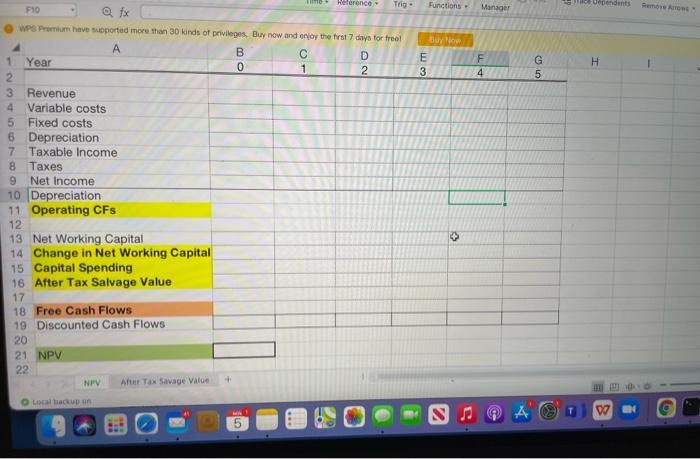

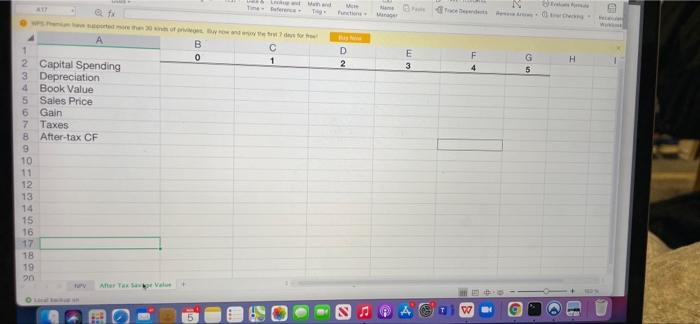

Iceman Inc. Your boss, Mr. Kuklinski, believes that Southom California will soon run short of water. One of the ramifications, other than widespread riting, is that there will be high demand for fresh potable water. He is considering starting an iceberg transport company named "feeman Indies this need and tus asked you to help him analyze the project The timeline for the proposed business is as follows: In Year (ie, this year), Me Kuklinski would acquire the necessary assets and set up operation. In Years 1, 2, , and 4, the business would be in full operation, shuttling chers from Alaska to Long Beach He plans to sell the ships at the end of Year 4 In Year 5 nothing will happen except he will collect all the cutstanding working capital. He will then move to Costa Rica, where they have plenty of water for both drinking and surfing Over the past year, Mr. Kulki has paid $200,000 to consultants to write a report with all the relevant figures for this project. This report suggests that he can purchase eight ships in Year Ofor $2,250,000 each Ships don't lose much value if they are well maintained, so it is expected that the lips will have a resale value of 2,000,000 at the end of Year 4. The ships are quite durable so they will be straight-line depreciated to er over 20 years The consulting report predicts that the company will be able to sell water $0.90 per pallon. The water will be melted from the iceberg at the rate of R35 pounds of ice to one all of water. However, 4% of the fee will be los due to evaporation during transit The plan is to pick up million pounds of scebergs with each ship in Year 1. As water becomes more scarce. the consultants expect the cargo to increase by 10% in Year 2 and then by another 10% in Year 3, and by mother 10% in Year 4. The tax rate is 21%, and the required rate of return for this type of businesses is 11% per year. The majority of Iceman Ine's expenses are related to operating and maintaining the ship Variable costs (including gasoline, maintenance and repairs, insurance, hourly wages for the captain and Teck) we expected to be 50% of sume-year sales. Working capital requirements (including accounts receivable and inventory) we expected to be $200,000 in Your 0,10% of same-year sales in Years 1 to 4 and 50 in Year 5 Iceman Inc. will sign a fouryear lease for a slip in the Port of Long Beach at the rate of nat 5600.000 per year in cach of Yours through and this is expected to be the only fixed cost for the business 1) What is the after tax salvage value of the ships? Show your work in the spreadsheet (5 points) 2) Based on the assumptions in the attached case description, calculate the NPV of this project. Should your company accept the project? (12 points) 3) The last possibility that the consultants and in their report is that kemanne might face increased competition from desalination technologies in the 4th year of the project. There is a 30% chance that Iceman Inc. would need to cut their prices by 10 cents per gallon to sell the number of allons projected for year 4? What is the resulting expected" value of the NPV considering the two scarios? (points) Heference Trig Functions - vetendents Manager more O E NO H Com F 4 G 5 ch F10 WPS Promiu have soported more than 30 kinds of privileges Buy now and enjoy the first 7 days for free! B 1 Year 1 2 3 Revenue 4 Variable costs 5 Fixed costs 6 Depreciation 7 Taxable income 8 Taxes 9 Net Income 10 Depreciation 11 Operating CFS 12 13 Net Working Capital 14 Change in Net Working Capital 15 Capital Spending 16 After Tax Salvage Value 17 18 Free Cash Flows 19 Discounted Cash Flows 20 21 NPV 22 + NPV A Tax Savage Value Locabu TE W B mo D 2 F 1 E 3 H G 5 4 2 Capital Spending 3 Depreciation 4 Book Value 5 Sales Price 6 Gain 7 Taxes 8 After-tax CF 9 10 11 12 