Question: Identified International Business issues in your case study Presented solutions in relation to the issues/challenges that you have identified Flipkart: journey of an Indian e-commerce

Identified International Business issues in your case study

Presented solutions in relation to the issues/challenges that you have identified

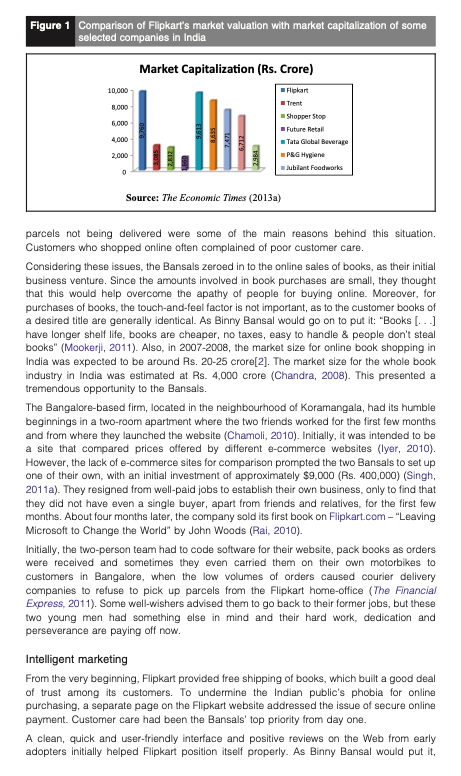

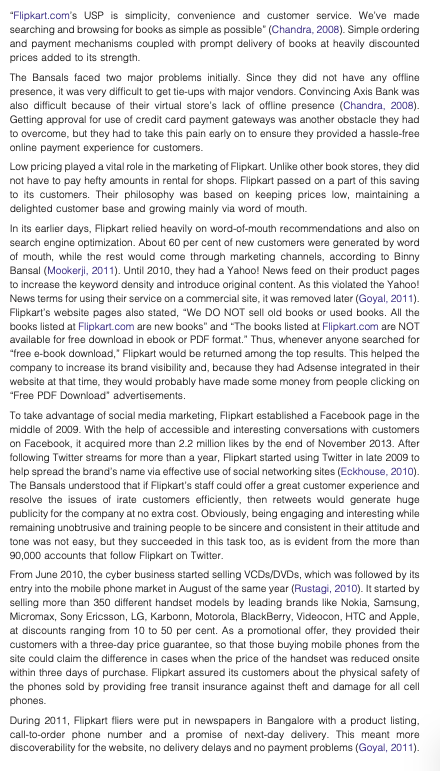

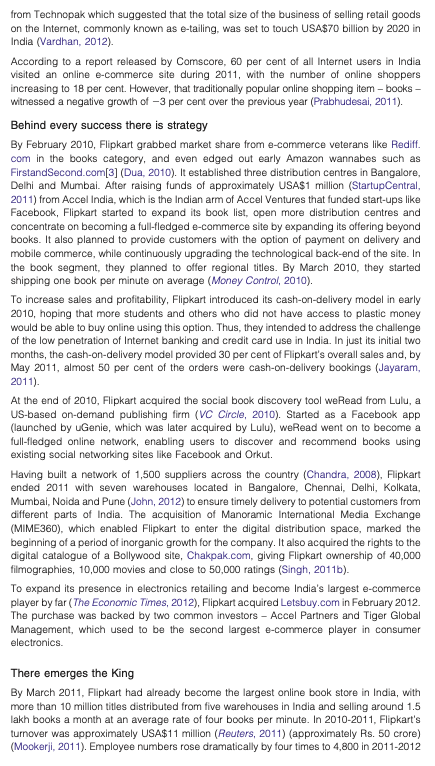

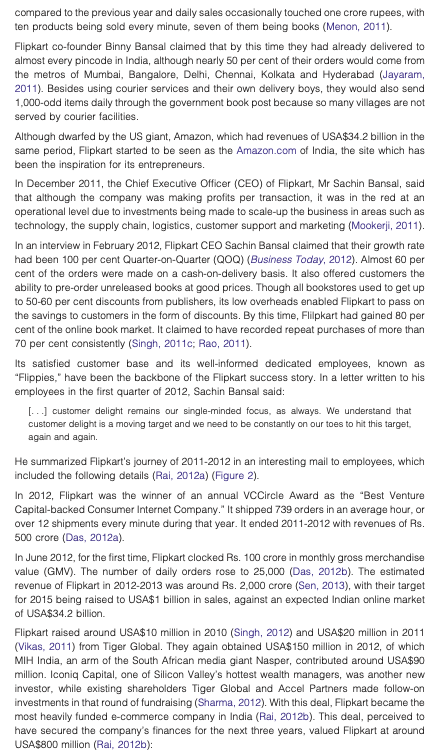

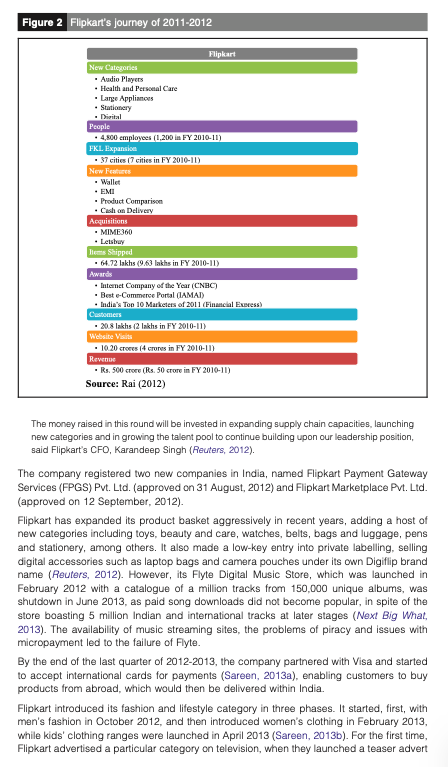

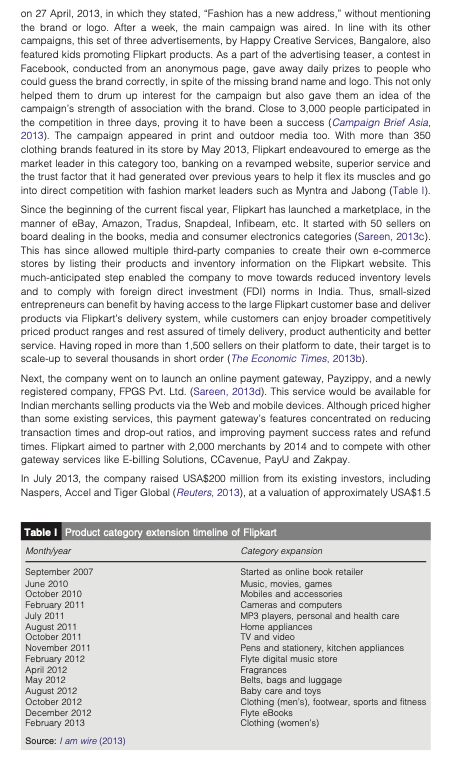

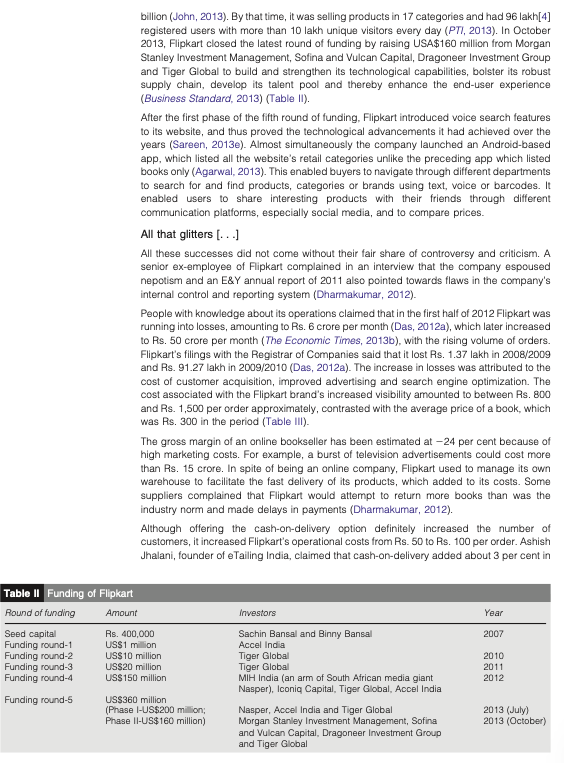

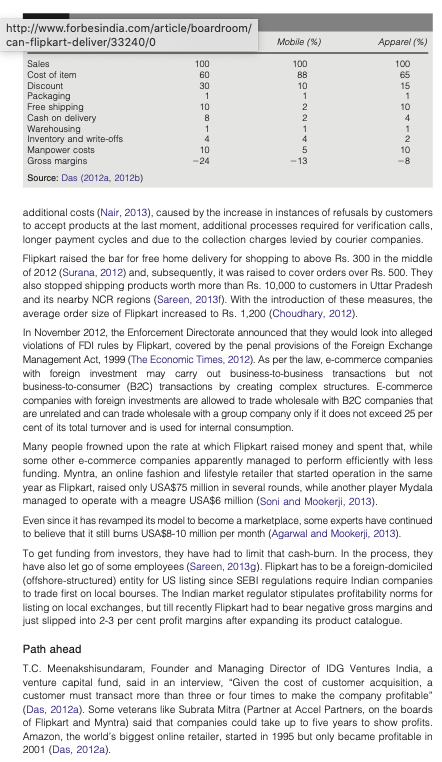

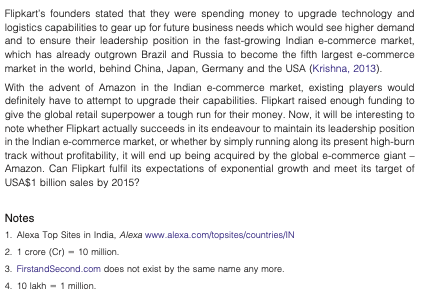

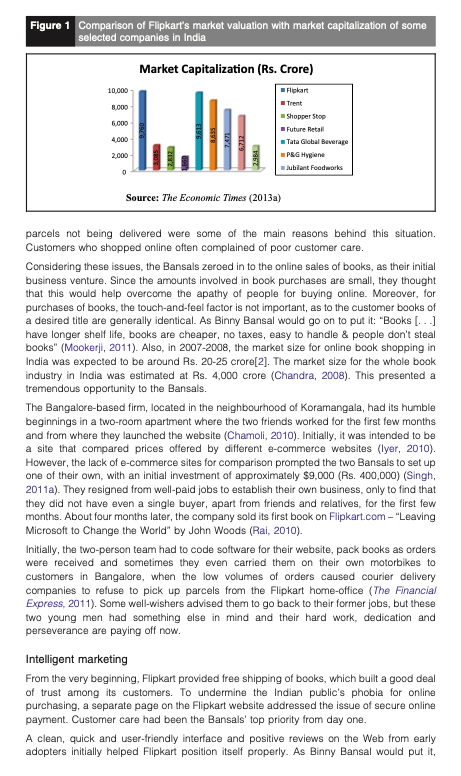

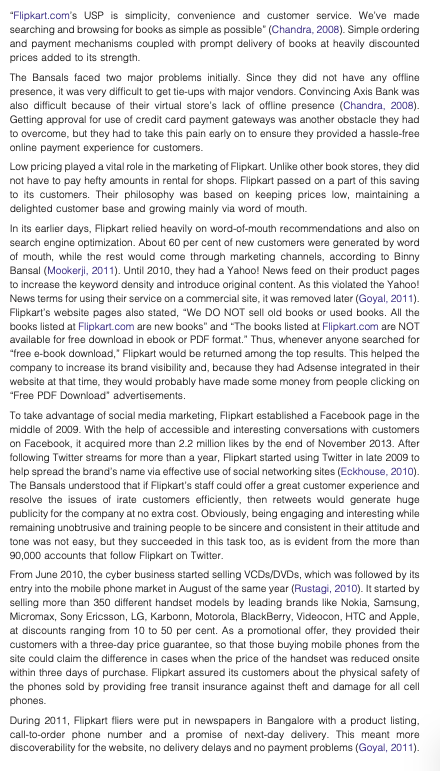

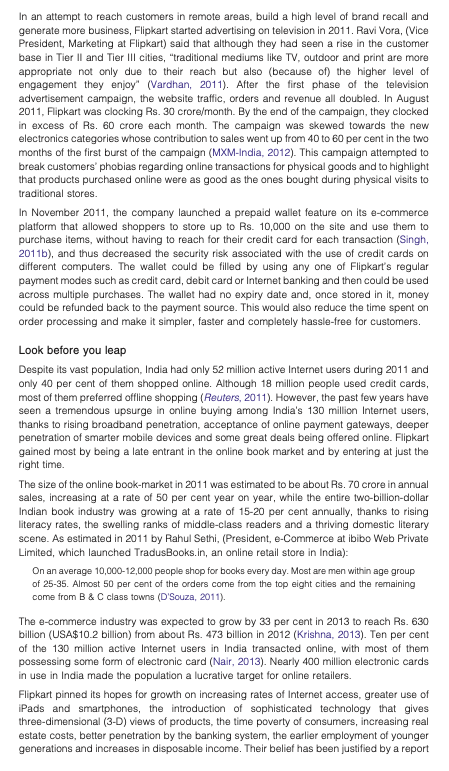

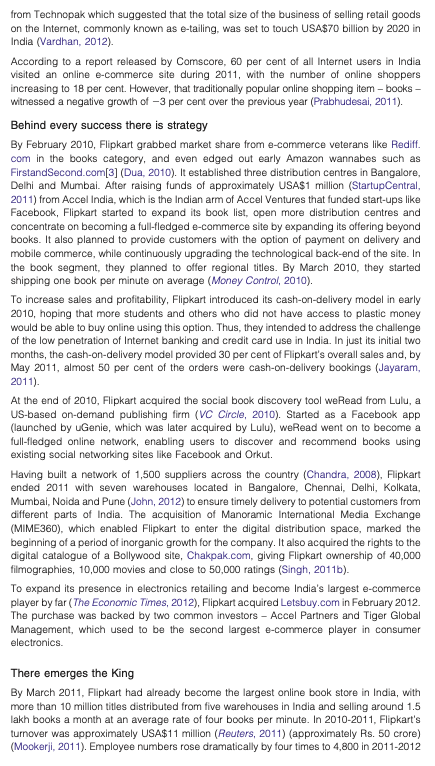

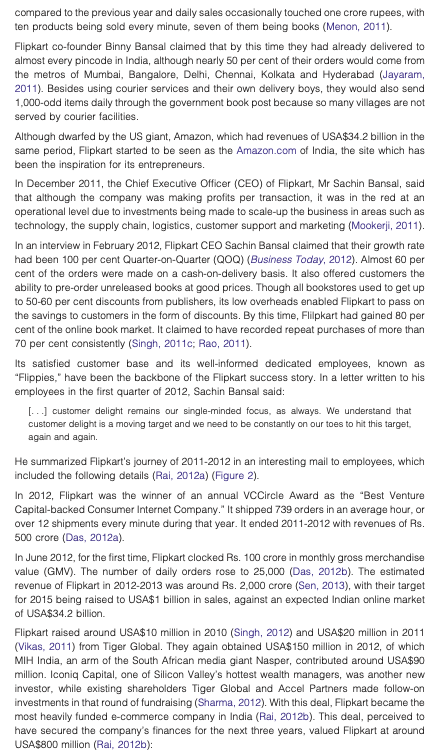

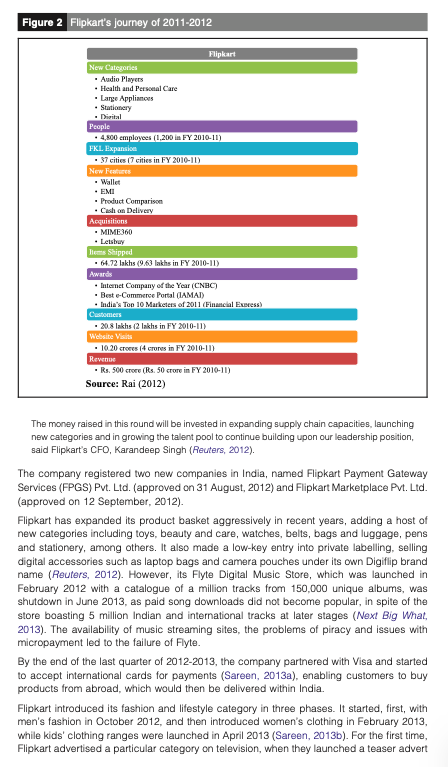

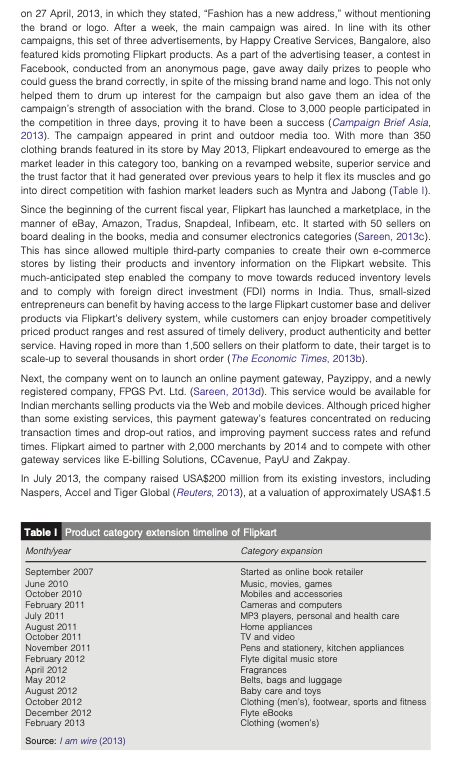

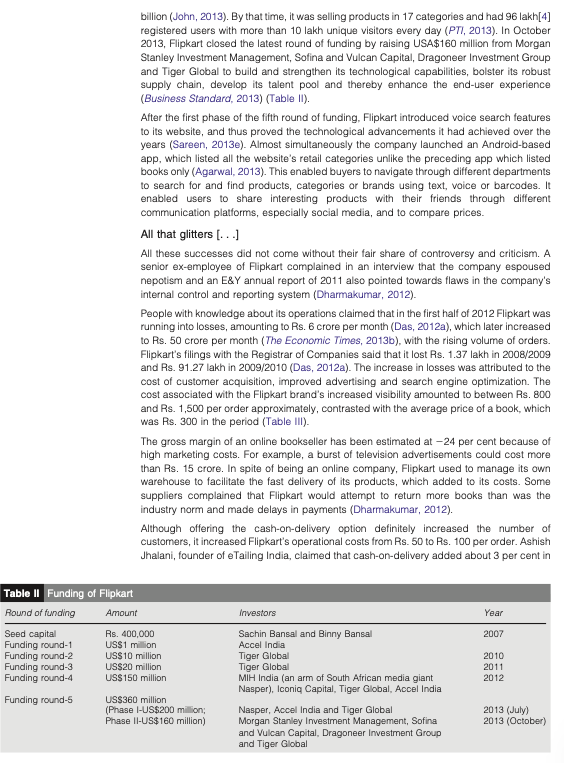

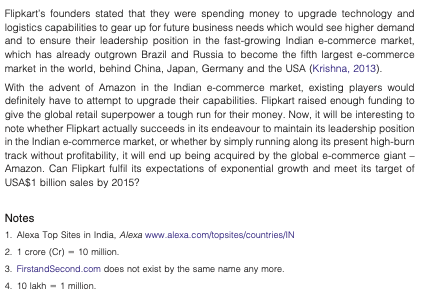

Flipkart: journey of an Indian e-commerce start-up Nirankush Dutta and Anil K. Bhat Nirankush Dutta and Anil K. Bhat are based at Birla Institute of Technology & Science, Pilani, Rajasthan, India. Introduction Founded in 2007 with less than USA$10,000 as investment capital, Flipkart has been seen as the "Amazon of India by many. The company has worn down the unwillingness of Indian customers to buy online and its product range has expanded from just books at its inception, to almost every retail category. Enthusiastic venture capitalists have poured a lot of money into the company, giving it an enviable valuation. However, to maintain its leadership profile and meet the expectations of its investors and the general public, Flipkart needs to continue its exponential rise. Can it do so, after almost five years since its incorporation? Can the company continue to delight Indian customers via the timely delivery of products at reasonable prices and, thus, beat the real Amazon and those other competitors that are limbering up for battle with the giant? The big bang The poster boy of Indian e-commerce, Flipkart Online Services Pvt. Ltd. was founded on 5 September, 2007, by Sachin Bansal and Binny Bansal. Hailing from Chandigarh, the two Indian Institute of Technology (IIT) Delhi computer science students were classmates of 2005's batch of graduates. Before jumping onto the entrepreneurship bandwagon, Sachin was employed for six months by Techspan, a software consultancy firm, which works on US defence projects, and then at Amazon India for a year and a half. Binny worked at Sarnoff India (a firm that is involved with high-end automation projects for the defence and automobile industries) for a year and a half and then at Amazon India for eight months. They both resigned in September 2007 and launched the Flipkart.com website on the 15 October in the same year (Chandra, 2008). From its beginning in 2007 as a two- member team, the company now has close to 3,000 employees across the country (The Economic Times, 2013a). Flipkart is the largest online book retailer in India, with 80 per cent of the online book market share (Lulgjuraj , 2013) and 40-45 per cent of the overall organized book market share by value in India (Mookerji, 2011). It ships out nearly 100,000 items every day (Mookerji, 2011). Boasting of close to one million visitors on its website daily (The Economic Times, 2013a), Flipkart.com is ranked tenth by Alexa.com[1] in the top 50 popular websites of India, ahead of Microsoft, Naukri. com, Twitter, Rediff and eBay. Its registered user base grew to 9.6 million in 2013 (The Times of India, 2013) from 5 million a year earlier (Choudhary, 2012). Its market valuation of USAS 1.6 billion places it alongside P&G India and Tata Global Beverages (The Economic Times, 2013a) (Figure 1). Although the growth rate of the Internet in India has been phenomenal for the last few years, still only a relatively small number of people ever shopped online before 2007. Feelings of insecurity about divulging credit card details during online purchase processes and fear of Disclaimer. This case is written solely for educational purposes and is not intended to represent successful or unsuccessful managerial decision making. The author's may have disguised names financial and other recognizable Information to protect contidentiality "Flipkart.com's USP is simplicity, convenience and customer service. We've made searching and browsing for books as simple as possible" (Chandra, 2008). Simple ordering and payment mechanisms coupled with prompt delivery of books at heavily discounted prices added to its strength. The Bansals faced two major problems initially. Since they did not have any offline presence, it was very difficult to get tie-ups with major vendors. Convincing Axis Bank was also difficult because of their virtual store's lack of offline presence (Chandra, 2008). Getting approval for use of credit card payment gateways was another obstacle they had to overcome, but they had to take this pain early on to ensure they provided a hassle-free online payment experience for customers. Low pricing played a vital role in the marketing of Flipkart. Unlike other book stores, they did not have to pay hefty amounts in rental for shops. Flipkart passed on a part of this saving to its customers. Their philosophy was based on keeping prices low, maintaining a delighted customer base and growing mainly via word of mouth. In its earlier days, Flipkart relied heavily on word-of-mouth recommendations and also on search engine optimization. About 60 per cent of new customers were generated by word of mouth, while the rest would come through marketing channels, according to Binny Bansal (Mookerji, 2011). Until 2010, they had a Yahoo! News feed on their product pages to increase the keyword density and introduce original content. As this violated the Yahoo! News terms for using their service on a commercial site, it was removed later (Goyal, 2011). Flipkart's website pages also stated, "We DO NOT sell old books or used books. All the books listed at Flipkart.com are new books" and "The books listed at Flipkart.com are NOT available for free download in ebook or PDF format." Thus, whenever anyone searched for "free e-book download," Flipkart would be returned among the top results. This helped the company to increase its brand visibility and, because they had Adsense integrated in their website at that time, they would probably have made some money from people clicking on "Free PDF Download' advertisements. To take advantage of social media marketing, Flipkart established a Facebook page in the middle of 2009. With the help of accessible and interesting conversations with customers on Facebook, it acquired more than 2.2 million likes by the end of November 2013. After following Twitter streams for more than a year, Flipkart started using Twitter in late 2009 to help spread the brand's name via effective use of social networking sites (Eckhouse, 2010). The Bansals understood that if Flipkart's staff could offer a great customer experience and resolve the issues of irate customers efficiently, then retweets would generate huge publicity for the company at no extra cost. Obviously, being engaging and interesting while remaining unobtrusive and training people to be sincere and consistent in their attitude and tone was not easy, but they succeeded in this task too, as is evident from the more than 90,000 accounts that follow Flipkart on Twitter. From June 2010, the cyber business started selling VCDs/DVDs, which was followed by its entry into the mobile phone market in August of the same year (Rustagi, 2010). It