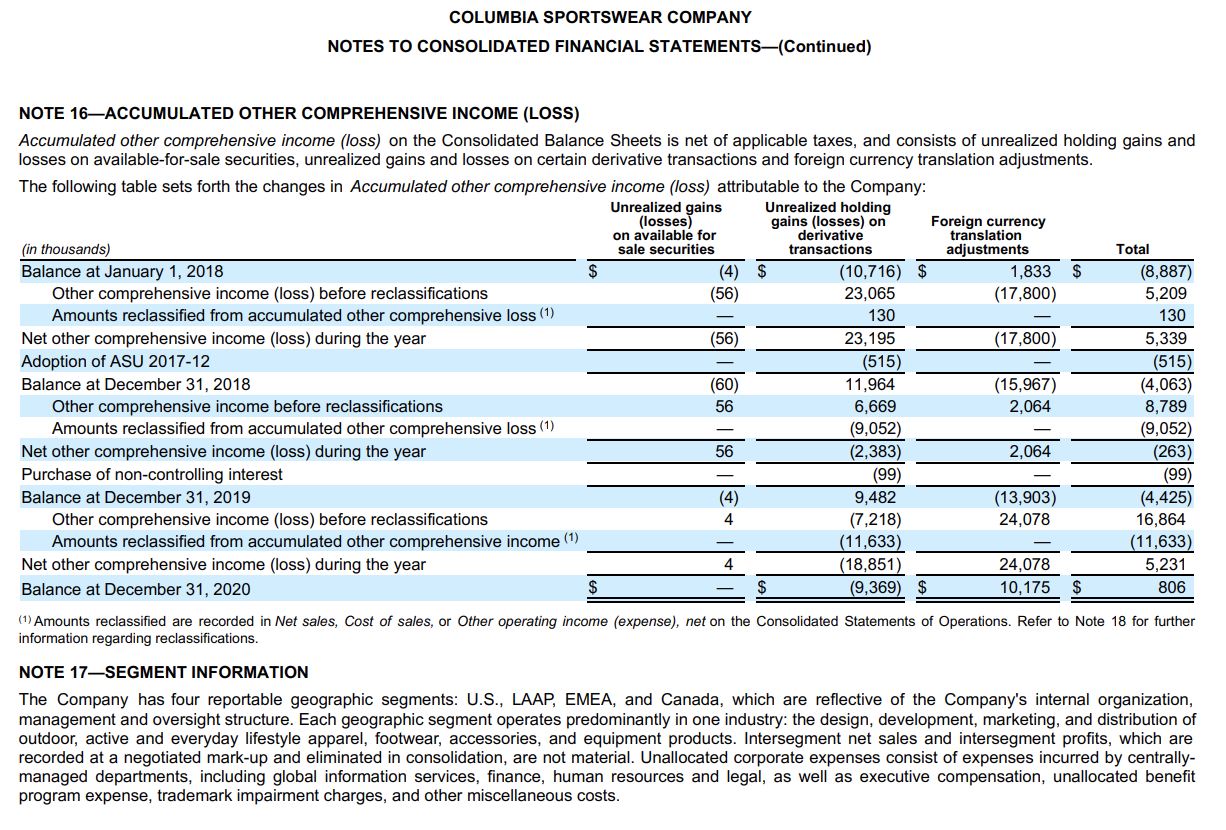

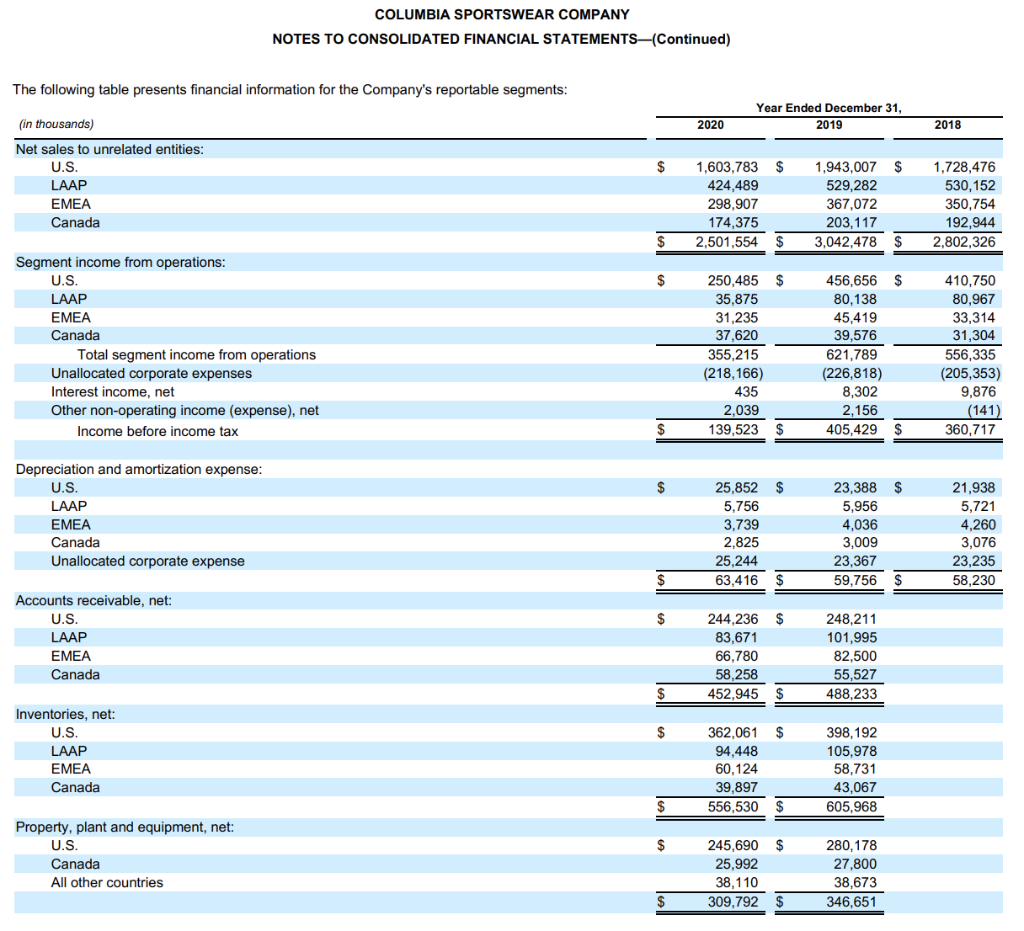

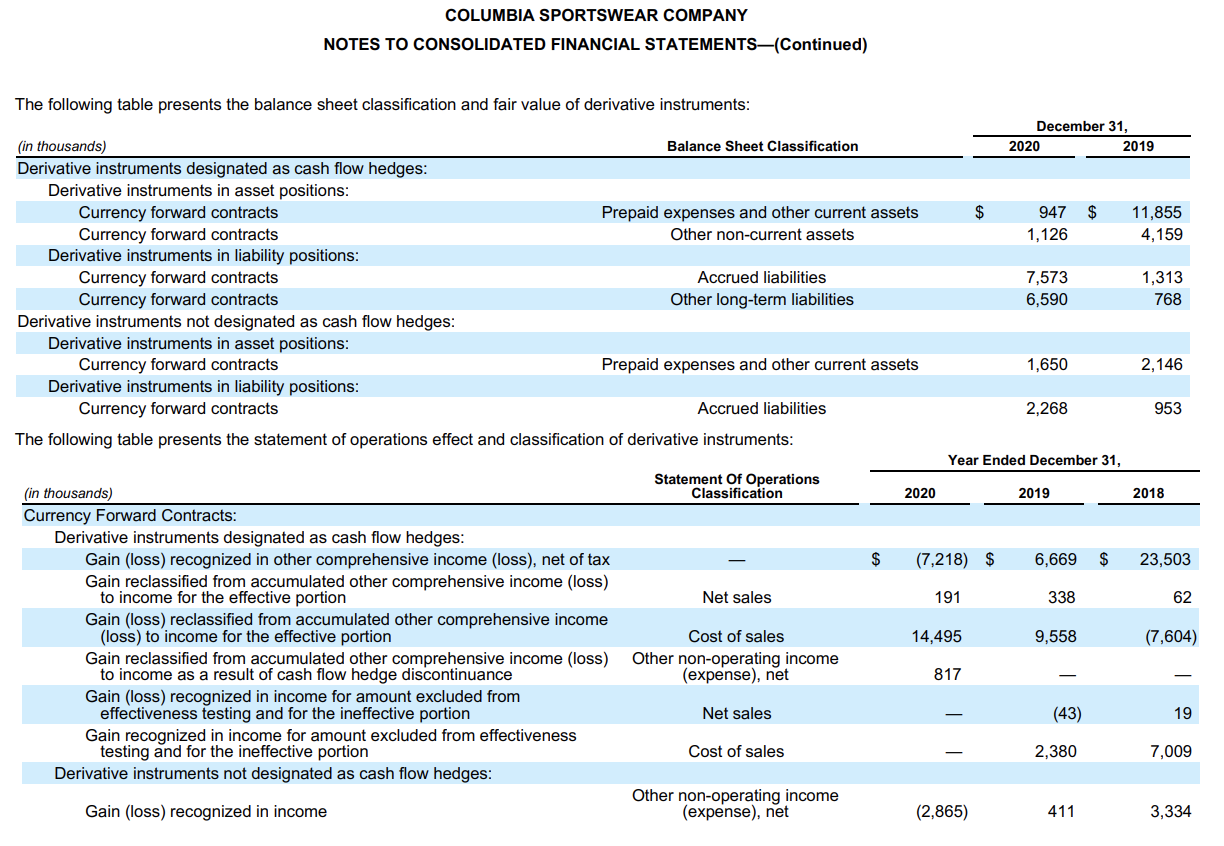

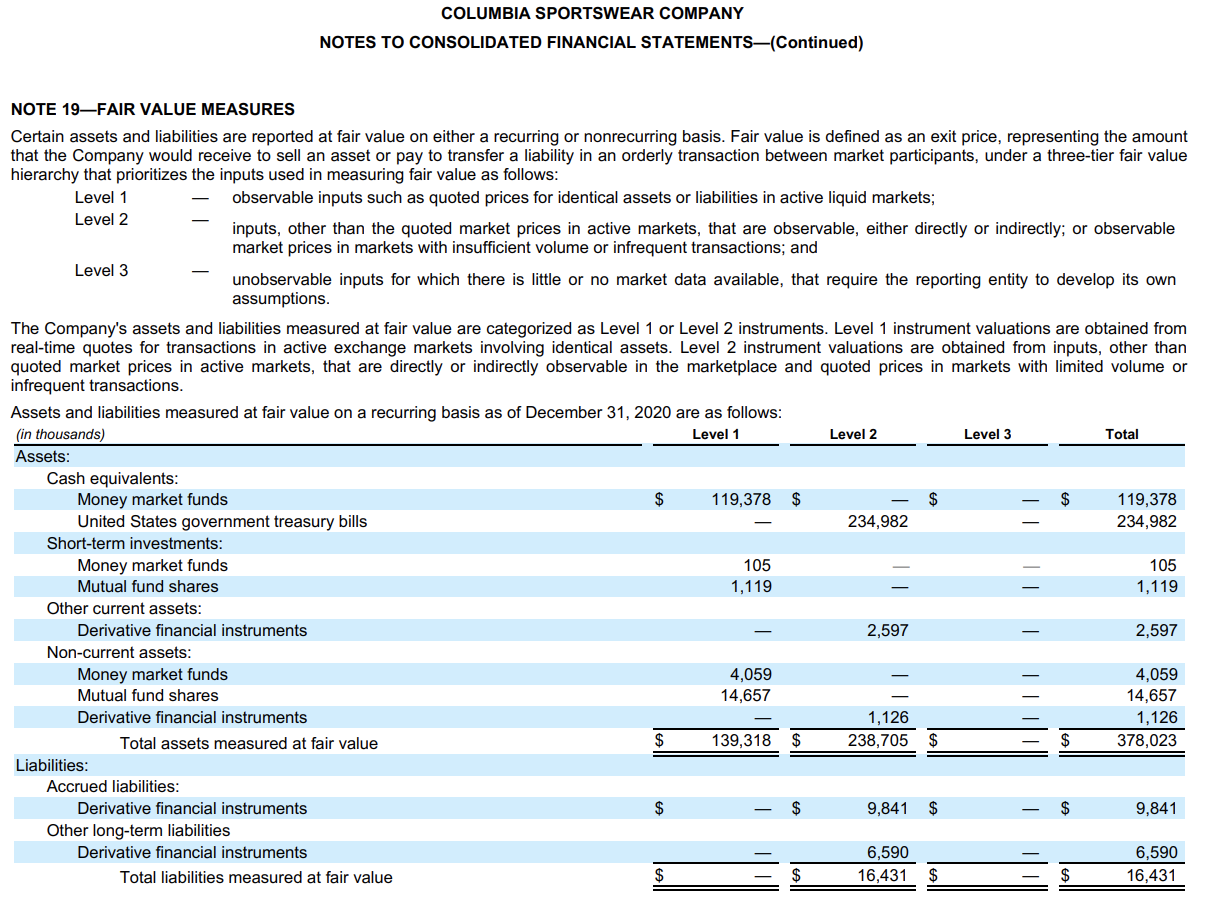

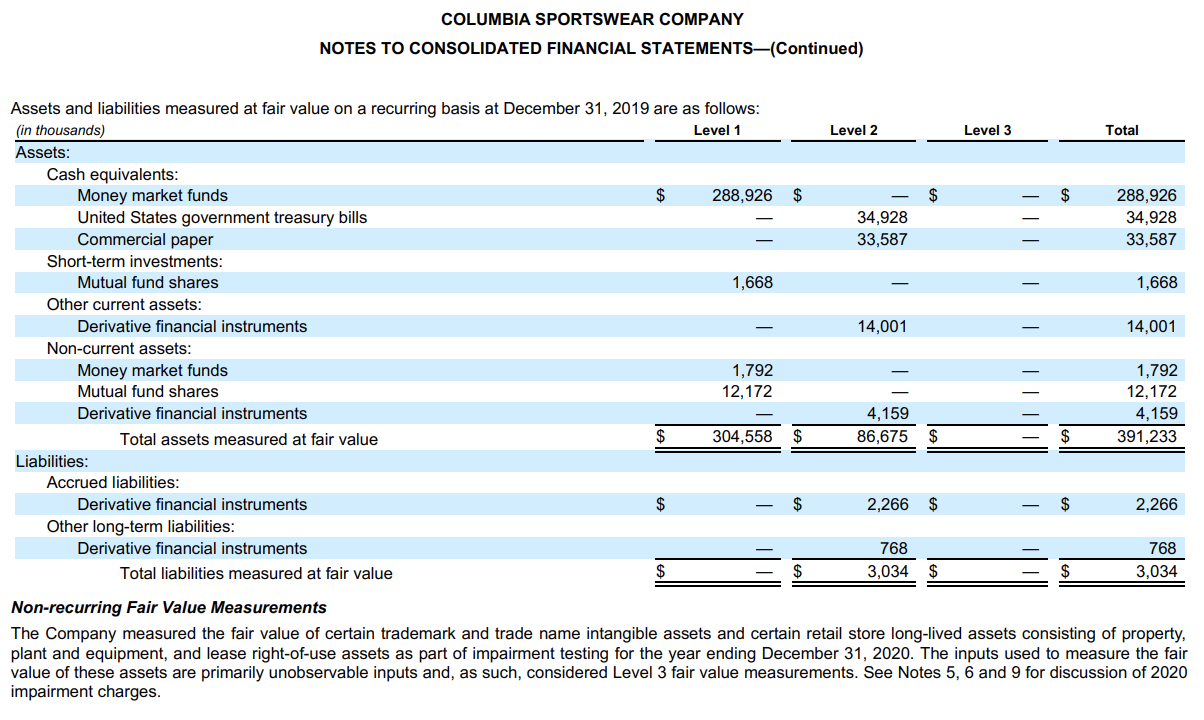

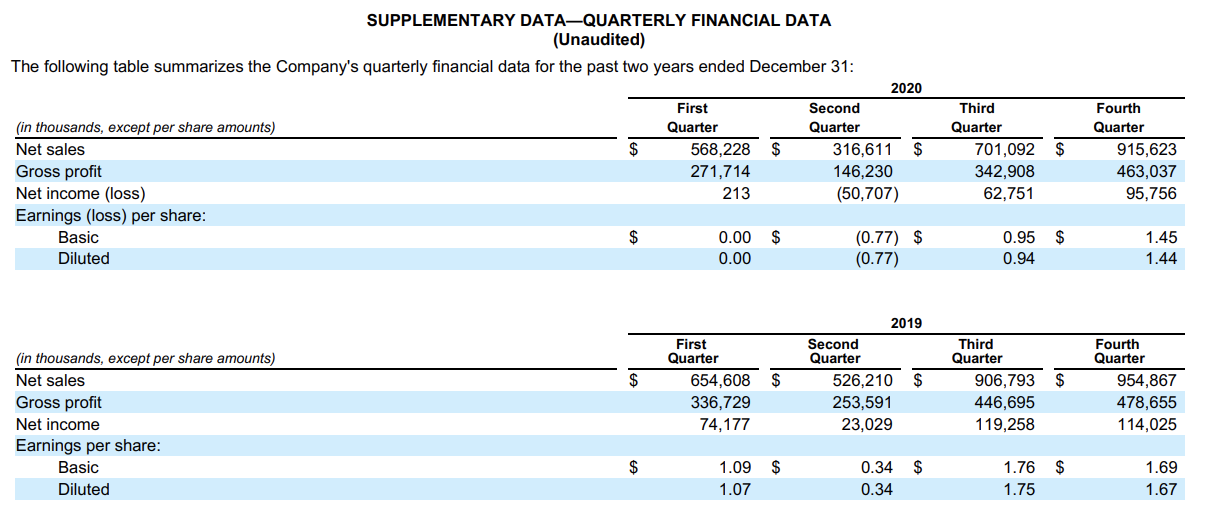

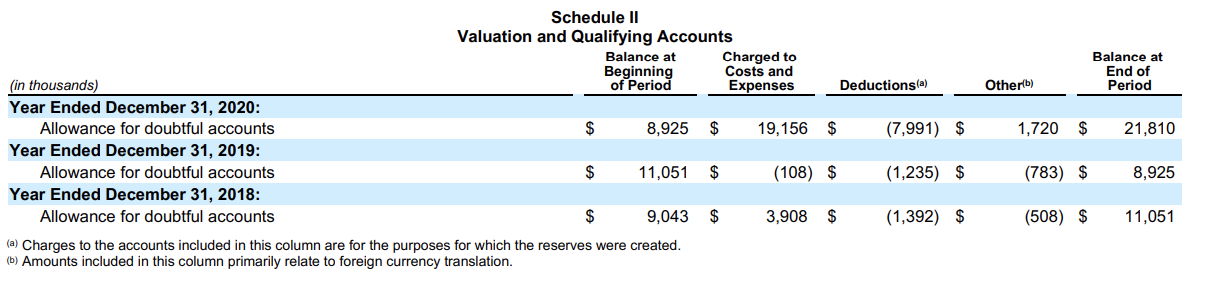

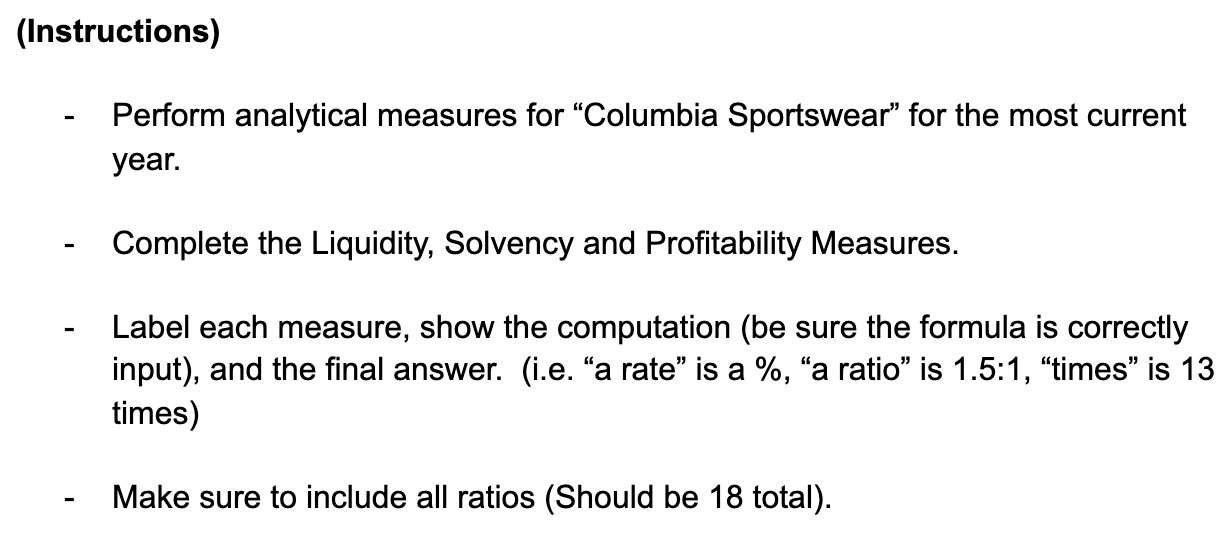

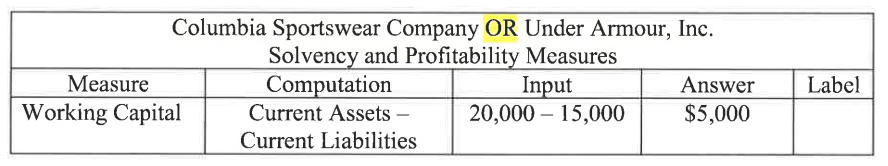

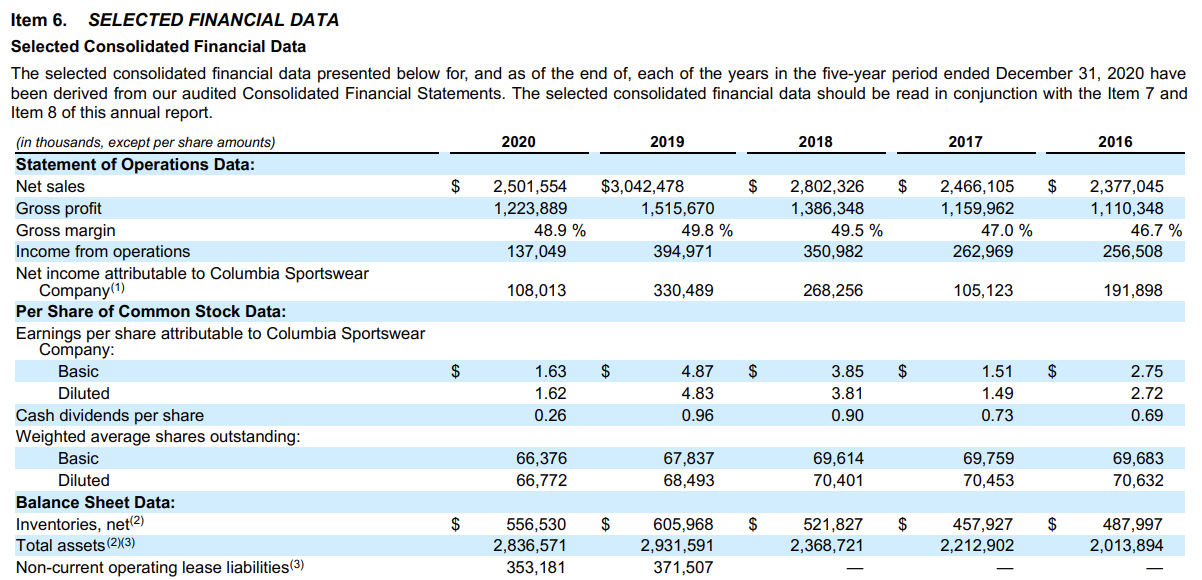

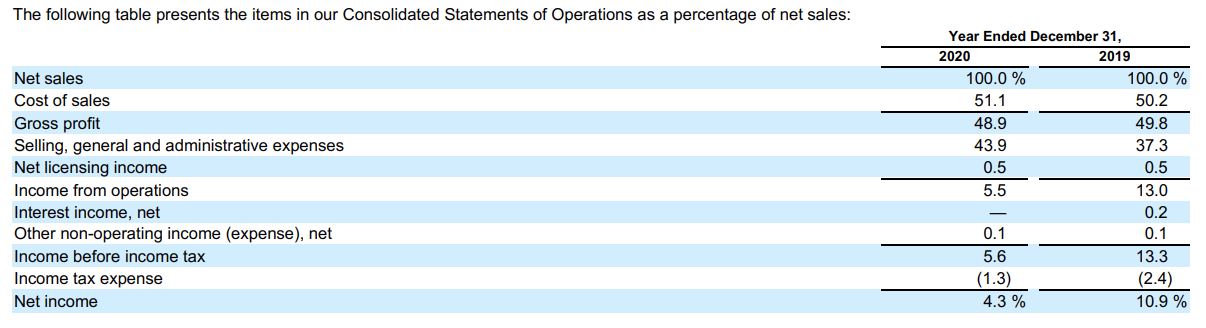

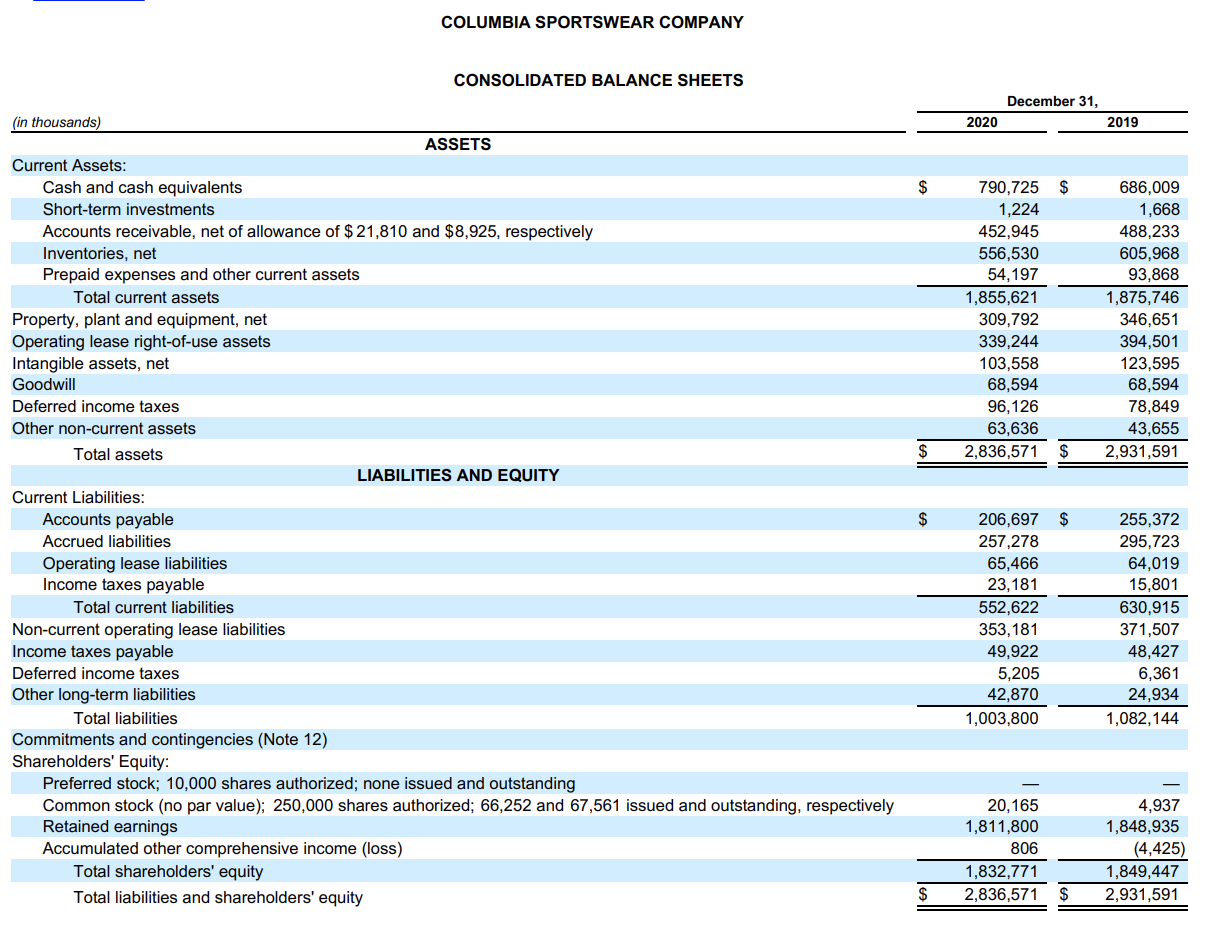

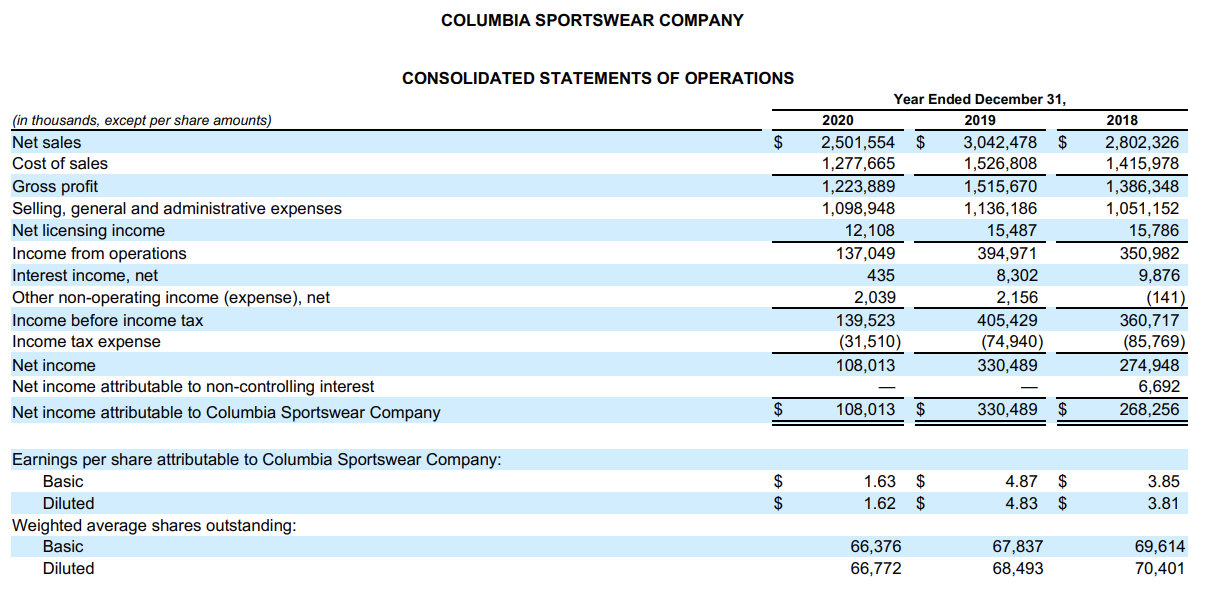

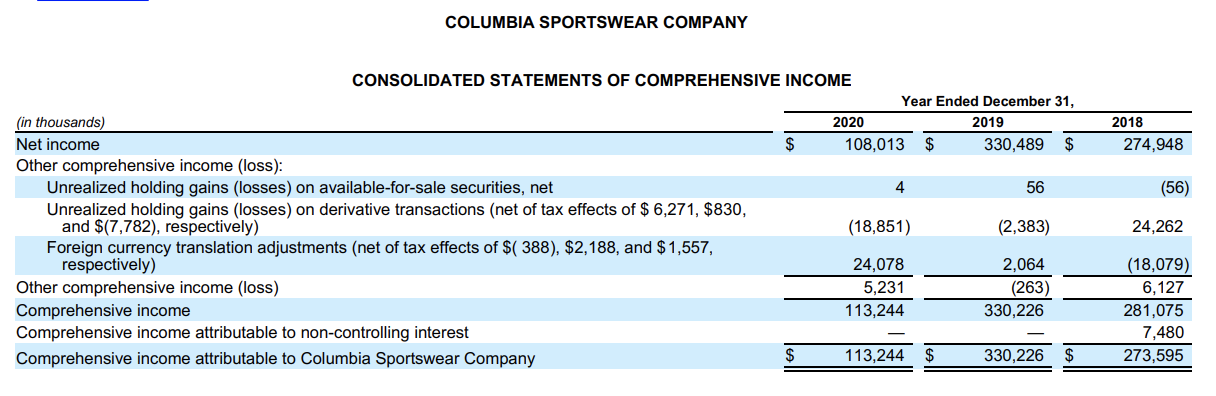

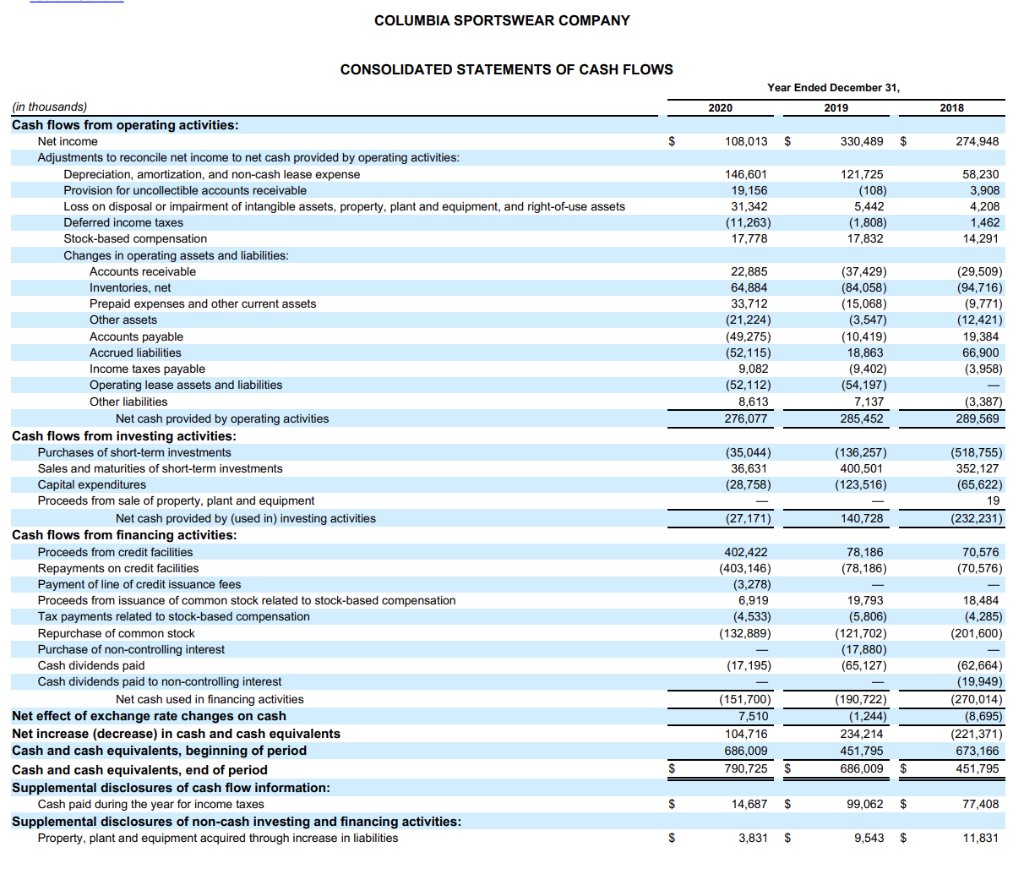

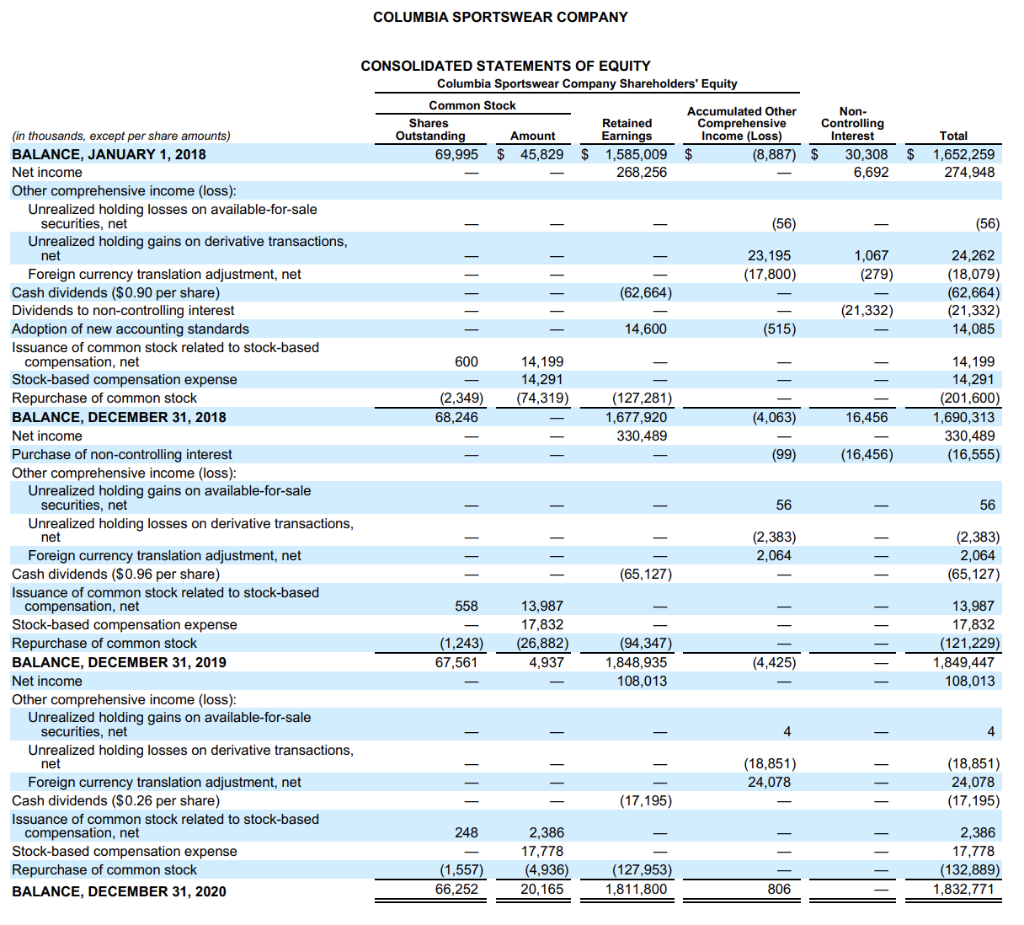

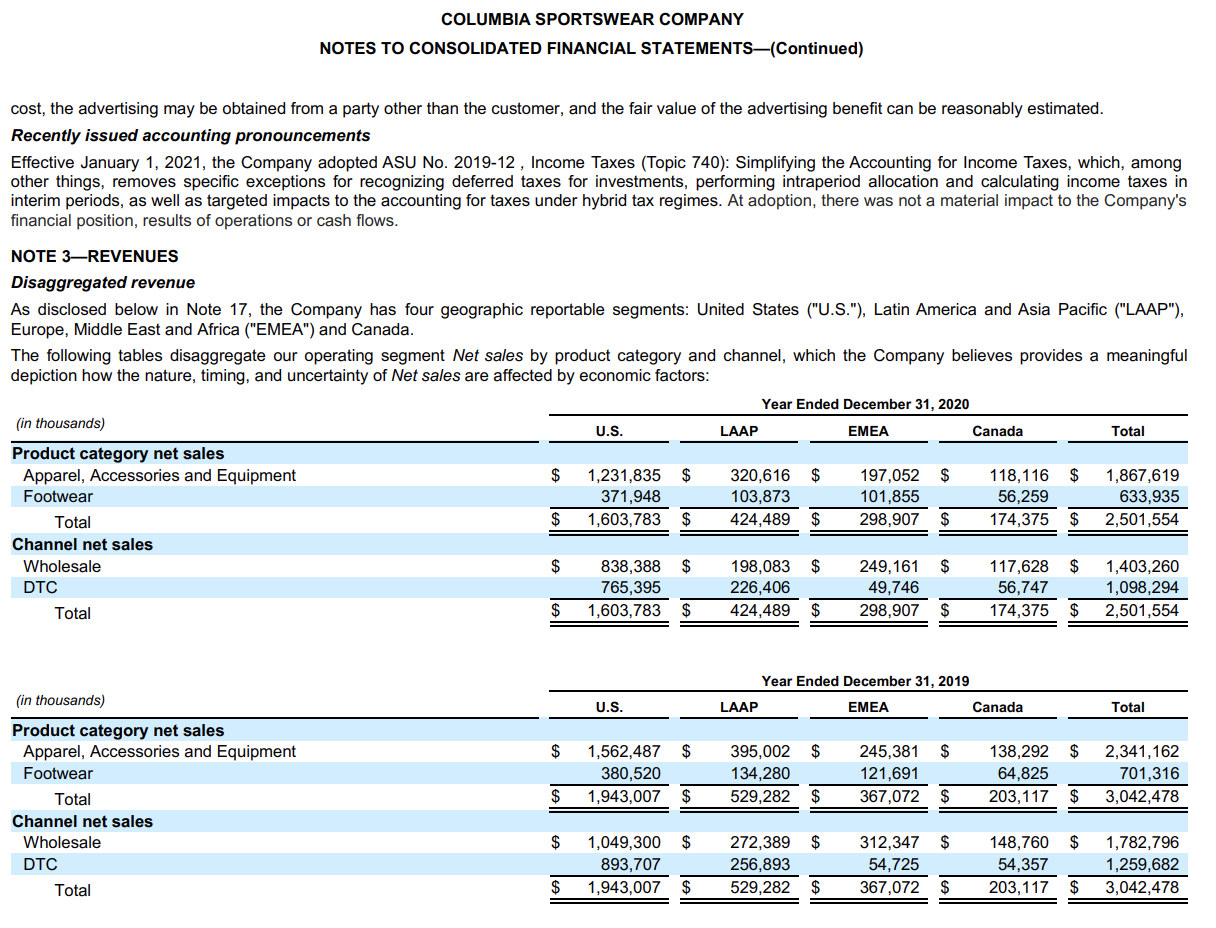

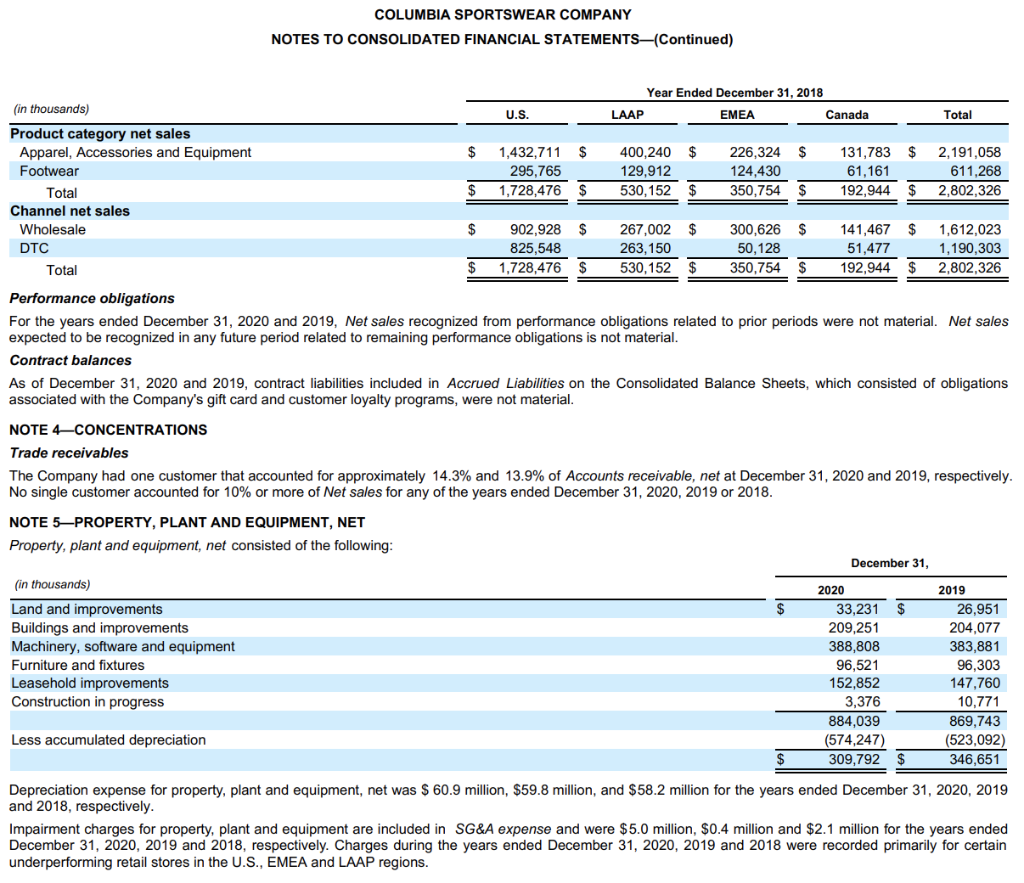

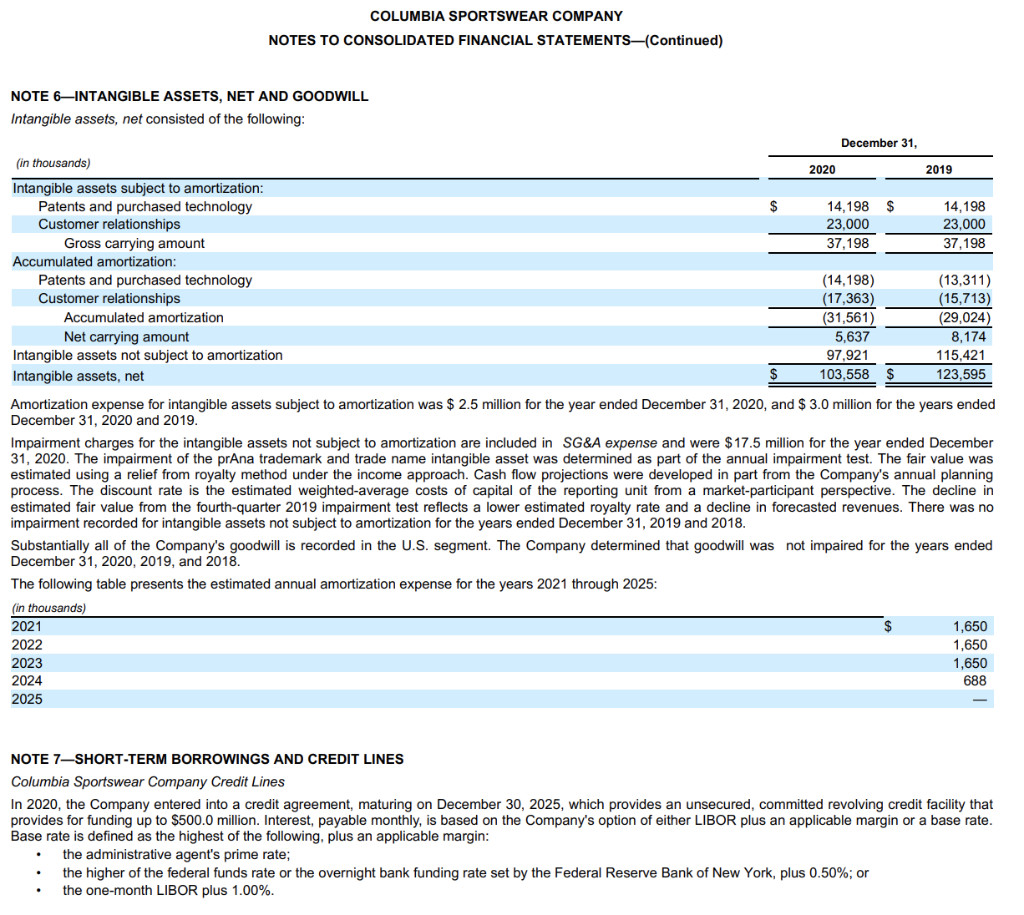

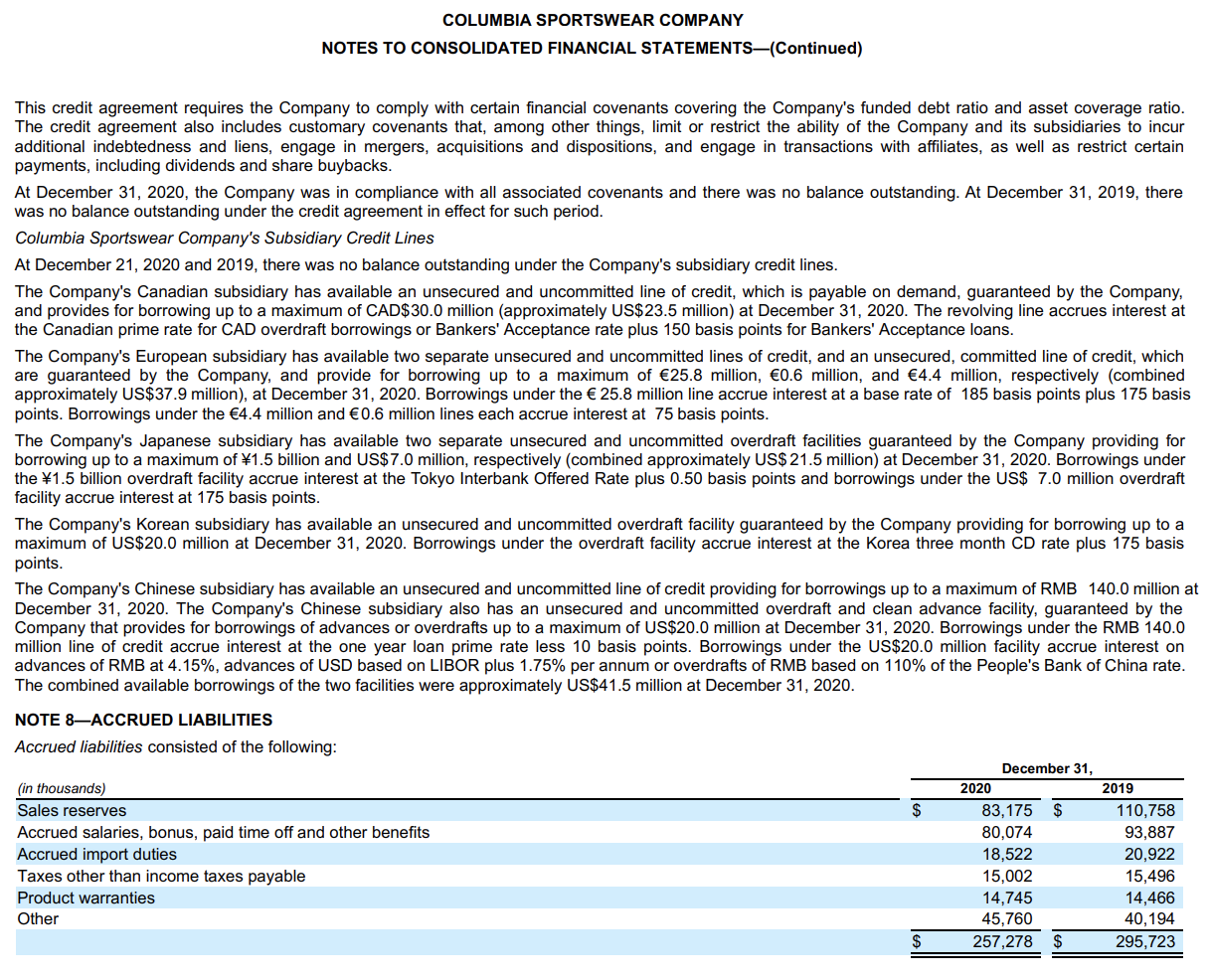

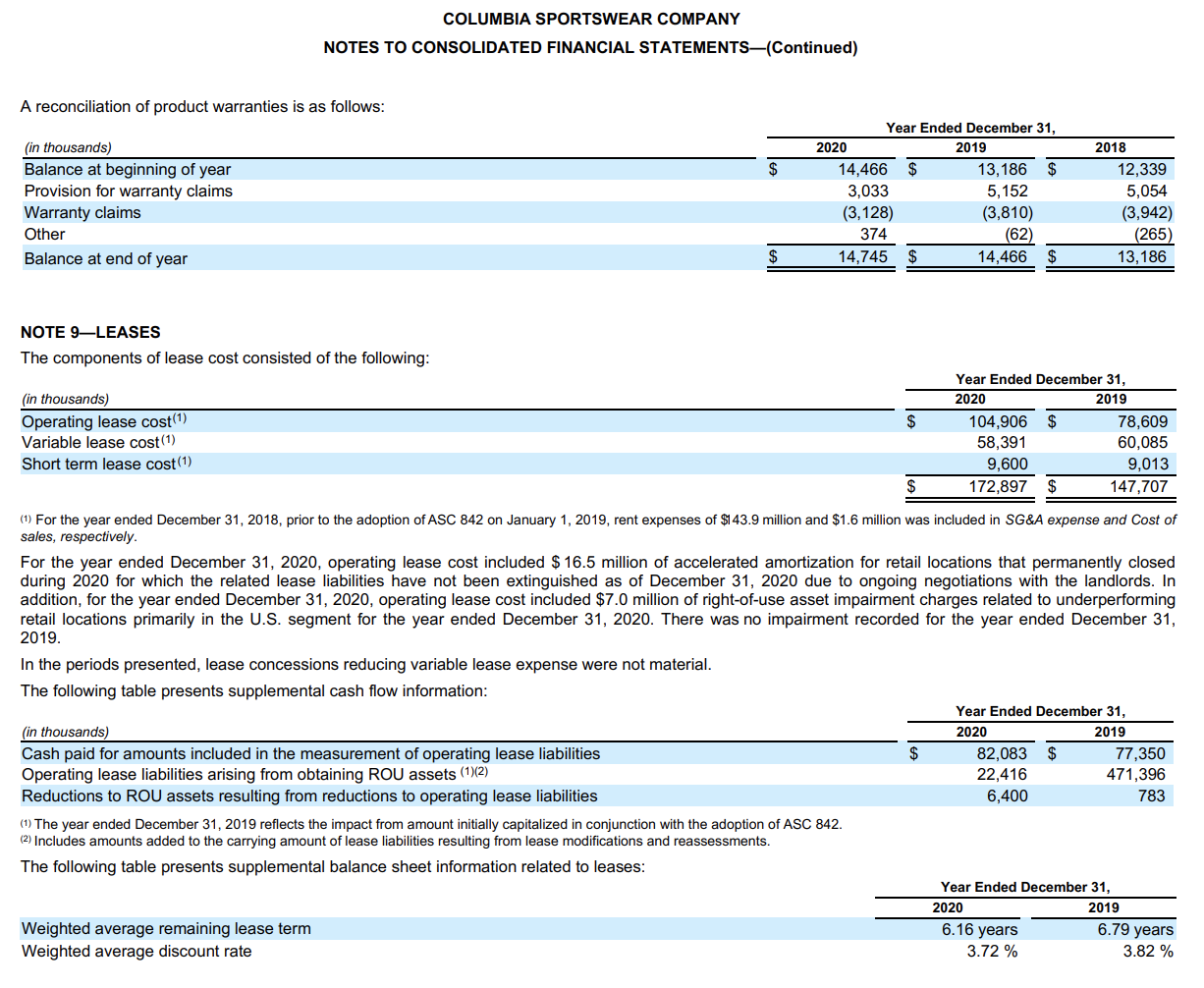

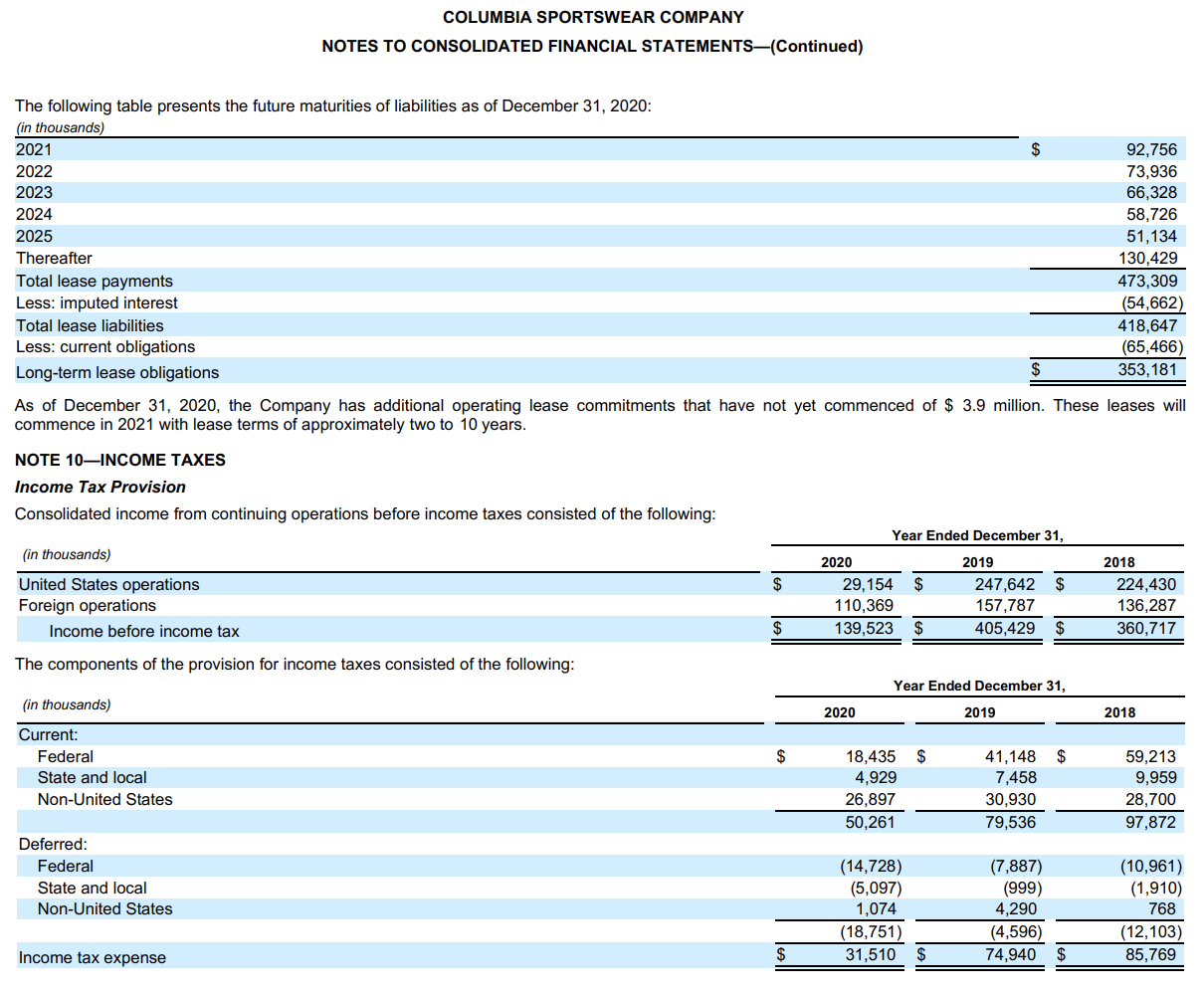

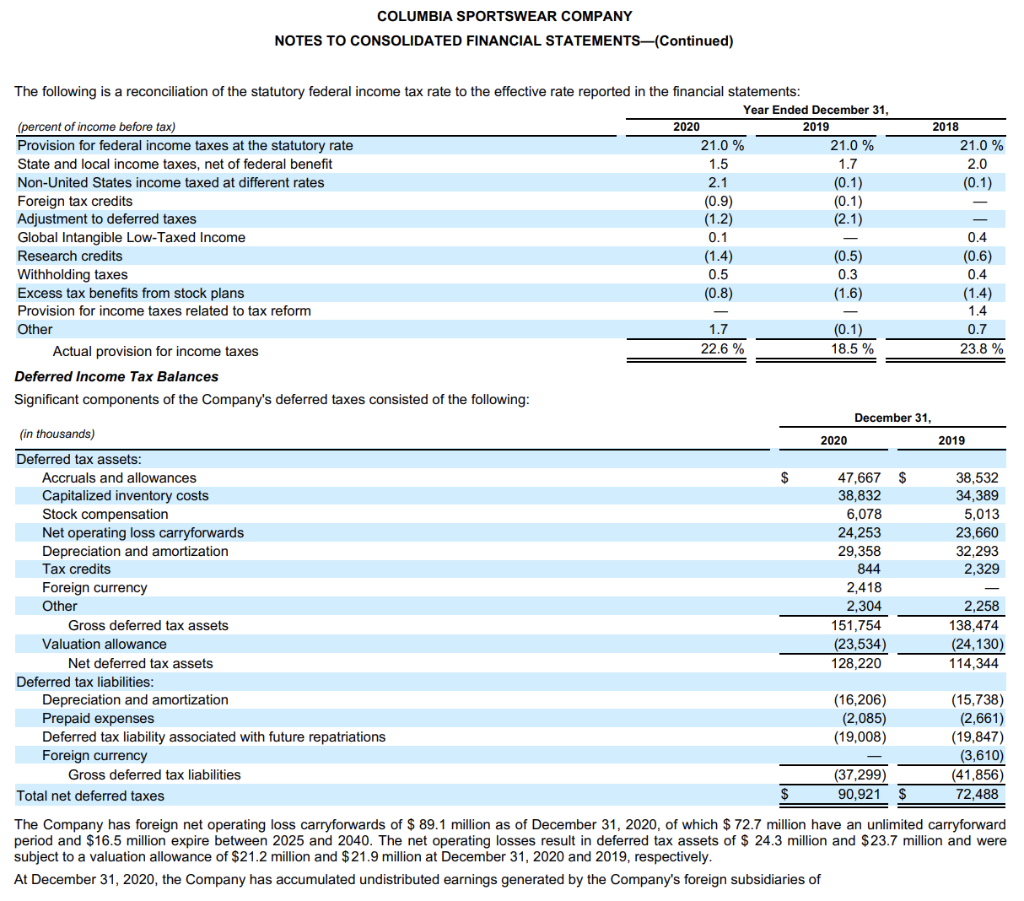

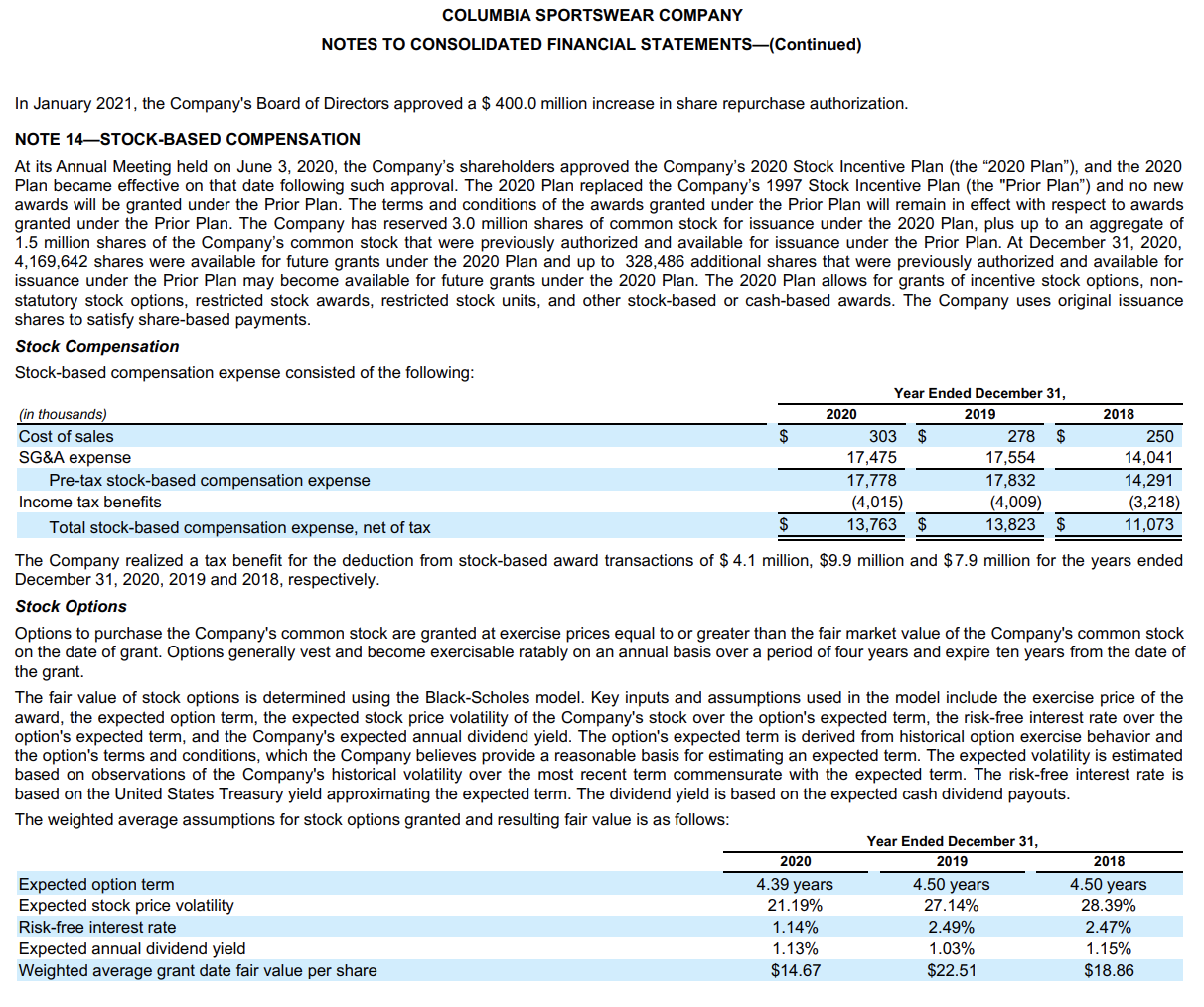

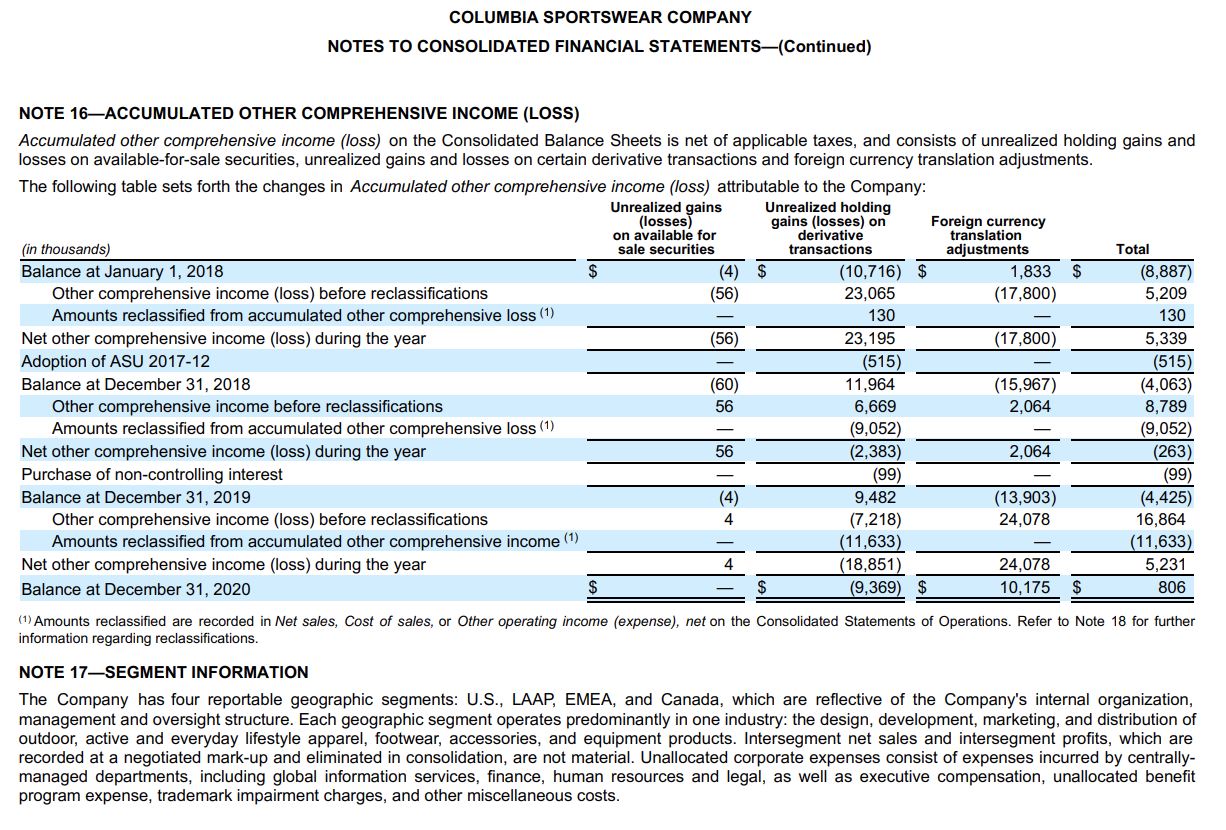

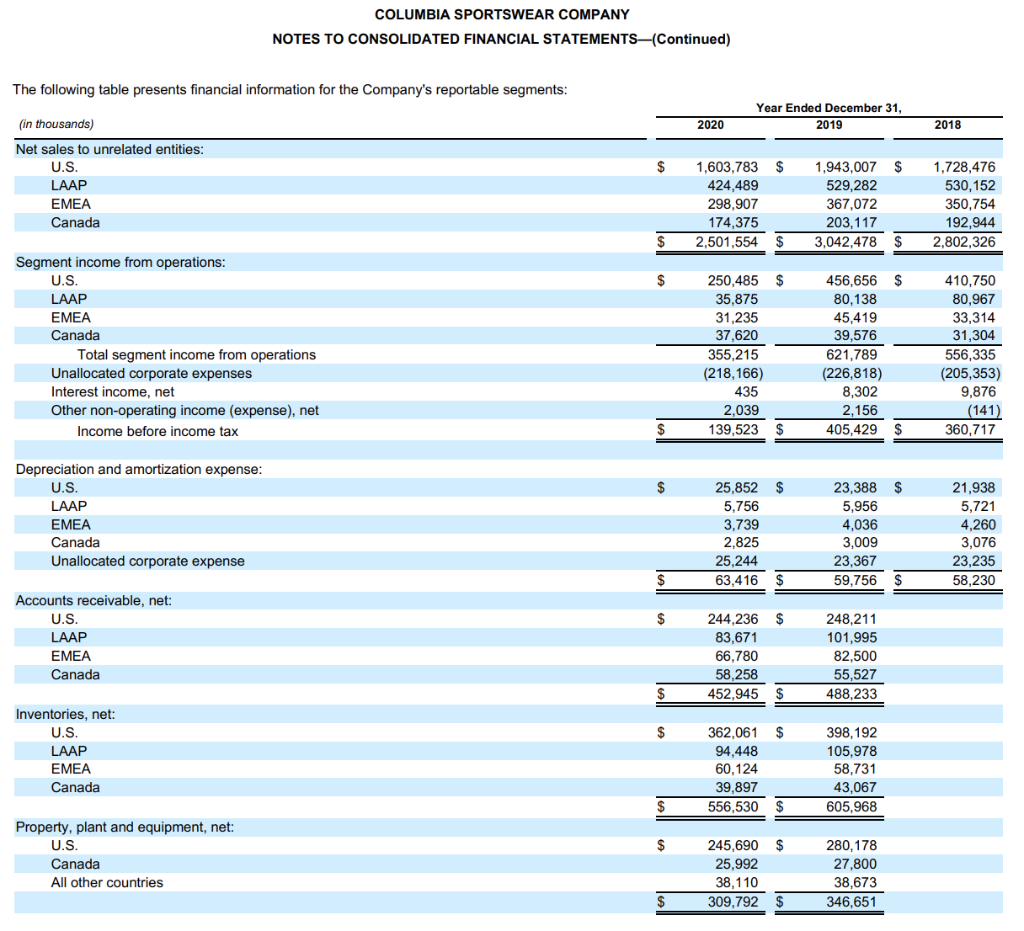

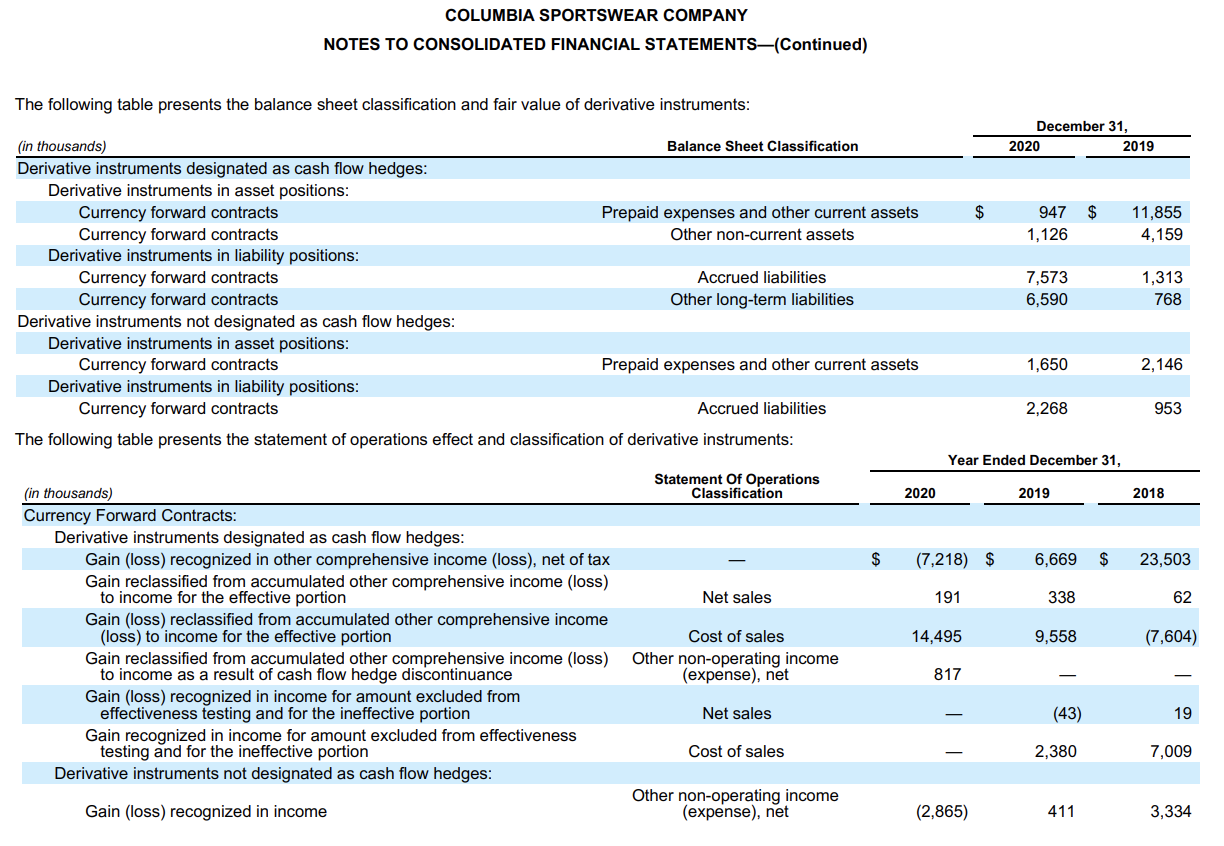

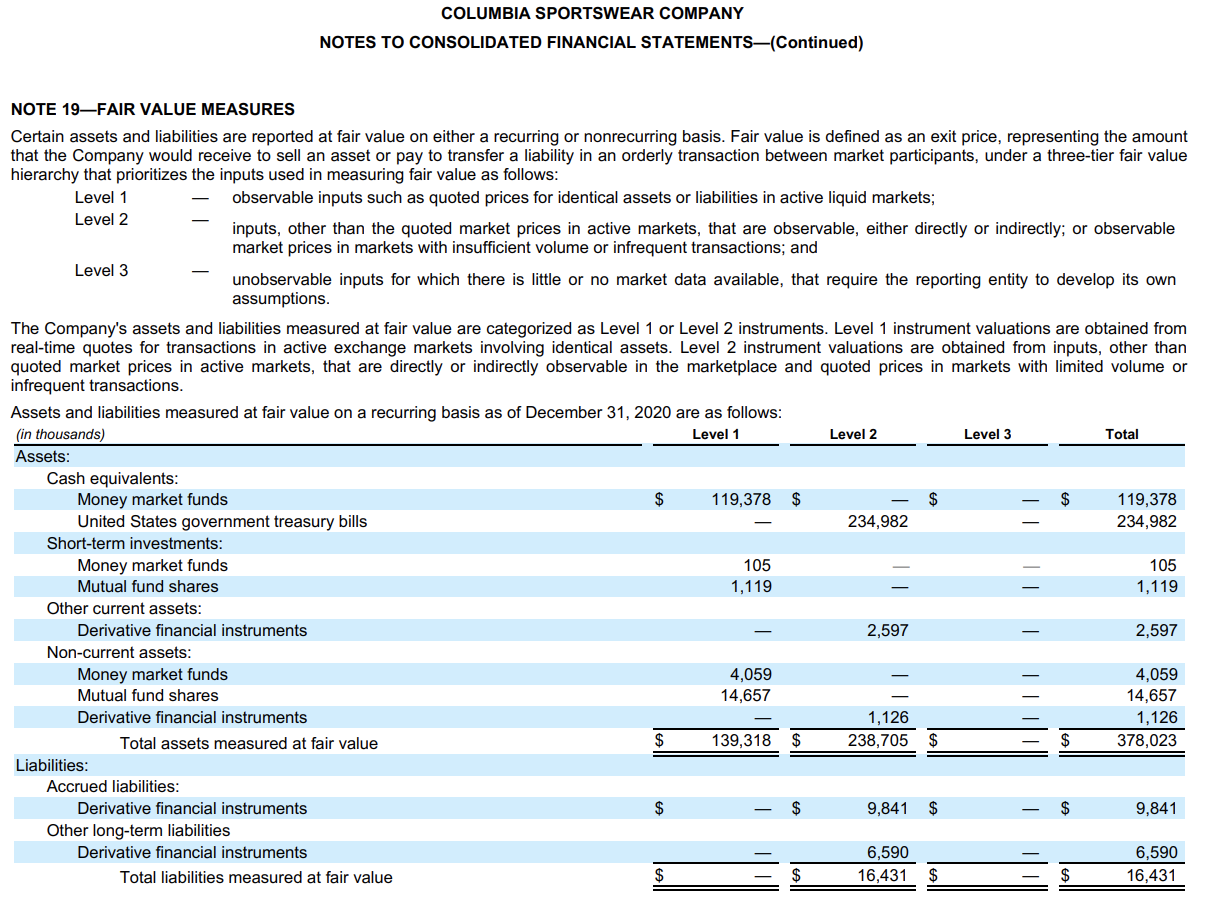

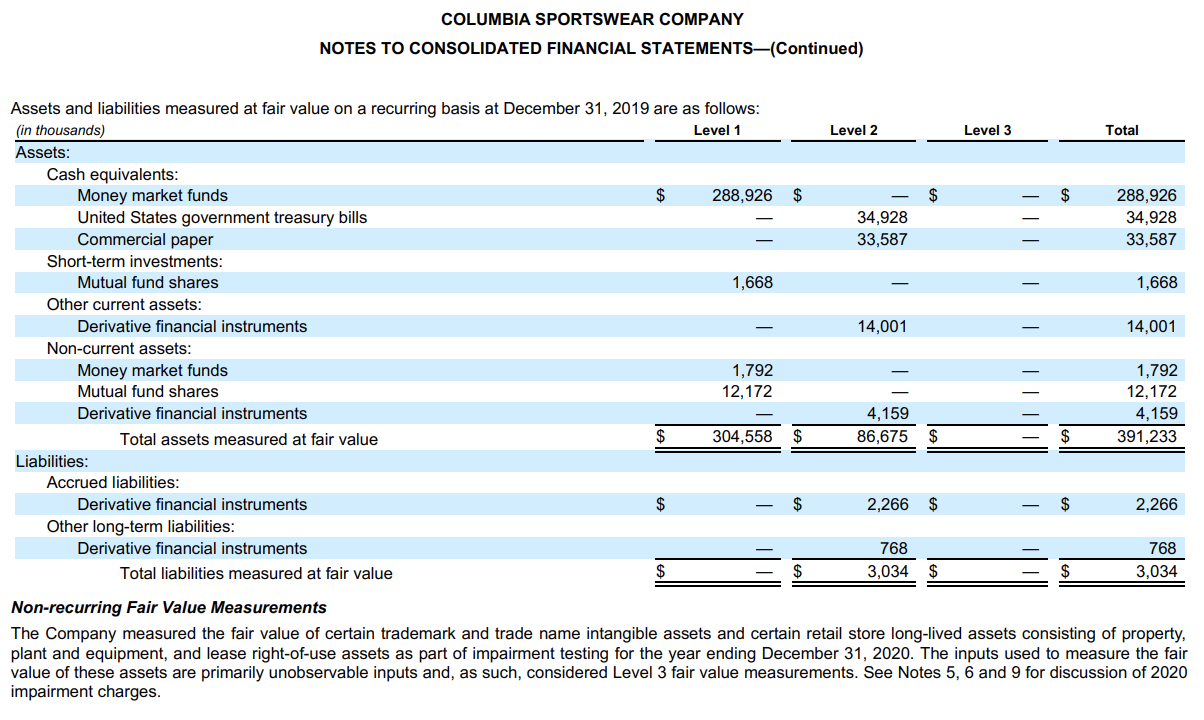

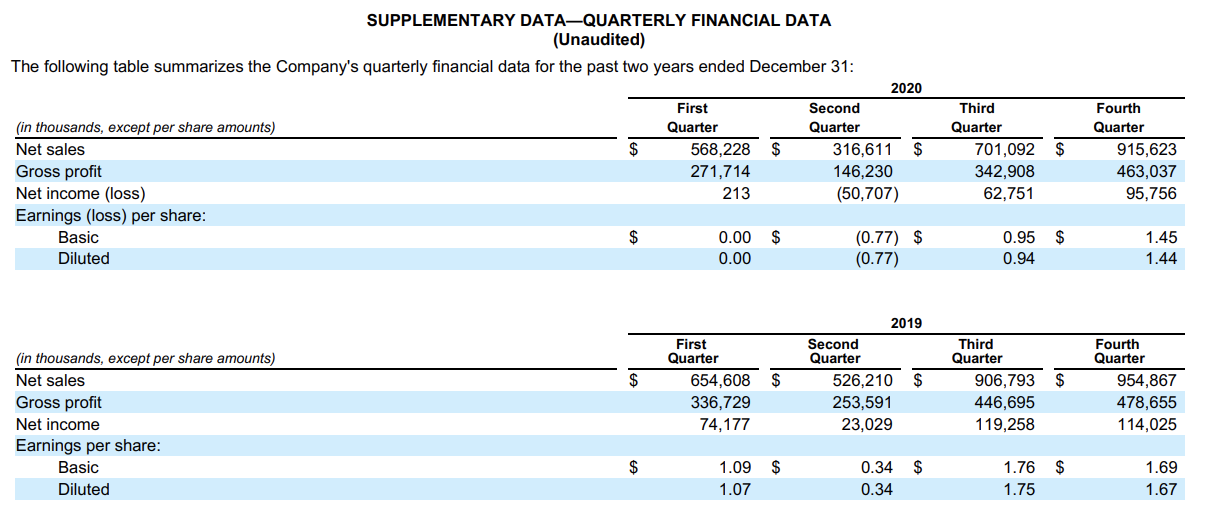

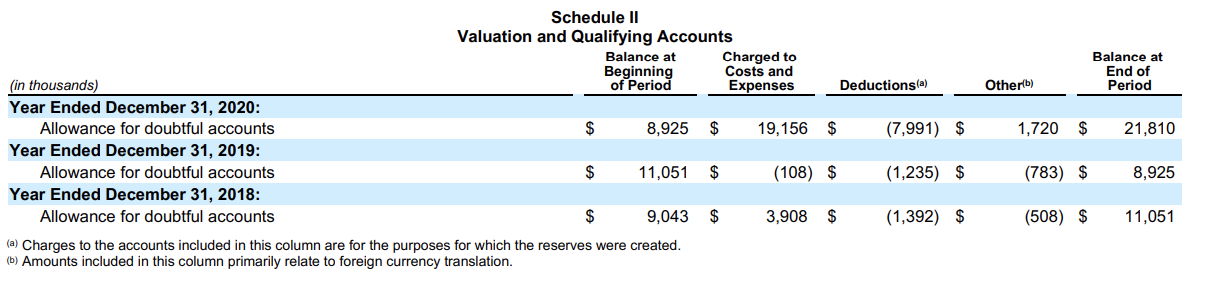

(Instructions) Perform analytical measures for Columbia Sportswear for the most current year. Complete the Liquidity, Solvency and Profitability Measures. Label each measure, show the computation (be sure the formula is correctly input), and the final answer. (i.e. "a rate is a %, "a ratio" is 1.5:1, "times is 13 times) 5 Make sure to include all ratios (Should be 18 total). Columbia Sportswear Company OR Under Armour, Inc. Solvency and Profitability Measures Measure Computation Input Answer Working Capital Current Assets - 20,000 - 15,000 $5,000 Current Liabilities Label Item 6. SELECTED FINANCIAL DATA Selected Consolidated Financial Data The selected consolidated financial data presented below for, and as of the end of each of the years in the five-year period ended December 31, 2020 have been derived from our audited Consolidated Financial Statements. The selected consolidated financial data should be read in conjunction with the Item 7 and Item 8 of this annual report. (in thousands, except per share amounts) 2020 2019 2018 2017 2016 Statement of Operations Data: Net sales $ 2,501,554 $3,042,478 $ 2,802,326 $ 2,466,105 $ 2,377,045 Gross profit 1,223,889 1,515,670 1,386,348 1,159,962 1,110,348 Gross margin 48.9 % 49.8 % 49.5 % 47.0 % 46.7 % Income from operations 137,049 394,971 350,982 262,969 256,508 Net income attributable to Columbia Sportswear Company (1) 108,013 330,489 268,256 105,123 191,898 Per Share of Common Stock Data: Earnings per share attributable to Columbia Sportswear Company: Basic $ 1.63 $ 4.87 $ 3.85 $ 1.51 $ 2.75 Diluted 1.62 4.83 3.81 1.49 2.72 Cash dividends per share 0.26 0.96 0.90 0.73 0.69 Weighted average shares outstanding: Basic 66,376 67,837 69,614 69,759 69,683 Diluted 66,772 68,493 70,401 70,453 70,632 Balance Sheet Data: Inventories, net(2) $ 556,530 605,968 $ 521,827 $ 457,927 $ 487,997 Total assets (2)(3) 2,836,571 2,931,591 2,368,721 2,212,902 2,013,894 Non-current operating lease liabilities(3) 353,181 371,507 The following table presents the items in our Consolidated Statements of Operations as a percentage of net sales: Net sales Cost of sales Gross profit Selling, general and administrative expenses Net licensing income Income from operations Interest income, net Other non-operating income (expense), net Income before income tax Income tax expense Net income Year Ended December 31, 2020 2019 100.0 % 100.0 % 51.1 50.2 48.9 49.8 43.9 37.3 0.5 0.5 5.5 13.0 0.2 0.1 0.1 5.6 13.3 (1.3) (2.4) 4.3 % 10.9 % COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS December 31, 2019 2020 $ $ 790,725 1,224 452,945 556,530 54,197 1,855,621 309,792 339,244 103,558 68,594 96, 126 63,636 2,836,571 686,009 1,668 488,233 605,968 93,868 1,875,746 346,651 394,501 123,595 68,594 78,849 43,655 2,931,591 (in thousands) ASSETS Current Assets: Cash and cash equivalents Short-term investments Accounts receivable, net of allowance of $ 21,810 and $8,925, respectively Inventories, net Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Operating lease right-of-use assets Intangible assets, net Goodwill Deferred income taxes Other non-current assets Total assets LIABILITIES AND EQUITY Current Liabilities: Accounts payable Accrued liabilities Operating lease liabilities Income taxes payable Total current liabilities Non-current operating lease liabilities Income taxes payable Deferred income taxes Other long-term liabilities Total liabilities Commitments and contingencies (Note 12) Shareholders' Equity: Preferred stock; 10,000 shares authorized; none issued and outstanding Common stock (no par value); 250,000 shares authorized; 66,252 and 67,561 issued and outstanding, respectively Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity Total liabilities and shareholders' equity $ $ 206,697 257,278 65,466 23,181 552,622 353,181 49,922 5,205 42,870 1,003,800 255,372 295,723 64,019 15,801 630,915 371,507 48,427 6,361 24,934 1,082,144 20,165 1,811,800 806 1,832,771 2,836,571 $ 4,937 1,848,935 (4,425) 1,849,447 2,931,591 $ COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS 2020 $ (in thousands, except per share amounts) Net sales Cost of sales Gross profit Selling, general and administrative expenses Net licensing income Income from operations Interest income, net Other non-operating income (expense), net Income before income tax Income tax expense Net income Net income attributable to non-controlling interest Net income attributable to Columbia Sportswear Company Year Ended December 31, 2019 2,501,554 $ 3,042,478 $ 1,277,665 1,526,808 1,223,889 1,515,670 1,098,948 1,136,186 12,108 15,487 137,049 394,971 435 8,302 2,039 2,156 139,523 405,429 (31,510) (74,940) 108,013 330,489 2018 2,802,326 1,415,978 1,386,348 1,051,152 15,786 350,982 9,876 (141) 360,717 (85,769) 274,948 6,692 268,256 $ 108,013 $ 330,489 $ $ $ 1.63 $ 1.62 $ 4.87 4.83 3.85 3.81 $ $ Earnings per share attributable to Columbia Sportswear Company: Basic Diluted Weighted average shares outstanding: Basic Diluted 66,376 66,772 67,837 68,493 69,614 70,401 COLUMBIA SPORTSWEAR COMPANY 2018 274,948 (56) CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Year Ended December 31, (in thousands) 2020 2019 Net income $ 108,013 $ 330,489 $ Other comprehensive income (loss): Unrealized holding gains (losses) on available-for-sale securities, net 4 56 Unrealized holding gains (losses) on derivative transactions (net of tax effects of $ 6,271, $830, and $(7,782), respectively) (18,851) (2,383) Foreign currency translation adjustments (net of tax effects