iabove is the excel sheet that is to be updated from the question above. Could you show workings in the excel . Thank you

iabove is the excel sheet that is to be updated from the question above. Could you show workings in the excel . Thank you

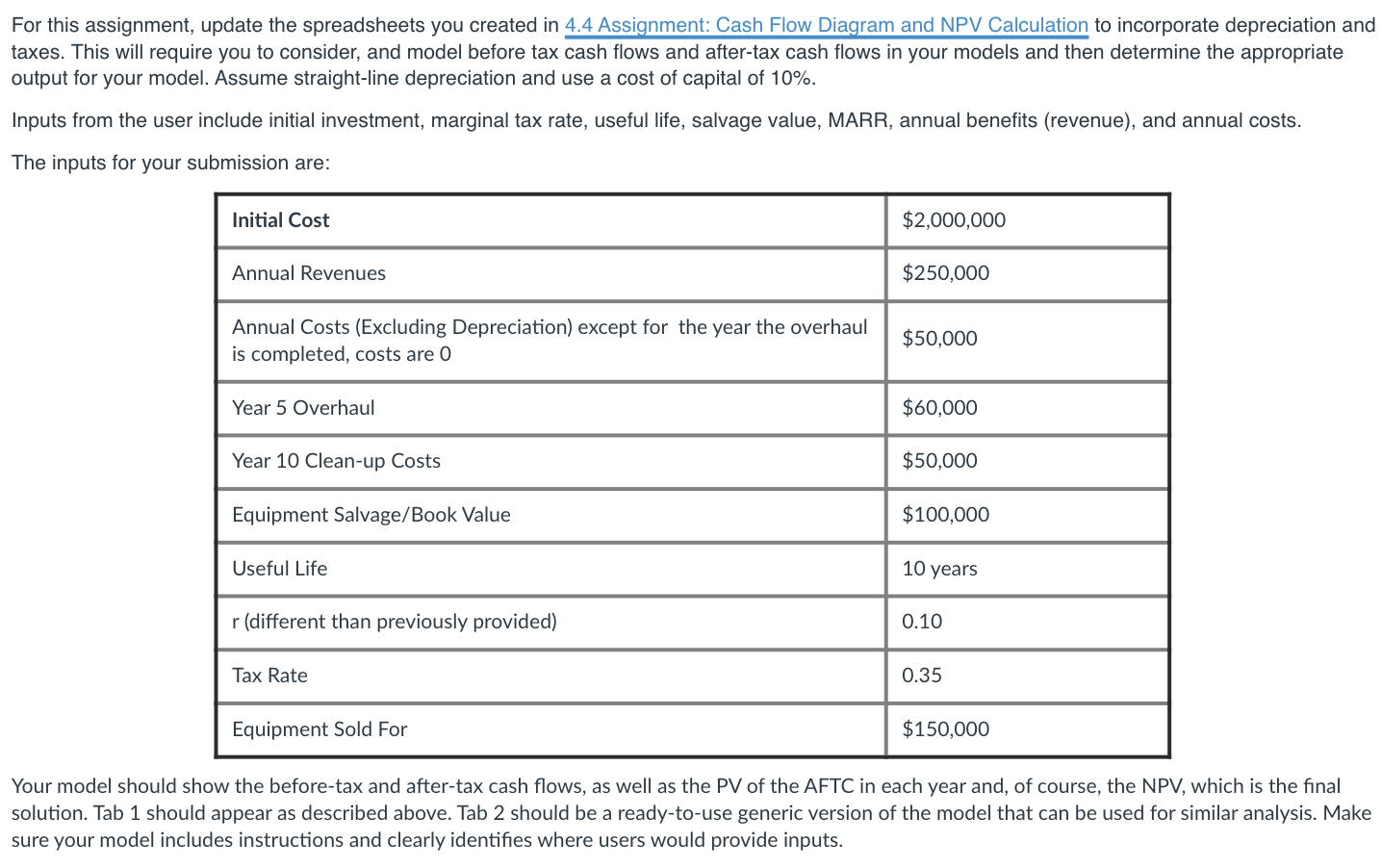

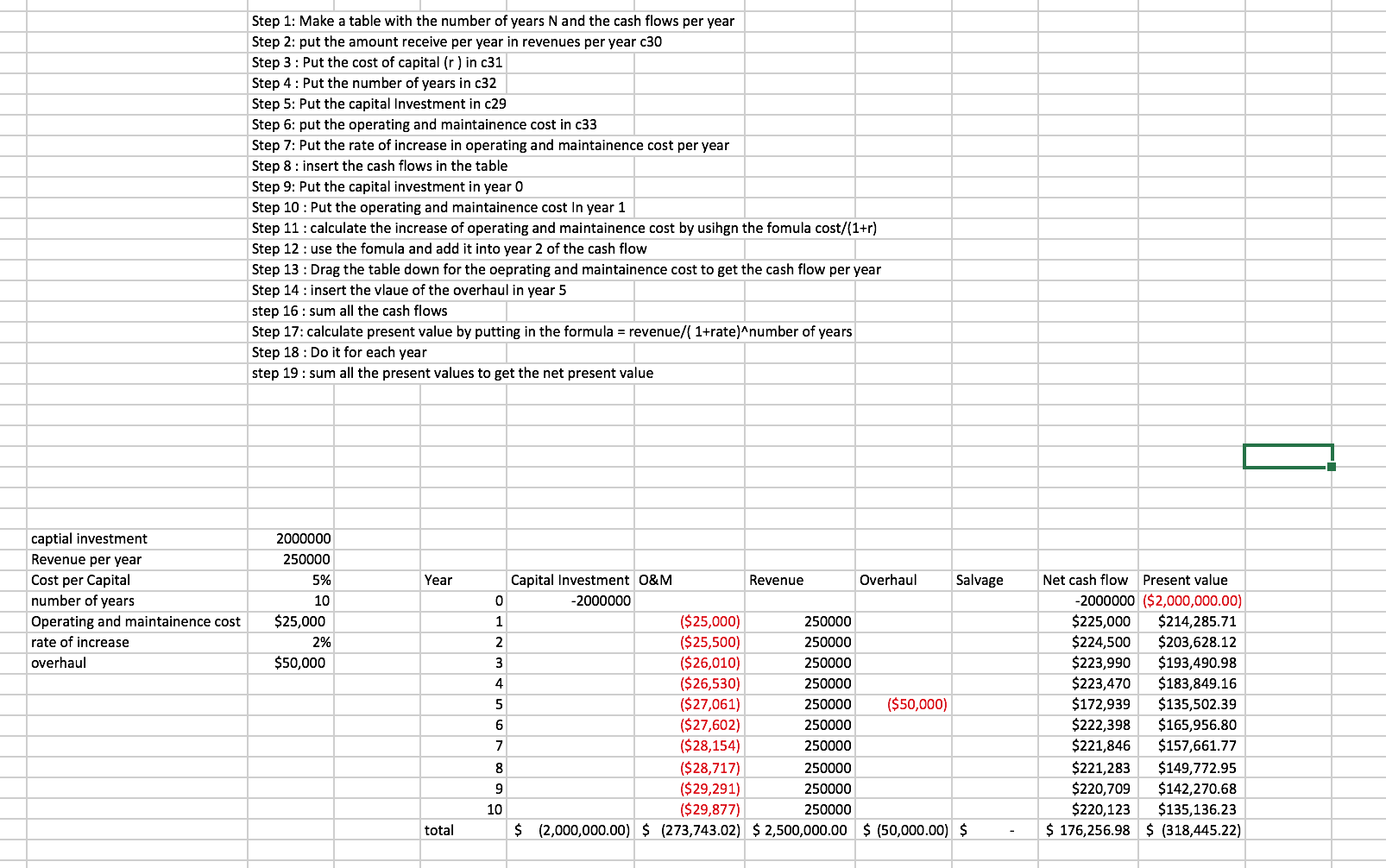

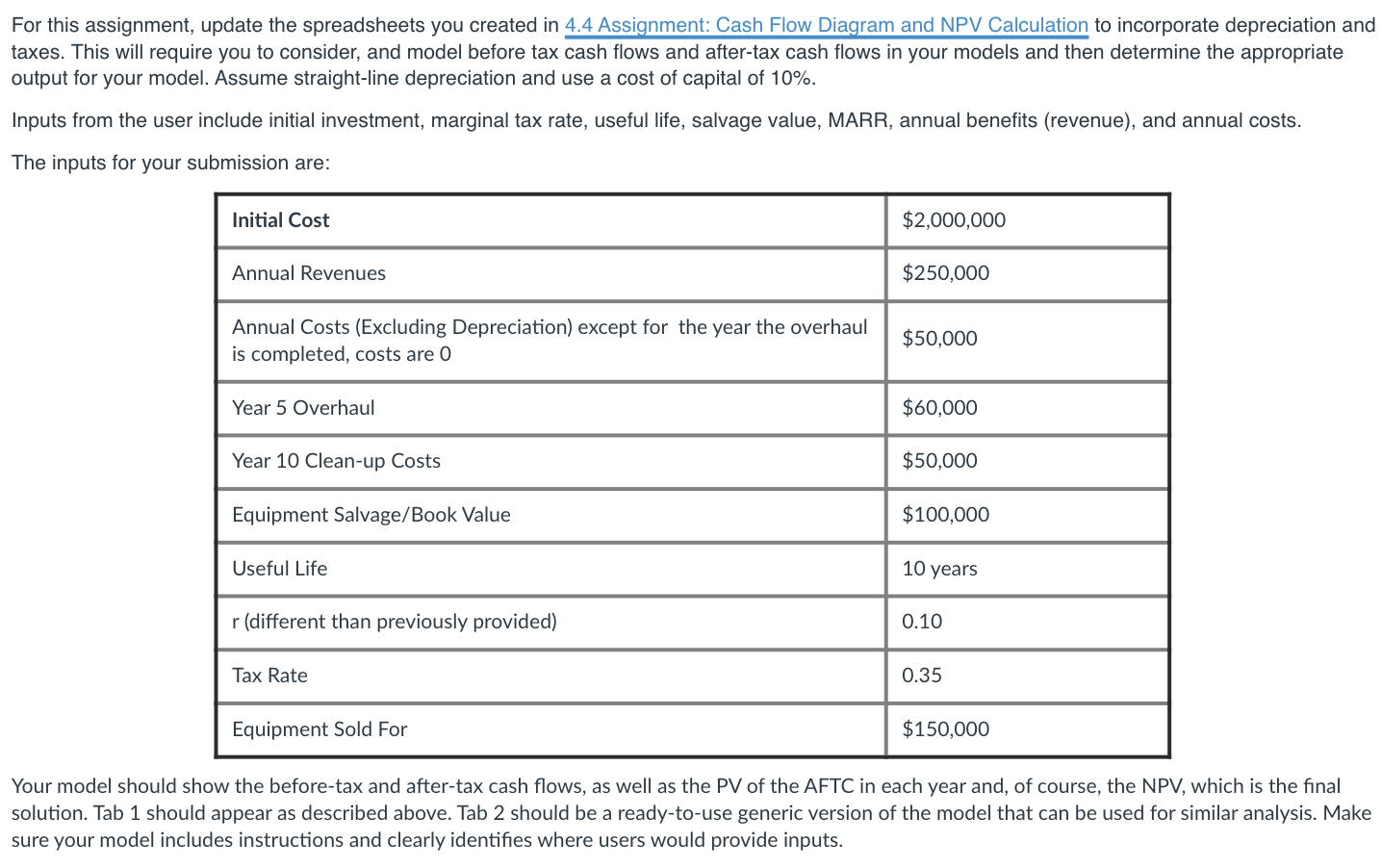

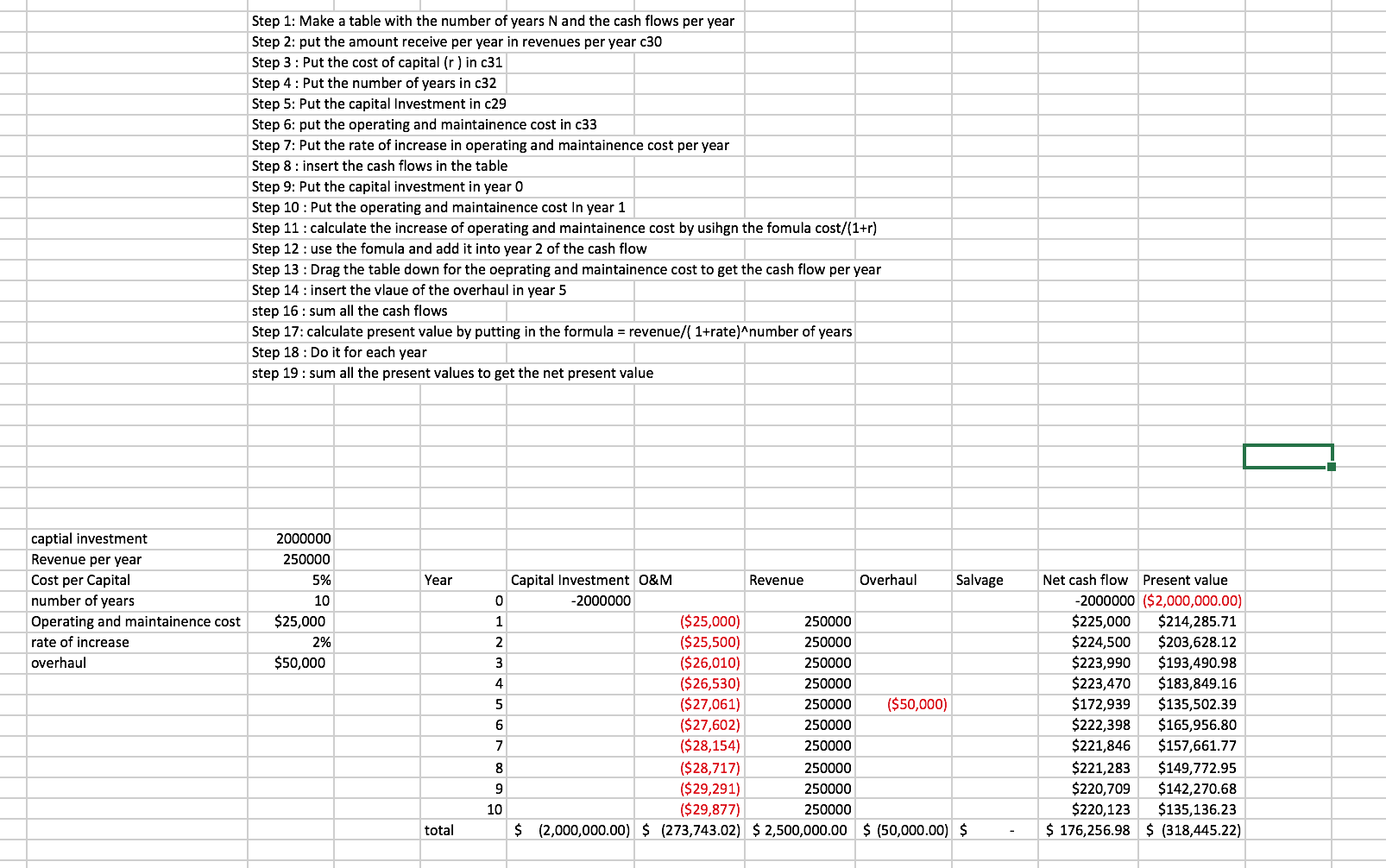

For this assignment, update the spreadsheets you created in 4.4 Assignment: Cash Flow Diagram and NPV Calculation to incorporate depreciation and taxes. This will require you to consider, and model before tax cash flows and after-tax cash flows in your models and then determine the appropriate output for your model. Assume straight-line depreciation and use a cost of capital of 10%. Inputs from the user include initial investment, marginal tax rate, useful life, salvage value, MARR, annual benefits (revenue), and annual costs. The inputs for your submission are: Initial Cost Annual Revenues Annual Costs (Excluding Depreciation) except for the year the overhaul is completed, costs are Year 5 Overhaul Year 10 Clean-up Costs Equipment Salvage/Book Value Useful Life r (different than previously provided) Tax Rate Equipment Sold For $2,000,000 $250,000 $50,000 $60,000 $50,000 $100,000 10 years 0.10 0.35 $150,000 Your model should show the before-tax and after-tax cash flows, as well