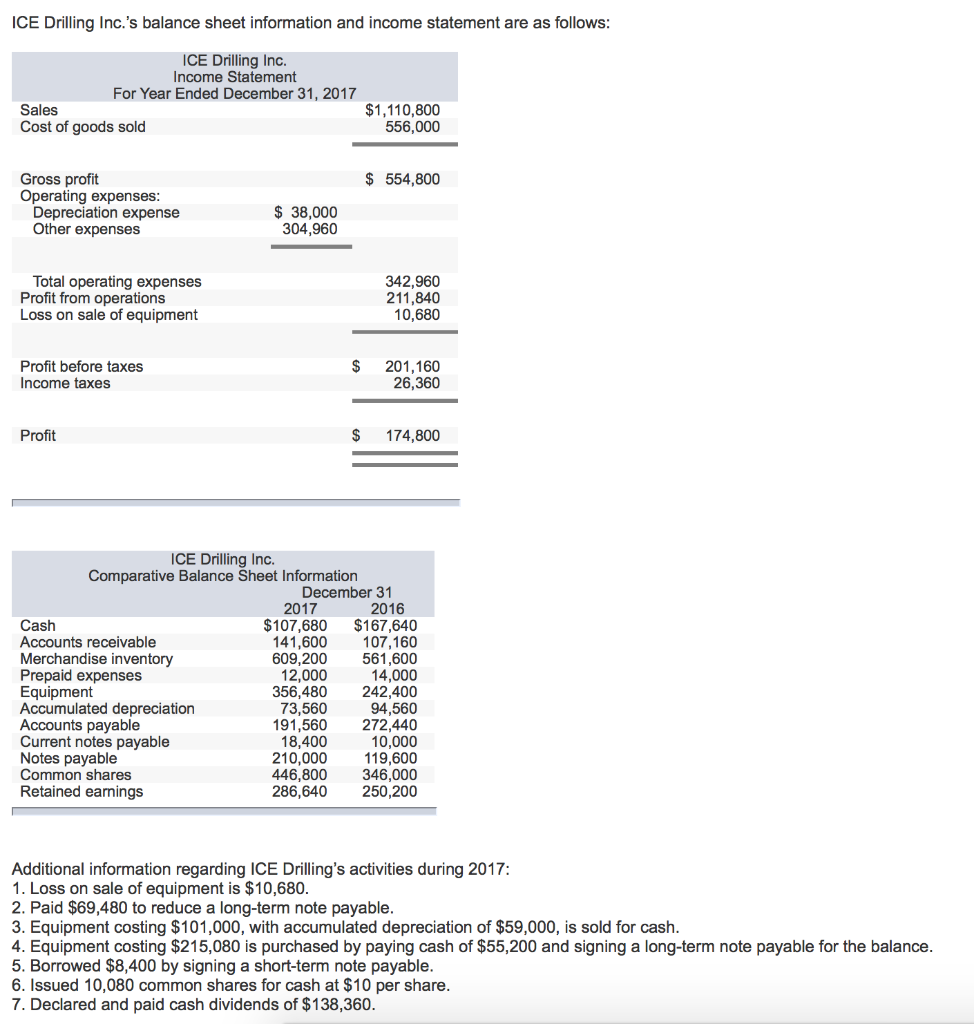

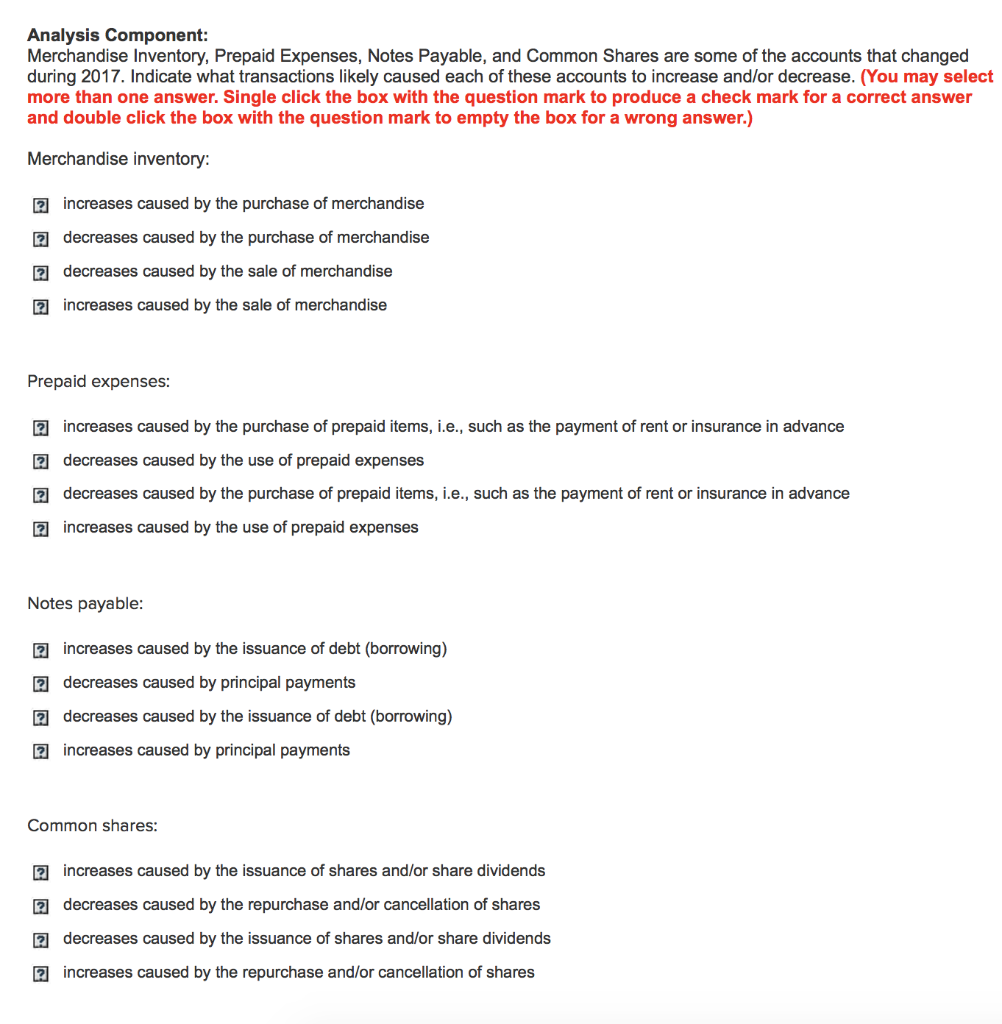

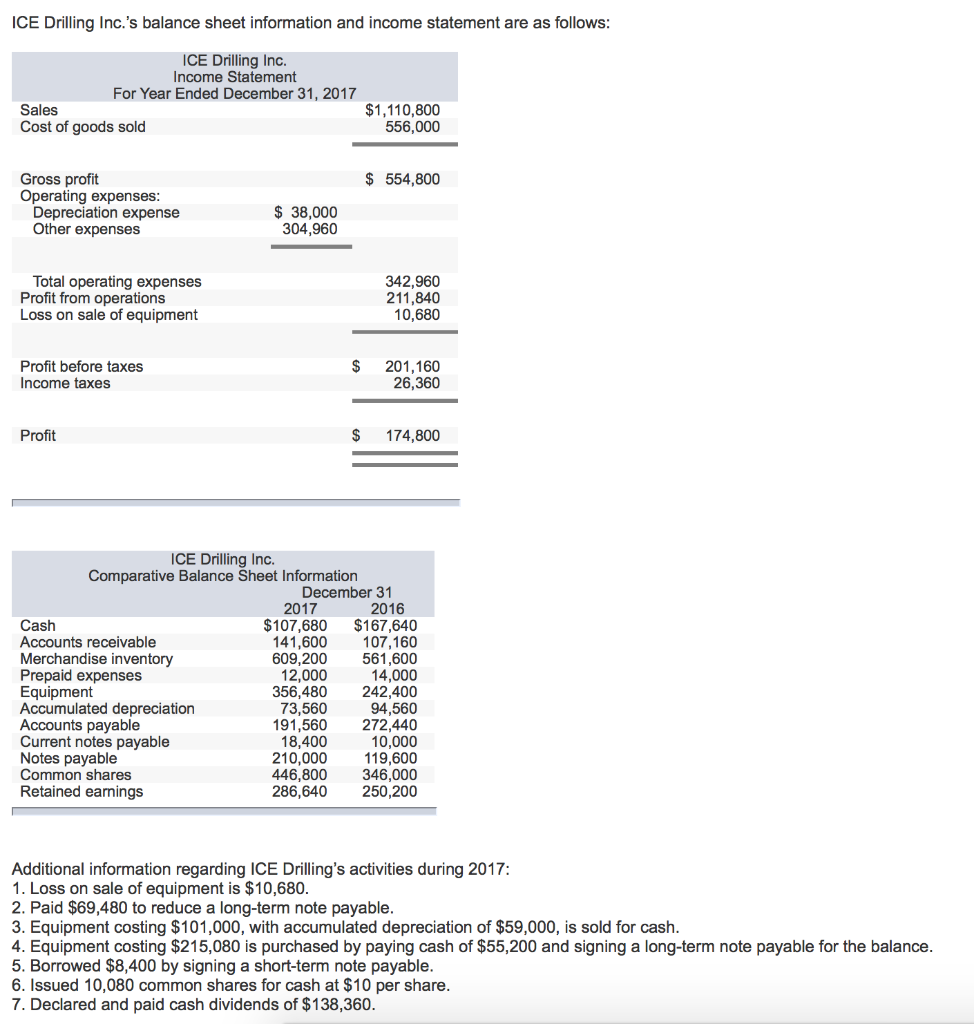

ICE Drilling Inc.'s balance sheet information and income statement are as follows ICE Drilling Inc. Income Statement For Year Ended December 31, 2017 Sales Cost of goods sold $1,110,800 556,000 Gross profit Operating expenses $ 554,800 Depreciation expense Other expenses $ 38,000 304,960 Total operating expenses Profit from operations Loss on sale of equipment 342,960 211,840 10,680 Profit before taxes Income taxes $ 201,160 26,360 Profit $ 174,800 ICE Drilling Inc. Comparative Balance Sheet Information December 31 2017 2016 Cash Accounts receivable Merchandise inventory Prepaid expenses Equipment Accumulated depreciation Accounts payable Current notes payable Notes payable Common shares Retained eanings $107,680 $167,640 141,600 107,160 609,200 561,600 14,000 356,480 242,400 94,560 191,560 272,440 10,000 119,600 446,800 346,000 286,640 250,200 12,000 73,560 18,400 210,000 Additional information regarding ICE Drilling's activities during 2017: 1. Loss on sale