Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IBM Required: 1. Compute the five component ratios of a decomposition of ROE (net profit margin, total asset turnover, return on assets, financial leverage,

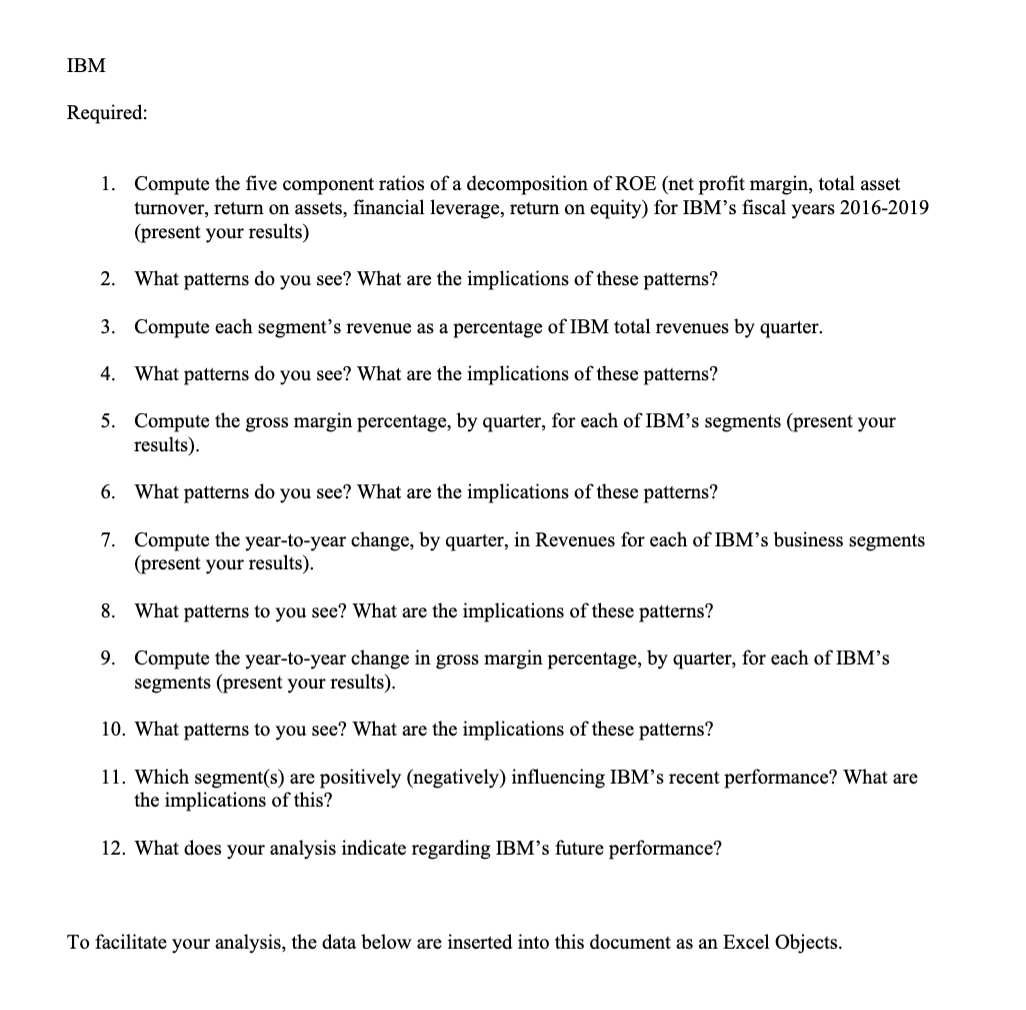

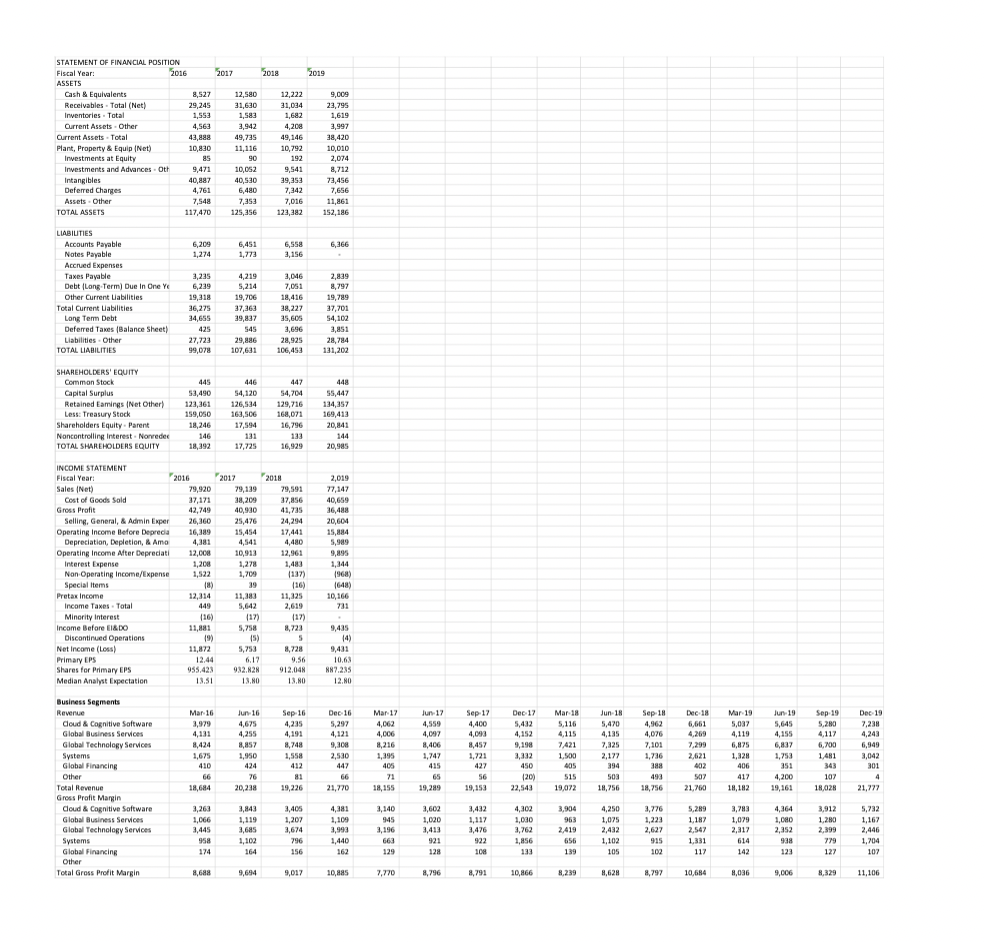

IBM Required: 1. Compute the five component ratios of a decomposition of ROE (net profit margin, total asset turnover, return on assets, financial leverage, return on equity) for IBM's fiscal years 2016-2019 (present your results) 2. What patterns do you see? What are the implications of these patterns? 3. Compute each segment's revenue as a percentage of IBM total revenues by quarter. 4. What patterns do you see? What are the implications of these patterns? 5. Compute the gross margin percentage, by quarter, for each of IBM's segments (present your results). 6. What patterns do you see? What are the implications of these patterns? 7. Compute the year-to-year change, by quarter, in Revenues for each of IBM's business segments (present your results). 8. What patterns to you see? What are the implications of these patterns? 9. Compute the year-to-year change in gross margin percentage, by quarter, for each of IBM's segments (present your results). 10. What patterns to you see? What are the implications of these patterns? 11. Which segment(s) are positively (negatively) influencing IBM's recent performance? What are the implications of this? 12. What does your analysis indicate regarding IBM's future performance? To facilitate your analysis, the data below are inserted into this document as an Excel Objects.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started