Answered step by step

Verified Expert Solution

Question

1 Approved Answer

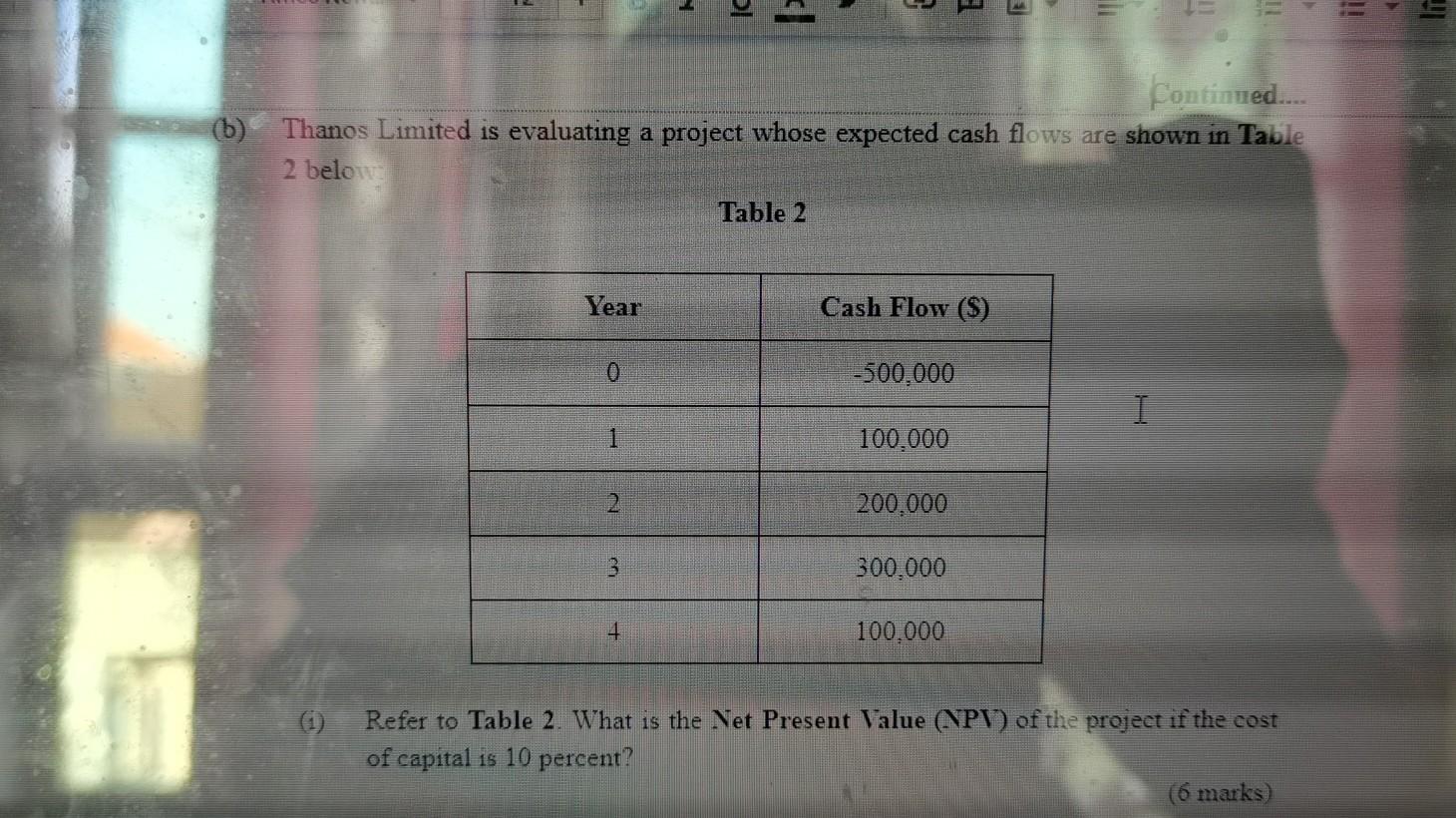

IC E Continued... (b) Thanos Limited is evaluating a project whose expected cash flows are shown in Table 2 below Table 2 Year Cash Flow

