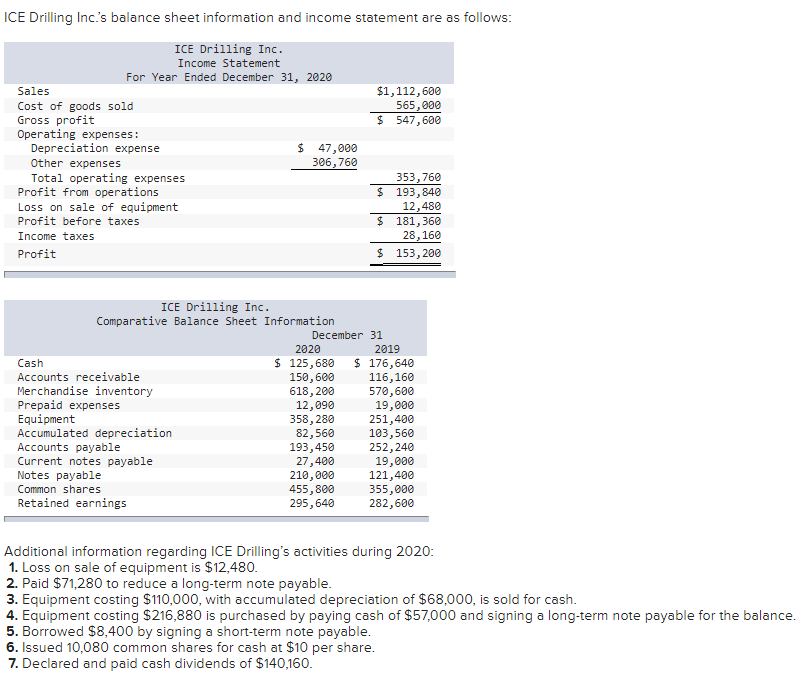

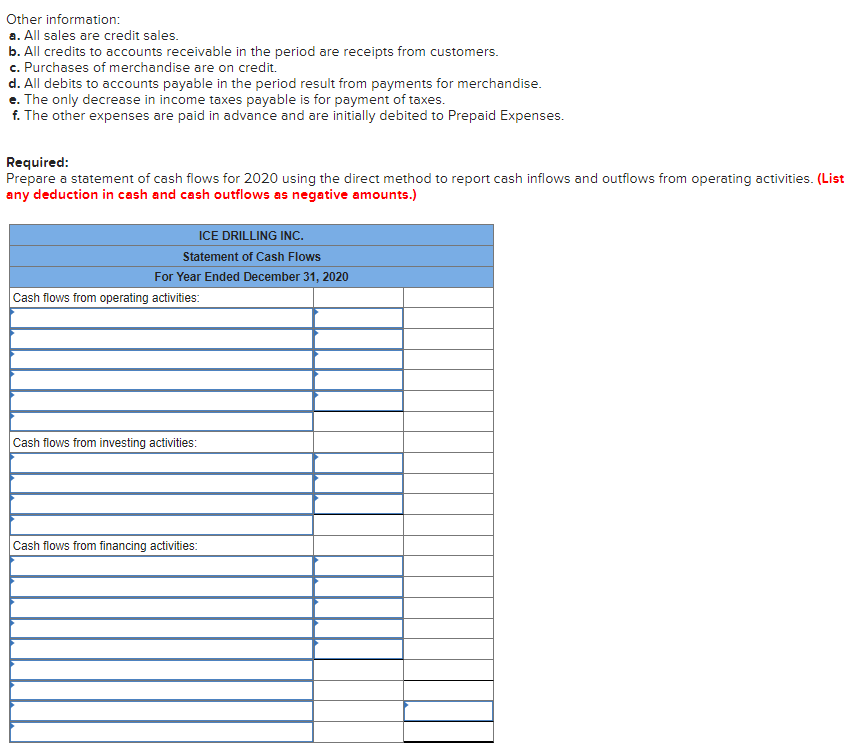

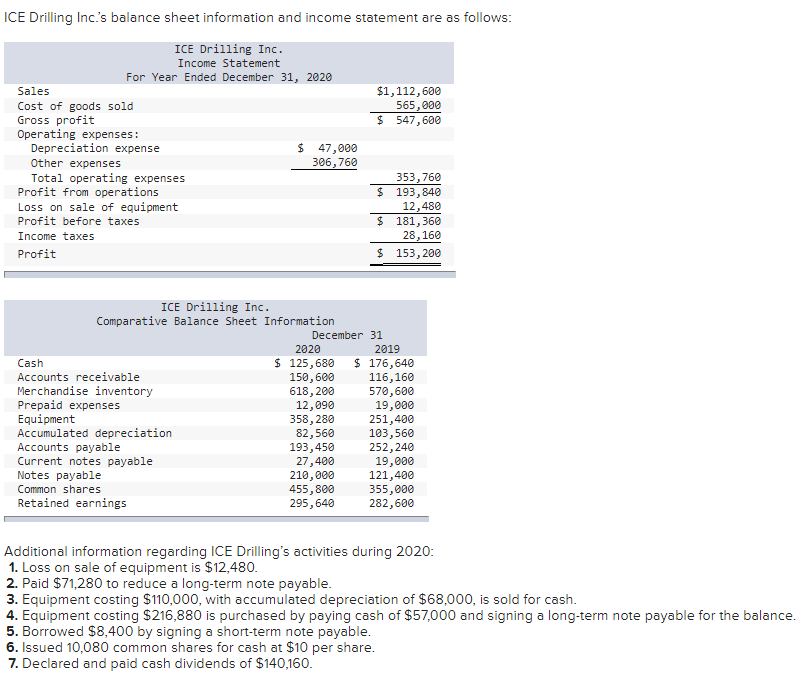

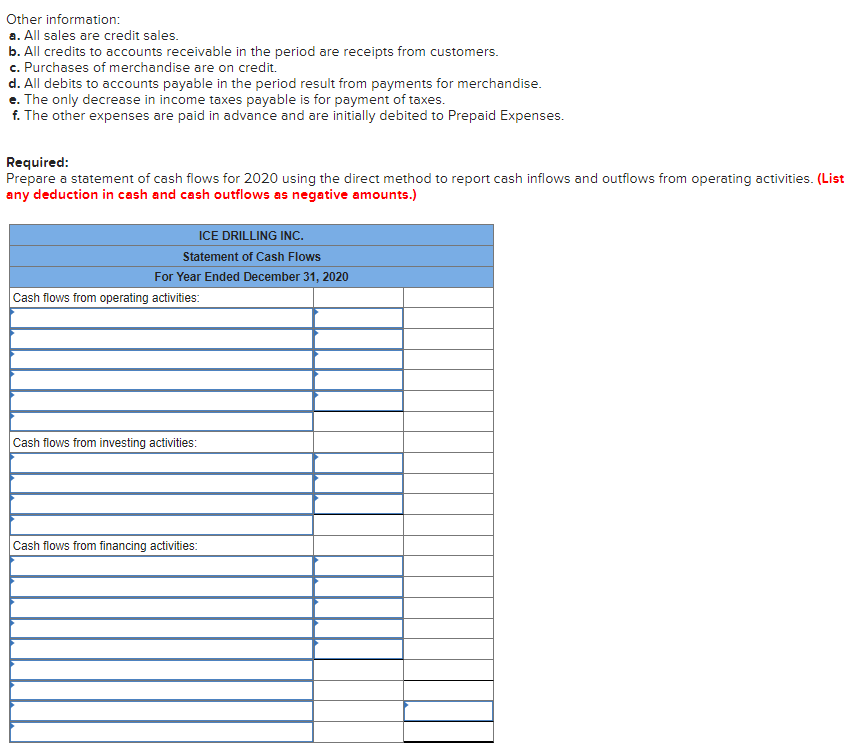

ICE Drilling Inc.'s balance sheet information and income statement are as follows: ICE Drilling Inc. Income Statement For Year Ended December 31, 2020 Sales $1,112,600 Cost of goods sold 565,000 Gross profit $ 547,600 Operating expenses: Depreciation expense $ 47,000 Other expenses 306,760 Total operating expenses 353, 760 Profit from operations $ 193,840 Loss on sale of equipment 12,480 Profit before taxes $ 181,360 Income taxes 28,160 Profit $ 153,200 ICE Drilling Inc. Comparative Balance Sheet Information December 31 2020 2019 Cash $ 125,680 $ 176,640 Accounts receivable 150,600 116,160 Merchandise inventory 618,200 570,600 Prepaid expenses 12,090 19,000 Equipment 358,280 251,400 Accumulated depreciation 82,560 103,560 Accounts payable 193,450 252,240 Current notes payable 27,400 19,000 Notes payable 210,000 121,400 Common shares 455,800 355,000 Retained earnings 295,640 282,600 Additional information regarding ICE Drilling's activities during 2020: 1. Loss on sale of equipment is $12,480. 2. Paid $71,280 to reduce a long-term note payable. 3. Equipment costing $110,000, with accumulated depreciation of $68,000, is sold for cash. 4. Equipment costing $216,880 is purchased by paying cash of $57,000 and signing a long-term note payable for the balance. 5. Borrowed $8,400 by signing a short-term note payable. 6. Issued 10,080 common shares for cash at $10 per share. 7. Declared and paid cash dividends of $140,160. Other information: a. All sales are credit sales. b. All credits to accounts receivable in the period are receipts from customers. c. Purchases of merchandise are on credit. d. All debits to accounts payable in the period result from payments for merchandise. e. The only decrease in income taxes payable is for payment of taxes. f. The other expenses are paid in advance and are initially debited to Prepaid Expenses. Required: Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. (List any deduction in cash and cash outflows as negative amounts.) ICE DRILLING INC. Statement of Cash Flows For Year Ended December 31, 2020 Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities