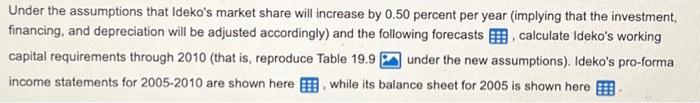

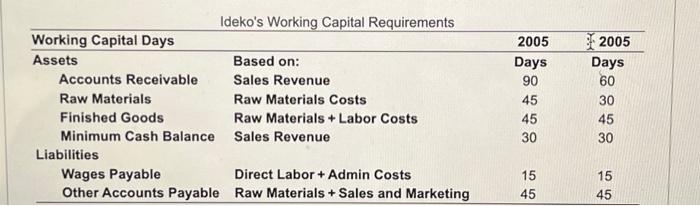

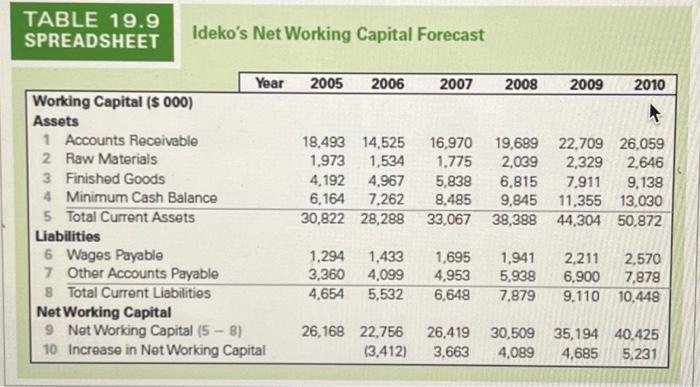

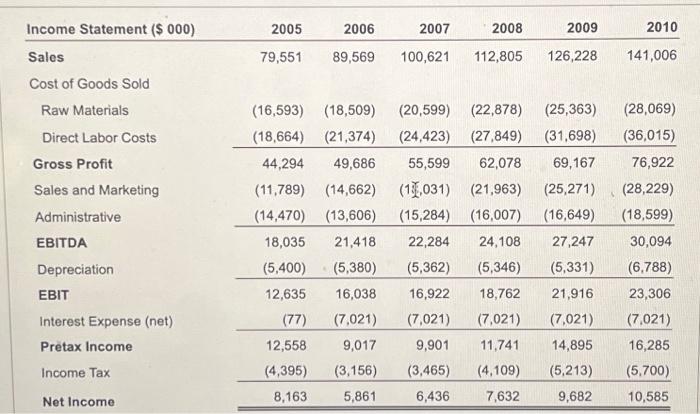

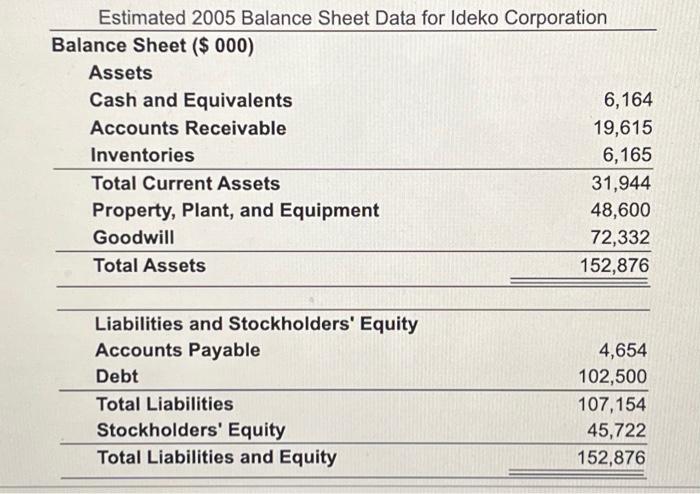

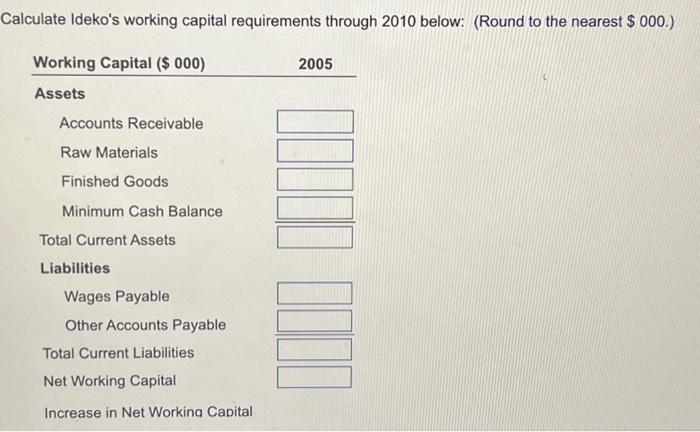

Ideko's Net Working Capital Forecast Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet (\$000) Assets Cash and Equivalents Accounts Receivable 6,164 Inventories 19,615 Total Current Assets 6,165 Property, Plant, and Equipment 48,600 Goodwill 72,332 Total Assets 152,876 Liabilities and Stockholders' Equity Accounts Payable 4,654 Debt 102,500 Total Liabilities 107,154 Stockholders' Equity 45,722 Total Liabilities and Equity 152,876 \begin{tabular}{llcc} \multicolumn{4}{c}{ Ideko's Working Capital Requirements } \\ \hline Working Capital Days & & 2005 & 2005 \\ \hline Assets & Based on: & Days & Days \\ Accounts Receivable & Sales Revenue & 90 & 60 \\ Raw Materials & Raw Materials Costs & 45 & 30 \\ Finished Goods & Raw Materials + Labor Costs & 45 & 45 \\ Minimum Cash Balance & Sales Revenue & 30 & 30 \\ Liabilities & & & \\ Wages Payable & Direct Labor + Admin Costs & 15 & 15 \\ Other Accounts Payable & Raw Materials + Sales and Marketing & 45 & 45 \\ \hline \end{tabular} Calculate Ideko's working capital requirements through 2010 below: (Round to the nearest $000.) Under the assumptions that Ideko's market share will increase by 0.50 percent per year (implying that the