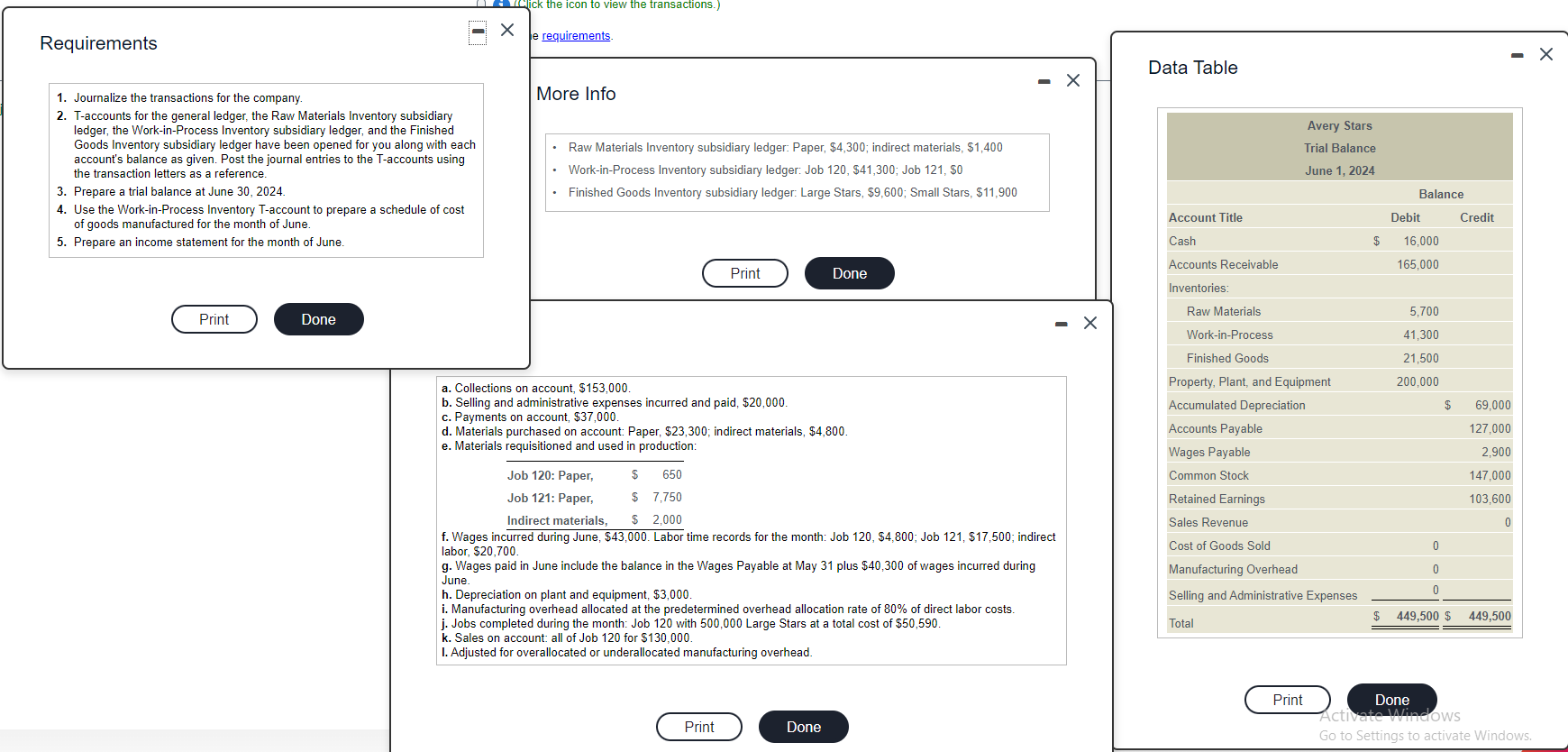

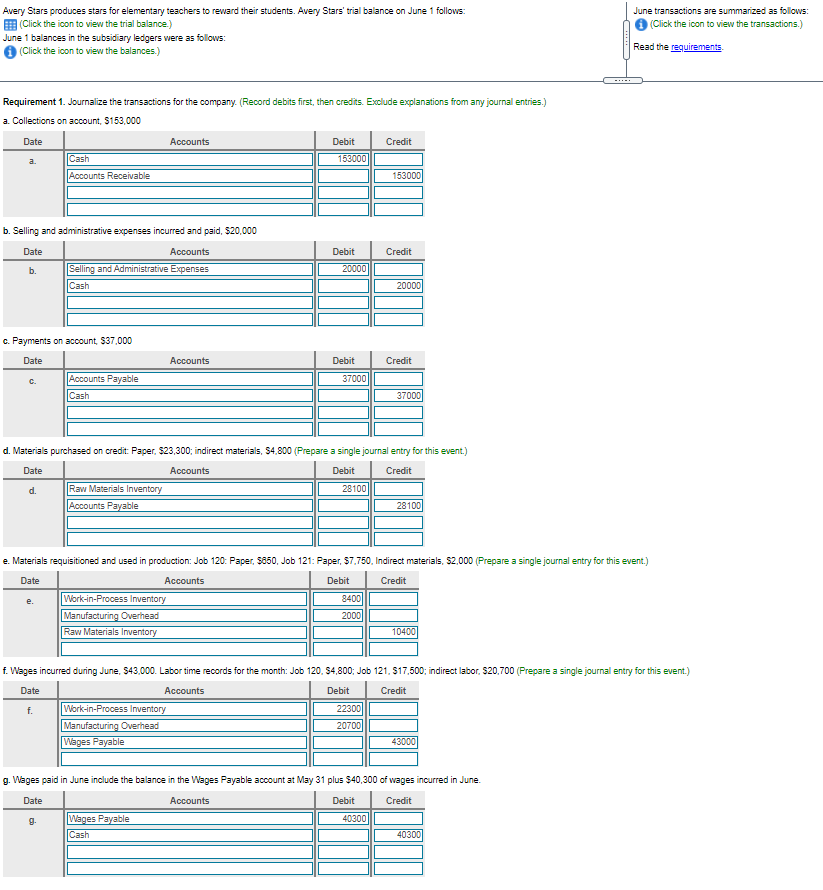

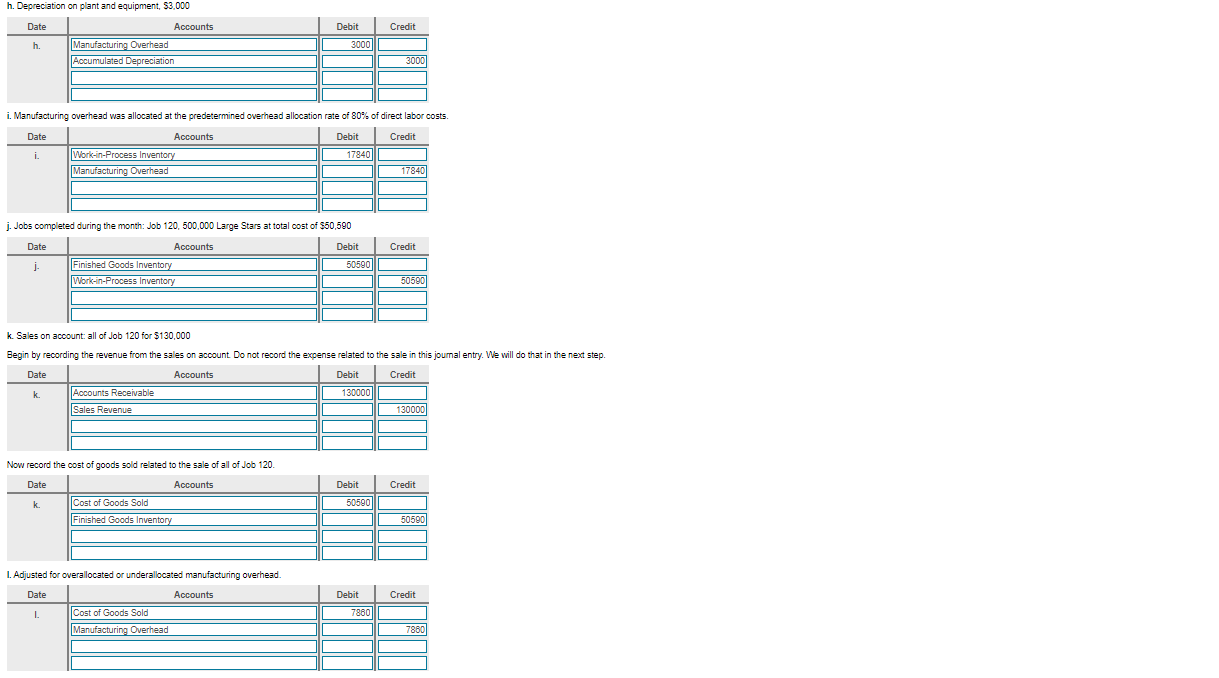

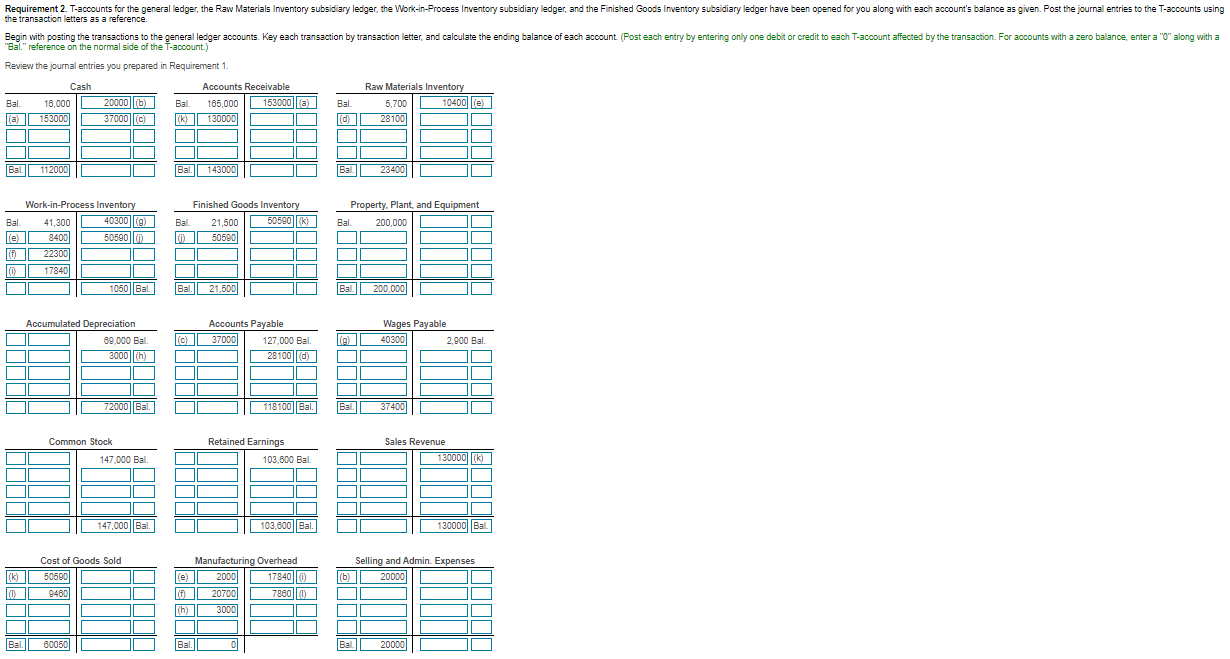

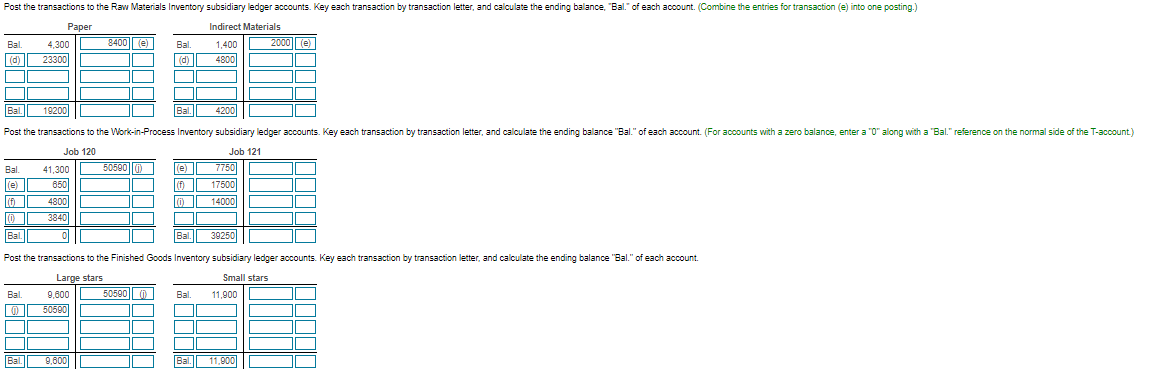

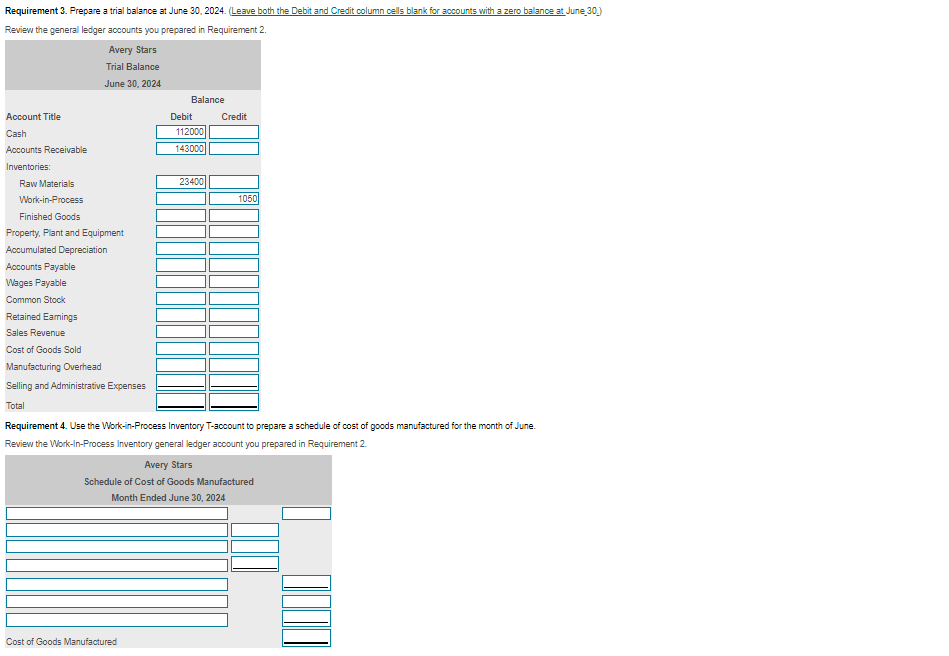

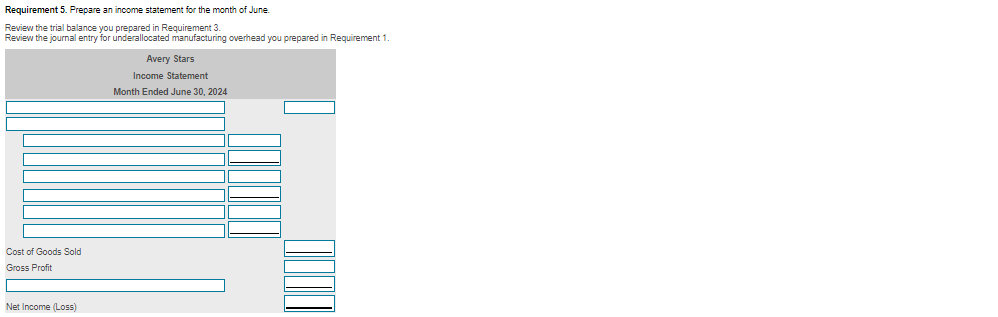

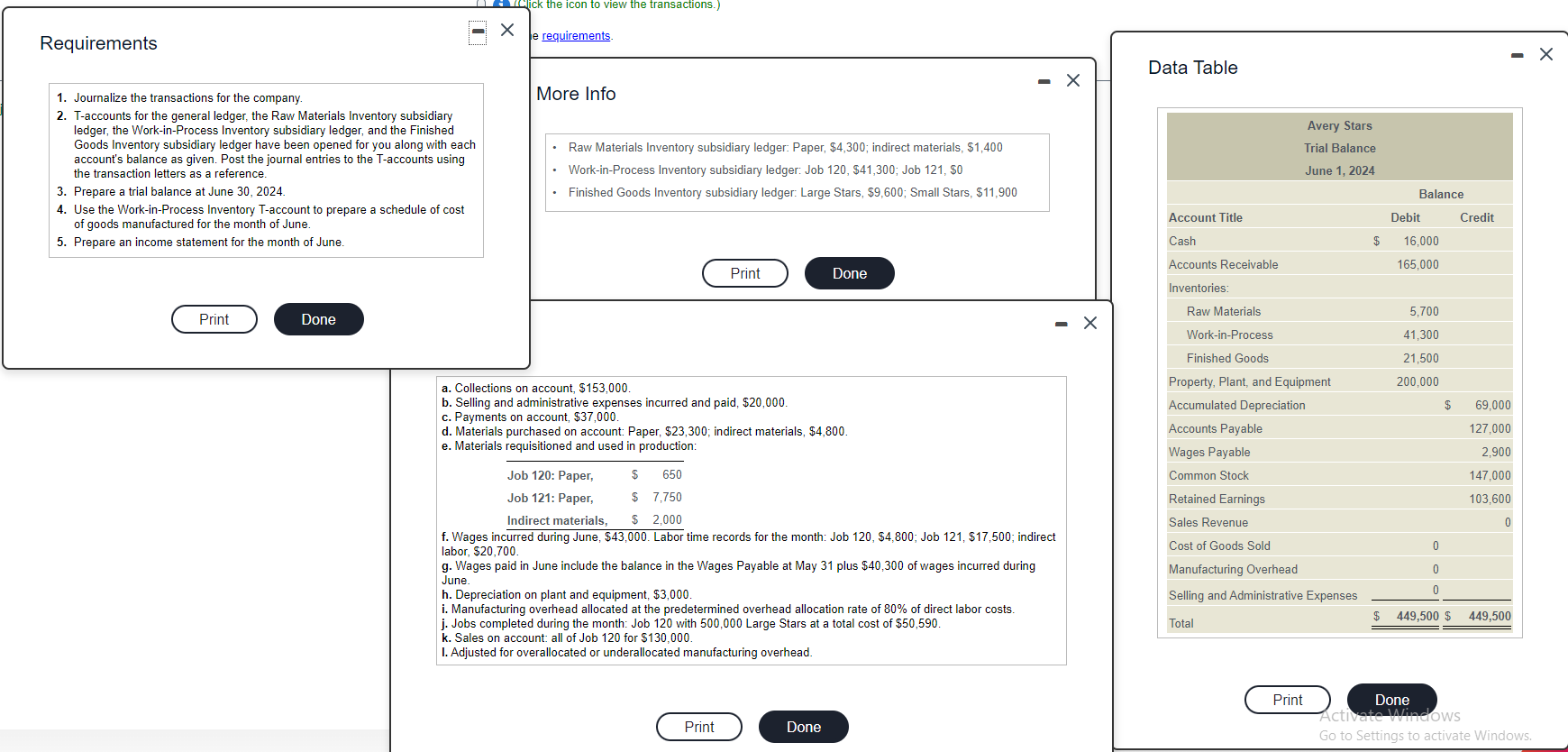

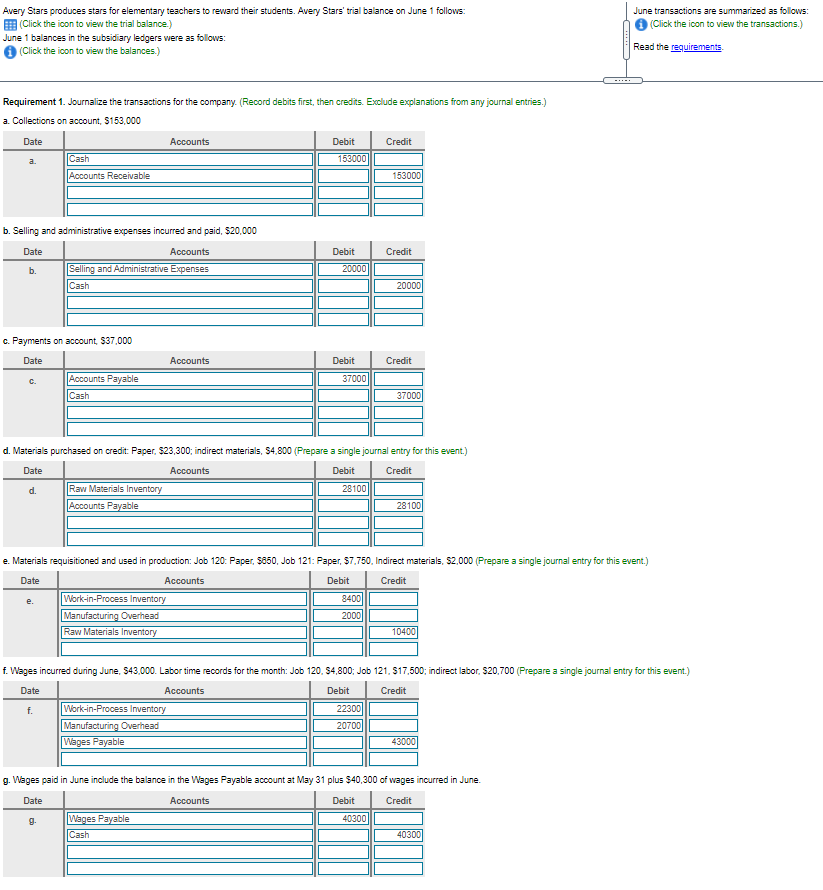

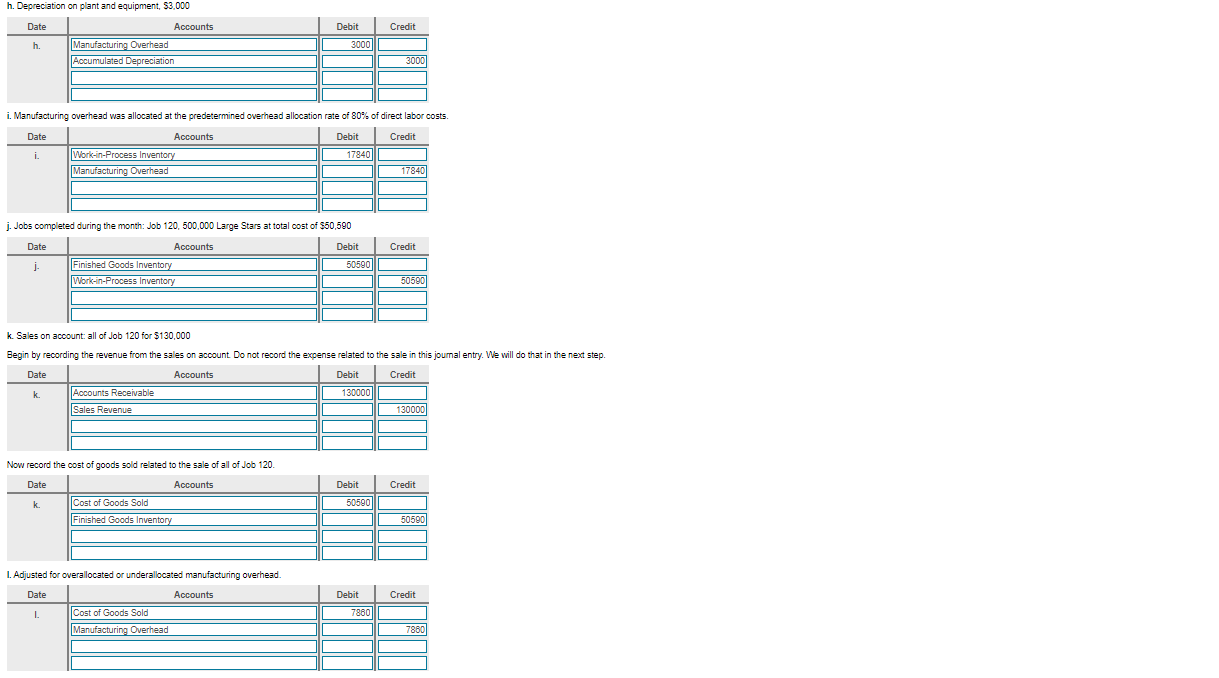

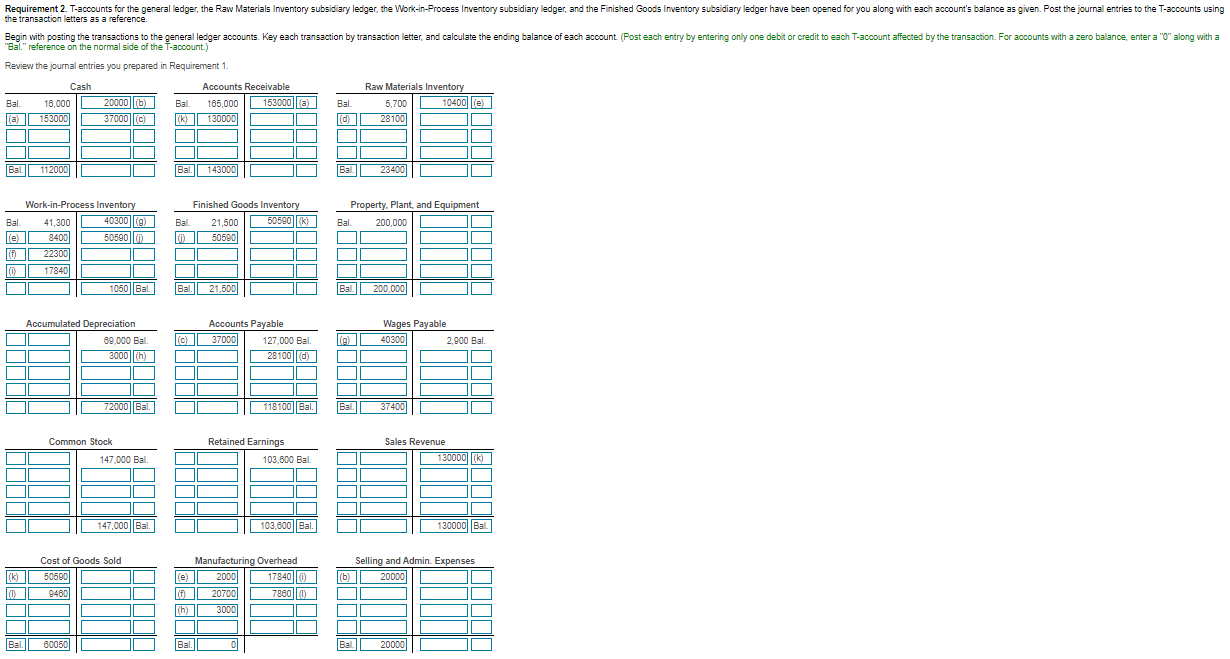

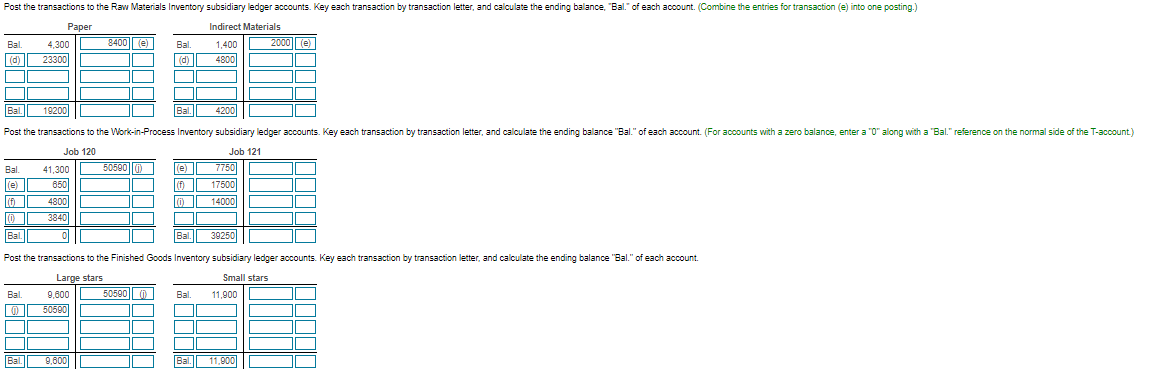

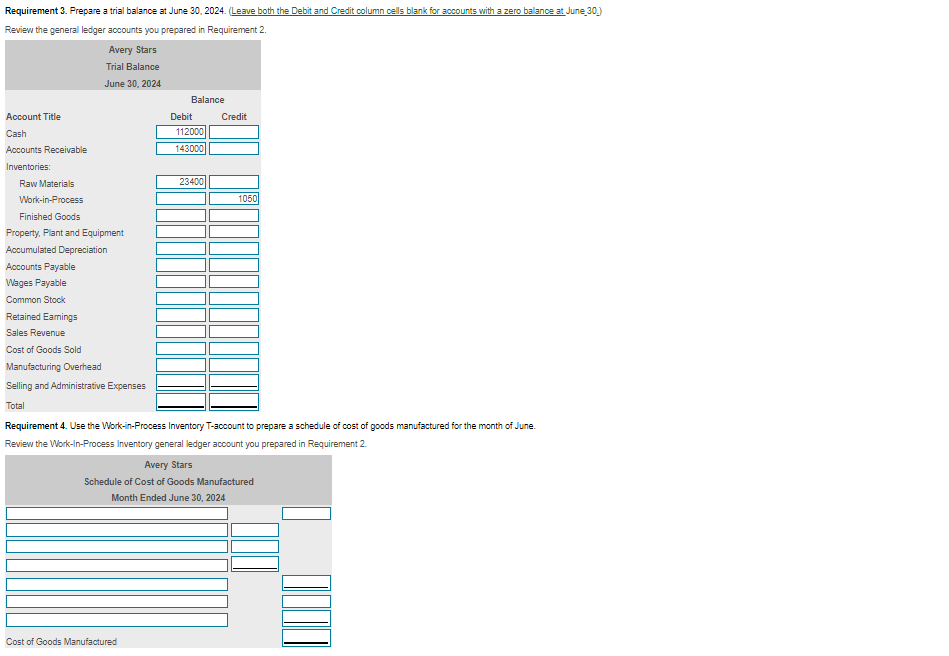

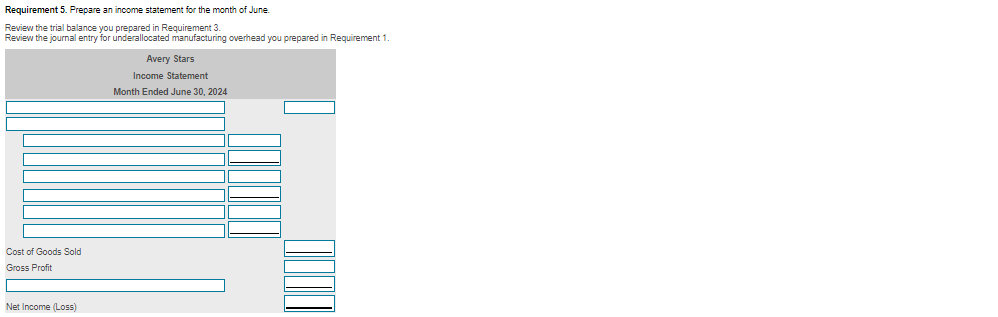

ick the icon to view the transactions.) e requirements Requirements - X Data Table - X More Info 1. Journalize the transactions for the company. 2. T-accounts for the general ledger, the Raw Materials Inventory subsidiary ledger, the Work-in-Process Inventory subsidiary ledger, and the Finished Goods Inventory subsidiary ledger have been opened for you along with each account's balance as given. Post the journal entries to the T-accounts using the transaction letters as a reference. 3. Prepare a trial balance at June 30, 2024. 