Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would normally know how to solve it . However, the fact that the interest is carried forward makes it hard. The teacher gave us

I would normally know how to solve it However, the fact that the interest is carried forward makes it hard.

The teacher gave us this as help:

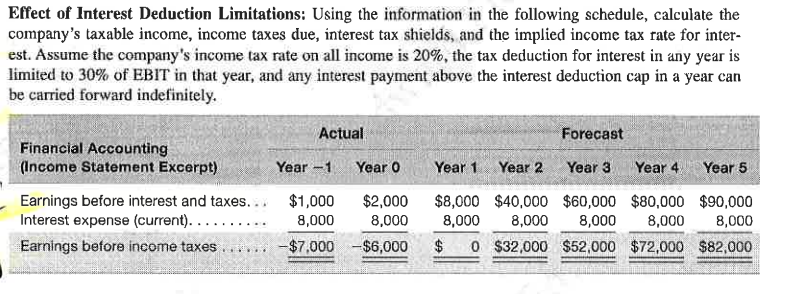

P Measuring the Effect of Interest Deduction Limitations. EBIT and Interest Cap

Actual Actual Forecast Forecast Forecast Forecast Forecast

Financial Accounting Income Statement Excerpt Year Year Year Year Year Year Year

Earnings Before Interest and Taxes $ $ $ $ $ $

Interest Expense Current Earnings Before Income Taxes $ $ $ $ $ $ $ Interest Deduction Cap $ $ $ $ $ $ Calculation of the Companys Taxable Income

Actual Actual Forecast Forecast Forecast Forecast Forecast

Levered Company Taxable Income Year Year Year Year Year Year Year

Earnings Before Interest and Taxes $ $ $ $ $ $ $

PreValuation Interest Carryforward

PostValation Interest Carryforward

Interest Expense Current

Taxable Income

Income Taxes

Earnings $ $ $ $ $ $ $

Average Tax Rate

PreValuation Interest Carryforward Balance Year Year Year Year Year Year Year

Beginning Interest Carryforward $ $ $ $ $ $ $

Change in Interest Carryforward

Ending Interest Carryforward $ $ $ $ $ $ $

PostValuation Interest Carryforward Balance Year Year Year Year Year Year Year

Beginning Interest Carryforward $ $ $ $ $

Change in Interest Carryforward

Ending Interest Carryforward $ $ $ $ $

Calculation of the Companys Unlevered Taxable Income, Interest Tax Shield, and Implied Tax Rate for Interest Actual Actual Forecast Forecast Forecast Forecast Forecast

Unlevered Company Taxable Income Year Year Year Year Year Year Year

Earnings Before Interest and Taxes

PreValuation Interest Carryforward

Interest Expense Current Taxable

Income Taxes

Earnings

Average Tax Rate

PreValuation Interest Carryforward Balance

Year Year Year Year Year Year Year

Beginning Interest Carryforward

Change in Interest Carryforward

Ending Interest Carryforward

Interest Tax Shield:

Income Taxes Unlevered Firm

Income Taxes with Interest Deduction

Interest Tax Shield

Implied Income Tax Rate for Interest Tax Shields

Year Year Year Year Year Interest Tax Shield

Interest Expense Current

Implied Income Tax Rate for Interest Tax Shields

Comparison Interest Tax Shield Using Marginal Tax Rate x Interest

Year Year Year Year Year

Interest Expense Current

Marginal Income Tax Rate

Interest Tax Shield Using Marginal Tax Rate x Interest

Correct Interest Tax Shield

Overstated Understated Interest Tax Shield $ $ $ $ $

Problem

Dollars in millions Growth WACC Year Year Year Firm Value Growth Rate

Comparable Company $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started