Question

Ideal Ratios Differ for Companies in Different Industries Different industries have different normal ratios. For example, one would expect that a Foodland would have a

Ideal Ratios Differ for Companies in Different Industries

Different industries have different normal ratios. For example, one would expect that a Foodland would have a faster turnover of inventory since it is selling perishables while a steel mill would have slower inventory turnover since it takes a while to make its product and to ship its product.

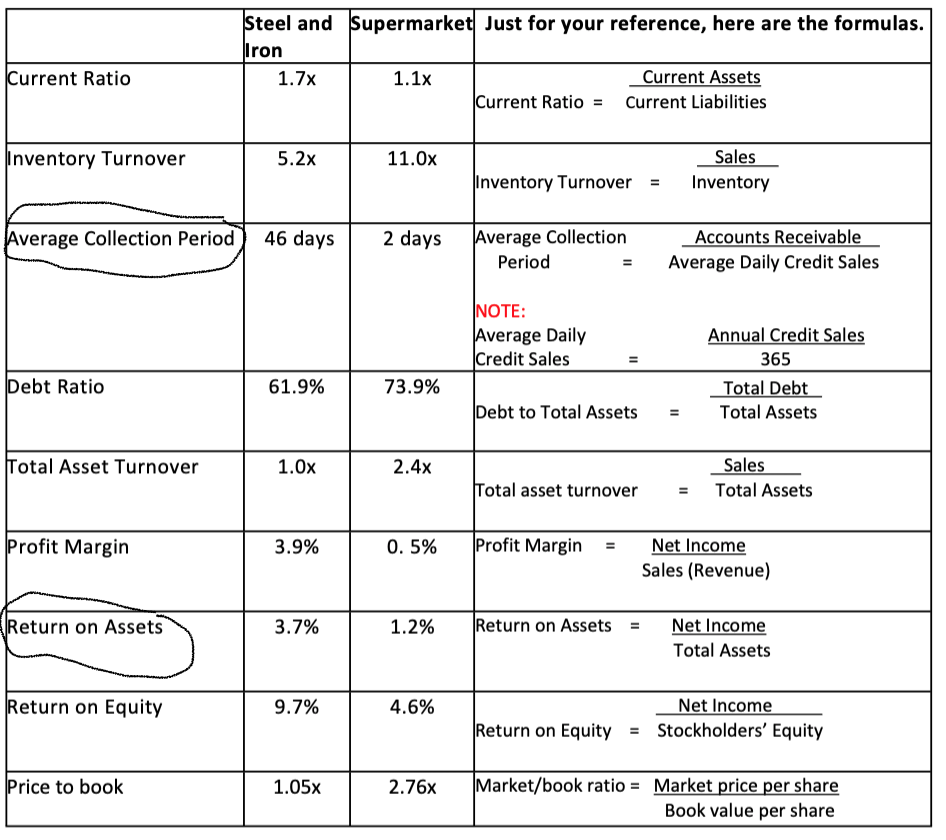

If you look at the ratios of the two companies in the table below, you will see this reflected in their different inventory turnover (11x for Foodland and 5x for the steel company).

This assignment asks you to explain some of the reasons for the differences in the ratios of a steel mill and a store like Foodland. In other words, you need to explain why a steel company would have a "normal" set of ratios that is different from a "normal" set for a supermarket.

Look at the table below at the ratios for the Steel Mill and Foodland Stores and explain as much as you can the reasons for the differences in their ratios. Assume that the ratios you see are all healthy ratios for companies in these two different industries. You are not looking for problems with the companies or to pick a winner. Instead, you are looking to explain why these two companies have normal ratios for their industries which differ from each other, as in my example above of the difference in inventory turnover ratios.

Explain your reasoning for the difference in each pair of ratios in the table below. There are eight ratios and you need to write at least one paragraph for each ratio pair (you do not need to write about the inventory turnover since I explained it above.) You will need to think carefully about the differences in each industry and about how each ratio is calculated to answer correctly.

= Only need help on the Average collection Period and Return on Assets please!! Thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started