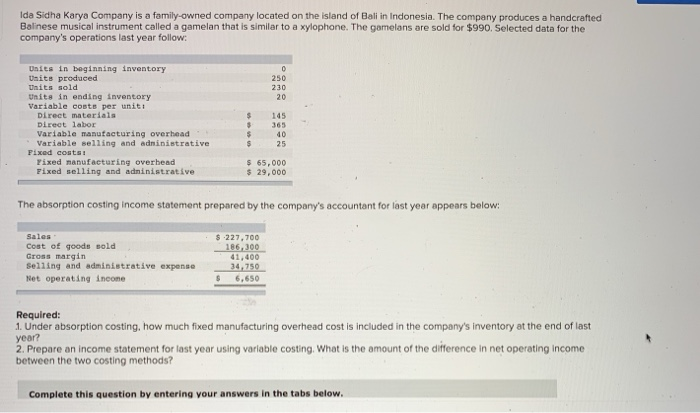

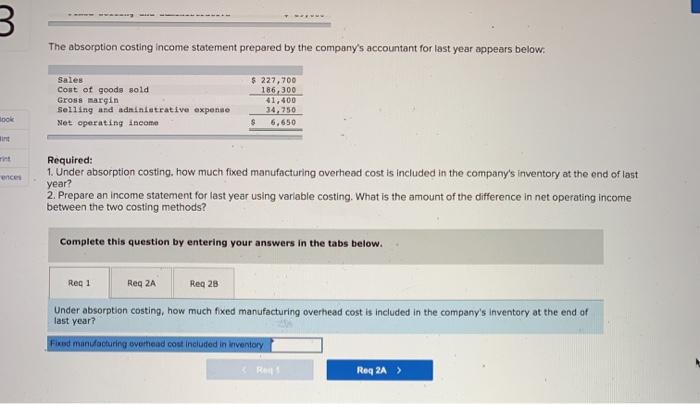

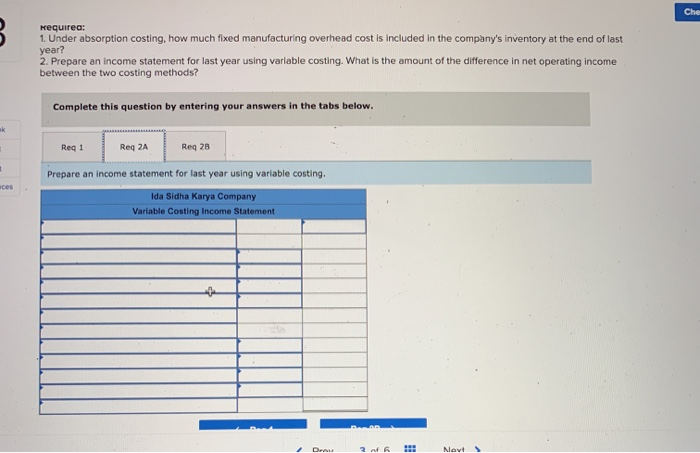

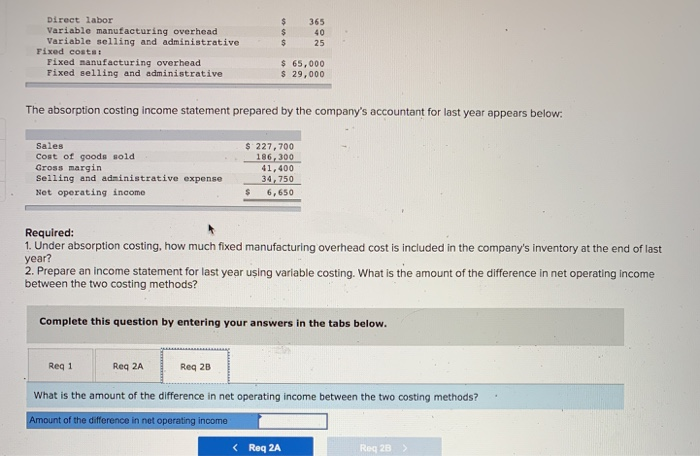

Ida Sidha Karya Company is a family-owned company located on the island of Ball in Indonesia. The company produces a handcrafted Balinese musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $990. Selected data for the company's operations last year follow: 0 250 230 20 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs: Yixed manufacturing overhead Fixed selling and administrative $ $ S $ 145 365 40 25 $ 65,000 $ 29,000 The absorption costing income statement prepared by the company's accountant for last year appears below: $ 227,700 186,300 Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income 34.750 6,650 S Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing. What is the amount of the difference in net operating Income between the two costing methods? Complete this question by entering your answers in the tabs below. 3 The absorption costing income statement prepared by the company's accountant for last year appears below. Sales Cost of goods sold Gross margin Selling and adninistrative expense Net operating income $ 227,700 186,300 41,400 34,750 $ 6,650 ook ences Required: 1. Under absorption costing. how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing. What is the amount of the difference in net operating income between the two costing methods? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? Fixed manufacturing overhead cost included in Inventory Reg Req2A) Che Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing. What is the amount of the difference in net operating income between the two costing methods? Complete this question by entering your answers in the tabs below. ak Reg 1 Req ZA Req 28 + Prepare an income statement for last year using variable costing. aces Ida Sidha Karya Company Variable Costing Income Statement Dr. 2 Navt $ $ $ 365 40 25 Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs: Fixed manufacturing overhead Fixed selling and administrative $ 65,000 $ 29,000 The absorption costing income statement prepared by the company's accountant for last year appears below: Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income $ 227,700 186,300 41,400 34,750 $ 6,650 Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing. What is the amount of the difference in net operating income between the two costing methods? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 2B What is the amount of the difference in net operating income between the two costing methods? Amount of the difference in net operating income