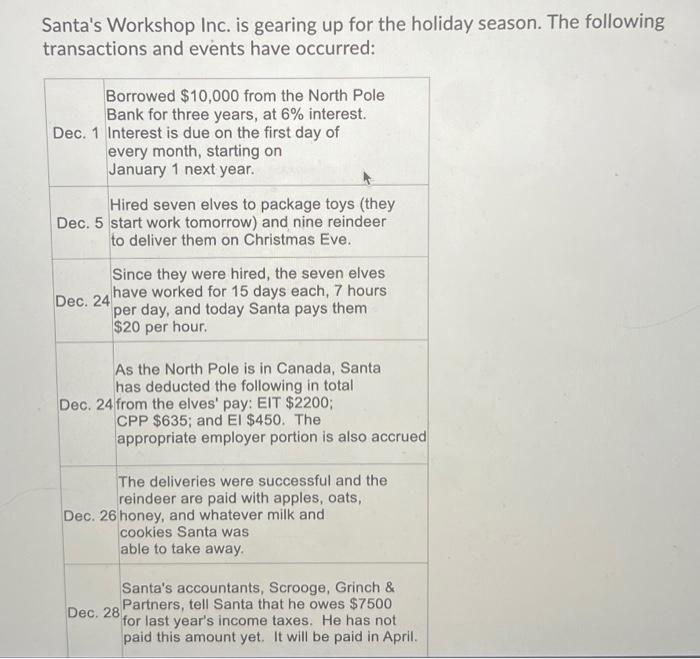

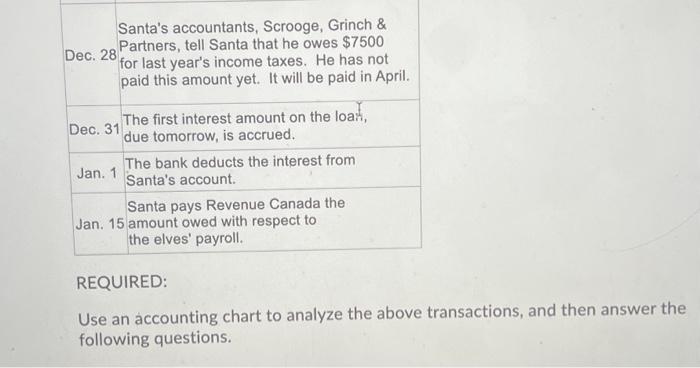

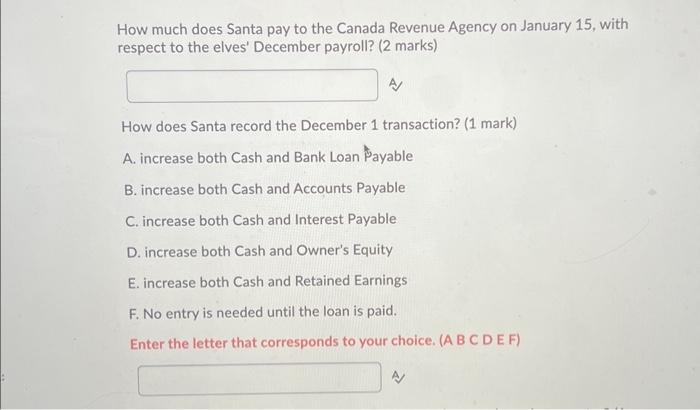

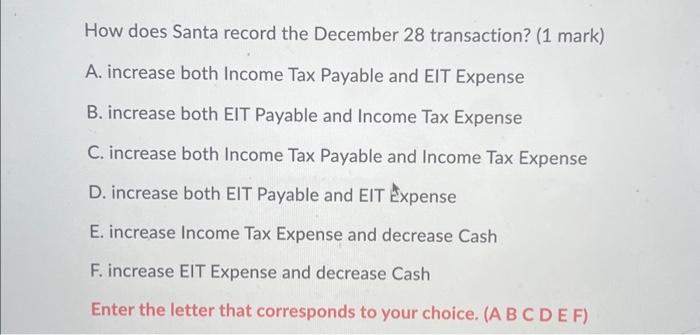

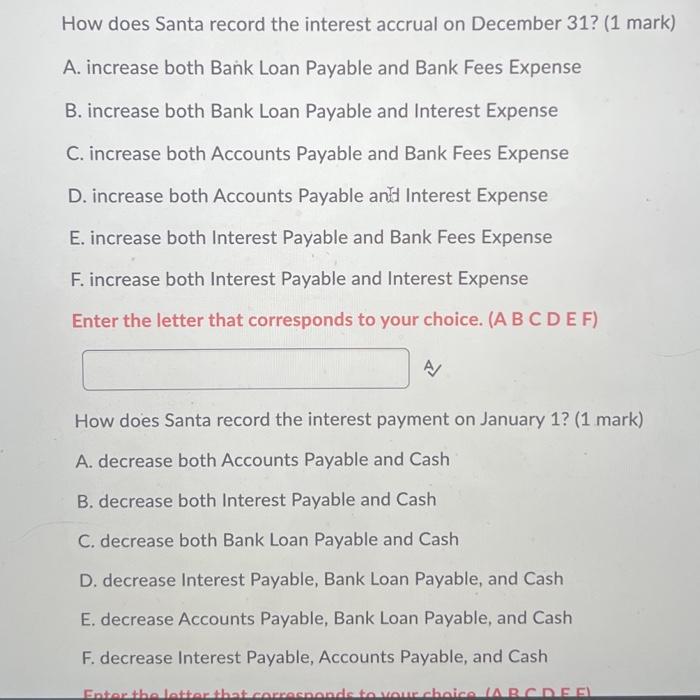

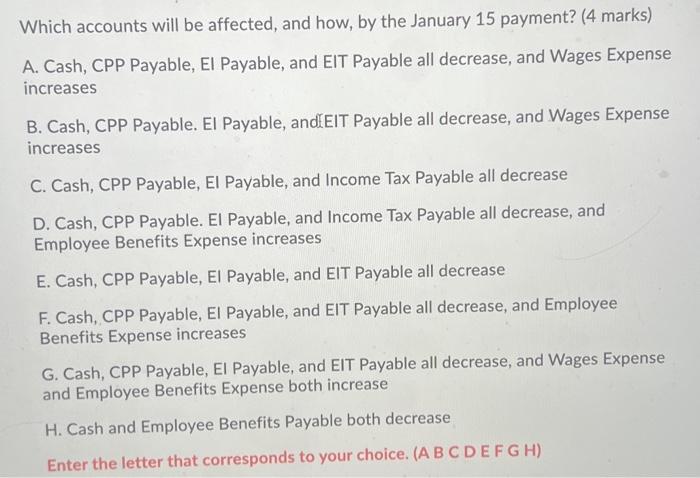

iday season. The following REQUIRED: Use an accounting chart to analyze the above transactions, and then answer the following questions. How much does Santa pay to the Canada Revenue Agency on January 15, with respect to the elves' December payroll? (2 marks) A How does Santa record the December 1 transaction? (1 mark) A. increase both Cash and Bank Loan Payable B. increase both Cash and Accounts Payable C. increase both Cash and Interest Payable D. increase both Cash and Owner's Equity E. increase both Cash and Retained Earnings F. No entry is needed until the loan is paid. Enter the letter that corresponds to your choice. (A B C D E F) How does Santa record the December 28 transaction? (1 mark) A. increase both Income Tax Payable and EIT Expense B. increase both EIT Payable and Income Tax Expense C. increase both Income Tax Payable and Income Tax Expense D. increase both EIT Payable and EIT Expense E. increase Income Tax Expense and decrease Cash F. increase EIT Expense and decrease Cash Enter the letter that corresponds to your choice. (A B C D E F) How does Santa record the interest accrual on December 31? (1 mark A. increase both Bankk Loan Payable and Bank Fees Expense B. increase both Bank Loan Payable and Interest Expense C. increase both Accounts Payable and Bank Fees Expense D. increase both Accounts Payable antid Interest Expense E. increase both Interest Payable and Bank Fees Expense F. increase both Interest Payable and Interest Expense Enter the letter that corresponds to your choice. (A B C D E F) How does Santa record the interest payment on January 1? (1 mark) A. decrease both Accounts Payable and Cash B. decrease both Interest