started by selling more than 350 different handset models by leading brands like Nokia, Samsung, Micromax, Sony Ericsson,LG, Karbonn, Motorola, BlackBerry, Videocon, HTC and Apple, at discounts ranging from 10 to 50 per cent. As a promotional offer, they provided their customers with a three-day price guarantee, so that those buying mobile phones from the site could claim the difference in cases when the price of the handset was reduced onsite within three days of purchase. Flipkart assured its customers about the physical safety of the phones sold by providing free transit insurance against theft and damage for all cell phones. During 2011, Flipkart fliers were put in newspapers in Bangalore with a product listing, call-to-order phone number and a promise of next-day delivery. This meant more discoverability for the website, no delivery delays and no payment problems (Goyal, 2011). In an attempt to reach customers in remote areas, build a high level of brand recall and generate more business, Flipkart started advertising on television in 2011. Ravi Vora, (Vice President, Marketing at Flipkart) said that although they had seen a rise in the customer base in Tier II and Tier III cities, "traditional mediums like TV, outdoor and print are more appropriate not only due to their reach but also (because of the higher level of engagement they enjoy" (Vardhan, 2011). After the first phase of the television advertisement campaign, the website traffic, orders and revenue all doubled. In August 2011, Flipkart was clocking Rs. 30 crore/month. By the end of the campaign, they clocked in excess of Rs. 60 crore each month. The campaign was skewed towards the new electronics categories whose contribution to sales went up from 40 to 60 per cent in the two months of the first burst of the campaign (MXM-India, 2012). This campaign attempted to break customers' phobias regarding online transactions for physical goods and to highlight that products purchased online were as good as the ones bought during physical visits to traditional stores. In November 2011, the company launched a prepaid wallet feature on its e-commerce platform that allowed shoppers to store up to Rs. 10,000 on the site and use them to purchase items, without having to reach for their credit card for each transaction (Singh, 2011b), and thus decreased the security risk associated with the use of credit cards on different computers. The wallet could be filled by using any one of Flipkart's regular payment modes such as credit card, debit card or Internet banking and then could be used across multiple purchases. The wallet had no expiry date and, once stored in it, money could be refunded back to the payment source. This would also reduce the time spent on order processing and make it simpler, faster and completely hassle-free for customers. Look before you leap Despite its vast population, India had only 52 million active Internet users during 2011 and only 40 per cent of them shopped online. Although 18 million people used credit cards, most of them preferred offline shopping (Reuters, 2011). However, the past few years have seen a tremendous upsurge in online buying among India's 130 million Internet users, thanks to rising broadband penetration, acceptance of online payment gateways, deeper penetration of smarter mobile devices and some great deals being offered online. Flipkart gained most by being a late entrant in the online book market and by entering at just the right time. The size of the online book-market in 2011 was estimated to be about Rs. 70 crore in annual sales, increasing at a rate of 50 per cent year on year, while the entire two-billion-dollar Indian book industry was growing at a rate of 15-20 per cent annually, thanks to rising literacy rates, the swelling ranks of middle-class readers and a thriving domestic literary scene. As estimated in 2011 by Rahul Sethi, (President, e-Commerce at ibibo Web Private Limited, which launched TradusBooks.in, an online retail store in India): On an average 10,000-12,000 people shop for books every day. Most are men within age group of 25-35. Almost 50 per cent of the orders come from the top eight cities and the remaining come from B & C class towns (D'Souza, 2011). The e-commerce industry was expected to grow by 33 per cent in 2013 to reach Rs. 630 billion (USA$10.2 billion) from about Rs. 473 billion in 2012 (Krishna, 2013). Ten per cent of the 130 million active Internet users in India transacted online, with most of them possessing some form of electronic card (Nair, 2013). Nearly 400 million electronic cards in use in India made the population a lucrative target for online retailers. Flipkart pinned its hopes for growth on increasing rates of Internet access, greater use of iPads and smartphones, the introduction of sophisticated technology that gives three-dimensional (3-D) views of products, the time poverty of consumers, increasing real estate costs, better penetration by the banking system, the earlier employment of younger generations and increases in disposable income. Their belief has been justified by a report from Technopak which suggested that the total size of the business of selling retail goods on the Internet, commonly known as e-tailing, was set to touch USA$70 billion by 2020 in India (Vardhan, 2012) According to a report released by Comscore, 60 per cent of all Internet users in India visited an online e-commerce site during 2011, with the number of online shoppers increasing to 18 per cent. However, that traditionally popular online shopping item - books - witnessed a negative growth of -3 per cent over the previous year (Prabhudesai, 2011). Behind every success there is strategy By February 2010, Flipkart grabbed market share from e-commerce veterans like Rediff. com in the books category, and even edged out early Amazon wannabes such as FirstandSecond.com[3] (Dua, 2010). It established three distribution centres in Bangalore, Delhi and Mumbai. After raising funds of approximately USA$1 million (StartupCentral, 2011) from Accel India, which is the Indian arm of Accel Ventures that funded start-ups like Facebook, Flipkart started to expand its book list, open more distribution centres and concentrate on becoming a full-fledged e-commerce site by expanding its offering beyond books. It also planned to provide customers with the option of payment on delivery and mobile commerce, while continuously upgrading the technological back-end of the site. In the book segment, they planned to offer regional titles. By March 2010, they started shipping one book per minute on average (Money Control, 2010). To increase sales and profitability, Flipkart introduced its cash-on-delivery model in early 2010, hoping that more students and others who did not have access to plastic money would be able to buy online using this option. Thus, they intended to address the challenge of the low penetration of Internet banking and credit card use in India. In just its initial two months, the cash-on-delivery model provided 30 per cent of Flipkart's overall sales and, by May 2011, almost 50 per cent of the orders were cash-on-delivery bookings (Jayaram, 2011). At the end of 2010, Flipkart acquired the social book discovery tool weRead from Lulu, a US-based on-demand publishing firm (VC Circle, 2010). Started as a Facebook app (launched by Genie, which was later acquired by Lulu), weRead went on to become a full-fledged online network, enabling users to discover and recommend books using existing social networking sites like Facebook and Orkut. Having built a network of 1,500 suppliers across the country (Chandra, 2008), Flipkart ended 2011 with seven warehouses located in Bangalore, Chennai, Delhi, Kolkata, Mumbai, Noida and Pune (John, 2012) to