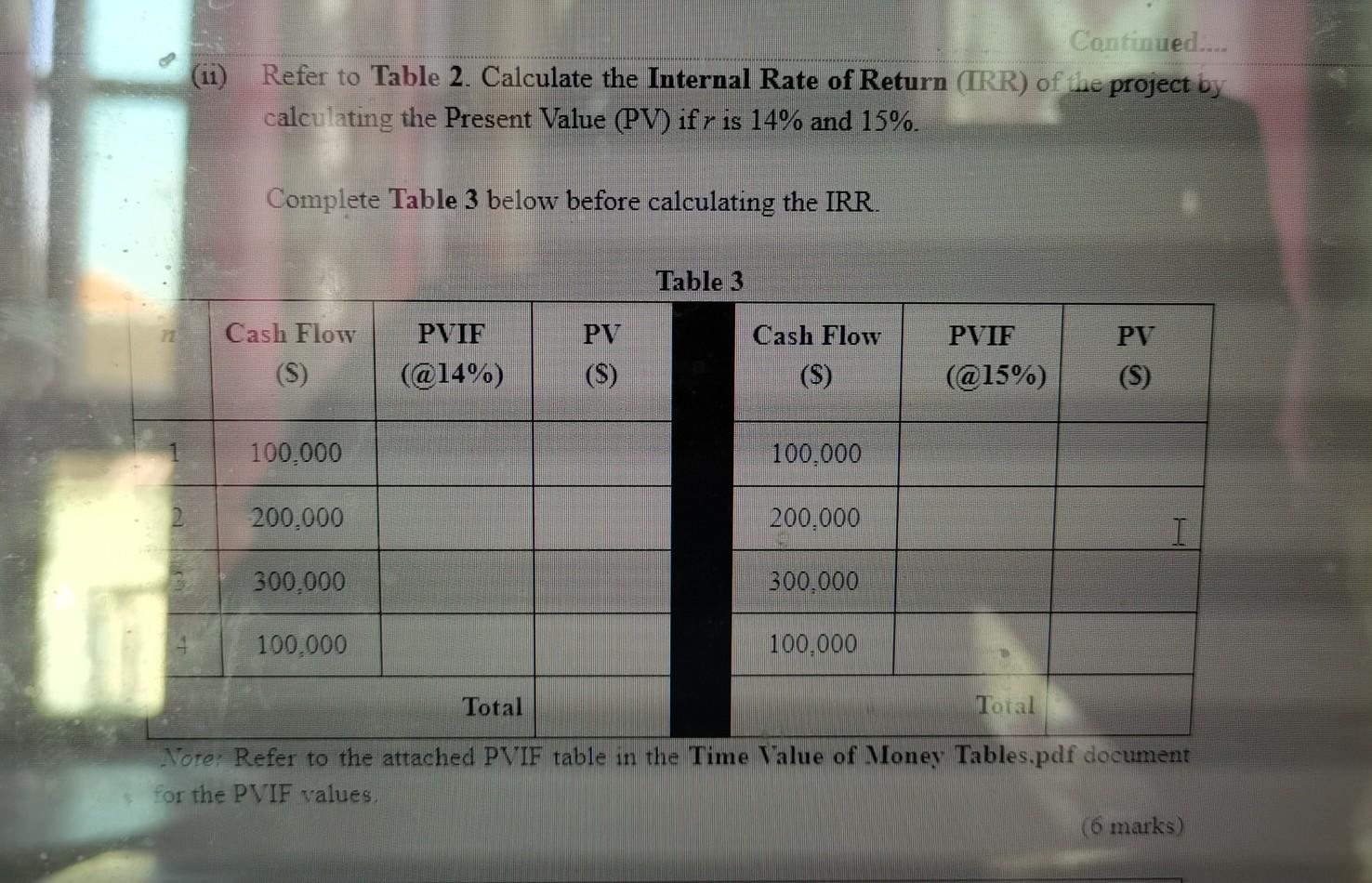

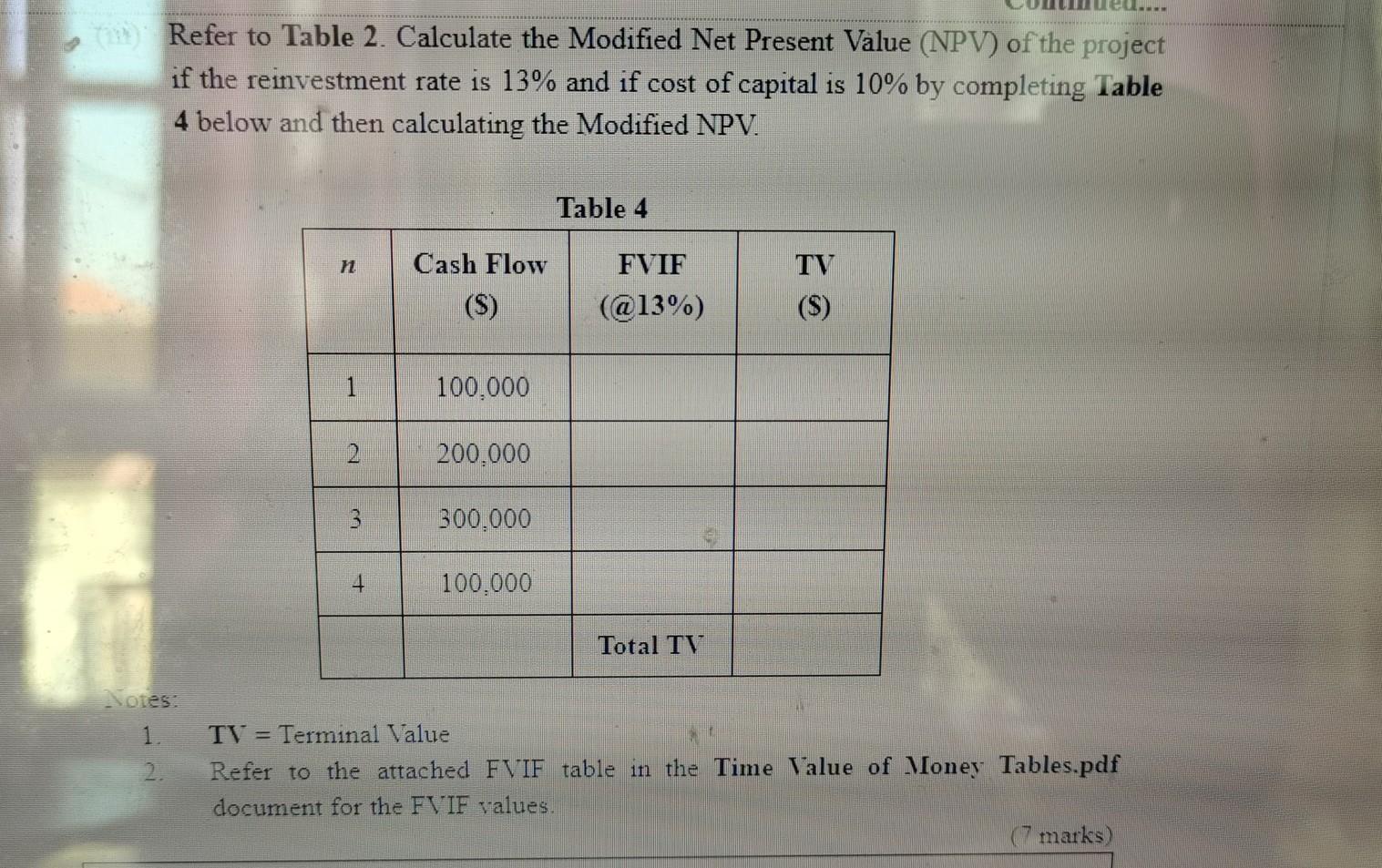

IC E Continued... (b) Thanos Limited is evaluating a project whose expected cash flows are shown in Table 2 below Table 2 Year Cash Flow (S) 0 -500,000 I 1 100.000 2 200,000 300,000 1 100.000 Refer to Table 2. What is the Net Present Value (NPV) of the project if the cost of capital is 10 percent? (6 marks) Continued.... Refer to Table 2. Calculate the Internal Rate of Return (IRR) of the project by calculating the Present Value (PV) ifr is 14% and 15%. Complete Table 3 below before calculating the IRR. Table 3 PV Cash Flow (S) PVIF (@14%) PV (s) Cash Flow (S) PVIF (@15%) (S) 100.000 100.000 200.000 200.000 I 300.000 300.000 100,000 100,000 Total Total Note: Refer to the attached PVIF table in the Time Value of Money Tables.pdf document for the PVIF values. (6 marks) Refer to Table 2. Calculate the Modified Net Present Value (NPV) of the project if the reinvestment rate is 13% and if cost of capital is 10% by completing Table 4 below and then calculating the Modified NPV. Table 4 Cash Flow TV FVIF (@13%) (S) 1 100,000 2 200.000 3 300.000 4 100.000 Total TV Nores 1. 2. TV = Terminal Value Refer to the attached FVIF table in the Time Value of Money Tables.pdf document for the FV IF values

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started