investment, financing, and depreciation will be adjusted accordingly) and the following forecasts , calculate Ideko's working capital requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). Ideko's pro-forma income statements for 2005-2010 are shown here while its balance sheet for 2005 is shown here \begin{tabular}{lrrrrrr} Income Statement ($000) & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \hline Sales & 79,551 & 89,569 & 100,621 & 112,805 & 126,228 & 141,006 \\ Cost of Goods Sold & & & & & & \\ Raw Materials & (16,593) & (18,509) & (20,599) & (22,878) & (25,363) & (28,069) \\ Direct Labor Costs & (18,664) & (21,374) & (24,423) & (27,849) & (31,698) & (36,015) \\ \cline { 2 - 8 } Gross Profit & 44,294 & 49,686 & 55,599 & 62,078 & 69,167 & 76,922 \\ Sales and Marketing & (11,789) & (14,662) & (10.031) & (21,963) & (25,271) & (28,229) \\ Administrative & (14,470) & (13,606) & (15,284) & (16,007) & (16,649) & (18,599) \\ EBITDA & 18,035 & 21,418 & 22,284 & 24,108 & 27,247 & 30,094 \\ Depreciation & (5,400) & (5,380) & (5,362) & (5,346) & (5,331) & (6,788) \\ EBIT & 12,635 & 16,038 & 16,922 & 18,762 & 21,916 & 23,306 \\ Interest Expense (net) & (77) & (7,021) & (7,021) & (7,021) & (7,021) & (7,021) \\ Pretax Income & 12,558 & 9,017 & 9,901 & 11,741 & 14,895 & 16,285 \\ Income Tax & (4,395) & (3,156) & (3,465) & (4,109) & (5,213) & (5,700) \\ Net Income & 8,163 & 5,861 & 6,436 & 7,632 & 9,682 & 10,585 \\ \hline \hline \end{tabular}