13 14 15 16 17 18 19 20 V Aerox Velut O W Iceman Inc. Your boss, Mr. Kuklinski, believes that Southom California will soon run short of water. One of the ramifications, other than widespread riting, is that there will be high demand for fresh potable water. He is considering starting an iceberg transport company named "feeman Indies this need and tus asked you to help him analyze the project The timeline for the proposed business is as follows: In Year (ie, this year), Me Kuklinski would acquire the necessary assets and set up operation. In Years 1, 2, , and 4, the business would be in full operation, shuttling chers from Alaska to Long Beach He plans to sell the ships at the end of Year 4 In Year 5 nothing will happen except he will collect all the cutstanding working capital. He will then move to Costa Rica, where they have plenty of water for both drinking and surfing Over the past year, Mr. Kulki has paid $200,000 to consultants to write a report with all the relevant figures for this project. This report suggests that he can purchase eight ships in Year Ofor $2,250,000 each Ships don't lose much value if they are well maintained, so it is expected that the lips will have a resale value of 2,000,000 at the end of Year 4. The ships are quite durable so they will be straight-line depreciated to er over 20 years The consulting report predicts that the company will be able to sell water $0.90 per pallon. The water will be melted from the iceberg at the rate of R35 pounds of ice to one all of water. However, 4% of the fee will be los due to evaporation during transit The plan is to pick up million pounds of scebergs with each ship in Year 1. As water becomes more scarce. the consultants expect the cargo to increase by 10% in Year 2 and then by another 10% in Year 3, and by mother 10% in Year 4. The tax rate is 21%, and the required rate of return for this type of businesses is 11% per year. The majority of Iceman Ine's expenses are related to operating and maintaining the ship Variable costs (including gasoline, maintenance and repairs, insurance, hourly wages for the captain and Teck) we expected to be 50% of sume-year sales. Working capital requirements (including accounts receivable and inventory) we expected to be $200,000 in Your 0,10% of same-year sales in Years 1 to 4 and 50 in Year 5 Iceman Inc. will sign a fouryear lease for a slip in the Port of Long Beach at the rate of nat 5600.000 per year in cach of Yours through and this is expected to be the only fixed cost for the business 1) What is the after tax salvage value of the ships? Show your work in the spreadsheet (5 points) 2) Based on the assumptions in the attached case description, calculate the NPV of this project. Should your company accept the project? (12 points) 3) The last possibility that the consultants and in their report is that kemanne might face increased competition from desalination technologies in the 4th year of the project. There is a 30% chance that Iceman Inc. would need to cut their prices by 10 cents per gallon to sell the number of allons projected for year 4? What is the resulting expected" value of the NPV considering the two scarios? (points) Heference Trig Functions - vetendents Manager more O E NO H Com F 4 G 5 ch F10 WPS Promiu have soported more than 30 kinds of privileges Buy now and enjoy the first 7 days for free! B 1 Year 1 2 3 Revenue 4 Variable costs 5 Fixed costs 6 Depreciation 7 Taxable income 8 Taxes 9 Net Income 10 Depreciation 11 Operating CFS 12 13 Net Working Capital 14 Change in Net Working Capital 15 Capital Spending 16 After Tax Salvage Value 17 18 Free Cash Flows 19 Discounted Cash Flows 20 21 NPV 22 + NPV A Tax Savage Value Locabu TE W B mo D 2 F 1 E 3 H G 5 4 2 Capital Spending 3 Depreciation 4 Book Value 5 Sales Price 6 Gain 7 Taxes 8 After-tax CF 9 10 11 12 13 14 15 16 17 18 19 20 V Aerox Velut O W