ensure timely delivery to potential customers from different parts of India. The acquisition of Manoramic International Media Exchange (MIME360), which enabled Flipkart to enter the digital distribution space, marked the beginning of a period of inorganic growth for the company. It also acquired the rights to the digital catalogue of a Bollywood site, Chakpak.com, giving Flipkart ownership of 40,000 filmographies, 10,000 movies and close to 50,000 ratings (Singh, 2011b). To expand its presence in electronics retailing and become India's largest e-commerce player by far (The Economic Times, 2012), Flipkart acquired Letsbuy.com in February 2012. The purchase was backed by two common investors - Accel Partners and Tiger Global Management, which used to be the second largest e-commerce player in consumer electronics There emerges the King By March 2011, Flipkart had already become the largest online book store in India, with more than 10 million titles distributed from five warehouses in India and selling around 1.5 lakh books a month at an average rate of four books per minute. In 2010-2011, Flipkart's turnover was approximately USA$11 million (Reuters, 2011) (approximately Rs. 50 crore) (Mookerji, 2011). Employee numbers rose dramatically by four times to 4,800 in 2011-2012 compared to the previous year and daily sales occasionally touched one crore rupees, with ten products being sold every minute, seven of them being books (Menon, 2011). Flipkart co-founder Binny Bansal claimed that by this time they had already delivered to almost every pincode in India, although nearly 50 per cent of their orders would come from the metros of Mumbai, Bangalore, Delhi, Chennai, Kolkata and Hyderabad (Jayaram, 2011). Besides using courier services and their own delivery boys, they would also send 1,000-odd items daily through the government book post because so many villages are not served by courier facilities Although dwarfed by the US giant, Amazon, which had revenues of USA$34.2 billion in the same period, Flipkart started to be seen as the Amazon.com of India, the site which has been the inspiration for its entrepreneurs. In December 2011, the Chief Executive Officer (CEO) of Flipkart, Mr Sachin Bansal, said that although the company was making profits per transaction, it was in the red at an operational level due to investments being made to scale-up the business in areas such as technology, the supply chain, logistics, customer support and marketing (Mookerji, 2011). In an interview in February 2012, Flipkart CEO Sachin Bansal claimed that their growth rate had been 100 per cent Quarter-on-Quarter (Q00) (Business Today, 2012). Almost 60 per cent of the orders were made on a cash-on-delivery basis. It also offered customers the ability to pre-order unreleased books at good prices. Though all bookstores used to get up to 50-60 per cent discounts from publishers, its low overheads enabled Flipkart to pass on the savings to customers in the form of discounts. By this time, Flipkart had gained 80 per cent of the online book market. It claimed to have recorded repeat purchases of more than 70 per cent consistently (Singh, 2011c; Rao, 2011). Its satisfied customer base and its well-informed dedicated employees, known as "Flippies," have been the backbone of the Flipkart success story. In a letter written to his employees in the first quarter of 2012, Sachin Bansal said: [...] customer delight remains our single-minded focus, as always. We understand that customer delight is a moving target and we need to be constantly on our toes to hit this target, again and again. He summarized Flipkart's journey of 2011-2012 in an interesting mail to employees, which included the following details (Rai, 2012a) (Figure 2). In 2012, Flipkart was the winner of an annual VCCircle Award as the "Best Venture Capital-backed Consumer Internet Company." It shipped 739 orders in an average hour, or over 12 shipments every minute during that year. It ended 2011-2012 with revenues of Rs. 500 crore (Das, 2012a). In June 2012, for the first time, Flipkart clocked Rs. 100 crore in monthly gross merchandise value (GMV). The number of daily orders rose to 25,000 (Das, 2012b). The estimated revenue of Flipkart in 2012-2013 was around Rs. 2,000 crore (Sen, 2013), with their target for 2015 being raised to USA$1 billion in sales, against an expected Indian online market of USA$34.2 billion. Flipkart raised around USA$10 million in 2010 (Singh, 2012) and USA$20 million in 2011 (Vikas, 2011) from Tiger Global. They again obtained USA$150 million in 2012, of which MIH India, an arm of the South African media giant Nasper, contributed around USA$90 million. Iconiq Capital, one of Silicon Valley's hottest wealth managers, was another new investor, while existing shareholders Tiger Global and Accel Partners made follow-on investments in that round of fundraising (Sharma, 2012). With this deal, Flipkart became the most heavily funded e-commerce company in India (Rai, 2012b). This deal, perceived to have secured the company's finances for the next three years, valued Flipkart at around USA$800 million (Rai, 2012b): Figure 2 Flipkart's journey of 2011-2012 Flipkart New Categories Audio Players Health and Personal Care Large Appliances Stationery Dirital People 4,800 employees (1,200 in FY 2010-11) FKI. Expansion . 37 cities 7 cities in FY 2010-11) New Features . Wallet - EMI . Product Comparison Cash on Delivery Acquisitions MIME 160 Letsby lems Shipped 64.72 lakhs (9.63 lakhs in FY 2010-11) Awards Internet Company of the Year (CNBC) . Best e-Commerce Portal (LAMAI) India's Top 10 Marketers of 2011 (Financial Express) Customers . 20.8 lakhs 2 lakhs in FY 2010-11) Website Visits - 10.20 crores (4 crores in FY 2010-11) Revenue - Rs. 500 crore (Rs. 50 crore in FY 2010-11) Source: Rai (2012) The money raised in this round will be invested in expanding supply chain capacities, launching new categories and in growing the talent pool to continue building upon our leadership position, said Flipkart's CFO, Karandeep Singh (Reuters, 2012). The company registered two new companies in India, named Flipkart Payment Gateway Services (FPGS) Pvt. Ltd. (approved on 31 August, 2012) and Flipkart Marketplace Pvt. Ltd. (approved on 12 September, 2012). Flipkart has expanded its product basket aggressively in recent years, adding a host of new categories including toys, beauty and care, watches, belts, bags and luggage, pens and stationery, among others. It also made a low-key entry into private labelling, selling digital accessories such as laptop bags and camera pouches under its own Digiflip brand name (Reuters, 2012). However, its Flyte Digital Music Store, which was launched in February 2012 with a catalogue of a million tracks from 150,000 unique albums, was shutdown in June 2013, as paid song downloads did not become popular, in spite of the store boasting 5 million Indian and international tracks at later stages (Next Big What, 2013). The availability of music streaming sites, the problems of piracy and issues with micropayment led to the failure of Flyte. By the end of the last quarter of 2012-2013, the company partnered with Visa and started to accept international cards for payments (Sareen, 2013a), enabling customers to buy products from abroad, which would then be delivered within India. Flipkart introduced its fashion and lifestyle category in three phases. It started, first, with men's fashion in October 2012, and then introduced women's clothing in February 2013, while kids' clothing ranges were launched in April 2013 (Sareen, 2013b). For the first time, Flipkart advertised a particular category on television, when they launched a teaser advert on 27 April, 2013, in which they stated, "Fashion has a new