Payable and Cash C. decrease both Bank Loan Payable and Cash D. decrease Interest Payable, Bank Loan Payable, and Cash E. decrease Accounts Payable, Bank Loan Payable, and Cash F. decrease Interest Payable, Accounts Payable, and Cash Which accounts will be affected, and how, by the January 15 payment? (4 marks) A. Cash, CPP Payable, EI Payable, and EIT Payable all decrease, and Wages Expense increases B. Cash, CPP Payable. EI Payable, and:EIT Payable all decrease, and Wages Expense increases C. Cash, CPP Payable, EI Payable, and Income Tax Payable all decrease D. Cash, CPP Payable. EI Payable, and Income Tax Payable all decrease, and Employee Benefits Expense increases E. Cash, CPP Payable, EI Payable, and EIT Payable all decrease F. Cash, CPP Payable, EI Payable, and EIT Payable all decrease, and Employee Benefits Expense increases G. Cash, CPP Payable, EI Payable, and EIT Payable all decrease, and Wages Expense and Employee Benefits Expense both increase H. Cash and Employee Benefits Payable both decrease Enter the letter that corresponds to your choice. (A B C D E F G H) iday season. The following REQUIRED: Use an accounting chart to analyze the above transactions, and then answer the following questions. How much does Santa pay to the Canada Revenue Agency on January 15, with respect to the elves' December payroll? (2 marks) A How does Santa record the December 1 transaction? (1 mark) A. increase both Cash and Bank Loan Payable B. increase both Cash and Accounts Payable C. increase both Cash and Interest Payable D. increase both Cash and Owner's Equity E. increase both Cash and Retained Earnings F. No entry is needed until the loan is paid. Enter the letter that corresponds to your choice. (A B C D E F) How does Santa record the December 28 transaction? (1 mark) A. increase both Income Tax Payable and EIT Expense B. increase both EIT Payable and Income Tax Expense C. increase both Income Tax