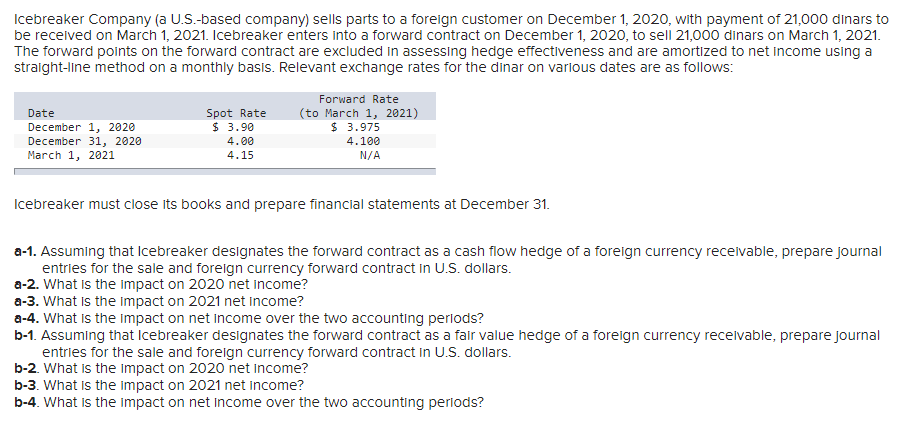

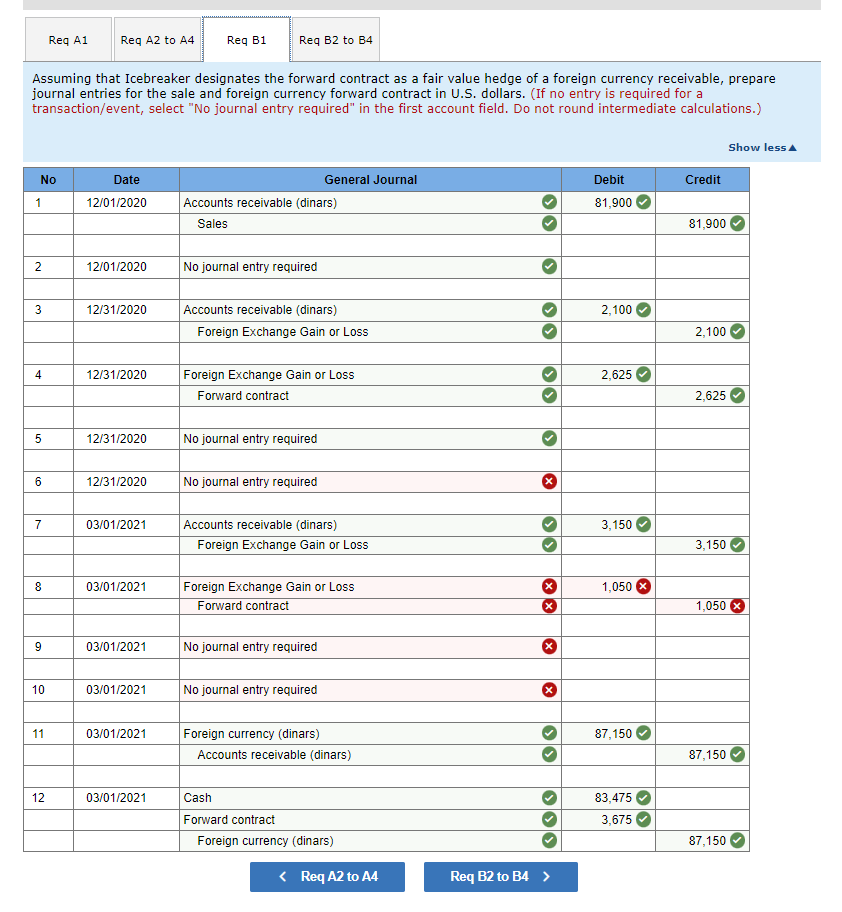

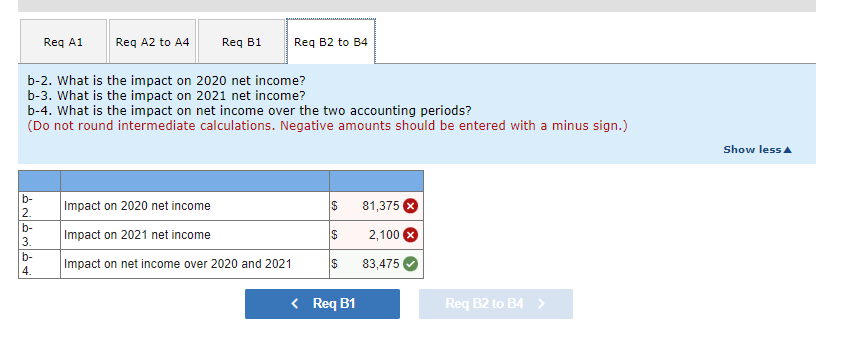

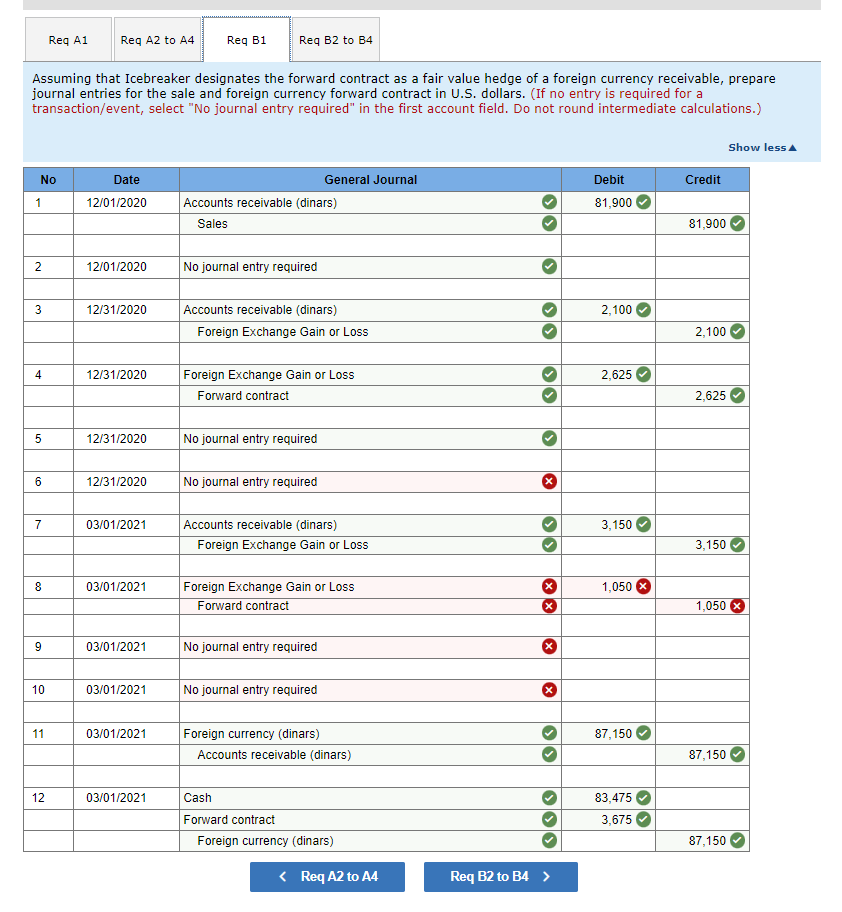

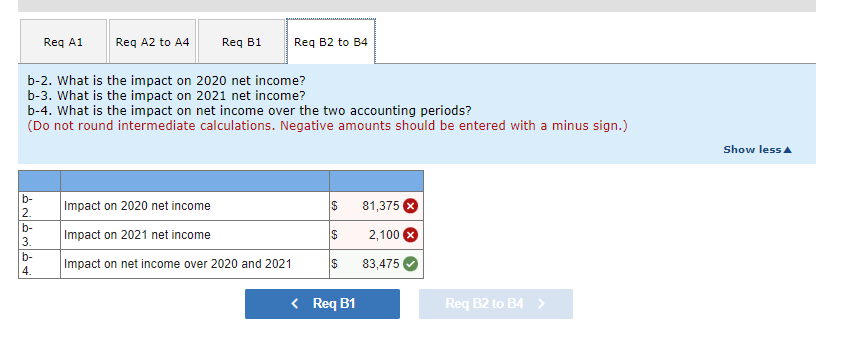

Icebreaker Company (a U.S.-based company) sells parts to a foreign customer on December 1, 2020, with payment of 21,000 dinars to be received on March 1, 2021. Icebreaker enters into a forward contract on December 1, 2020, to sell 21,000 dinars on March 1, 2021. The forward points on the forward contract are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis. Relevant exchange rates for the dinar on various dates are as follows: Date December 1, 2020 December 31, 2020 March 1, 2021 Spot Rate $ 3.90 4.00 4.15 Forward Rate (to March 1, 2021) $ 3.975 4.100 N/A Icebreaker must close its books and prepare financial statements at December 31. 8-1. Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency receivable, prepare journal entries for the sale and foreign currency forward contract in U.S. dollars. a-2. What is the impact on 2020 net income? a-3. What is the impact on 2021 net income? a-4. What is the impact on net income over the two accounting periods? b-1. Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency receivable, prepare journal entries for the sale and foreign currency forward contract in U.S. dollars. b-2. What is the impact on 2020 net income? b-3. What is the impact on 2021 net income? b-4. What is the impact on net income over the two accounting periods? Reg A1 