Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ICoug, Inc. (henceforth the company') is an American robot vacuum retailer located in Pullman, WA. ICoug had gained recognition for its quality products and

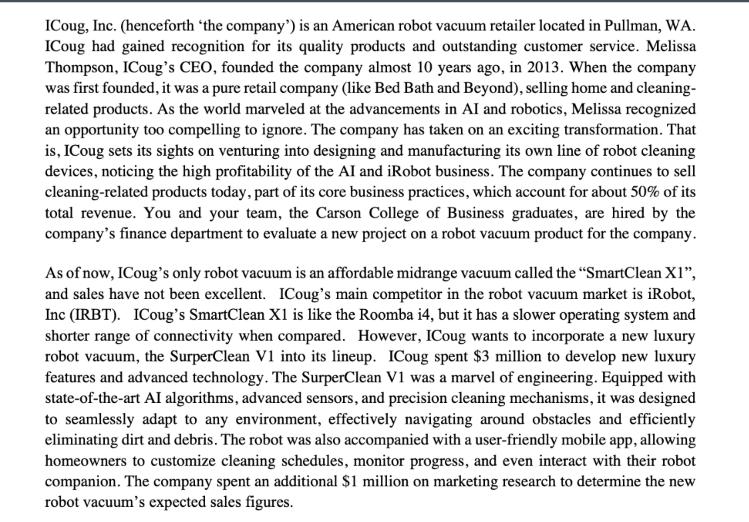

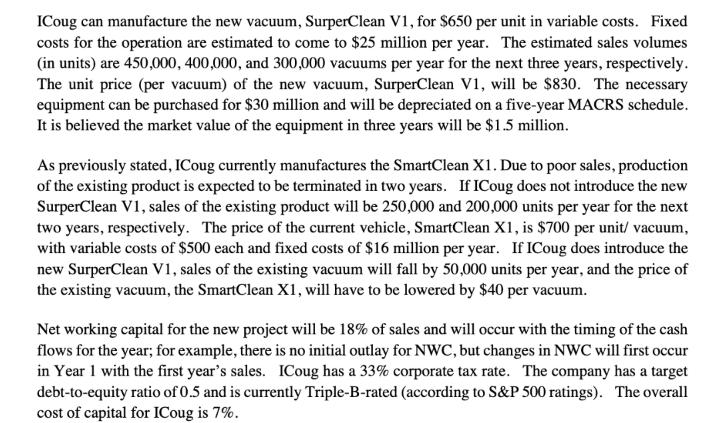

ICoug, Inc. (henceforth the company') is an American robot vacuum retailer located in Pullman, WA. ICoug had gained recognition for its quality products and outstanding customer service. Melissa Thompson, ICoug's CEO, founded the company almost 10 years ago, in 2013. When the company was first founded, it was a pure retail company (like Bed Bath and Beyond), selling home and cleaning- related products. As the world marveled at the advancements in AI and robotics, Melissa recognized an opportunity too compelling to ignore. The company has taken on an exciting transformation. That is, ICoug sets its sights on venturing into designing and manufacturing its own line of robot cleaning devices, noticing the high profitability of the AI and iRobot business. The company continues to sell cleaning-related products today, part of its core business practices, which account for about 50% of its total revenue. You and your team, the Carson College of Business graduates, are hired by the company's finance department to evaluate a new project on a robot vacuum product for the company. As of now, ICoug's only robot vacuum is an affordable midrange vacuum called the "SmartClean X1", and sales have not been excellent. ICoug's main competitor in the robot vacuum market is iRobot, Inc (IRBT). ICoug's SmartClean X1 is like the Roomba i4, but it has a slower operating system and shorter range of connectivity when compared. However, ICoug wants to incorporate a new luxury robot vacuum, the SurperClean V1 into its lineup. ICoug spent $3 million to develop new luxury features and advanced technology. The SurperClean V1 was a marvel of engineering. Equipped with state-of-the-art AI algorithms, advanced sensors, and precision cleaning mechanisms, it was designed to seamlessly adapt to any environment, effectively navigating around obstacles and efficiently eliminating dirt and debris. The robot was also accompanied with a user-friendly mobile app, allowing homeowners to customize cleaning schedules, monitor progress, and even interact with their robot companion. The company spent an additional $1 million on marketing research to determine the new robot vacuum's expected sales figures. ICoug can manufacture the new vacuum, SurperClean V1, for $650 per unit in variable costs. Fixed costs for the operation are estimated to come to $25 million per year. The estimated sales volumes (in units) are 450,000, 400,000, and 300,000 vacuums per year for the next three years, respectively. The unit price (per vacuum) of the new vacuum, SurperClean V1, will be $830. The necessary equipment can be purchased for $30 million and will be depreciated on a five-year MACRS schedule. It is believed the market value of the equipment in three years will be $1.5 million. As previously stated, ICoug currently manufactures the SmartClean X1. Due to poor sales, production of the existing product is expected to be terminated in two years. If ICoug does not introduce the new SurperClean V1, sales of the existing product will be 250,000 and 200,000 units per year for the next two years, respectively. The price of the current vehicle, SmartClean X1, is $700 per unit/ vacuum, with variable costs of $500 each and fixed costs of $16 million per year. If ICoug does introduce the new SurperClean V1, sales of the existing vacuum will fall by 50,000 units per year, and the price of the existing vacuum, the SmartClean X1, will have to be lowered by $40 per vacuum. Net working capital for the new project will be 18% of sales and will occur with the timing of the cash flows for the year; for example, there is no initial outlay for NWC, but changes in NWC will first occur in Year 1 with the first year's sales. ICoug has a 33% corporate tax rate. The company has a target debt-to-equity ratio of 0.5 and is currently Triple-B-rated (according to S&P 500 ratings). The overall cost of capital for ICoug is 7%. The finance department of the company has asked you to prepare a report for Melissa, the company's CEO, and the report should answer the following questions. QUESTIONS 1. Can you prepare the income statement and the total cash flow (CFFA) table for this new project? 2. Please use these tables to help explain to Melissa the relevant and irrelevant cash flows of this project? 3. The company's CEO, Melissa, wants to understand the risk of the robot vacuum industry better. Since ICoug's main competitor, iRobot, Inc (IRBT), is a leading company in this industry, Melissa asks you to perform the following analysis on IRBT. a. Using the past N years of weekly data (ending in December 2022), estimate your own beta and alpha of IRBT based on a regression analysis. Document the data sources used. Also, explain how long a period (from which year to which year) you decide to use to perform your estimation, and explain why? b. Provide your beta and alpha estimates, as well as the statistical significance (e.g., t ratio, or p-value). Comment briefly. c. Plot the security characteristic line for this company, and clearly show alpha and beta on the diagram. Is the company correctly priced, overpriced, or underpriced? d. From the above analysis, can you explain to Melissa the risk characteristics of IRBT and the robot vacuum industry using the beta you estimated? Do you think your estimated beta makes sense given the nature of the company and the industry?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Income Statement for the New Project Year Sales Revenue Variable Costs Fixed Costs Depreciation EBIT Taxes 33 Net Income 1 373500000 292500000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started