of $( 388), $2,188, and $1,557, respectively) 24,078 2,064 Other comprehensive income (loss) 5,231 (263) Comprehensive income 113,244 330,226 Comprehensive income attributable to non-controlling interest $ Comprehensive income attributable to Columbia Sportswear Company 113,244 $ 330,226 $ 24,262 (18,079) 6,127 281,075 7,480 273,595 COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS Year Ended December 31, 2019 2020 2018 $ 108,013 $ 330,489 $ 274,948 146,601 19, 156 31,342 (11,263) 17,778 121,725 (108) 5,442 58,230 3,908 4,208 1,462 14,291 (1.808) 17,832 22.885 64.884 Inventories, net 33,712 (29,509) (94.716) (9,771) (12,421) 19,384 66,900 ver assets (37,429) (84,058) (15,068) (3,547) (10,419) 18,863 (9,402) (21,224) (49,275) (52,115) 9,082 (52,112) 8,613 276,077 (3,958) (54,197) 7,137 285,452 (3.387) 289,569 (in thousands) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization, and non-cash lease expense Provision for uncollectible accounts receivable Loss on disposal or impairment of intangible assets, property, plant and equipment, and right-of-use assets Deferred income taxes Stock-based compensation Changes in operating assets and liabilities: Accounts receivable Prepaid expenses and other current assets Other assets Accounts payable Accrued liabilities Income taxes payable Operating lease assets and liabilities Other liabilities Net cash provided by operating activities Cash flows from investing activities: Purchases of short-term investments Sales and maturities of short-term investments Capital expenditures Proceeds from sale of property, plant and equipment Net cash provided by (used in) investing activities Cash flows from financing activities: Proceeds from credit facilities Repayments on credit facilities Payment of line of credit issuance fees Proceeds from issuance of common stock related to stock-based compensation On pay Tax payments related to stock-based compensation Repurchase of common stock Purchase of non-controlling interest Cash dividends paid Cash dividends paid to non-controlling interest Net cash used in financing activities Net effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period Supplemental disclosures of cash flow information: Cash paid during the year for income taxes Supplemental disclosures of non-cash investing and financing activities: Property, plant and equipment acquired through increase in liabilities (35,044) 36,631 (28,758) (136,257) 400,501 (123,516) (518,755) 352,127 (65,622) 19 (232,231) (27.171) 140,728 78,186 (78,186) 70,576 (70,576) 402,422 (403,146) (3,278) 6,919 (4,533) (132,889) 19,793 (5,806) (121,702) (17,880) (65,127 18,484 (4,285) (201,600) (17,195) (151,700) 7,510 104.716 686,009 790,725 (190,722) (1,244) 234,214 451,795 686,009 (62,664) (19,949) (270,014) (8,695) (221,371) 673.166 451,795 S $ 14,687 $ 99,062 $ 77,408 $ 3,831 $ 9,543 $ 11,831 COLUMBIA SPORTSWEAR COMPANY Total 1,652,259 274,948 (56) 1,067 24,262 (18,079) (62,664) (21,332) 14,085 14,199 14,291 (201,600) 1,690,313 330,489 (16,555) CONSOLIDATED STATEMENTS OF EQUITY Columbia Sportswear Company Shareholders' Equity Common Stock Accumulated Other Non- Shares Retained Comprehensive Controlling (in thousands, except per share amounts) Outstanding Amount Earnings Income (Loss) Interest BALANCE, JANUARY 1, 2018 69,995 45,829 $ 1,585,009 (8,887) $ 30,308 Net income 268.256 6,692 Other comprehensive income (loss): Unrealized holding losses on available-for-sale securities, net (56) Unrealized holding gains on derivative transactions, net 23,195 Foreign currency translation adjustment, net (17,800) (279) Cash dividends ($0.90 per share) (62,664) Dividends to non-controlling interest (21,332) Adoption of new accounting standards 14,600 (515) Issuance of common stock related to stock-based compensation, net 600 14,199 Stock-based compensation expense 14,291 Repurchase of common stock (2,349) (74,319) (127,281) BALANCE, DECEMBER 31, 2018 68,246 1,677,920 (4,063) 16,456 Net income 330,489 Purchase of non-controlling interest (99) (16,456) Other comprehensive income (loss): Unrealized holding gains on available-for-sale securities, net 56 Unrealized holding losses on derivative transactions, net (2,383) Foreign currency translation adjustment, net 2,064 Cash dividends ($0.96 per share) (65,127) Issuance of common stock related to stock-based compensation, net 558 13,987 Stock-based compensation expense 17,832 Repurchase of common stock (1,243) (26,882) (94,347) BALANCE, DECEMBER 31, 2019 67,561 4,937 1,848,935 (4,425) Net income 108,013 Other comprehensive income (loss): Unrealized holding gains on available-for-sale securities, net Unrealized holding losses on derivative transactions, net (18,851) Foreign currency translation adjustment, net 24,078 Cash dividends ($0.26 per share) (17,195) Issuance of common stock related to stock-based compensation, net 248 2,386 Stock-based compensation expense 17,778 Repurchase of common stock (1,557) (4,936) (127,953) BALANCE, DECEMBER 31, 2020 66,252 20,165 1,811,800 806 56 TTI (2,383) 2,064 (65,127) |||||||||| 13,987 17,832 (121,229) 1,849,447 108,013 (18,851) 24,078 (17,195) 2,386 17,778 (132,889) 1,832,771 COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) cost, the advertising may be obtained from a party other than the customer, and the fair value of the advertising benefit can be reasonably estimated. Recently issued accounting pronouncements Effective January 1, 2021, the Company adopted ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes, which, among other things, removes specific exceptions for recognizing deferred taxes for investments, performing intraperiod allocation and calculating income taxes in interim periods, as well as targeted impacts to the accounting for taxes under hybrid tax regimes. At adoption, there was not a material impact to the Company's financial position, results of operations or cash flows. NOTE 3REVENUES Disaggregated revenue As disclosed below in Note 17, the Company has four geographic reportable segments: United States ("U.S."), Latin America and Asia Pacific ("LAAP"), Europe, Middle East and Africa ("EMEA") and Canada. The following tables disaggregate our operating segment Net sales by product category and channel, which the Company believes provides a meaningful depiction how the nature, timing, and uncertainty of Net sales are affected by economic factors: Year Ended December 31, 2020 (in thousands) U.S. LAAP EMEA Canada Total Product category net sales Apparel, Accessories and Equipment $ 1,231,835 $ 320,616 $ 197,052 118,116 $ 1,867,619 Footwear 371,948 103,873 101,855 56,259 633,935 Total $ 1,603,783 $ 424,489 $ 298,907 174,375 $ 2,501,554 Channel net sales Wholesale $ 838,388 $ 198,083 $ 249,161 $ 117,628 $ 1,403,260 DTC 765,395 226,406 49,746 56,747 1,098,294 Total $ 