Answered step by step

Verified Expert Solution

Question

1 Approved Answer

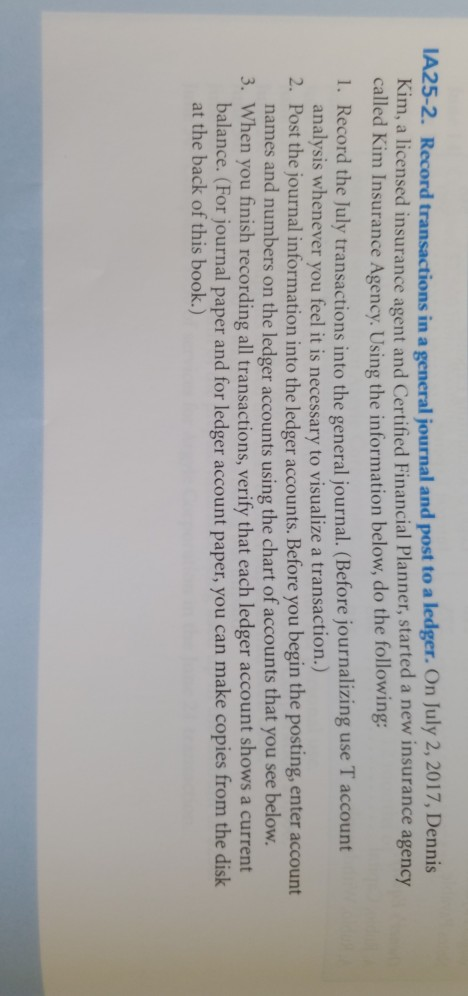

IA25-2. Record transactions in a general journal and post to a ledger. On July 2, 2017, Dennis Kim, a licensed insurance agent and Certified Financial

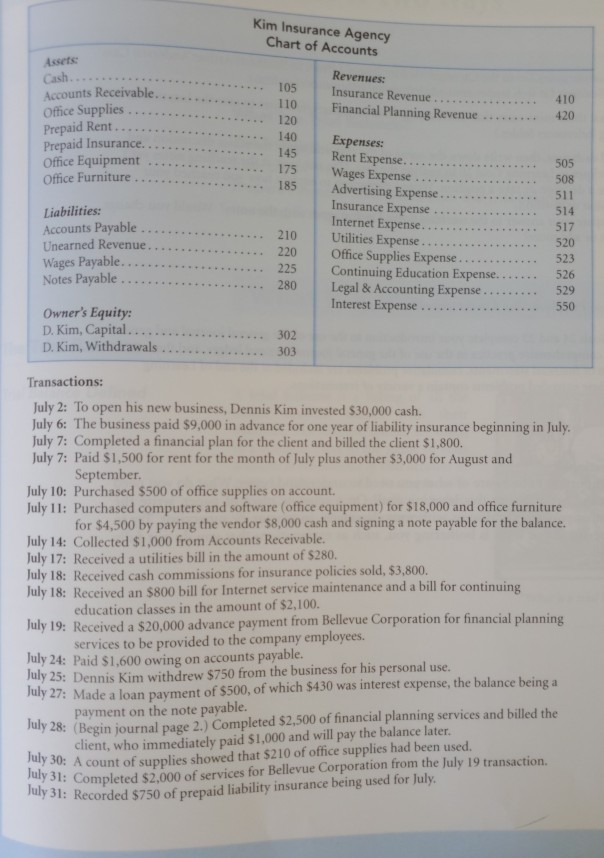

IA25-2. Record transactions in a general journal and post to a ledger. On July 2, 2017, Dennis Kim, a licensed insurance agent and Certified Financial Planner, started a new insurance agency called Kim Insurance Agency. Using the information below, do the following: 1. Record the July transactions into the general journal. (Before journalizing analysis whenever you feel it is necessary to visualize a transaction.) 2. Post the journal information into the ledger accounts. Before you begin the posting, enter account names and numbers on the ledger accounts using the chart of accounts that you see below 3. When you finish recording all transactions, verify that each ledger account shows a current balance. (For journal paper and for ledger account paper, you can make copies from the disk at the back of this book.) use T account Kim Insurance Agency Chart of Accounts Assets Cash Accounts Receivable. Office Supplies Prepaid Rent Prepaid Insurance. Office Equipment Office Furniture. Revenues: 105 Insurance Revenue 410 110 Financial Planning Revenue 420 120 140 145 Expenses: Rent Expense... Wages Expense Advertising Expense. Insurance Expense Internet Expense. Utilities Expense Office Supplies Expense. Continuing Education Expense. Legal & Accounting Expense Interest Expense. 505 175 508 185 511 Liabilities Accounts Payable Unearned Revenue Wages Payable.. Notes Payable 514 517 210 520 220 523 225 526 280 529 550 Owner's Equity: D. Kim, Capital.. D. Kim, Withdrawals 302 303 Transactions: July 2: To open his new business, Dennis Kim invested $30,000 cash. July 6: The business paid $9,000 in advance for one year of liability insurance beginning in July July 7: Completed a financial plan for the client and billed the client $1,800. July 7: Paid $1,500 for rent for the month of July plus another $3,000 for August and September. July 10: Purchased $500 of office supplies on account. July 11: Purchased computers and software (office equipment) for $18,000 and office furniture for $4,500 by paying the vendor $8,000 cash and signing a note payable for the balance. July 14: Collected $1,000 from Accounts Receivable. July 17: Received a utilities bill in the amount of $280. July 18: Received cash commissions for insurance policies sold, $3,800. July 18: Received an $800 bill for Internet service maintenance and a bill for continuing education classes in the amount of $2,100. July 19: Received a $20,000 advance payment from Bellevue Corporation for financial planning services to be provided to the company employees. July 24: Paid $1,600 owing July 25: Dennis Kim withdrew $750 from the business for his personal July 27: Made a loan payment of $500, of which $430 was interest expense, the balance being on accounts payable. use. a July 28: (Begin journal page 2.) Completed $2,500 of financial planning services and billed the client, who immediately paid $1,000 and will pay the balance later. July 30: A count of supplies showed that $210 of office supplies had been used. July 31: Completed $2,000 of services for Bellevue Corporation from the July 19 transaction. July 31: Recorded $750 of prepaid liability insurance being used for July. on the note payable. payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started