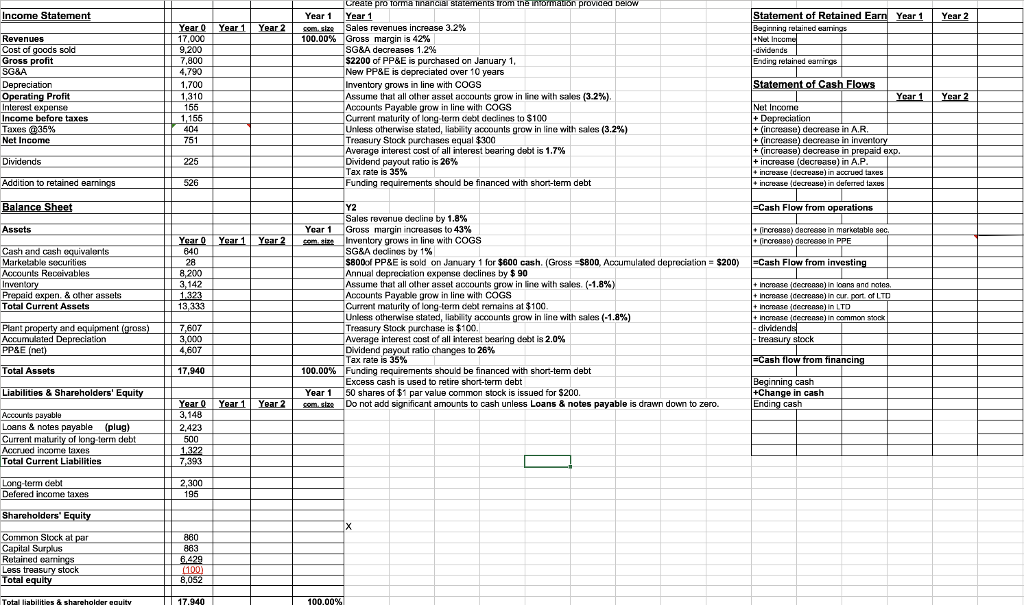

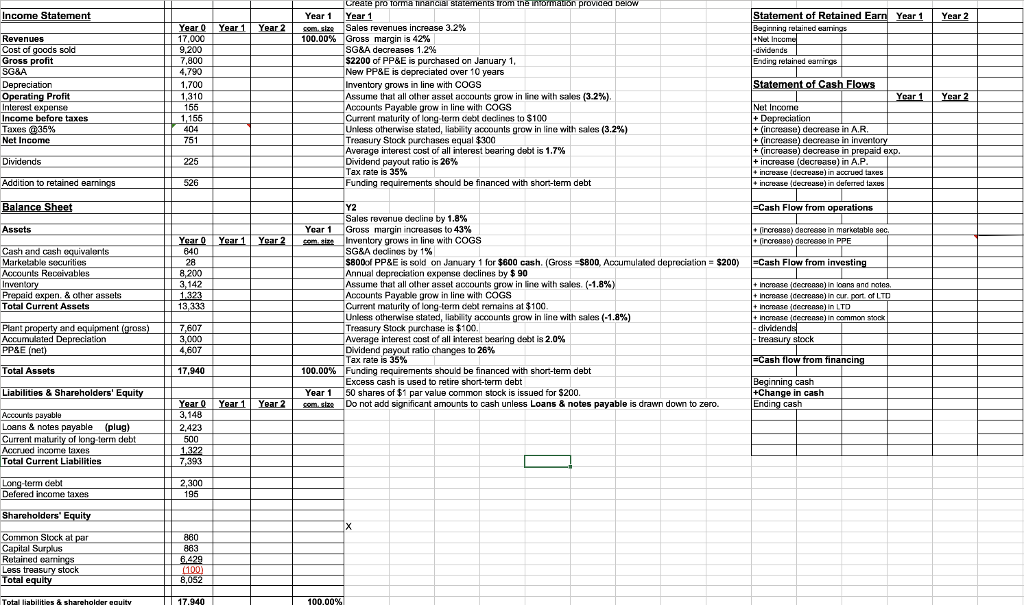

I Year 1 ncome Statement Yea Statement of Retained Ea Yea Year Year Year Gouinning retainedeseurings Sales revenues increase 3.2% Revenues 00.00% Gross margin is 42% Cost ofgoods sold I S.200 SG&A decreases 1.2% Gross profit 7800 Ending relained earnings S2200 of PP&E is purchased on January 1 SG&A 4.190 New PP&E is depreciated over 10 years 1700 Statement of Cash Flows Depreciation Inventory grows in line with COGS Operating Profit 1310 Assume that all other asset accounts grow in line with sales 13.2% Interest expense 155 Net Income Accounts Payable grow in line with COGS Income before taxes 11155 Depreciation Current maturity of long-term debt declines to $100 Taxes @35% 404 Cincrease decrease in AR. 3.2% otherwise stated liability accounts grow in line with sales Net Income 751 Cincrease decrease in inventory Treasury Stock purchases equal$300 increase decrease in prepaid exp. Average interest cost of all interest bearing debt is 1.7% Dividends 225 tincrease (decrease) in AP Dividend payout ratio is 26% Tax rate is 35% ed ta Addition to retained earnings 526 binuruause decrease in deferred laxes Funding requirements should be financed with short-tem debt Balance Sheet 2 ECash Flow from operations Sales revenue decline by 1.8% Assets Year 1 Hincre888 decrease n marketable 8ec. Gross margin increases to 43% ne with COGS inventory grows in decrease in PPE Cash and cash equivalents 640 SG&A declines by 1% Marketable securities 28 Cash Flow from investing or $600 cash $200 S800of PP& E is sold on January Gross S800, Accumulated depreciation Accounts Receivables 8200 Annual depreciation expense declines by 90 Inventory 3142 Increase decre88e)In Oana and notea ounts grow in line with sales. (-1.8% ssume that all other asset acc Prepaid expen. other assets 1323 Increase decreRae)in port otITD e with COGS Accounts Payable grow in Total Current Assets I EK33 Current maturity of long-term debt remains at $100. accounts grow in line with sales (-1.8% Unless otherwise stated, liability Plant property and equipment gross1 7507 Treasury Stock purchase is $100. Accurmulated Depreciationd 3,000 Average interest cost of all interest bearing debt is 2.0% stock treasu Dividend payout ratio changes to 26%. Cash flow from financing Tax rate is 35% Total Assets 00.00% Funding requirements should be financed with short-tem debt Excess cash is used to retire short-term debt Liabilities & Shareholders Equity +Change in cash I Year 50 shares of $1 par value common stock is issued for S200 Year Year Year!2 Ending cash Do not add significant amounts to cash unless Loans & notes payable is drawn d own to zero. Acceunis payable 3.148 2.423 Loans & notes payable (plug) Current maturity oflong-term debt 500 Accrued income taxes 1322 Total Current