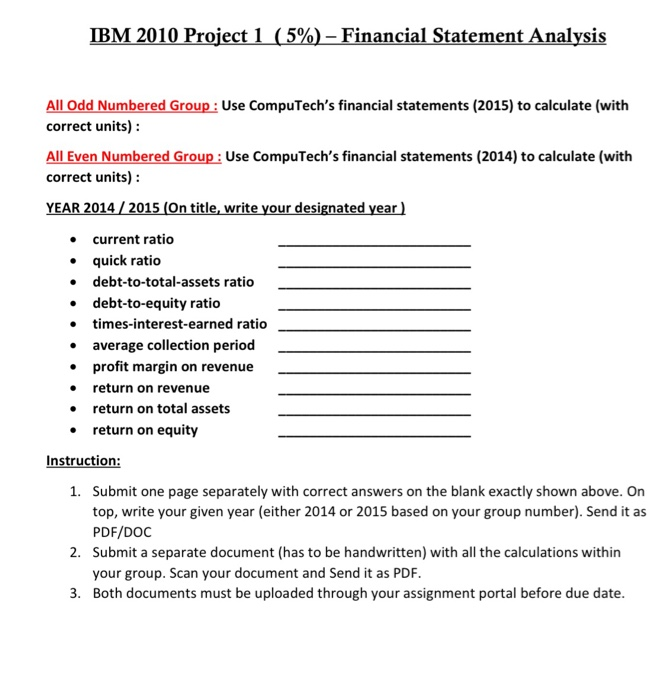

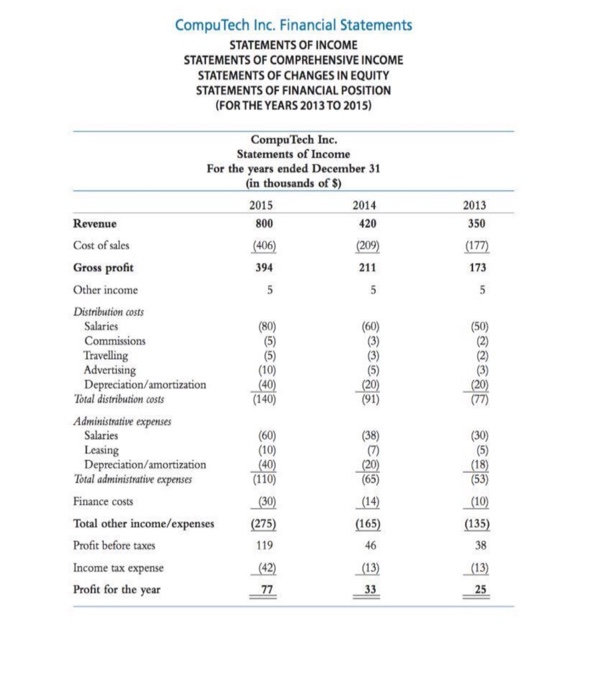

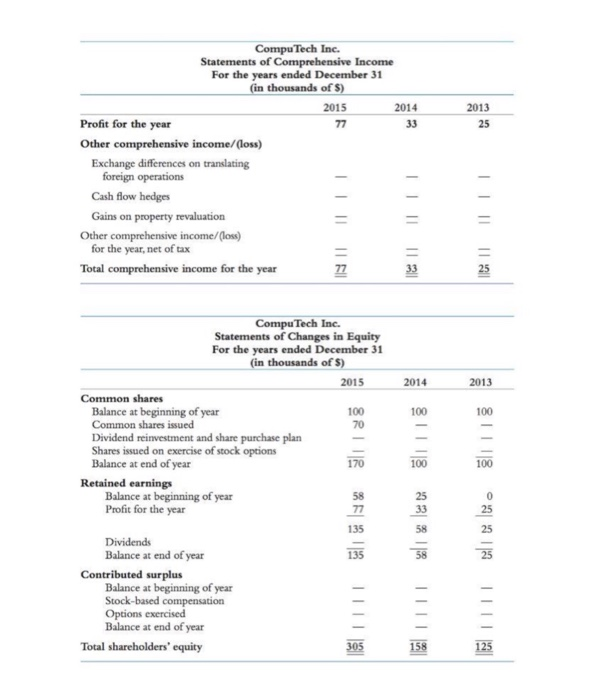

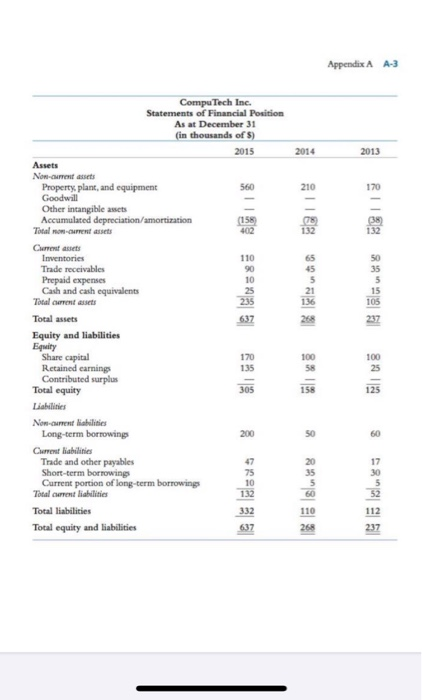

IBM 2010 Project 1 (5%) - Financial Statement Analysis All Odd Numbered Group : Use CompuTech's financial statements (2015) to calculate (with correct units): All Even Numbered Group : Use CompuTech's financial statements (2014) to calculate (with correct units): YEAR 2014 / 2015 (On title, write your designated year) current ratio quick ratio debt-to-total-assets ratio debt-to-equity ratio times-interest-earned ratio average collection period profit margin on revenue return on revenue return on total assets return on equity Instruction: 1. Submit one page separately with correct answers on the blank exactly shown above. On top, write your given year (either 2014 or 2015 based on your group number). Send it as PDF/DOC 2. Submit a separate document (has to be handwritten) with all the calculations within your group. Scan your document and Send it as PDF. 3. Both documents must be uploaded through your assignment portal before due date. CompuTech Inc. Financial Statements STATEMENTS OF INCOME STATEMENTS OF COMPREHENSIVE INCOME STATEMENTS OF CHANGES IN EQUITY STATEMENTS OF FINANCIAL POSITION (FOR THE YEARS 2013 TO 2015) 2013 350 (177) 173 394 5 (50) (2) CompuTech Inc. Statements of Income For the years ended December 31 (in thousands of $) 2015 2014 Revenue 800 420 Cost of sales (406) (209) Gross profit 211 Other income 5 5 Distribution costs Salaries (80) (60) Commissions (5) Travelling Advertising (10) Depreciation/amortization Total distribution costs (140) (91) Administrative expenses Salaries (60) (38) Leasing (10) Depreciation/amortization (40) Total administrative expenses Finance costs (30) (14) Total other income/expenses (275) (165) Profit before taxes 119 46 Income tax expense (42) (13) Profit for the year 77 33 (110) (30) (5) (18) (53) (10) (135) 38 (13) 25 2013 25 CompuTech Inc. Statements of Comprehensive Income For the years ended December 31 (in thousands of s) 2015 2014 Profit for the year 77 33 Other comprehensive income/(loss) Exchange differences on translating foreign operations Cash flow hedges Gains on property revaluation Other comprehensive income/(los) for the year, net of tax Total comprehensive income for the year 111 1111 2014 2013 CompuTech Inc. Statements of Changes in Equity For the years ended December 31 (in thousands of s) 2015 Common shares Balance at beginning of year 100 Common shares issued 70 Dividend reinvestment and share purchase plan Shares issued on exercise of stock options Balance at end of year Retained earnings Balance at beginning of year 58 Profit for the year 77 100 100 170 100 100 25 33 0 25 135 58 135 Dividends Balance at end of year Contributed surplus Balance at beginning of year Stock-based compensation Options exercised Balance at end of year Total shareholders' equity 305 158 125 Appendix A A-3 2014 2013 210 170 132 132 110 65 50 35 5 105 CompuTech Inc. Statements of Financial Position As at December 31 (in thousands of S) 2015 Assets Non-current assets Property, plant, and equipment 560 Goodwill Other intangible assets Accumulated depreciation/amortization (158 Total non-current assets 402 Current Inventories Trade receivables 90 Prepaid expenses 10 Cash and cash equivalents 25 Total current assets 235 Total assets 637 Equity and liabilities Equity Share capital 170 Retained earnings 135 Contributed surplus Total equity 305 Liabilities Now current liabilities Long-term borrowing 200 Current liabilities Trade and other payables 47 Short-term borrowings 75 Current portion of long-term borrowings 10 Total current liabilities 132 Total liabilities 332 Total equity and liabilities 637 237 100 58 100 25 158 125 50 60 17 5 52 110 112 237 268 Mine is even numbered group