as the PV of the AFTC in each year and, of course, the NPV, which is the final solution. Tab 1 should appear as described above. Tab 2 should be a ready-to-use generic version of the model that can be used for similar analysis. Make sure your model includes instructions and clearly identifies where users would provide inputs. captial investment Revenue per year Cost per Capital number of years Operating and maintainence cost rate of increase overhaul Step 1: Make a table with the number of years N and the cash flows per year Step 2: put the amount receive per year in revenues per year c30 Step 3: Put the cost of capital (r) in c31 Step 4: Put the number of years in c32 Step 5: Put the capital Investment in c29 Step 6: put the operating and maintainence cost in c33 Step 7: Put the rate of increase in operating and maintainence cost per year Step 8: insert the cash flows in the table Step 9: Put the capital investment in year 0 Step 10: Put the operating and maintainence cost In year 1 Step 11: calculate the increase of operating and maintainence cost by usihgn the fomula cost/(1+r) Step 12: use the fomula and add it into year 2 of the cash flow Step 13: Drag the table down for the oeprating and maintainence cost to get the cash flow per year Step 14: insert the vlaue of the overhaul in year 5 step 16 sum all the cash flows Step 17: calculate present value by putting in the formula = revenue/(1+rate)^number of years Step 18: Do it for each year step 19: sum all the present values to get the net present value 2000000 250000 5% 10 $25,000 2% $50,000 Year total 0 1 2 3 4 5 6 7 8 9 10 Capital Investment O&M -2000000 ($25,000) ($25,500) ($26,010) ($26,530) ($27,061) ($27,602) ($28,154) Revenue 250000 250000 250000 250000 250000 250000 250000 250000 250000 250000 Overhaul ($50,000) Salvage ($28,717) ($29,291) ($29,877) $ (2,000,000.00) $ (273,743.02) $2,500,000.00 $ (50,000.00) $ Net cash flow Present value -2000000 ($2,000,000.00) $225,000 $214,285.71 $224,500 $203,628.12 $223,990 $193,490.98 $183,849.16 $223,470 $172,939 $135,502.39 $222,398 $165,956.80 $221,846 $157,661.77 $149,772.95 $142,270.68 $135,136.23 $ (318,445.22) $221,283 $220,709 $220,123 $ 176,256.98 For this assignment, update the spreadsheets you created in 4.4 Assignment: Cash Flow Diagram and NPV Calculation to incorporate depreciation and taxes. This will require you to consider, and model before tax cash flows and after-tax cash flows in your models and then determine the appropriate output for your model. Assume straight-line depreciation and use a cost of capital of 10%. Inputs from the user include initial investment, marginal tax rate, useful life, salvage value, MARR, annual benefits (revenue), and annual costs. The inputs for your submission are: Initial Cost Annual Revenues Annual Costs (Excluding