Liabilities 7393 Shareholders' Equi Year 2 I Year 1 ncome Statement Yea Statement of Retained Ea Yea Year Year Year Gouinning retainedeseurings Sales revenues increase 3.2% Revenues 00.00% Gross margin is 42% Cost ofgoods sold I S.200 SG&A decreases 1.2% Gross profit 7800 Ending relained earnings S2200 of PP&E is purchased on January 1 SG&A 4.190 New PP&E is depreciated over 10 years 1700 Statement of Cash Flows Depreciation Inventory grows in line with COGS Operating Profit 1310 Assume that all other asset accounts grow in line with sales 13.2% Interest expense 155 Net Income Accounts Payable grow in line with COGS Income before taxes 11155 Depreciation Current maturity of long-term debt declines to $100 Taxes @35% 404 Cincrease decrease in AR. 3.2% otherwise stated liability accounts grow in line with sales Net Income 751 Cincrease decrease in inventory Treasury Stock purchases equal$300 increase decrease in prepaid exp. Average interest cost of all interest bearing debt is 1.7% Dividends 225 tincrease (decrease) in AP Dividend payout ratio is 26% Tax rate is 35% ed ta Addition to retained earnings 526 binuruause decrease in deferred laxes Funding requirements should be financed with short-tem debt Balance Sheet 2 ECash Flow from operations Sales revenue decline by 1.8% Assets Year 1 Hincre888 decrease n marketable 8ec. Gross margin increases to 43% ne with COGS inventory grows in decrease in PPE Cash and cash equivalents 640 SG&A declines by 1% Marketable securities 28 Cash Flow from investing or $600 cash $200 S800of PP& E is sold on January Gross S800, Accumulated depreciation Accounts Receivables 8200 Annual depreciation expense declines by 90 Inventory 3142 Increase decre88e)In Oana and notea ounts grow in line with sales. (-1.8% ssume that all other asset acc Prepaid expen. other assets 1323 Increase decreRae)in port otITD e with COGS Accounts Payable grow in Total Current Assets I EK33 Current maturity of long-term debt remains at $100. accounts grow in line with sales (-1.8% Unless otherwise stated, liability Plant property and equipment gross1 7507 Treasury Stock purchase is $100. Accurmulated Depreciationd 3,000 Average interest cost of all interest bearing debt is 2.0% stock treasu Dividend payout ratio changes to 26%. Cash flow from financing Tax rate is 35% Total Assets 00.00% Funding requirements should be financed with short-tem debt Excess cash is used to retire short-term debt Liabilities & Shareholders Equity +Change in cash I Year 50 shares of $1 par value common stock is issued for S200 Year Year Year!2 Ending cash Do not add significant amounts to cash unless Loans & notes payable is drawn d own to zero. Acceunis payable 3.148 2.423 Loans & notes payable (plug) Current maturity oflong-term debt 500 Accrued income taxes 1322 Total Current Liabilities 7393 Shareholders' Equi Year 2