4. Use the Work-in-Process Inventory T-account to prepare a schedule of cost of goods manufactured for the month of June. 5. Prepare an income statement for the month of June. Raw Materials Inventory subsidiary ledger: Paper, $4,300; indirect materials, $1,400 Work-in-Process Inventory subsidiary ledger: Job 120, $41,300; Job 121, 50 Finished Goods Inventory subsidiary ledger: Large Stars, $9,600; Small Stars, $11,900 Avery Stars Trial Balance June 1, 2024 Balance Debit Credit Account Title Cash $ 16.000 Accounts Receivable 165,000 Print Done Inventories: Raw Materials 5,700 Print Done 41,300 21.500 200,000 Work-in-Process Finished Goods Property, Plant, and Equipment Accumulated Depreciation Accounts Payable Wages Payable $ a. Collections on account, $153,000. b. Selling and administrative expenses incurred and paid, $20,000. c. Payments on account, $37,000. d. Materials purchased on account: Paper, $23,300; indirect materials, $4,800. e. Materials requisitioned and used in production: 69,000 127,000 2,900 Common Stock 147,000 103,600 Retained Earnings Sales Revenue Cost of Goods Sold 0 0 Job 120: Paper, $ 650 Job 121: Paper, $ 7.750 Indirect materials, $ 2,000 f. Wages incurred during June, $43,000. Labor time records for the month: Job 120, 54,800; Job 121, $17,500; indirect labor, $20,700 g. Wages paid in June include the balance in the Wages Payable