Reg A2 to A4 Req B1 Req B2 to B4 Assuming that Icebreaker designates the forward contract as a fair value hedge of a foreign currency receivable, prepare journal entries for the sale and foreign currency forward contract in U.S. dollars. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) Show less No Date Debit Credit 1 12/01/2020 General Journal Accounts receivable (dinars) Sales 81,900 81,900 N 12/01/2020 No journal entry required 3 12/31/2020 2,100 Accounts receivable (dinars) Foreign Exchange Gain or Loss 2,100 4 12/31/2020 2,625 Foreign Exchange Gain or Loss Forward contract 2.625 5 12/31/2020 No journal entry required 6 12/31/2020 No journal entry required 7 03/01/2021 3,150 Accounts receivable (dinars) Foreign Exchange Gain or Loss 3,150 8 8 03/01/2021 1,050 Foreign Exchange Gain or Loss Forward contract 1,050 9 03/01/2021 No journal entry required 10 03/01/2021 No journal entry required 11 03/01/2021 87,150 Foreign currency (dinars) Accounts receivable (dinars) 87,150 12 03/01/2021 Cash 83,475 3,675 Forward contract Foreign currency (dinars) 87,150 Reg A1 Req A2 to 44 Req B1 Req B2 to 14 b-2. What is the impact on 2020 net income? b-3. What is the impact on 2021 net income? b-4. What is the impact on net income over the two accounting periods? (Do not round intermediate calculations. Negative amounts should be entered with a minus sign.) Show less $ 81,375 b- 2. b- 3. b- 4. Impact on 2020 net income Impact on 2021 net income $ 2,100 Impact on net income over 2020 and 2021 $ 83,475