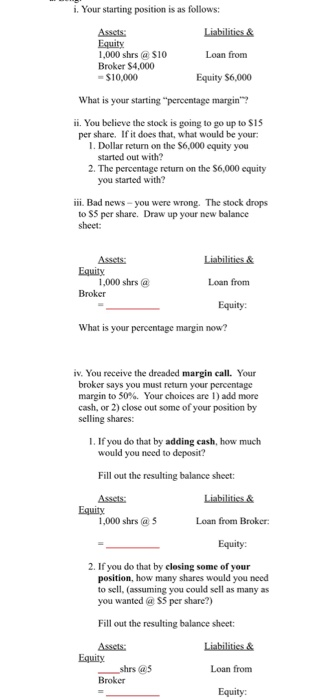

i. Your starting position is as follows: Liabilities & Assets Equity 1,000 shrs @ $10 Broker $4.000 -$10,000 Loan from Equity $6,000 What is your starting "percentage margin? ii. You believe the stock is going to go up to $15 per share. If it does that, what would be your 1. Dollar return on the $6,000 equity you started out with? 2. The percentage return on the S6,000 equity you started with? iii. Bad news - you were wrong. The stock drops to $5 per share. Draw up your new balance sheet: Liabilities & Assets Equity 1,000 shrs @ Broker Loan from Equity What is your percentage margin now? iv. You receive the dreaded margin call. Your broker says you must retum your percentage margin to 50%. Your choices are 1) add more cash, or 2) close out some of your position by selling shares: 1. If you do that by adding cash, how much would you need to deposit? Fill out the resulting balance sheet: Liabilities & Assets Equity 1,000 shrs @ 5 Loan from Broker: Equity 2. If you do that by closing some of your position, how many shares would you need to sell. (assuming you could sell as many as you wanted @ ss per share?) Fill out the resulting balance sheet: Liabilities & Assets Equity shrs @s Broker Loan from Equity: i. Your starting position is as follows: Liabilities & Assets Equity 1,000 shrs @ $10 Broker $4.000 -$10,000 Loan from Equity $6,000 What is your starting "percentage margin? ii. You believe the stock is going to go up to $15 per share. If it does that, what would be your 1. Dollar return on the $6,000 equity you started out with? 2. The percentage return on the S6,000 equity you started with? iii. Bad news - you were wrong. The stock drops to $5 per share. Draw up your new balance sheet: Liabilities & Assets Equity 1,000 shrs @ Broker Loan from Equity What is your percentage margin now? iv. You receive the dreaded margin call. Your broker says you must retum your percentage margin to 50%. Your choices are 1) add more cash, or 2) close out some of your position by selling shares: 1. If you do that by adding cash, how much would you need to deposit? Fill out the resulting balance sheet: Liabilities & Assets Equity 1,000 shrs @ 5 Loan from Broker: Equity 2. If you do that by closing some of your position, how many shares would you need to sell. (assuming you could sell as many as you wanted @ ss per share?) Fill out the resulting balance sheet: Liabilities & Assets Equity shrs @s Broker Loan from Equity