address," without mentioning the brand or logo. After a week, the main campaign was aired. In line with its other campaigns, this set of three advertisements, by Happy Creative Services, Bangalore, also featured kids promoting Flipkart products. As a part of the advertising teaser, a contest in Facebook, conducted from an anonymous page, gave away daily prizes to people who could guess the brand correctly, in spite of the missing brand name and logo. This not only helped them to drum up interest for the campaign but also gave them an idea of the campaign's strength of association with the brand. Close to 3,000 people participated in the competition in three days, proving it to have been a success (Campaign Brief Asia, 2013). The campaign appeared in print and outdoor media too. With more than 350 clothing brands featured in its store by May 2013, Flipkart endeavoured to emerge as the market leader in this category too, banking on a revamped website, superior service and the trust factor that it had generated over previous years to help it flex its muscles and go into direct competition with fashion market leaders such as Myntra and Jabong (Table 1). Since the beginning of the current fiscal year, Flipkart has launched a marketplace in the manner of eBay, Amazon, Tradus, Snapdeal, Infibeam, etc. It started with 50 sellers on board dealing in the books, media and consumer electronics categories (Sareen, 2013c). This has since allowed multiple third-party companies to create their own e-commerce stores by listing their products and inventory information on the Flipkart website. This much-anticipated step enabled the company to move towards reduced inventory levels and to comply with foreign direct investment (FDI) norms in India. Thus, small-sized entrepreneurs can benefit by having access to the large Flipkart customer base and deliver products via Flipkart's delivery system, while customers can enjoy broader competitively priced product ranges and rest assured of timely delivery, product authenticity and better service. Having roped in more than 1,500 sellers on their platform to date, their target is to scale-up to several thousands in short order (The Economic Times, 2013b). Next, the company went on to launch an online payment gateway, Payzippy, and a newly registered company, FPGS Pvt. Ltd. (Sareen, 2013d). This service would be available for Indian merchants selling products via the Web and mobile devices. Although priced higher than some existing services, this payment gateway's features concentrated on reducing transaction times and drop-out ratios, and improving payment success rates and refund times. Flipkart aimed to partner with 2,000 merchants by 2014 and to compete with other gateway services like E-billing Solutions, CCavenue, PayU and Zakpay. In July 2013, the company raised USA$200 million from its existing investors, including Naspers, Accel and Tiger Global (Reuters, 2013), at a valuation of approximately USA$1.5 Table Product category extension timeline of Flipkart Month/year Category expansion September 2007 Started as online book retailer June 2010 Music, movies, games October 2010 Mobiles and accessories February 2011 Cameras and computers July 2011 MP3 players, personal and health care August 2011 Home appliances October 2011 TV and video November 2011 Pens and stationery, kitchen appliances February 2012 Flyte digital music store April 2012 Fragrances May 2012 Belts, bags and luggage August 2012 Baby care and toys October 2012 Clothing (men's), footwear, sports and fitness December 2012 Flyte eBooks February 2013 Clothing (women's) Source: I am wire (2013) Mobile (%) Apparel (%) 100 http://www.forbesindia.com/article/boardroom/ can-flipkart-deliver/33240/0 Sales 100 Cost of item 60 Discount 30 Packaging 1 Free shipping 10 Cash on delivery 8 Warehousing 1 Inventory and write-offs Manpower costs 10 Gross margins -24 Source: Das (2012a, 2012b) 10 1 2 2 1 4 5 -13 100 65 15 1 10 4 1 2 10 -8 4 additional costs (Nair, 2013), caused by the increase in instances of refusals by customers to accept products at the last moment, additional processes required for verification calls, longer payment cycles and due to the collection charges levied by courier companies. Flipkart raised the bar for free home delivery for shopping to above Rs. 300 in the middle of 2012 (Surana, 2012) and, subsequently, it was raised to cover orders over Rs. 500. They also stopped shipping products worth more than Rs. 10,000 to customers in Uttar Pradesh and its nearby NCR regions (Sareen, 20131). With the introduction of these measures, the average order size of Flipkart increased to Rs. 1,200 (Choudhary, 2012). In November 2012, the Enforcement Directorate announced that they would look into alleged violations of FDI rules by Flipkart, covered by the penal provisions of the Foreign Exchange Management Act, 1999 (The Economic Times, 2012). As per the law, e-commerce companies with foreign investment may carry out business-to-business transactions but not business-to-consumer (B2C) transactions by creating complex structures. E-commerce companies with foreign investments are allowed to trade wholesale with B2C companies that are unrelated and can trade wholesale with a group company only if it does not exceed 25 per cent of its total turnover and is used for internal consumption. Many people frowned upon the rate at which Flipkart raised money and spent that, while some other e-commerce companies apparently managed to perform efficiently with less funding. Myntra, an online fashion and lifestyle retailer that started operation in the same year as Flipkart , raised only USA$75 million in several rounds, while another player Mydala managed to operate with a meagre USA$6 million (Soni and Mookerji, 2013). Even since it has revamped its model to become a marketplace, some experts have continued to believe that it still burns USA$8-10 million per month (Agarwal and Mookerji, 2013). To get funding from investors, they have had to limit that cash-bum. In the process, they have also let go of some employees (Sareen, 2013g). Flipkart has to be a foreign-domiciled (offshore-structured) entity for US listing since SEBI regulations require Indian companies to trade first on local bourses. The Indian market regulator stipulates profitability norms for listing on local exchanges, but till recently Flipkart had to bear negative gross margins and just slipped into 2-3 per cent profit margins after expanding its product catalogue. Path ahead T.C. Meenakshisundaram, Founder and Managing Director of IDG Ventures India, a venture capital fund, said in an interview, "Given the cost of customer acquisition, a customer must transact more than three or four times to make the company profitable" (Das, 2012a). Some veterans like Subrata Mitra (Partner at Accel Partners, on the boards of Flipkart and Myntra) said that companies could take up to five years to show profits. Amazon, the world's biggest online retailer, started in 1995 but only became profitable in 2001 (Das, 2012a). Flipkart's founders stated that they were spending money to upgrade technology and logistics capabilities to gear up for future business needs which would see higher demand and to ensure their leadership position in the fast-growing Indian e-commerce market, which has already outgrown Brazil and Russia to become the fifth largest e-commerce market in the world, behind China, Japan, Germany and the USA (Krishna, 2013). With the advent of Amazon in the Indian e-commerce market, existing players would definitely have to attempt to upgrade their capabilities. Flipkart raised enough funding to give the global retail superpower a tough run for their money. Now, it will be interesting to note whether Flipkart actually succeeds in its endeavour to maintain its leadership position in the Indian e-commerce market, or whether by simply running along its present high-burn track without profitability, it will end up being acquired by the global e-commerce giant- Amazon. Can Flipkart fulfil its expectations of exponential growth and meet its target of USA$1 billion sales by 2015? Notes 1. Alexa Top Sites in India. Alexa www.alexa.com/topsites/countries/IN 2. 1 crore (Cr) - 10 million 3. Firstand Second.com does not exist by the same name any more. 4. 10 lakh - 1 million Flipkart: journey of an Indian e-commerce start-up Nirankush Dutta and Anil K. Bhat Nirankush Dutta and Anil K. Bhat are based at Birla Institute of Technology & Science, Pilani, Rajasthan, India. Introduction Founded in 2007 with less than USA$10,000 as investment capital, Flipkart has been seen as the "Amazon of India by many. The company has worn down the unwillingness of Indian customers to buy online and its product range has expanded from just books at its inception, to almost every retail category. Enthusiastic venture capitalists have poured a lot of money into the company, giving it an enviable valuation. However, to maintain its leadership profile and meet the expectations of its investors and the general public, Flipkart needs to continue its exponential rise. Can it do so, after almost five years since its incorporation? Can the company continue to delight Indian customers via the timely delivery of products at reasonable prices and, thus, beat the real Amazon and those other competitors that are limbering up for battle with the giant? The big bang The poster boy of Indian e-commerce, Flipkart Online Services Pvt. Ltd. was founded on 5 September, 2007, by Sachin Bansal and Binny Bansal. Hailing from Chandigarh, the two Indian Institute of Technology (IIT) Delhi computer science students were classmates of 2005's batch of graduates. Before jumping onto the entrepreneurship bandwagon, Sachin was employed for six months by Techspan, a software consultancy firm, which works on US defence projects, and then at Amazon India for a year and a half. Binny worked at Sarnoff India (a firm that is involved with high-end automation projects for the defence and automobile industries) for a year and a half and then at Amazon India for eight months. They both resigned in September 2007 and launched the Flipkart.com website on the 15 October in the same year (Chandra, 2008). From its beginning in 2007 as a two- member team, the company now has close to 3,000 employees across the country (The Economic Times, 2013a). Flipkart is the largest online book retailer in India, with 80 per cent of the online book market share (Lulgjuraj , 2013) and 40-45 per cent of the overall organized book market share by value in India (Mookerji, 2011). It ships out nearly 100,000 items every day (Mookerji, 2011). Boasting of close to one million visitors on its website daily (The Economic Times, 2013a), Flipkart.com is ranked tenth by Alexa.com[1] in the top 50 popular websites of India, ahead of Microsoft, Naukri. com, Twitter, Rediff and eBay. Its registered user base grew to 9.6 million in 2013 (The Times of India, 2013) from 5 million a year earlier (Choudhary, 2012). Its market valuation of USAS 1.6 billion places it alongside P&G India and Tata Global Beverages (The Economic Times, 2013a) (Figure 1). Although the growth rate of the Internet in India has been phenomenal for the last few years, still only a relatively small number of people ever shopped online before 2007. Feelings of insecurity about divulging credit card details during online purchase processes and fear of Disclaimer. This case is written solely for educational purposes and is not intended to represent successful or unsuccessful managerial decision making. The author's may have disguised names financial and other recognizable Information to protect contidentiality "Flipkart.com's USP is simplicity, convenience and customer service. We've made searching and browsing for books as simple as possible" (Chandra, 2008). Simple ordering and payment mechanisms coupled with prompt delivery of books at heavily discounted prices added to its strength. The Bansals faced two major problems initially. Since they did not have any offline presence, it was very difficult to get tie-ups with major vendors. Convincing Axis Bank was also difficult because of their virtual store's lack of offline presence (Chandra, 2008). Getting approval for use of credit card payment gateways was another obstacle they had to overcome, but they had to take this pain early on to ensure they provided a hassle-free online payment experience for customers. Low pricing played a vital role in the marketing of Flipkart. Unlike other book stores, they did not have to pay hefty amounts in rental for shops. Flipkart passed on a part of this saving to its customers. Their philosophy was based on keeping prices low, maintaining a delighted customer base and growing mainly via word of mouth. In its earlier days, Flipkart relied heavily on word-of-mouth recommendations and also on search engine optimization. About 60 per cent of new customers were generated by word of mouth, while the rest would come through marketing channels, according to Binny Bansal (Mookerji, 2011). Until 2010, they had a Yahoo! News feed on their product pages to increase the keyword density and introduce original content. As this violated the Yahoo! News terms for using their service on a commercial site, it was removed later (Goyal, 2011). Flipkart's website pages also stated, "We DO NOT sell old books or used books. All the books listed at Flipkart.com are new books" and "The books listed at Flipkart.com are NOT available for free download in ebook or PDF format." Thus, whenever anyone searched for "free e-book download," Flipkart would be returned among the top results. This helped the company to increase its brand visibility and, because they had Adsense integrated in their website at that time, they would probably have made some money from people clicking on "Free PDF Download' advertisements. To take advantage of social media marketing, Flipkart established a Facebook page in the middle of 2009. With the help of accessible and interesting conversations with customers on Facebook, it acquired more than 2.2 million likes by the end of November 2013. After following Twitter streams for more than a year, Flipkart started using Twitter in late 2009 to help spread the brand's name via effective use of social networking sites (Eckhouse, 2010). The Bansals understood that if Flipkart's staff could offer a great customer experience and resolve the issues of irate customers efficiently, then retweets would generate huge publicity for the company at no extra cost. Obviously, being engaging and interesting while remaining unobtrusive and training people to be sincere and consistent in their attitude and tone was not easy, but they succeeded in this task too, as is evident from the more than 90,000 accounts that follow Flipkart on Twitter. From June 2010, the cyber business started selling VCDs/DVDs, which was followed by its entry into the mobile phone market in August of the same year (Rustagi, 2010). It started by selling more than 350 different handset models by leading brands like Nokia, Samsung, Micromax, Sony Ericsson,LG, Karbonn, Motorola, BlackBerry, Videocon, HTC and Apple, at discounts ranging from 10 to 50 per cent. As a promotional offer, they provided their customers with a three-day price guarantee, so that those buying mobile phones from the site could claim the difference in cases when the price of the handset was reduced onsite within three days of purchase. Flipkart assured its customers about the physical safety of the phones sold by providing free transit insurance against theft and damage for all cell phones. During 2011, Flipkart fliers were put in newspapers in Bangalore with a product listing, call-to-order phone number and a promise of next-day delivery. This meant more discoverability for the website, no delivery delays and no payment problems (Goyal, 2011). In an attempt to reach customers in remote areas, build a high level of brand recall and generate more business, Flipkart started advertising on television in 2011. Ravi Vora, (Vice President, Marketing at Flipkart) said that although they had seen a rise in the customer base in Tier II and Tier III cities, "traditional mediums like TV, outdoor and print are more appropriate not only due to their reach but also (because of the higher level of engagement they enjoy" (Vardhan, 2011). After the first phase of the television advertisement campaign, the website traffic, orders and revenue all doubled. In August 2011, Flipkart was clocking Rs. 30 crore/month. By the end of the campaign, they clocked in excess of Rs. 60 crore each month. The campaign was skewed towards the new electronics categories whose contribution to sales went up from 40 to 60 per cent in the two months of the first burst of the campaign (MXM-India, 2012). This campaign attempted to break customers' phobias regarding online transactions for physical goods and to highlight that products purchased online were as good as the ones bought during physical visits to traditional stores. In November 2011, the company launched a prepaid wallet feature on its e-commerce platform that allowed shoppers to store up to Rs. 10,000 on the site and use them to purchase items, without having to reach for their credit card for each transaction (Singh, 2011b), and thus decreased the security risk associated with the use of credit cards on different computers. The wallet could be filled by using any one of Flipkart's regular payment modes such as credit card, debit card or Internet banking and then could be used across multiple purchases. The wallet had no expiry date and, once stored in it, money could be refunded back to the payment source. This would also reduce the time spent on order processing and make it simpler, faster and completely hassle-free for customers. Look before you leap Despite its vast population, India had only 52 million active Internet users during 2011 and only 40 per cent of them shopped online. Although 18 million people used credit cards, most of them preferred offline shopping (Reuters, 2011). However, the past few years have seen a tremendous upsurge in online buying among India's 130 million Internet users, thanks to rising broadband penetration, acceptance of online payment gateways, deeper penetration of smarter mobile devices and some great deals being offered online. Flipkart gained most by being a late entrant in the online book market and by entering at just the right time. The size of the online book-market in 2011 was estimated to be about Rs. 70 crore in annual sales, increasing at a rate of 50 per cent year on year, while the entire two-billion-dollar Indian book industry was growing at a rate of 15-20 per cent annually, thanks to rising literacy rates, the swelling ranks of middle-class readers and a thriving domestic literary scene. As estimated in 2011 by Rahul Sethi, (President, e-Commerce at ibibo Web Private Limited, which launched TradusBooks.in, an online retail store in India): On an average 10,000-12,000 people shop for books every day. Most are men within age group of 25-35. Almost 50 per cent of the orders come from the top eight cities and the remaining come from B & C class towns (D'Souza, 2011). The e-commerce industry was expected to grow by 33 per cent in 2013 to reach Rs. 630 billion (USA$10.2 billion) from about Rs. 473 billion in 2012 (Krishna, 2013). Ten per cent of the 130 million active Internet users in India transacted online, with most of them possessing some form of electronic card (Nair, 2013). Nearly 400 million electronic cards in use in India made the population a lucrative target for online retailers. Flipkart pinned its hopes for growth on increasing rates of Internet access, greater use of iPads and smartphones, the introduction of sophisticated technology that gives three-dimensional (3-D) views of products, the time poverty of consumers, increasing real estate costs, better penetration by the banking system, the earlier employment of younger generations and increases in disposable income. Their belief has been justified by a report from Technopak which suggested that the total size of the business of selling retail goods on the Internet, commonly known as e-tailing, was set to touch USA$70 billion by 2020 in India (Vardhan, 2012) According to a report released by Comscore, 60 per cent of all Internet users in India visited an online e-commerce site during 2011, with the number of online shoppers increasing to 18 per cent. However, that traditionally popular online shopping item - books - witnessed a negative growth of -3 per cent over the previous year (Prabhudesai, 2011). Behind every success there is strategy By February 2010, Flipkart grabbed market share from e-commerce veterans like Rediff. com in the books category, and even edged out early Amazon wannabes such as FirstandSecond.com[3] (Dua, 2010). It established three distribution centres in Bangalore, Delhi and Mumbai. After raising funds of approximately USA$1 million (StartupCentral, 2011) from Accel India, which is the Indian arm of Accel Ventures that funded start-ups like Facebook, Flipkart started to expand its book list, open more distribution centres and concentrate on becoming a full-fledged e-commerce site by expanding its offering beyond books. It also planned to provide customers with the option of payment on delivery and mobile commerce, while continuously upgrading the technological back-end of the site. In the book segment, they planned to offer regional titles. By March 2010, they started shipping one book per minute on average (Money Control, 2010). To increase sales and profitability, Flipkart introduced its cash-on-delivery model in early 2010, hoping that more students and others who did not have access to plastic money would be able to buy online using this option. Thus, they intended to address the challenge of the low penetration of Internet banking and credit card use in India. In just its initial two months, the cash-on-delivery model provided 30 per cent of Flipkart's overall sales and, by May 2011, almost 50 per cent of the orders were cash-on-delivery bookings (Jayaram, 2011). At the end of 2010, Flipkart acquired the social book discovery tool weRead from Lulu, a US-based on-demand publishing firm (VC Circle, 2010). Started as a Facebook app (launched by Genie, which was later acquired by Lulu), weRead went on to become a full-fledged online network, enabling users to discover and recommend books using existing social networking sites like Facebook and Orkut. Having built a network of 1,500 suppliers across the country (Chandra, 2008), Flipkart ended 2011 with seven warehouses located in Bangalore, Chennai, Delhi, Kolkata, Mumbai, Noida and Pune (John, 2012) to ensure timely delivery to potential customers from different parts of India. The acquisition of Manoramic International Media Exchange (MIME360), which enabled Flipkart to enter the digital distribution space, marked the beginning of a period of inorganic growth for the company. It also acquired the rights to the digital catalogue of a Bollywood site, Chakpak.com, giving Flipkart ownership of 40,000 filmographies, 10,000 movies and close to 50,000 ratings (Singh, 2011b). To expand its presence in electronics retailing and become India's largest