1,603,783 $ 424,489 $ 298,907 174,375 2,501,554 Year Ended December 31, 2019 U.S. LAAP EMEA Canada Total $ $ $ $ $ (in thousands) Product category net sales Apparel, Accessories and Equipment Footwear Total Channel net sales Wholesale DTC 1,562,487 380,520 1,943,007 395,002 134,280 529,282 245,381 121,691 367,072 138,292 64,825 203, 117 2,341,162 701,316 3,042,478 $ $ $ $ $ $ 1,049,300 $ 893,707 1,943,007 $ 272,389 $ 256,893 529,282 $ 312,347 $ 54,725 367,072 $ 148,760 $ 54,357 203,117 $ 1,782,796 1,259,682 3,042,478 Total $ COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) (in thousands) Year Ended December 31, 2018 LAAP EMEA Canada U.S. Total $ $ Product category net sales Apparel, Accessories and Equipment Footwear Total Channel net sales Wholesale 1,432,711 295.765 1,728,476 400,240 $ 129,912 530,152 226,324 $ 124,430 350,754 $ 131,783 61,161 192,944 2,191,058 611,268 2,802,326 $ $ $ DTC 902,928 $ 825,548 1,728,476 $ 267,002 263,150 530,152 300,626 50,128 350.754 141,467 51,477 192,944 1,612,023 1,190,303 2,802,326 Total Performance obligations For the years ended December 31, 2020 and 2019, Net sales recognized from performance obligations related to prior periods were not material. Net sales expected to be recognized in any future period related to remaining performance obligations is not material. Contract balances As of December 31, 2020 and 2019, contract liabilities included in Accrued Liabilities on the Consolidated Balance Sheets, which consisted of obligations associated with the Company's gift card and customer loyalty programs, were not material. NOTE 4-CONCENTRATIONS Trade receivables The Company had one customer that accounted for approximately 14.3% and 13.9% of Accounts receivable, net at December 31, 2020 and 2019, respectively. No single customer accounted for 10% or more of Net Sales for any of the years ended December 31, 2020, 2019 or 2018. NOTE 5PROPERTY, PLANT AND EQUIPMENT, NET Property, plant and equipment, net consisted of the following: December 31, (in thousands) Land and improvements Buildings and improvements Machinery, software and equipment Furniture and fixtures Leasehold improvements Construction in progress 2020 33,231 209,251 388,808 96,521 152,852 3,376 884,039 (574,247) 309,792 2019 26,951 204,077 383,881 96,303 147,760 10,771 869,743 (523,092) 346,651 Less accumulated depreciation Depreciation expense for property, plant and equipment, net was $ 60.9 million, $59.8 million, and $58.2 million for the years ended December 31, 2020, 2019 and 2018, respectively. Impairment charges for property, plant and equipment are included in SG&A expense and were $5.0 million, $0.4 million and $2.1 million for the years ended December 31, 2020, 2019 and 2018, respectively. Charges during the years ended December 31, 2020, 2019 and 2018 were recorded primarily for certain underperforming retail stores in the U.S., EMEA and LAAP regions. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) 2019 S NOTE 6INTANGIBLE ASSETS, NET AND GOODWILL Intangible assets, net consisted of the following: December 31, (in thousands) 2020 Intangible assets subject to amortization: Patents and purchased technology $ 14,198 $ 14,198 Customer relationships 23,000 23,000 Gross carrying amount 37,198 37,198 Accumulated amortization: Patents and purchased technology (14,198) (13,311) Customer relationships (17,363) (15,713) Accumulated amortization (31,561) (29,024) Net carrying amount 5,637 8,174 Intangible assets not subject to amortization 97,921 115,421 Intangible assets, net 103,558 123,595 Amortization expense for intangible assets subject to amortization was $2.5 million for the year ended December 31, 2020, and $ 3.0 million for the years ended December 31, 2020 and 2019. Impairment charges for the intangible assets not subject to amortization are included in SG&A expense and were $17.5 million for the year ended December 31, 2020. The impairment of the prAna trademark and trade name intangible asset was determined as part of the annual impairment test. The fair value was estimated using a relief from royalty method under the income approach. Cash flow projections were developed in part from the Company's annual planning process. The discount rate is the estimated weighted average costs of capital of the reporting unit from a market-participant perspective. The decline in estimated fair value from the fourth-quarter 2019 impairment test reflects a lower estimated royalty rate and a decline in forecasted revenues. There was no impairment recorded for intangible assets not subject to amortization for the years ended December 31, 2019 and 2018. Substantially all of the Company's goodwill is recorded in the U.S. segment. The Company determined that goodwill was not impaired for the years ended December 31, 2020, 2019, and 2018. The following table presents the estimated annual amortization expense for the years 2021 through 2025: (in thousands) 2021 1,650 2022 1,650 2023 1,650 2024 688 2025 NOTE 7SHORT-TERM BORROWINGS AND CREDIT LINES Columbia Sportswear Company Credit Lines In 2020, the Company entered into a credit agreement, maturing on December 30, 2025, which provides an unsecured, committed revolving credit facility that provides for funding up to $500.0 million. Interest, payable monthly, is based on the Company's option of either LIBOR plus an applicable margin or a base rate. Base rate is defined as the highest of the following, plus an applicable margin: the administrative agent's prime rate; the higher of the federal funds rate or the overnight bank funding rate set by the Federal Reserve Bank of New York, plus 0.50%; or the one-month LIBOR plus 1.00%. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) This credit agreement requires the Company to comply with certain financial covenants covering the Company's funded debt ratio and asset coverage ratio. The credit agreement also includes customary covenants that, among other things, limit or restrict the ability of the Company and its subsidiaries to incur additional indebtedness and liens, engage in mergers, acquisitions and dispositions, and engage in transactions with affiliates, as well as restrict certain payments, including dividends and share buybacks. At December 31, 2020, the Company was in compliance with all associated covenants and there was no balance outstanding. At December 31, 2019, there was no balance outstanding under the credit agreement in effect for such period. Columbia Sportswear Company's Subsidiary Credit Lines At December 21, 2020 and 2019, there was no balance outstanding under the Company's subsidiary credit lines. The Company's Canadian subsidiary has available an unsecured and uncommitted line of credit, which is payable on demand, guaranteed by the Company, and provides for borrowing up