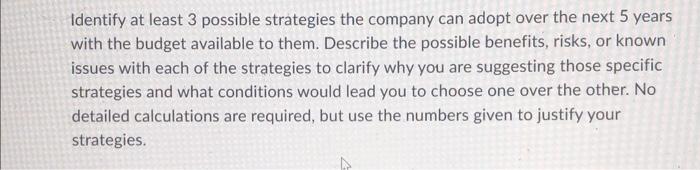

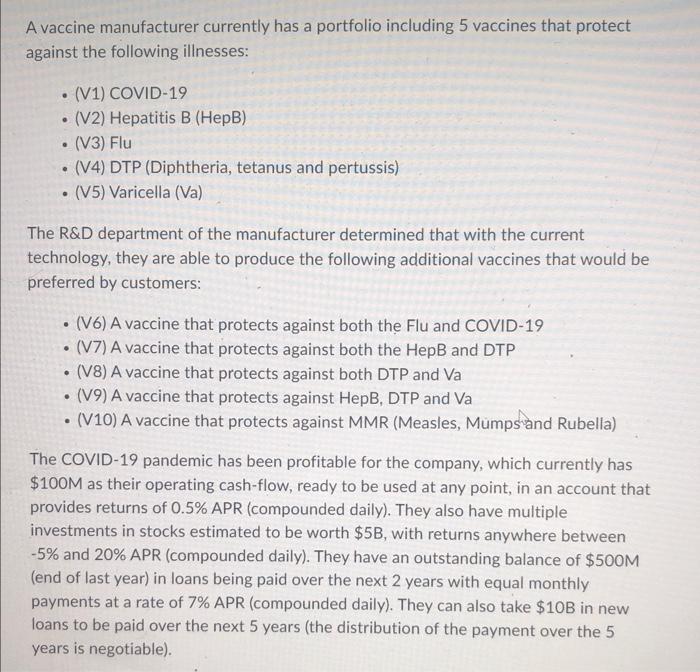

Identify at least 3 possible strategies the company can adopt over the next 5 years with the budget available to them. Describe the possible benefits, risks, or known issues with each of the strategies to clarify why you are suggesting those specific strategies and what conditions would lead you to choose one over the other. No detailed calculations are required, but use the numbers given to justify your strategies. A vaccine manufacturer currently has a portfolio including 5 vaccines that protect against the following illnesses: . (V1) COVID-19 (V2) Hepatitis B (HepB) (V3) Flu (V4) DTP (Diphtheria, tetanus and pertussis) (V5) Varicella (Va) . . . The R&D department of the manufacturer determined that with the current technology, they are able to produce the following additional vaccines that would be preferred by customers: . . (V6) A vaccine that protects against both the Flu and COVID-19 (17) A vaccine that protects against both the HepB and DTP (V8) A vaccine that protects against both DTP and Va (19) A vaccine that protects against HepB, DTP and Va (V10) A vaccine that protects against MMR (Measles, Mumps and Rubella) The COVID-19 pandemic has been profitable for the company, which currently has $100M as their operating cash-flow, ready to be used at any point, in an account that provides returns of 0.5% APR (compounded daily). They also have multiple investments in stocks estimated to be worth $5B, with returns anywhere between -5% and 20% APR (compounded daily). They have an outstanding balance of $500M (end of last year) in loans being paid over the next 2 years with equal monthly payments at a rate of 7% APR (compounded daily). They can also take $10B in new loans to be paid over the next 5 years (the distribution of the payment over the 5 years is negotiable) Identify at least 3 possible strategies the company can adopt over the next 5 years with the budget available to them. Describe the possible benefits, risks, or known issues with each of the strategies to clarify why you are suggesting those specific strategies and what conditions would lead you to choose one over the other. No detailed calculations are required, but use the numbers given to justify your strategies. A vaccine manufacturer currently has a portfolio including 5 vaccines that protect against the following illnesses: . (V1) COVID-19 (V2) Hepatitis B (HepB) (V3) Flu (V4) DTP (Diphtheria, tetanus and pertussis) (V5) Varicella (Va) . . . The R&D department of the manufacturer determined that with the current technology, they are able to produce the following additional vaccines that would be preferred by customers: . . (V6) A vaccine that protects against both the Flu and COVID-19 (17) A vaccine that protects against both the HepB and DTP (V8) A vaccine that protects against both DTP and Va (19) A vaccine that protects against HepB, DTP and Va (V10) A vaccine that protects against MMR (Measles, Mumps and Rubella) The COVID-19 pandemic has been profitable for the company, which currently has $100M as their operating cash-flow, ready to be used at any point, in an account that provides returns of 0.5% APR (compounded daily). They also have multiple investments in stocks estimated to be worth $5B, with returns anywhere between -5% and 20% APR (compounded daily). They have an outstanding balance of $500M (end of last year) in loans being paid over the next 2 years with equal monthly payments at a rate of 7% APR (compounded daily). They can also take $10B in new loans to be paid over the next 5 years (the distribution of the payment over the 5 years is negotiable)