of equipment is $10,680 2. Paid $69,480 to reduce a long-term note payable 3. Equipment costing $101,000, with accumulated depreciation of $59,000, is sold for cash 4. Equipment costing $215,080 is purchased by paying cash of $55,200 and signing a long-term note payable for the balance 5. Borrowed $8,400 by signing a short-term note payable 6. Issued 10,080 common shares for cash at $10 per share 7. Declared and paid cash dividends of $138,360 Required: Prepare a statement of cash flows for 2017 that reports the cash inflows and outflows from operating activities according to the indirect method. (I CE DRILLING INC Statement of Cash Flows For Year Ended December 31, 2017 Cash flows from operating activities Adjustments to reconcile profit to net cash inflows from operating activities: Cash flows from investing activities: Cash flows from financing activities: Analysis Component: Merchandise Inventory, Prepaid Expenses, Notes Payable, and Common Shares are some of the accounts that changed during 2017. Indicate what transactions likely caused each of these accounts to increase and/or decrease. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Merchandise inventory 2 increases caused by the purchase of merchandise 2 decreases caused by the purchase of merchandise 2 decreases caused by the sale of merchandise 2increases caused by the sale of merchandise Prepaid expenses: 2increases caused by the purchase of prepaid items, i.e., such as the payment of rent or insurance in advance 2 decreases caused by the use of prepaid expenses decreases caused by the purchase of prepaid items, i.e., such as the payment of rent or insurance in advance 2increases caused by the use of prepaid expenses Notes payable: 2 increases caused by the issuance of debt (borrowing) 2 decreases caused by principal payments decreases caused by the issuance of debt (borrowing) 2 increases caused by principal payments Common shares: 2 increases caused by the issuance of shares and/or share dividends 2 decreases caused by the repurchase and/or cancellation of shares decreases caused by the issuance of shares and/or share dividends 2increases caused by the repurchase and/or cancellation of shares