to a maximum of CAD$30.0 million (approximately US$23.5 million) at December 31, 2020. The revolving line accrues interest at the Canadian prime rate for CAD overdraft borrowings or Bankers' Acceptance rate plus 150 basis points for Bankers' Acceptance loans. The Company's European subsidiary has available two separate unsecured and uncommitted lines of credit, and an unsecured, committed line of credit, which are guaranteed by the Company, and provide for borrowing up to a maximum of 25.8 million, 0.6 million, and 4.4 million, respectively combined approximately US$37.9 million), at December 31, 2020. Borrowings under the 25.8 million line accrue interest at a base rate of 185 basis points plus 175 basis points. Borrowings under the 4.4 million and 0.6 million lines each accrue interest at 75 basis points. The Company's Japanese subsidiary has available two separate unsecured and uncommitted overdraft facilities guaranteed by the Company providing for borrowing up to a max of \1.5 billion and US$7.0 illion, respectively combined approximately US$ 21.5 million) at December 31, 2020. Borrowings the 1.5 billion overdraft facility accrue interest at the Tokyo Interbank Offered Rate plus 0.50 basis points and borrowings under the US$ 7.0 million overdraft facility accrue interest at 175 basis points. The Company's Korean subsidiary has available an unsecured and uncommitted overdraft facility guaranteed by the Company providing for borrowing up to a maximum of US$20.0 million at December 31, 2020. Borrowings under the overdraft facility accrue interest at the Korea three month CD rate plus 175 basis points. The Company's Chinese subsidiary has available an unsecured and uncommitted line of credit providing for borrowings up to a maximum of RMB 140.0 million at December 31, 2020. The Company's Chinese subsidiary also has an unsecured and uncommitted overdraft and clean advance facility, guaranteed by the Company that provides for borrowings of advances or overdrafts up to a maximum of US$20.0 million at December 31, 2020. Borrowings under the RMB 140.0 million line of credit accrue interest at the one year loan prime rate less 10 basis points. Borrowings under the US$20.0 million facility accrue interest on advances of RMB at 4.15%, advances of USD based on LIBOR plus 1.75% per annum or overdrafts of RMB based on 110% of the People's Bank of China rate. The combined available borrowings of the two facilities were approximately US$41.5 million at December 31, 2020. NOTE 8-ACCRUED LIABILITIES Accrued liabilities consisted of the following: $ (in thousands) Sales reserves Accrued salaries, bonus, paid time off and other benefits Accrued import duties Taxes other than income taxes payable Product warranties Other December 31, 2020 2019 83, 175 $ 110,758 80,074 93,887 18,522 20,922 15,002 15,496 14,745 14,466 45,760 40,194 257,278 295,723 $ COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) A reconciliation of product warranties is as follows: $ (in thousands) Balance at beginning of year Provision for warranty claims Warranty claims Other Balance at end of year Year Ended December 31, 2020 2019 14,466 $ 13,186 $ 3,033 5,152 (3,128) (3,810) 374 (62) 14,745 14,466 $ 2018 12,339 5,054 (3,942) (265) 13,186 $ NOTE 9-LEASES The components of lease cost consisted of the following: $ (in thousands) Operating lease cost(1) Variable lease cost (1) Short term lease cost (1) Year Ended December 31, 2020 2019 104,906 $ 78,609 58,391 60,085 9,600 9,013 172,897 $ 147,707 $ (1) For the year ended December 31, 2018, prior to the adoption of ASC 842 on January 1, 2019, rent expenses of $143.9 million and $1.6 million was included in SG&A expense and Cost of sales, respectively. For the year ended December 31, 2020, operating lease cost included $ 16.5 million of accelerated amortization for retail locations that permanently closed during 2020 for which the related lease liabilities have not been extinguished as of December 31, 2020 due to ongoing negotiations with the landlords. In addition, for the year ended December 31, 2020, operating lease cost included $7.0 million of right-of-use asset impairment charges related to underperforming retail locations primarily in the U.S. segment for the year ended December 31, 2020. There was no impairment recorded for the year ended December 31, 2019. In the periods presented, lease concessions reducing variable lease expense were not material. The following table presents supplemental cash flow information: Year Ended December 31, (in thousands) 2020 2019 Cash paid for amounts included in the measurement of operating lease liabilities $ 82,083 $ 77,350 Operating lease liabilities arising from obtaining ROU assets (1)(2) 22,416 471,396 Reductions to ROU assets resulting from reductions to operating lease liabilities 6,400 783 (1) The year ended December 31, 2019 reflects the impact from amount initially capitalized in conjunction with the adoption of ASC 842. (2) Includes amounts added to the carrying amount of lease liabilities resulting from lease modifications and reassessments. The following table presents supplemental balance sheet information related to leases: Year Ended December 31, 2020 2019 Weighted average remaining lease term 6.79 years Weighted average discount rate 3.72 % 3.82 % 6.16 years COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) The following table presents the future maturities of liabilities as of December 31, 2020: (in thousands) 2021 92,756 2022 73,936 2023 66,328 2024 58,726 2025 51,134 Thereafter 130,429 Total lease payments 473,309 Less: imputed interest (54,662) Total lease liabilities 418,647 Less: current obligations (65,466) Long-term lease obligations 353,181 As of December 31, 2020, the Company has additional operating lease commitments that have not yet commenced of $ 3.9 million. These leases will commence in 2021 with lease terms of approximately two to 10 years. NOTE 10INCOME TAXES Income Tax Provision Consolidated income from continuing operations before income taxes consisted of the following: Year Ended December 31, (in thousands) 2020 2019 2018 United States operations $ 29,154 $ 247,642 $ 224,430 Foreign operations 110,369 157,787 136,287 Income before income tax $ 139,523 $ 405,429 $ 360,717 The components of the provision for income taxes consisted of the following: Year Ended December 31, 2020 2019 2018 (in thousands) Current: Federal State and local Non-United States $ $ $ 18,435 4,929 26,897 50,261 41,148 7,458 30,930 79,536 59,213 9,959 28,700 97,872 Deferred: Federal State and local Non-United States (14,728) (5,097) 1,074 (7,887) (999) 4,290 (4,596) 74,940 (10,961) (1,910) 768 (12,103) 85,769 (18,751) 31,510 Income tax expense $ $ $ COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) The following is a