at May 31 plus $40,300 of wages incurred during June h. Depreciation on plant and equipment, $3,000. i. Manufacturing overhead allocated at the predetermined overhead allocation rate of 80% of direct labor costs. j. Jobs completed during the month: Job 120 with 500,000 Large Stars at a total cost of $50,590. k. Sales on account: all of Job 120 for $130,000. 1. Adjusted for overallocated or underallocated manufacturing overhead. Manufacturing Overhead 0 0 Selling and Administrative Expenses $ 449,500 $ 449,500 Total Print Done Activate Windows Go to Settings to activate Windows. Print Done Avery Stars produces stars for elementary teachers to reward their students. Avery Stars' trial balance on June 1 follows: (Click the icon to view the trial balance) June 1 balances in the subsidiary ledgers were as follows: (Click the icon to view the balances.) June transactions are summarized as follows: (Click the icon to view the transactions.) Read the requirements THE Requirement 1. Journalize the transactions for the company. (Record debits first, then credits. Exclude explanations from any journal entries.) a Collections on account, S153,000 Date Accounts Debit Credit a. Cash 153000 Accounts Receivable 153000 b. Selling administrative expenses incurred paid, $20.000 Date Credit Accounts Selling and Administrative Expenses Cash Debit 20000 b. 20000 c. Payments on account, $37.000 Date Accounts Credit Debit 37000 c. Accounts Payable Cash 37000 d. Materiais purchased on credit: Paper. 523,300; indirect materials, 54.800 (Prepare a single journal entry for this event.) Date Accounts Debit Credit d. Raw Materials Inventory 28100 Accounts Payable 281001 Date e. Materials requisitioned and used in production: Job 120: Paper, 5050, Job 121: Paper, 57.750. Indirect materials, $2.000 (Prepare a single journal entry for this event.) Accounts Debit Credit Work-in-Process Inventory 8400 Manufacturing Overhead 2000 Raw Materials Inventory 10400 e. f. Wages incurred during June 543.000. Labor time records for the month: Job 120.54,800: Job 121,517,500; indirect labor. $20,700 (Prepare a single journal entry for this event.) Date Accounts Debit Credit f. Work-in-Process Inventory 22300 Manufacturing Overhead 20700 Wages Payable 43000 g. Wages paid in June include the balance in the Wages Payable account at May 31 plus $40,300 of wages incurred in June. Date Accounts Credit Debit 40300 g Wages Payable Cash 40300 h. Depreciation on plant and equipment, $3.000 Date Accounts Credit Debit 3000 h. Manufacturing Overhead Accumulated Depreciation 3000 i. Manufacturing overhead was allocated at the predetermined overhead allocation rate of 80% of direct labor costs. Date Credit Accounts Work-in-Process Inventory Manufacturing Overhead Debit 17840 i. 17840 j. Jobs completed during the month Job 120, 500,000 Large Stars at total cost of $50,590 , Date Accounts Debit j Finished Goods Inventory 50590 Work-in-Process Inventory Credit 50590 k. Sales on account: all of Job 120 for $130,000 Begin by recording the revenue from the sales on account Do not record the expense related to the sale in this journal entry. We will do that in the next step. Date Accounts Debit Credit k. Accounts Receivable 130000 Sales Revenue 130000 Credit Now record the cost of goods sold related to the sale of all of Job 120. Date Accounts k. Cost of Goods Sold Finished Goods Inventory Debit 50590 50500 1. Adjusted for overallocated or underallocated manufacturing overhead Date Debit Credit L Accounts Cost of Goods Sold Manufacturing Overhead 7860 7860) Requirement 2. T-accounts for the general ledger, the Raw Materials Inventory subsidiary ledger, the Work-in-Process Inventory subsidiary ledger, and the Finished Goods Inventory subsidiary ledger have been opened for you along with each account's balance as given. Post the journal entries to the T-accounts using the transaction letters as a reference. Begin with posting the transactions to the general ledger accounts. Key each transaction by transaction letter, and calculate the ending balance of each account (Post each entry by entering only one debitor credit to each T-account affected by the transaction. For accounts with a zero balance, enter a "0" along with a "Bal" reference on the normal side of the T-account.) Review the journal entries you prepared in Requirement 1. Cash Bal 16,000 153000 20000l (b) 37000 (c) Accounts Receivable Bal 165,000 153000|| (a) (k) || 130000 Bal lid d) Raw Materials Inventory 5,700 10400|lie) 28100 la Bal 112000] Bal. 143000 Bali 234001 Bal Work-in-Process Inventory 41,300 40300 g) 8400 505000) Property, Plant, and Equipment Bal 200,000 Bal 1 0) Finished Goods Inventory 21,500 50590K) 50500 (e) if 22300 17840 60 D 1050 || Bal Bal.21.500 Bal 200,000 Accumulated Depreciation 69,000 Bal 3000 (h) Accounts Payable (c) N 37000 127,000 Bal. 28100|d) Wages Payable 403001 2,900 Bal (g) ) 1 72000 Bal. 118100 Bal. Bal 37400 Common Stock 147,000 Bal TIN Retained Earnings 103,600 Bal. Sales Revenue 130000k) IN IN 103,600 || Bal. 147.000|| Bal 130000 Ball Cost of Goods Sold 50500 94601 Selling and Admin. Expenses . 