Depreciation) except for the year the overhaul is completed, costs are Year 5 Overhaul Year 10 Clean-up Costs Equipment Salvage/Book Value Useful Life r (different than previously provided) Tax Rate Equipment Sold For $2,000,000 $250,000 $50,000 $60,000 $50,000 $100,000 10 years 0.10 0.35 $150,000 Your model should show the before-tax and after-tax cash flows, as well as the PV of the AFTC in each year and, of course, the NPV, which is the final solution. Tab 1 should appear as described above. Tab 2 should be a ready-to-use generic version of the model that can be used for similar analysis. Make sure your model includes instructions and clearly identifies where users would provide inputs. captial investment Revenue per year Cost per Capital number of years Operating and maintainence cost rate of increase overhaul Step 1: Make a table with the number of years N and the cash flows per year Step 2: put the amount receive per year in revenues per year c30 Step 3: Put the cost of capital (r) in c31 Step 4: Put the number of years in c32 Step 5: Put the capital Investment in c29 Step 6: put the operating and maintainence cost in c33 Step 7: Put the rate of increase in operating and maintainence cost per year Step 8: insert the cash flows in the table Step 9: Put the capital investment in year 0 Step 10: Put the operating and maintainence cost In year 1 Step 11: calculate the increase of operating and maintainence cost by usihgn the fomula cost/(1+r) Step 12: use the fomula and add it into year 2 of the cash flow Step 13: Drag the table down for the oeprating and maintainence cost to get the cash flow per year Step 14: insert the vlaue of the overhaul in year 5 step 16 sum all the cash flows Step 17: calculate present value by putting in the formula = revenue/(1+rate)^number of years Step 18: Do it for each year step 19: sum all the present values to get the net present value 2000000 250000 5% 10 $25,000 2% $50,000 Year total 0 1 2 3 4 5 6 7 8 9 10 Capital Investment O&M -2000000 ($25,000) ($25,500) ($26,010) ($26,530) ($27,061) ($27,602) ($28,154) Revenue 250000 250000 250000 250000 250000 250000 250000 250000 250000 250000 Overhaul ($50,000) Salvage ($28,717) ($29,291) ($29,877) $ (2,000,000.00) $ (273,743.02) $2,500,000.00 $ (50,000.00) $ Net cash flow Present value -2000000 ($2,000,000.00) $225,000 $214,285.71 $224,500 $203,628.12 $223,990 $193,490.98 $183,849.16 $223,470 $172,939 $135,502.39 $222,398 $165,956.80 $221,846 $157,661.77 $149,772.95 $142,270.68 $135,136.23 $ (318,445.22) $221,283 $220,709 $220,123 $ 176,256.98

iabove is the excel sheet that is to be updated from the question above. Could you show workings in the excel . Thank you

iabove is the excel sheet that is to be updated from the question above. Could you show workings in the excel . Thank you