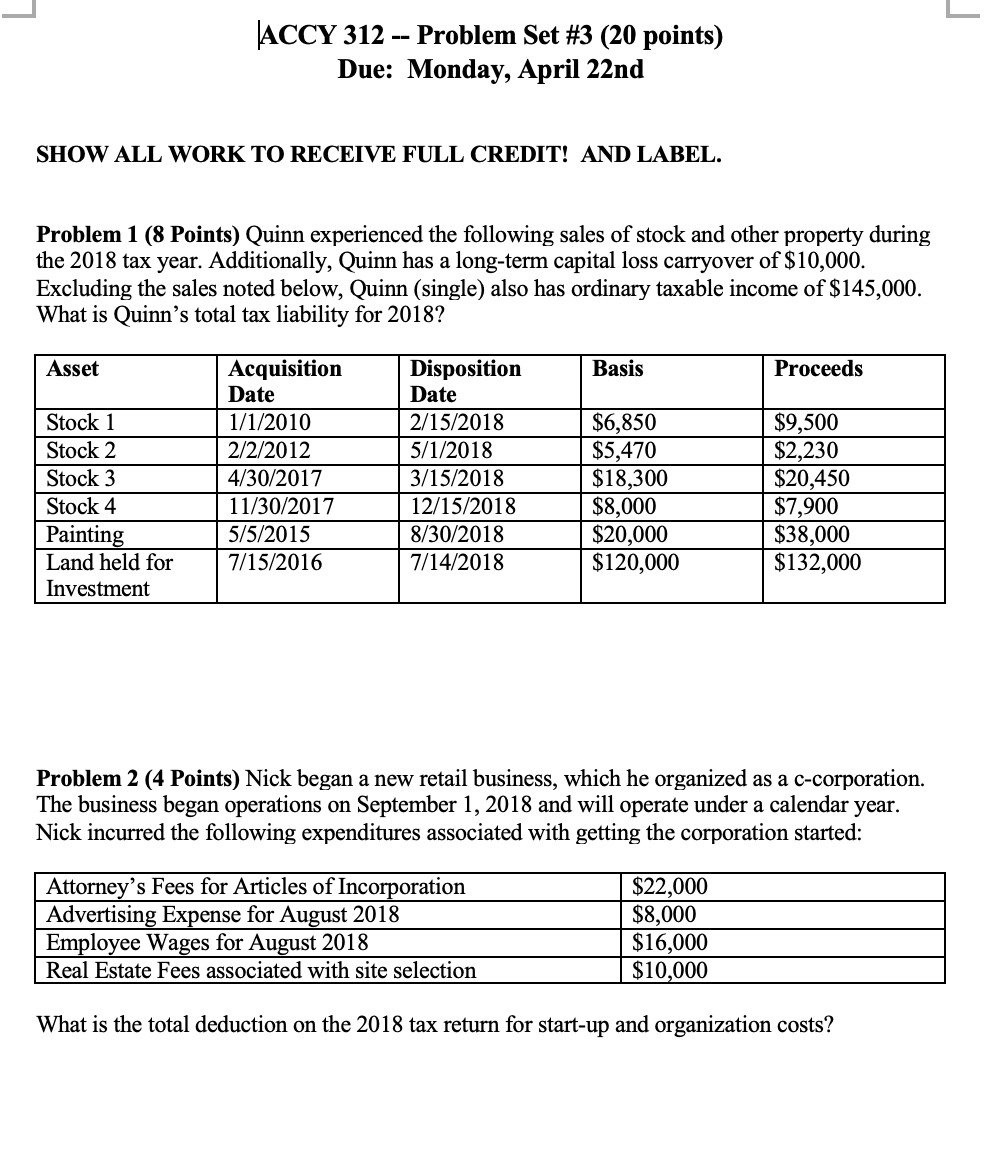

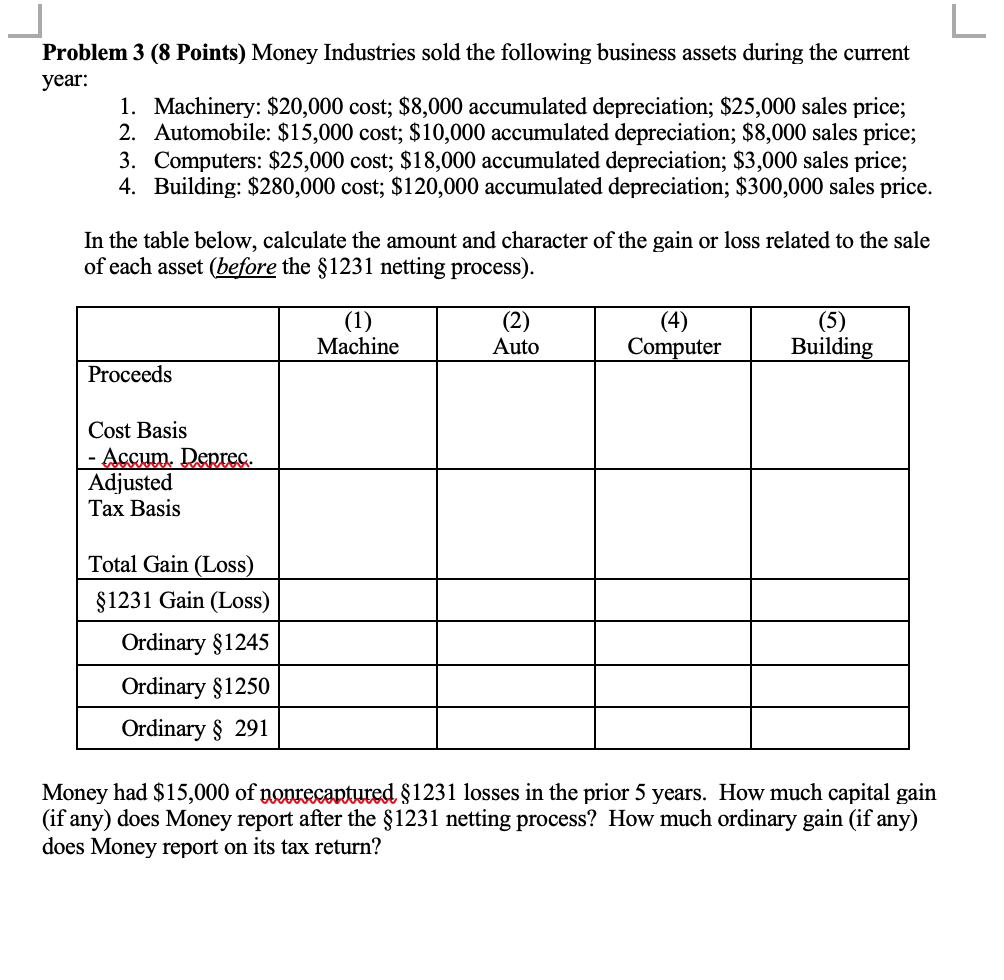

IACCY 312 Problem Set #3 (20 points) Due: Monday, April 22nd SHOW ALL WORK TO RECEIVE FULL CREDIT! AND LABEL. Problem 1 (8 Points) Quinn experienced the following sales of stock and other property during the 2018 tax year. Additionally, Quinn has a long-term capital loss carryover of $10,000. Excluding the sales noted below, Quinn (single) also has ordinary taxable income of $145,000. What is Quinn's total tax liability for 2018? Asset Acquisition Disposition Basis Proceeds Date Date 1/1/2010 2/15/2018 $6,850 $9,500 2/2/2012 5/1/2018 $5,470 $2,230 4/30/2017 3/15/2018 $18,300 $20,450 11/30/2017 12/15/2018 $8,000 $7,900 5/5/2015 8/30/2018 $20,000 $38,000 Land held for 2/\" 15/2016 7/14/2018 $120,000 $132,000 Investment Problem 2 (4 Points) Nick began a new retail business, which he organized as a c-corporation. The business began operations on September 1, 2018 and will operate under a calendar year. Nick incurred the following expenditures associated with getting the corporation started: Attorney's Fees for Articles of Incorporation $22,000 Advertising Expense for August 2018 $8,000 Employee Wages for August 2018 $16,000 Real Estate Fees associated with site selection $10 000 What is the total deduction on the 2018 tax return for start-up and organization costs? _| Problem 3 (8 Points) Money Industries sold the following business assets during the current year: 1. Machinery: $20,000 cost; $8,000 accumulated depreciation; $25,000 sales price; 2. Automobile: $15,000 cost; $10,000 accumulated depreciation; $8,000 sales price; 3. Computers: $25,000 cost; $18,000 accumulated depreciation; $3,000 sales price; 4. Building: $280,000 cost; $120,000 accumulated depreciation; $300,000 sales price. In the table below, calculate the amount and character of the gain or loss related to the sale of each asset (before the 1231 netting process). Auto Computer Proceeds Cost Basis Tax Basis Total Gain (Loss) 1231 Gain (Loss) mm m crammuso 0mm Money had $15,000 of Wm 1231 losses in the prior 5 years. How much capital gain (if any) does Money report after the 1231 netting process? How much ordinary gain (if any) does Money report on its tax return