reconciliation of the statutory federal income tax rate to the effective rate reported in the financial statements: Year Ended December 31, (percent of income before tax) 2020 2019 2018 Provision for federal income taxes at the statutory rate 21.0 % 21.0 % 21.0% State and local income taxes, net of federal benefit 1.5 1.7 2.0 Non-United States income taxed at different rates 2.1 (0.1) (0.1) Foreign tax credits (0.9) (0.1) Adjustment to deferred taxes (1.2) (2.1) Global Intangible Low-Taxed Income 0.1 0.4 Research credits (1.4) (0.5) (0.6) Withholding taxes 0.5 0.3 0.4 Excess tax benefits from stock plans (0.8) (1.6) (1.4) Provision for income taxes related to tax reform 1.4 Other 1.7 (0.1) 0.7 Actual provision for income taxes 22.6 % 18.5 % 23.8 % Deferred Income Tax Balances Significant components of the Company's deferred taxes consisted of the following: December 31, (in thousands) 2020 2019 Deferred tax assets: Accruals and allowances $ 47,667 $ 38,532 Capitalized inventory costs 38,832 34,389 Stock compensation 6,078 5,013 Net operating loss carryforwards 24,253 23,660 Depreciation and amortization 29,358 32,293 Tax credits 844 2,329 Foreign currency 2,418 Other 2,258 Gross deferred tax assets 151,754 138,474 Valuation allowance (23,534) (24,130) Net deferred tax assets 128,220 114,344 Deferred tax liabilities: Depreciation and amortization (16,206) (15,738) Prepaid expenses (2,085) (2,661) Deferred tax liability associated with future repatriations (19,008) (19,847) Foreign currency (3,610) Gross deferred tax liabilities (37,299) (41,856) Total net deferred taxes $ 90,921 72,488 2,304 The Company has foreign net operating loss carryforwards of $ 89.1 million as of December 31, 2020, of which $ 72.7 million have an unlimited carryforward period and $16.5 million expire between 2025 and 2040. The net operating losses result in deferred tax assets of $ 24.3 million and $23.7 million and were subject to a valuation allowance of $21.2 million and $21.9 million at December 31, 2020 and 2019, respectively. At December 31, 2020, the Company has accumulated undistributed earnings generated by the Company's foreign subsidiaries of COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) $320.8 million. As $100.0 million of such earnings have previously been subject to the one-time transition tax on foreign earnings by the Tax Cuts and Jobs Act, any additional taxes due with respect to such earnings would generally be limited to foreign and state taxes and have been recorded as a deferred tax liability. However, the Company intends to indefinitely reinvest the earnings generated after January 1, 2018 and expects future domestic cash generation to be sufficient to meet future domestic cash needs. Unrecognized Tax Benefits The Company conducts business globally, and, as a result, the Company or one or more of its subsidiaries file income tax returns in the United States federal jurisdiction and various state and foreign jurisdictions. The Company is subject to examination by taxing authorities throughout the world, including such major jurisdictions as Canada, China, France, Japan, South Korea, Switzerland, and the United States. The Company has effectively settled Canadian tax examinations of all years through 2012, United States tax examinations of all years through 2013, Japanese tax examinations of all years through 2014, France tax examinations of all years through 2014, Swiss tax examinations of all years through 2014, Italy tax examinations of all years through 2016, and China tax examinations of all years through 2018. The Korean National Tax Service concluded an audit of the Company's 2009 through 2013 corporate income tax returns in 2014, and an audit of the Company's 2014 corporate income tax return in 2016. Due to the nature of the findings in both of these audits, the Company has invoked the Mutual Agreement Procedures outlined in the United States-Korean income tax treaty. The Company does not anticipate that adjustments relative to these findings, or any other ongoing tax audits, will result in material changes to its financial condition, results of operations or cash flows. Other than the findings previously noted, the Company is not currently under examination in any major jurisdiction. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows: December 31, (in thousands) 2020 $ 12,478 $ $ 1,903 Balance at beginning of year Increases related to prior year tax positions Decreases related to prior year tax positions Increases related to current year tax positions Settlements Expiration of statute of limitations Balance at end of year (162) 906 2019 11,064 4,374 (5,423) 4,991 (1,464) (1,064) 12,478 2018 10,512 490 (1,093) 1,818 319 (982) 11,064 (632) 14,493 $ $ $ Due to the potential for resolution of income tax audits currently in progress, and the expiration of various statutes of limitation, it is reasonably possible that the unrecognized tax benefits balance may change within the twelve months following December 31, 2020 by a range of zero to $5.4 million. Open tax years, including those previously mentioned, contain matters that could be subject to differing interpretations of applicable tax laws and regulations as they relate to the amount, timing, or inclusion of revenue and expenses or the sustainability of income tax credits for a given examination cycle. Unrecognized tax benefits of $13.6 million, $11.5 million and $9.1 million would affect the effective tax rate if recognized at December 31, 2020, 2019 and 2018, respectively. The Company recognizes interest expense and penalties related to income tax matters in Income tax expense. The Company recognized a net increase of accrued interest and penalties of $0.8 million in 2020, and a net reversal of accrued interest and penalties of $ 0.5 million in 2019 and a net increase of accrued interest and penalties of $0.4 million in 2018, all of which related to uncertain tax positions. The Company had $ 2.3 million and $ 1.5 million of accrued interest and penalties related to uncertain tax positions at December 31, 2020 and 2019, respectively. NOTE 11-RETIREMENT SAVINGS PLANS 401(k) Profit-Sharing Plan The Company has a 401(k) profit-sharing plan, which covers substantially all United States employees. Participation begins the first day of the quarter following completion of 30 days of service. The Company, with approval of the Board of Directors, may elect to make discretionary matching or non-matching contributions. Costs recognized for Company contributions to the plan were $10.1 million, $9.4 million and $8.9 million for the years ended December 31, 2020, 2019 and 2018, respectively. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) In January 2021, the Company's Board of Directors approved a $ 400.0 million increase in share repurchase authorization. NOTE 14-STOCK-BASED COMPENSATION At its Annual Meeting held on June 3, 2020, the Company's shareholders approved the Company's 2020 Stock Incentive Plan (the 2020 Plan"), and the 2020 Plan became effective on that date following such approval. The 2020 Plan replaced the Company's 1997 Stock Incentive Plan (the "Prior Plan") and no new awards will be granted under the Prior Plan. The terms and conditions of the awards granted under the Prior Plan will remain in effect with respect to awards granted under the Prior Plan. The Company has reserved 3.0 million shares of common stock for issuance under the 2020 Plan, plus up to an aggregate of 1.5 million shares of the Company's common stock that were previously authorized and available for issuance under the Prior Plan. At December 31, 2020, 4,169,642 shares were available for future grants under the 2020 Plan and up to 328,486 additional shares that were previously authorized and available for issuance under the Prior Plan may become available for future grants under the 2020 Plan. The 2020 Plan allows for grants of incentive stock options, non- statutory stock options, restricted stock awards, restricted stock units, and other stock-based or cash-based awards. The Company uses original issuance shares to satisfy share-based payments. Stock Compensation Stock-based compensation expense consisted of the following: Year Ended December 31, (in thousands) 2020 2019 2018 Cost of sales 303 278 250 SG&A expense 17,475 17,554 14,041 Pre-tax stock-based compensation expense 17,778 17,832 14,291 Income tax benefits (4,015) (4,009) (3,218) Total stock-based compensation expense, net of tax $ 13,763 13,823 $ 11,073 The Company realized a tax benefit for the deduction from stock-based award transactions of $ 4.1 million, $9.9 million and $7.9 million for the years ended December 31, 2020, 2019 and 2018, respectively. Stock Options Options to purchase the Company's common stock are granted at exercise prices equal to or greater than the fair market value of the Company's common stock on the date of grant. Options generally vest and become exercisable ratably on an annual basis over a period of four years and expire ten years from the date of the grant. The fair value of stock options is determined using the Black-Scholes model. Key inputs and assumptions used in the model include the exercise price of the award, the expected option term, the expected stock price volatility of the Company's stock over the option's expected term, the risk-free interest rate over the option's expected term, and the Company's expected annual dividend yield. The option's expected term is derived from historical option exercise behavior and the option's terms and conditions, which the Company believes provide a reasonable basis for estimating an expected term. The expected volatility is estimated based on observations of the Company's historical volatility over the most recent term commensurate with the expected term. The risk-free interest rate is based on the United States Treasury yield approximating the expected term. The dividend yield is based on the expected cash dividend payouts. The weighted average assumptions for stock options granted and resulting fair value is as follows: Year Ended December 31, 2020 2019 2018 Expected option term 4.39 years 4.50 years Expected stock price volatility 21.19% 27.14% 28.39% Risk-free interest rate 1.14% 2.49% 2.47% Expected annual dividend yield 1.13% 1.03% 1.15% Weighted average grant date fair value per share $14.67 $22.51 $18.86 4.50 years COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) The following table summarizes stock option activity under the Plan: Weighted Average Weighted Average Aggregate Intrinsic Number of Value 10 Exercise Remaining Contractual Shares Price Life (in thousands) Options outstanding at January 1, 2018 1,769,887 44.22 6.69 48,962 Granted 402,010 76.48 Cancelled (67,440) 60.75 Exercised (499,836) 36.98 Options outstanding at December 31, 2018 1,604,621 53.86 6.95 48,703 Granted 395,653 93.98 Cancelled (68,275) 74.10 Exercised (452,325) 43.76 Options outstanding at December 31, 2019 1,479,674 66.74 7.11 49,930 Granted 660,071 87.25 Cancelled (78,163) 83.76 Exercised (142,419) 48.58 Options outstanding at December 31, 2020 1,919,163 74.45 7.19 $ 29,489 Options vested and expected to vest at December 31, 2020 1,839,590 73.88 7.12 $ 29,185 Options exercisable at December 31, 2020 806,320 60.31 5.53 $ 22,620 (1)The aggregate intrinsic value above represents pre-tax intrinsic value that would have been realized if all options had been exercised on the last business day of the period indicated, based on the Company's closing stock price on that day. Stock option compensation expense for the years ended December 31, 2020, 2019 and 2018 was $ 7.0 million, $6.2 million and $4.9 million, respectively. At December 31, 2020, unrecognized costs related to outstanding stock options totaled $11.5 million, before any related tax benefit. The unrecognized costs related to stock options are being amortized over the related vesting period using the straight-line attribution method. These unrecognized costs related to stock options are being amortized over a weighted average period of 2.33 years. The aggregate intrinsic value of stock options exercised was $4.9 million, $26.8 million and $22.4 million for the years ended December 31, 2020, 2019 and 2018, respectively. The total cash received as a result of stock option exercises for the years ended December 31, 2020, 2019 and 2018 was $6.9 million, $19.8 million and $ 18.5 million, respectively. Restricted Stock Units Service-based restricted stock units are granted at no cost to key employees and generally vest over a period of four years. Performance-based restricted stock units are granted at no cost to certain members of the Company's senior executive team, excluding the Chief Executive Officer. Performance-based restricted stock units granted after 2009 generally vest over a performance period of between two and three years. Restricted stock units vest in accordance with the terms and conditions established by the Compensation Committee the Board of Directors, and are based on continued service and, in some instances, on individual performance or Company performance or both. The fair value of service-based and performance-based restricted stock units is determined using the Black-Scholes model. Key inputs and assumptions used in the model include the vesting period, the Company's expected annual dividend yield and the closing price of the Company's common stock on the date of grant The weighted average assumptions for restricted stock units granted and resulting fair value are as follows: Year Ended December 31, 2020 2019 2018 Vesting period 3.79 