e-commerce player by far (The Economic Times, 2012), Flipkart acquired Letsbuy.com in February 2012. The purchase was backed by two common investors - Accel Partners and Tiger Global Management, which used to be the second largest e-commerce player in consumer electronics There emerges the King By March 2011, Flipkart had already become the largest online book store in India, with more than 10 million titles distributed from five warehouses in India and selling around 1.5 lakh books a month at an average rate of four books per minute. In 2010-2011, Flipkart's turnover was approximately USA$11 million (Reuters, 2011) (approximately Rs. 50 crore) (Mookerji, 2011). Employee numbers rose dramatically by four times to 4,800 in 2011-2012 compared to the previous year and daily sales occasionally touched one crore rupees, with ten products being sold every minute, seven of them being books (Menon, 2011). Flipkart co-founder Binny Bansal claimed that by this time they had already delivered to almost every pincode in India, although nearly 50 per cent of their orders would come from the metros of Mumbai, Bangalore, Delhi, Chennai, Kolkata and Hyderabad (Jayaram, 2011). Besides using courier services and their own delivery boys, they would also send 1,000-odd items daily through the government book post because so many villages are not served by courier facilities Although dwarfed by the US giant, Amazon, which had revenues of USA$34.2 billion in the same period, Flipkart started to be seen as the Amazon.com of India, the site which has been the inspiration for its entrepreneurs. In December 2011, the Chief Executive Officer (CEO) of Flipkart, Mr Sachin Bansal, said that although the company was making profits per transaction, it was in the red at an operational level due to investments being made to scale-up the business in areas such as technology, the supply chain, logistics, customer support and marketing (Mookerji, 2011). In an interview in February 2012, Flipkart CEO Sachin Bansal claimed that their growth rate had been 100 per cent Quarter-on-Quarter (Q00) (Business Today, 2012). Almost 60 per cent of the orders were made on a cash-on-delivery basis. It also offered customers the ability to pre-order unreleased books at good prices. Though all bookstores used to get up to 50-60 per cent discounts from publishers, its low overheads enabled Flipkart to pass on the savings to customers in the form of discounts. By this time, Flipkart had gained 80 per cent of the online book market. It claimed to have recorded repeat purchases of more than 70 per cent consistently (Singh, 2011c; Rao, 2011). Its satisfied customer base and its well-informed dedicated employees, known as "Flippies," have been the backbone of the Flipkart success story. In a letter written to his employees in the first quarter of 2012, Sachin Bansal said: [...] customer delight remains our single-minded focus, as always. We understand that customer delight is a moving target and we need to be constantly on our toes to hit this target, again and again. He summarized Flipkart's journey of 2011-2012 in an interesting mail to employees, which included the following details (Rai, 2012a) (Figure 2). In 2012, Flipkart was the winner of an annual VCCircle Award as the "Best Venture Capital-backed Consumer Internet Company." It shipped 739 orders in an average hour, or over 12 shipments every minute during that year. It ended 2011-2012 with revenues of Rs. 500 crore (Das, 2012a). In June 2012, for the first time, Flipkart clocked Rs. 100 crore in monthly gross merchandise value (GMV). The number of daily orders rose to 25,000 (Das, 2012b). The estimated revenue of Flipkart in 2012-2013 was around Rs. 2,000 crore (Sen, 2013), with their target for 2015 being raised to USA$1 billion in sales, against an expected Indian online market of USA$34.2 billion. Flipkart raised around USA$10 million in 2010 (Singh, 2012) and USA$20 million in 2011 (Vikas, 2011) from Tiger Global. They again obtained USA$150 million in 2012, of which MIH India, an arm of the South African media giant Nasper, contributed around USA$90 million. Iconiq Capital, one of Silicon Valley's hottest wealth managers, was another new investor, while existing shareholders Tiger Global and Accel Partners made follow-on investments in that round of fundraising (Sharma, 2012). With this deal, Flipkart became the most heavily funded e-commerce company in India (Rai, 2012b). This deal, perceived to have secured the company's finances for the next three years, valued Flipkart at around USA$800 million (Rai, 2012b): Figure 2 Flipkart's journey of 2011-2012 Flipkart New Categories Audio Players Health and Personal Care Large Appliances Stationery Dirital People 4,800 employees (1,200 in FY 2010-11) FKI. Expansion . 37 cities 7 cities in FY 2010-11) New Features . Wallet - EMI . Product Comparison Cash on Delivery Acquisitions MIME 160 Letsby lems Shipped 64.72 lakhs (9.63 lakhs in FY 2010-11) Awards Internet Company of the Year (CNBC) . Best e-Commerce Portal (LAMAI) India's Top 10 Marketers of 2011 (Financial Express) Customers . 20.8 lakhs 2 lakhs in FY 2010-11) Website Visits - 10.20 crores (4 crores in FY 2010-11) Revenue - Rs. 500 crore (Rs. 50 crore in FY 2010-11) Source: Rai (2012) The money raised in this round will be invested in expanding supply chain capacities, launching new categories and in growing the talent pool to continue building upon our leadership position, said Flipkart's CFO, Karandeep Singh (Reuters, 2012). The company registered two new companies in India, named Flipkart Payment Gateway Services (FPGS) Pvt. Ltd. (approved on 31 August, 2012) and Flipkart Marketplace Pvt. Ltd. (approved on 12 September, 2012). Flipkart has expanded its product basket aggressively in recent years, adding a host of new categories including toys, beauty and care, watches, belts, bags and luggage, pens and stationery, among others. It also made a low-key entry into private labelling, selling digital accessories such as laptop bags and camera pouches under its own Digiflip brand name (Reuters, 2012). However, its Flyte Digital Music Store, which was launched in February 2012 with a catalogue of a million tracks from 150,000 unique albums, was shutdown in June 2013, as paid song downloads did not become popular, in spite of the store boasting 5 million Indian and international tracks at later stages (Next Big What, 2013). The availability of music streaming sites, the problems of piracy and issues with micropayment led to the failure of Flyte. By the end of the last quarter of 2012-2013, the company partnered with Visa and started to accept international cards for payments (Sareen, 2013a), enabling customers to buy products from abroad, which would then be delivered within India. Flipkart introduced its fashion and lifestyle category in three phases. It started, first, with men's fashion in October 2012, and then introduced women's clothing in February 2013, while kids' clothing ranges were launched in April 2013 (Sareen, 2013b). For the first time, Flipkart advertised a particular category on television, when they launched a teaser advert on 27 April, 2013, in which they stated, "Fashion has a new address," without mentioning the brand or logo. After a week, the main campaign was aired. In line with its other campaigns, this set of three advertisements, by Happy Creative Services, Bangalore, also featured kids promoting Flipkart products. As a part of the advertising teaser, a contest in Facebook, conducted from an anonymous page, gave away daily prizes to people who could guess the brand correctly, in spite of the missing brand name and logo. This not only helped them to drum up interest for the campaign but also gave them an idea of the