I'd appreciate any and all assistance on this problem. Thank you.

I'd appreciate any and all assistance on this problem. Thank you.

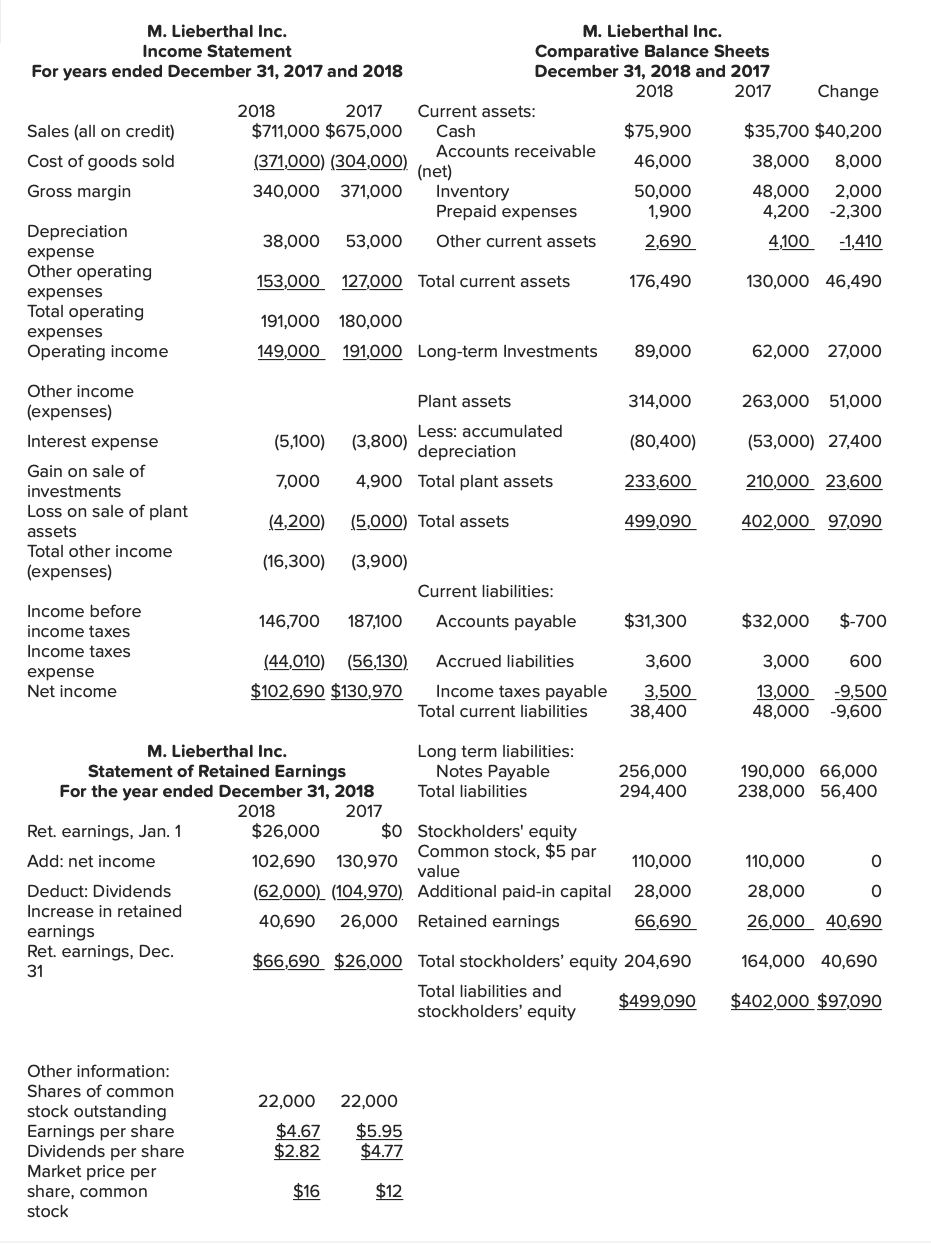

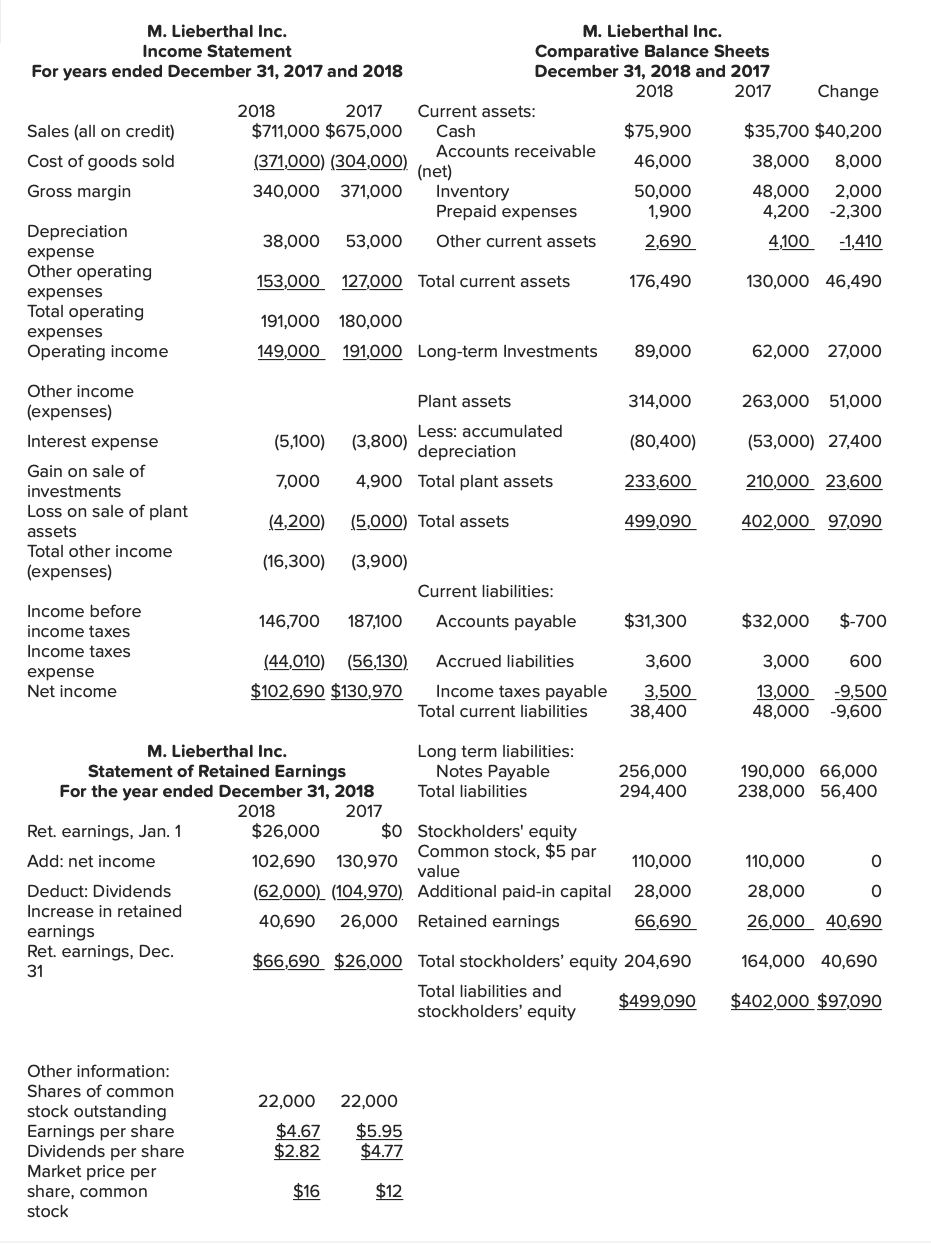

M. Lieberthal Inc. M. Lieberthal Inc. Income Statement Comparative Balance Sheets For years ended December 31, 2017 and 2018 December 31, 2018 and 2017 2018 2017 Change 2018 2017 Current assets: Sales (all on credit) $711,000 $675,000 Cash $75,900 $35,700 $40,200 Accounts receivable Cost of goods sold (371,000) (304,000) 46,000 38,000 8,000 (net) Gross margin 340,000 371,000 Inventory 50,000 48,000 2,000 Prepaid expenses 1,900 4,200 -2,300 Depreciation 38,000 53,000 Other current assets 2,690 4,100 -1,410 expense Other operating 153,000 127,000 Total current assets 176,490 130,000 46,490 expenses Total operating 191,000 180,000 expenses Operating income 149,000 191,000 Long-term Investments 89,000 62,000 27,000 Plant assets 314,000 263,000 51,000 (5,100) (80,400) (53,000) 27,400 Other income (expenses) Interest expense Gain on sale of investments Loss on sale of plant assets Total other income (expenses) Less: accumulated (3,800) depreciation 4,900 Total plant assets 7,000 233,600 210,000 23,600 (4,200) (5,000) Total assets 499,090 402,000 97,090 (16,300) (3,900) Current liabilities: 146,700 187,100 Accounts payable $31,300 $32,000 $-700 Income before income taxes Income taxes expense Net income Accrued liabilities 3,600 3,000 600 (44,010) (56,130). $102,690 $130,970 Income taxes payable Total current liabilities 13,000 3,500 38,400 48,000 -9,500 -9,600 190,000 66,000 238,000 56,400 M. Lieberthal Inc. Long term liabilities: Statement of Retained Earnings Notes Payable 256,000 For the year ended December 31, 2018 Total liabilities 294,400 2018 2017 Ret. earnings, Jan. 1 $26,000 $0 Stockholders' equity Common stock, $5 par Add: net income 102,690 130,970 110,000 value Deduct: Dividends (62,000) (104,970). Additional paid-in capital 28,000 Increase in retained 40,690 26,000 Retained earnings 66,690 earnings Ret. earnings, Dec. $66,690 $26,000 Total stockholders' equity 204,690 31 Total liabilities and $499,090 stockholders' equity 110,000 0 28,000 0 26,000 40,690 164,000 40,690 $402,000 $97,090 22,000 22,000 Other information: Shares of common stock outstanding Earnings per share Dividends per share Market price per share, common stock $4.67 $2.82 $5.95 $4.77 $16 $12 Cash Horiz Horiz Vertic Vertic Ratios Flows Analysis Analysis Analysis Analysis Requirement Prepare the cash flows from operations section of M. Lieberthal Inc.'s 2018 statement of cash flows using the indirect method. Enter items to be subtracted as negative values. M. Lieberthal Inc. Cash Flows from Operating ActivitiesIndirect Method For Year Ended December 31, 2018 Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operations:

I'd appreciate any and all assistance on this problem. Thank you.

I'd appreciate any and all assistance on this problem. Thank you.