20000 (k) ( (0) (b) (e) (1) (h) Manufacturing Overhead 2000 178400 207001 78600) 3000 Bal. 60050 Bal. Bal 20000 Post the transactions to the Raw Materials Inventory subsidiary ledger accounts. Key each transaction by transaction letter, and calculate the ending balance, "Bal." of each account. (Combine the entries for transaction (e) into one posting.) Bal Paper 4,300 23300 8400 || ) Ball (d) Indirect Materials 1,400 2000|| (e) 4800 (d) Bal. 192001 Ball 4200 505906 Post the transactions to the Work-in-Process Inventory subsidiary ledger accounts. Key each transaction by transaction letter, and calculate the ending balance "Bal" of each account. (For accounts with a zero balance, enter a "0" along with a "Bal" reference on the normal side of the T-account) Job 120 Job 121 Bal. 41,300 (e) 7750 le 650 (f) 17500 (+1 48001 (0) 14000 100 0 3840 Bal. Bal 39250 Post the transactions to the Finished Goods Inventory subsidiary ledger accounts. Key each transaction by transaction letter, and calculate the ending balance "Bal." of each account. Large stars Small stars Bal 9.600 50590|| 0 Bal. 11.900 0 50590 Bal. 9,600 Bal.11,000 Requirement 3. Prepare a trial balance at June 30, 2024. Leave both the Debit and Credit column cells blank for accounts with a zero balance at June 30.) Review the general ledger accounts you prepared in Requirement 2. Avery Stars Trial Balance June 30, 2024 Balance Account Title Debit Credit Cash 112000 Accounts Receivable 143000 Inventories: Raw Materials 23400 Work-in-Process 1050 Finished Goods Property. Plant and Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Eamings Sales Revenue Cost of Goods Sold Manufacturing Overhead Selling and Administrative Expenses Total Requirement 4. Use the Work-in-Process Inventory T-account to prepare a schedule of cost of goods manufactured for the month of June. Review the Work-In-Process Inventory general ledger account you prepared in Requirement 2 Avery Stars Schedule of Cost of Goods Manufactured Month Ended June 30, 2024 Cost of Goods Manufactured Requirement 5. Prepare an income statement for the month of June. Review the trial balance you prepared in Requirement 3. Review the journal entry for underallocated manufacturing overhead you prepared in Requirement 1. Avery Stars Income Statement Month Ended June 30, 2024 Cost of Goods Sold Gross Profit Net Income Loss) M