campaign's strength of association with the brand. Close to 3,000 people participated in the competition in three days, proving it to have been a success (Campaign Brief Asia, 2013). The campaign appeared in print and outdoor media too. With more than 350 clothing brands featured in its store by May 2013, Flipkart endeavoured to emerge as the market leader in this category too, banking on a revamped website, superior service and the trust factor that it had generated over previous years to help it flex its muscles and go into direct competition with fashion market leaders such as Myntra and Jabong (Table 1). Since the beginning of the current fiscal year, Flipkart has launched a marketplace in the manner of eBay, Amazon, Tradus, Snapdeal, Infibeam, etc. It started with 50 sellers on board dealing in the books, media and consumer electronics categories (Sareen, 2013c). This has since allowed multiple third-party companies to create their own e-commerce stores by listing their products and inventory information on the Flipkart website. This much-anticipated step enabled the company to move towards reduced inventory levels and to comply with foreign direct investment (FDI) norms in India. Thus, small-sized entrepreneurs can benefit by having access to the large Flipkart customer base and deliver products via Flipkart's delivery system, while customers can enjoy broader competitively priced product ranges and rest assured of timely delivery, product authenticity and better service. Having roped in more than 1,500 sellers on their platform to date, their target is to scale-up to several thousands in short order (The Economic Times, 2013b). Next, the company went on to launch an online payment gateway, Payzippy, and a newly registered company, FPGS Pvt. Ltd. (Sareen, 2013d). This service would be available for Indian merchants selling products via the Web and mobile devices. Although priced higher than some existing services, this payment gateway's features concentrated on reducing transaction times and drop-out ratios, and improving payment success rates and refund times. Flipkart aimed to partner with 2,000 merchants by 2014 and to compete with other gateway services like E-billing Solutions, CCavenue, PayU and Zakpay. In July 2013, the company raised USA$200 million from its existing investors, including Naspers, Accel and Tiger Global (Reuters, 2013), at a valuation of approximately USA$1.5 Table Product category extension timeline of Flipkart Month/year Category expansion September 2007 Started as online book retailer June 2010 Music, movies, games October 2010 Mobiles and accessories February 2011 Cameras and computers July 2011 MP3 players, personal and health care August 2011 Home appliances October 2011 TV and video November 2011 Pens and stationery, kitchen appliances February 2012 Flyte digital music store April 2012 Fragrances May 2012 Belts, bags and luggage August 2012 Baby care and toys October 2012 Clothing (men's), footwear, sports and fitness December 2012 Flyte eBooks February 2013 Clothing (women's) Source: I am wire (2013) Mobile (%) Apparel (%) 100 http://www.forbesindia.com/article/boardroom/ can-flipkart-deliver/33240/0 Sales 100 Cost of item 60 Discount 30 Packaging 1 Free shipping 10 Cash on delivery 8 Warehousing 1 Inventory and write-offs Manpower costs 10 Gross margins -24 Source: Das (2012a, 2012b) 10 1 2 2 1 4 5 -13 100 65 15 1 10 4 1 2 10 -8 4 additional costs (Nair, 2013), caused by the increase in instances of refusals by customers to accept products at the last moment, additional processes required for verification calls, longer payment cycles and due to the collection charges levied by courier companies. Flipkart raised the bar for free home delivery for shopping to above Rs. 300 in the middle of 2012 (Surana, 2012) and, subsequently, it was raised to cover orders over Rs. 500. They also stopped shipping products worth more than Rs. 10,000 to customers in Uttar Pradesh and its nearby NCR regions (Sareen, 20131). With the introduction of these measures, the average order size of Flipkart increased to Rs. 1,200 (Choudhary, 2012). In November 2012, the Enforcement Directorate announced that they would look into alleged violations of FDI rules by Flipkart, covered by the penal provisions of the Foreign Exchange Management Act, 1999 (The Economic Times, 2012). As per the law, e-commerce companies with foreign investment may carry out business-to-business transactions but not business-to-consumer (B2C) transactions by creating complex structures. E-commerce companies with foreign investments are allowed to trade wholesale with B2C companies that are unrelated and can trade wholesale with a group company only if it does not exceed 25 per cent of its total turnover and is used for internal consumption. Many people frowned upon the rate at which Flipkart raised money and spent that, while some other e-commerce companies apparently managed to perform efficiently with less funding. Myntra, an online fashion and lifestyle retailer that started operation in the same year as Flipkart , raised only USA$75 million in several rounds, while another player Mydala managed to operate with a meagre USA$6 million (Soni and Mookerji, 2013). Even since it has revamped its model to become a marketplace, some experts have continued to believe that it still burns USA$8-10 million per month (Agarwal and Mookerji, 2013). To get funding from investors, they have had to limit that cash-bum. In the process, they have also let go of some employees (Sareen, 2013g). Flipkart has to be a foreign-domiciled (offshore-structured) entity for US listing since SEBI regulations require Indian companies to trade first on local bourses. The Indian market regulator stipulates profitability norms for listing on local exchanges, but till recently Flipkart had to bear negative gross margins and just slipped into 2-3 per cent profit margins after expanding its product catalogue. Path ahead T.C. Meenakshisundaram, Founder and Managing Director of IDG Ventures India, a venture capital fund, said in an interview, "Given the cost of customer acquisition, a customer must transact more than three or four times to make the company profitable" (Das, 2012a). Some veterans like Subrata Mitra (Partner at Accel Partners, on the boards of Flipkart and Myntra) said that companies could take up to five years to show profits. Amazon, the world's biggest online retailer, started in 1995 but only became profitable in 2001 (Das, 2012a). Flipkart's founders stated that they were spending money to upgrade technology and logistics capabilities to gear up for future business needs which would see higher demand and to ensure their leadership position in the fast-growing Indian e-commerce market, which has already outgrown Brazil and Russia to become the fifth largest e-commerce market in the world, behind China, Japan, Germany and the USA (Krishna, 2013). With the advent of Amazon in the Indian e-commerce market, existing players would definitely have to attempt to upgrade their capabilities. Flipkart raised enough funding to give the global retail superpower a tough run for their money. Now, it will be interesting to note whether Flipkart actually succeeds in its endeavour to maintain its leadership position in the Indian e-commerce market, or whether by simply running along its present high-burn track without profitability, it will end up being acquired by the global e-commerce giant- Amazon. Can Flipkart fulfil its expectations of exponential growth and meet its target of USA$1 billion sales by 2015? Notes 1. Alexa Top Sites in India. Alexa www.alexa.com/topsites/countries/IN 2. 1 crore (Cr) - 10 million 3. Firstand Second.com does not exist by the same name any more. 4. 10 lakh - 1 million