Answered step by step

Verified Expert Solution

Question

1 Approved Answer

identify at least two operational risks and two operational risk mitigation strategies, at least two financial risks and two financial risk mitigation strategies, one market

identify at least two operational risks and two operational risk mitigation strategies, at least two financial risks and two financial risk mitigation strategies, one market risk and one market risk mitigation strategy

identify at least two operational risks and two operational risk mitigation strategies, at least two financial risks and two financial risk mitigation strategies, one market risk and one market risk mitigation strategy

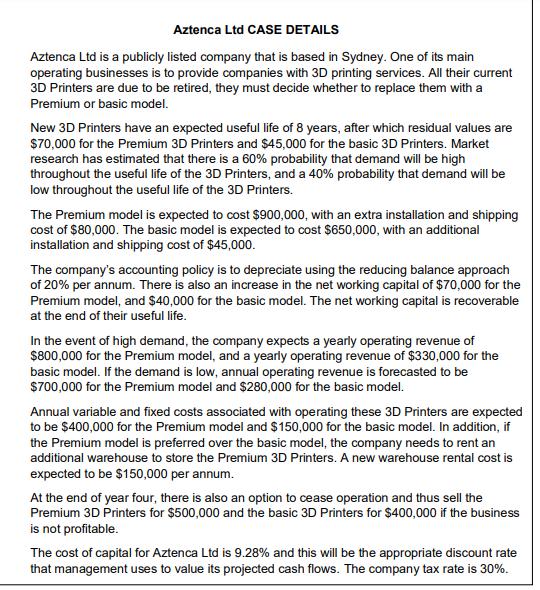

Aztenca Ltd CASE DETAILS Aztenca Ltd is a publicly listed company that is based in Sydney. One of its main operating businesses is to provide companies with 3D printing services. All their current 3D Printers are due to be retired, they must decide whether to replace them with a Premium or basic model. New 3D Printers have an expected useful life of 8 years, after which residual values are $70,000 for the Premium 3D Printers and $45,000 for the basic 3D Printers. Market research has estimated that there is a 60% probability that demand will be high throughout the useful life of the 3D Printers, and a 40% probability that demand will be low throughout the useful life of the 3D Printers. The Premium model is expected to cost $900,000, with an extra installation and shipping cost of $80,000. The basic model is expected to cost $650,000, with an additional installation and shipping cost of $45,000. The company's accounting policy is to depreciate using the reducing balance approach of 20% per annum. There is also an increase in the net working capital of $70,000 for the Premium model, and $40,000 for the basic model. The net working capital is recoverable at the end of their useful life. In the event of high demand, the company expects a yearly operating revenue of $800,000 for the Premium model, and a yearly operating revenue of $330,000 for the basic model. If the demand is low, annual operating revenue is forecasted to be $700,000 for the Premium model and $280,000 for the basic model. Annual variable and fixed costs associated with operating these 3D Printers are expected to be $400,000 for the Premium model and $150,000 for the basic model. In addition, if the Premium model is preferred over the basic model, the company needs to rent an additional warehouse to store the Premium 3D Printers. A new warehouse rental cost is expected to be $150,000 per annum. At the end of year four, there is also an option to cease operation and thus sell the Premium 3D Printers for $500,000 and the basic 3D Printers for $400,000 if the business is not profitable. The cost of capital for Aztenca Ltd is 9.28% and this will be the appropriate discount rate that management uses to value its projected cash flows. The company tax rate is 30%.

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Operational Risks Technology Obsolescence With rapidly evolving technology in the 3D printing industry there is a risk that the chosen 3D printers may become obsolete before the end of their useful li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started