Payable and Income Tax Expense D. increase both EIT Payable and EIT Expense E. increase Income Tax Expense and decrease Cash F. increase EIT Expense and decrease Cash Enter the letter that corresponds to your choice. (A B C D E F) How does Santa record the interest accrual on December 31? (1 mark A. increase both Bankk Loan Payable and Bank Fees Expense B. increase both Bank Loan Payable and Interest Expense C. increase both Accounts Payable and Bank Fees Expense D. increase both Accounts Payable antid Interest Expense E. increase both Interest Payable and Bank Fees Expense F. increase both Interest Payable and Interest Expense Enter the letter that corresponds to your choice. (A B C D E F) How does Santa record the interest payment on January 1? (1 mark) A. decrease both Accounts Payable and Cash B. decrease both Interest Payable and Cash C. decrease both Bank Loan Payable and Cash D. decrease Interest Payable, Bank Loan Payable, and Cash E. decrease Accounts Payable, Bank Loan Payable, and Cash F. decrease Interest Payable, Accounts Payable, and Cash Which accounts will be affected, and how, by the January 15 payment? (4 marks) A. Cash, CPP Payable, EI Payable, and EIT Payable all decrease, and Wages Expense increases B. Cash, CPP Payable. EI Payable, and:EIT Payable all decrease, and Wages Expense increases C. Cash, CPP Payable, EI Payable, and Income Tax Payable all decrease D. Cash, CPP Payable. EI Payable, and Income Tax Payable all decrease, and Employee Benefits Expense increases E. Cash, CPP Payable, EI Payable, and EIT Payable all decrease F. Cash, CPP Payable, EI Payable, and EIT Payable all decrease, and Employee Benefits Expense increases G. Cash, CPP Payable, EI Payable, and EIT Payable all decrease, and Wages Expense and Employee Benefits Expense both increase H. Cash and Employee Benefits Payable both decrease Enter the letter that corresponds to your choice. (A B C D E F G H)