years 3.76 years 3.77 years Expected annual dividend yield 1.18% 0.97% 1.15% Weighted average grant date fair value per restricted stock unit granted $78.90 $94.58 $73.74 COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) The following table summarizes the restricted stock unit activity under the Plan: Weighted Average Number of Grant Date Fair Value Shares Per Share Restricted stock units outstanding at January 1, 2018 449,475 $ 52.07 Granted 197,299 73.74 Vested(1) (155,847) 50.97 Forfeited (66,926) 53.19 Restricted stock units outstanding at December 31, 2018 424,001 62.38 Granted 177,618 94.58 Vested(1) (163,195) 60.45 Forfeited (33,320) 72.35 Restricted stock units outstanding at December 31, 2019 405,104 76.45 Granted 216,318 78.90 Vested(1) (160,229) 68.72 Forfeited (35,918) 79.36 Restricted stock units outstanding at December 31, 2020 425,275 $ 80.37 (1) The number of vested units includes shares withheld by the Company to pay up to maximum statutory requirements to taxing authorities on behalf of the employee. For the years ended December 31, 2020, 2019 and 2018, the Company withheld 54,543, 56,843 and 55,907 shares, respectively, to satisfy $4.5 million, $5.8 million and $4.3 million of employees' tax obligations, respectively. Restricted stock unit compensation expense for the years ended December 31, 2020, 2019 and 2018 was 10.8 million, $11.6 million and $9.4 million, respectively. At December 31, 2020, unrecognized costs related to restricted stock units totaled $ 18.6 million, before any related tax benefit. The unrecognized costs related to restricted stock units are being amortized over the related vesting period using the straight-line attribution method. These unrecognized costs at December 31, 2020 are expected to be recognized over a weighted average period of 2.08 years. The total grant date fair value of restricted stock units vested during the years ended December 31, 2020, 2019 and 2018 was $11.0 million, $9.9 million and $7.9 million, respectively. NOTE 15 EARNINGS PER SHARE Earnings per share ("EPS") is presented on both a basic and diluted basis. Basic EPS is based on the weighted average number of common shares outstanding. Diluted EPS reflects the potential dilution that could occur if outstanding securities or other contracts to issue common stock were exercised or converted into common stock. A reconciliation of the common shares used in the denominator for computing basic and diluted EPS is as follows: Year Ended December 31, (in thousands, except per share amounts) 2020 2019 2018 Weighted average common shares outstanding, used in computing basic earnings per share 66,376 67,837 69,614 Effect of dilutive stock options and restricted stock units 396 656 787 Weighted average common shares outstanding, used in computing diluted earnings per share 66,772 68,493 70,401 Earnings per share of common stock attributable to Columbia Sportswear Company: Basic $ 1.63 $ 4.87 $ 3.85 Diluted 1.62 $ 4.83 $ 3.81 Stock options and service-based restricted stock units, and performance-based restricted stock representing 1,122,935, 405,928 and 372,516 shares of common stock for the years ended December 31, 2020, 2019 and 2018, respectively, were outstanding but were excluded from the computation of diluted EPS because their effect would be anti-dilutive under the treasury stock method or because the shares were subject to performance conditions that had not been met. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) NOTE 16ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) Accumulated other comprehensive income (loss) on the Consolidated Balance Sheets is net of applicable taxes, and consists of unrealized holding gains and losses on available-for-sale securities, unrealized gains and losses on certain derivative transactions and foreign currency translation adjustments. The following table sets forth the changes in Accumulated other comprehensive income (loss) attributable to the Company: Unrealized gains Unrealized holding (losses) gains (losses) on Foreign currency on available for derivative translation (in thousands) sale securities transactions adjustments Total Balance at January 1, 2018 $ (4) (10,716) $ 1,833 $ (8,887) Other comprehensive income (loss) before reclassifications (56) 23,065 (17,800) 5,209 Amounts reclassified from accumulated other comprehensive loss (1) 130 130 Net other comprehensive income (loss) during the year (56) 23,195 (17,800) 5,339 Adoption of ASU 2017-12 (515) (515) Balance at December 31, 2018 (60) 11,964 (15,967) (4,063) Other comprehensive income before reclassifications 56 6,669 2,064 8,789 Amounts reclassified from accumulated other comprehensive loss (1) (9,052) (9,052) Net other comprehensive income (loss) during the year 56 (2,383) 2,064 (263) Purchase of non-controlling interest (99) (99) Balance at December 31, 2019 (4) 9,482 (13,903) (4,425) Other comprehensive income (loss) before reclassifications 4 (7,218) 24,078 16,864 Amounts reclassified from accumulated other comprehensive income (1) (11,633) (11,633) Net other comprehensive income (loss) during the year 4 (18,851) 24,078 5,231 Balance at December 31, 2020 $ (9,369) $ 10,175 $ 806 (1) Amounts reclassified are recorded in Net sales, Cost of sales, or Other operating income (expense), net on the Consolidated Statements of Operations. Refer to Note 18 for further information regarding reclassifications. NOTE 17SEGMENT INFORMATION The Company has four reportable geographic segments: U.S., LAAP, EMEA, and Canada, which are reflective of the Company's internal organization, management and oversight structure. Each geographic segment operates predominantly in one industry: the design, development, marketing, and distribution of outdoor, active and everyday lifestyle apparel, footwear, accessories, and equipment products. Intersegment net sales and intersegment profits, which are recorded at a negotiated mark-up and eliminated in consolidation, are not material. Unallocated corporate expenses consist of expenses incurred by centrally- managed departments, including global information services, finance, human resources and legal, as well as executive compensation, unallocated benefit program expense, trademark impairment charges, and other miscellaneous costs. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) The following table presents financial information for the Company's reportable segments: Year Ended December 31, 2019 (in thousands) 2020 2018 Net sales to unrelated entities: U.S. LAAP EMEA Canada 1,603,783 $ 424,489 298,907 174,375 2,501,554 $ 1,943,007 $ 529,282 367,072 203.117 3,042,478 1,728,476 530,152 350,754 192,944 2,802,326 $ Segment income from operations: U.S. LAAP EMEA Canada Total segment income from operations Unallocated corporate expenses Interest income, net Other non-operating income (expense), net Income before income tax 250,485 $ 35,875 31.235 37,620 355,215 (218,166) 435 2,039 139,523 456,656 $ 80,138 45,419 39,576 621,789 (226,818) 8,302 2,156 405,429 $ 410,750 80,967 33,314 31,304 556,335 (205,353) 9,876 (141) 360,717 Depreciation and amortization expense: U.S. LAAP EMEA Canada Unallocated corporate expense 25,852 $ 5,756 3,739 2,825 25,244 63,416 23,388 $ 5,956 4,036 3,009 23,367 59,756 21,938 5,721 4,260 3,076 23,235 58,230 $ Accounts receivable, net: U.S. LAAP EMEA Canada 244,236 $ 83,671 66.780 58,258 452,945 $ 248,211 101,995 82,500 55,527 488,233 $ Inventories, net: U.S. LAAP EMEA Canada 362,061 $ 94,448 60,124 39,897 556,530 398,192 105,978 58,731 43,067 605,968 $ Property, plant and equipment, net: U.S. Canada All other countries 245,690 $ 25,992 38.110 309,792 280,178 27,800 38,673 346,651 $ COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) The following table presents the balance sheet classification and fair value of derivative instruments: December 31, 2020 2019 $ $ 947 1,126 11,855 4,159 (in thousands) Balance Sheet Classification Derivative instruments designated as cash flow hedges: Derivative instruments in asset positions: Currency forward contracts Prepaid expenses and other current assets Currency forward contracts Other non-current assets Derivative instruments in liability positions: Currency forward contracts Accrued liabilities Currency forward contracts Other long-term liabilities Derivative instruments not designated as cash flow hedges: Derivative instruments in asset positions: Currency forward contracts Prepaid expenses and other current assets Derivative instruments in liability positions: Currency forward contracts Accrued liabilities The following table presents the statement of operations effect and classification of derivative instruments: 7,573 6,590 1,313 768 1,650 2,146 2,268 953 Year Ended December 31, Statement Of Operations Classification 2020 2019 2018 $ (7,218) $ 6,669 $ 23,503 Net sales 191 338 62 (in thousands) Currency Forward Contracts: Derivative instruments designated as cash flow hedges: Gain (loss) recognized in other comprehensive income (loss), net of tax Gain reclassified from accumulated other comprehensive income (loss) to income for the effective portion Gain (loss) reclassified from accumulated other comprehensive income (loss) to income for the effective portion Gain reclassified from accumulated other comprehensive income (loss) to income as a result of cash flow hedge discontinuance Gain (loss) recognized in income for amount excluded from effectiveness testing and for the ineffective portion Gain recognized in income for amount excluded from effectiveness testing and for the ineffective portion Derivative instruments not designated as cash flow hedges: 14,495 9,558 (7,604) Cost of sales Other non-operating income (expense), net 817 Net sales (43) 19 Cost of sales 2,380 7,009 Gain (loss) recognized in income Other non-operating income (expense), net (2,865) 411 3,334 COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) NOTE 19-FAIR VALUE MEASURES Certain assets and liabilities are reported at fair value on either a recurring or nonrecurring basis. Fair value is defined as an exit price, representing the amount that the Company would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants, under a three-tier fair value hierarchy that prioritizes the inputs used in measuring fair value as follows: Level 1 observable inputs such as quoted prices for identical assets or liabilities in active liquid markets; Level 2 inputs, other than the quoted market prices in active markets, that are observable, either directly or indirectly; or observable market prices in markets with insufficient volume or infrequent transactions; and Level 3 unobservable inputs for which there is little or no market data available, that require the reporting entity to develop its own assumptions. The Company's assets and liabilities measured at fair value are categorized as Level 1 or Level 2 instruments. Level 1 instrument valuations are obtained from real-time quotes for transactions in active exchange markets involving identical assets. Level 2 instrument valuations are obtained from inputs, other than quoted market prices in active markets, that are directly or indirectly observable in the marketplace and quoted prices in markets with limited volume or infrequent transactions. Assets and liabilities measured at fair value on a recurring basis as of December 31, 2020 are as follows: (in thousands) Level 1 Level 2 Level 3 Total Assets: Cash equivalents: Money market funds $ 119,378 $ $ 119,378 United States government treasury bills 234,982 234,982 Short-term investments: Money market funds 105 Mutual fund shares 1,119 1,119 Other current assets: Derivative financial instruments 2,597 2,597 Non-current assets: Money market funds 4,059 4,059 Mutual fund shares 14,657 14,657 Derivative financial instruments 1,126 1,126 Total assets measured at fair value $ 139,318 238,705 $ 378,023 Liabilities: Accrued liabilities: Derivative financial instruments $ $ 9,841 $ $ 9,841 Other long-term liabilities Derivative financial instruments 6,590 6,590 Total liabilities measured at fair value $ $ 16,431 $ 16,431 IL | 105 11 SUPPLEMENTARY DATA-QUARTERLY FINANCIAL DATA (Unaudited) The following table summarizes the Company's quarterly financial data for the past two years ended December 31: 2020 First Second (in thousands, except per share amounts) Quarter Quarter Net sales $ 568,228 $ 316,611 $ Gross profit 271,714 146,230 Net income (loss) (50,707) Earnings (loss) per share: Basic $ 0.00 $ (0.77) $ Diluted 0.00 (0.77) Third Quarter 701,092 $ 342,908 62,751 Fourth Quarter 915,623 463,037 95,756 213 $ 0.95 0.94 1.45 1.44 $ First Quarter 654,608 336,729 74,177 $ (in thousands, except per share amounts) Net sales Gross profit Net income Earnings per share: Basic Diluted 2019 Second Quarter 526,210 $ 253,591 23,029 Third Quarter 906,793 446,695 119,258 $ Fourth Quarter 954,867 478,655 114,025 $ $ $ $ 1.09 1.07 0.34 0.34 1.76 1.75 1.69 1.67 Schedule II Valuation and Qualifying Accounts Balance at Charged to Beginning Costs and of Period Expenses Balance at End of Period Deductions(a) Otherb) $ 8,925 $ 19,156 $ (7,991) $ 1,720 $ 21,810 (in thousands) Year Ended December 31, 2020: Allowance for doubtful accounts Year Ended December 31, 2019: Allowance for doubtful accounts Year Ended December 31, 2018: Allowance for doubtful accounts $ 11,051 $ (108) $ (1,235) $ (783) $ 8,925 $ 9,043 $ 3,908 $ (1,392) $ (508) $ 11,051 (a) Charges to the accounts included in this column are for the purposes for which the reserves were created. (b) Amounts included in this column primarily relate to foreign currency translation